A rollover IRA is used to receive funds rolled from outside custodians. This could be other IRAs, and also employer sponsored accounts like a 401(k). The Rollover IRA is essentially the same as a Traditional IRA, but there is one important factor to consider:If you roll in funds from employer accounts to a Rollover IRA […]

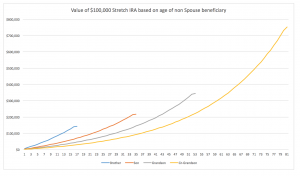

Understanding a Stretch IRA

A Stretch IRA is the term given to finding younger generations to be beneficiaries of IRA accounts in order to prolong the lifetime of the IRA vehicle post mortem. In order to understand the application of a stretch IRA it is important to be aware of the required minimum distribution (RMD) rules. Traditional IRA accounts […]

How to get out of a bad Roth IRA

Reader Eric commented on my ‘Experience opening up a Roth IRA‘ post to ask if he had been sold a poor investment for his Roth… sadly this is an example of where something that has great publicity (the Roth) and is now a necessity, has been taken to the extremes of money making by the […]

It’s Not only a paper loss…

While chatting with an established financial advisor earlier in the week he brought up a line that I hear propagated within the planning community. The line is The biggest financial mistake that people make is selling at the bottom of the market. This really isn’t an accurate statement, and while some people know the difference, in the […]

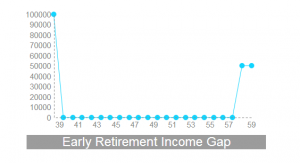

The dichotomy of early retirement and tax advantaged savings

I am a proponent of the FIRE concept, Financial Independence, Retire Early. Though the first part of the statement is the key, and once you have achieved financial independence you don’t have to start knitting, it just means that you have options. Options that can include taking a year (or a lifetime) off to sail […]

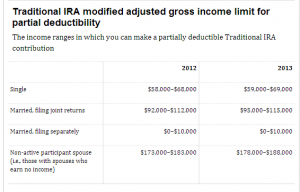

Backdoor Roth IRA – building a Roth IRA when income limits exclude you

One of the biggest frustrations to high earning people is how to build retirement assets when their income precludes them. Due to salary phases outs many tax incentives do not qualify for such earners, including the Traditional and the Roth IRAs. However, there is a way to create Roth IRA accounts using the Backdoor Roth […]

How to properly locate speculative stocks

Let’s kick things off with a value judgement. You need about 20 single stocks to be diversified, and you need to be able to explore correlations within them to ensure that you didn’t just acquire a slim sector that is highly at risk. As an arbitrary number, I would suggest you don’t need single speculative […]

How to win at Blackjack, and at Annuities

I’ve been known to have a punt on occasion, and when playing in casinos my favorite game was Blackjack for quite some time. Blackjack, for those of you unfamiliar with it is, is often considered to be a game of ’21’ in that the goal is to get as close to 21 without going over […]

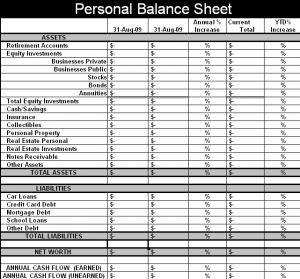

Creating a Tax Aware Personal Balance Sheet

I recently talked about some basic concepts that will help you on the path to wealth, in it I stated the two most important documents you need are the Personal Balance Sheet (listing assets and liabilities) and the Cash Flow Statement (what you spend your money on each month). This post will tackle the Personal […]

Budgeting for the 0.1%

I know. The whole 1% thing is so negative, but bear with me. Personally, I am totally cool with people becoming super wealthy and going on to spend their money as they see fit. Having money itself never impressed me, so seeing people with their fancy boats and shiny American teeth has always been a […]