You may have heard the classic story of the Shoemaker’s children having no shoes, or the phase Physician, heal thyself. But who is wurs shod, than the shoemakers wyfe, With shops full of newe shapen shoes all hir lyfe? [1546 J. Heywood Dialogue of Proverbs i. xi. E1V]It is a very real phenomenon that dedicated professionals are […]

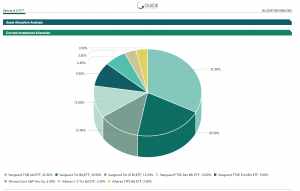

Thoughts on Daily Portfolio Rebalancing with Robo’s

I like Robo’s, especially Betterment as they appear much more human than the wicked Wealthfront. As an advisor myself I find that the strategies they implement offer a lot of food for thought in terms of offering the very best to our clients.One thing that does bother me a trifle is the use of marketing […]

The Pattern

The Pattern is what I call the path of most efficiency, the order in which things should be done. Everything has a Pattern, here’s one you might understand and can apply to other things. For my morning coffee I sometimes have to wash a French Press. This means that I need water from the one […]

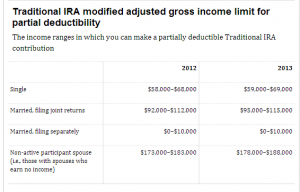

The Difference between a Rollover IRA and a Traditional IRA

A rollover IRA is used to receive funds rolled from outside custodians. This could be other IRAs, and also employer sponsored accounts like a 401(k). The Rollover IRA is essentially the same as a Traditional IRA, but there is one important factor to consider:If you roll in funds from employer accounts to a Rollover IRA […]

Understanding Total Return

It’s been a rough year for the market thus far, when looking at the return of your investment it is important to not just look at the price of the stock, bond, or fund, but rather its total return. This can be measured using the Internal Rate of Return (IRR) and Excel can show this […]

Why Mutual Funds Suck

The first US based Mutual Fund was created in 1924, called MITTX. The theory was that it allows an investor to buy a broad array of stocks without having to buy 1 piece at a time.. IE it makes diversification affordable. Great idea. Both active and passive funds hold stocks which are traded by the fund’s […]

Equity Risk Premium at 3.25%

I recently wrote a post asking you to think about how much you value a fixed rate of return. If you missed it, check it out here: How much is a fixed rate of return worth to you? I came across a post today via a twitter share from the CFA institute, which (it seems) […]

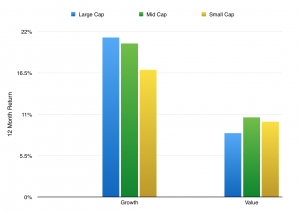

Building Model Portfolios -US Equities

I’m currently building model portfolios for my new firm. When looking at US Equities as part of a portfolio the question is how far to stratify them in an attempt to create management opportunities, it is my belief that the more we can granularize a product, the more opportunities will emerge, however this comes with […]

What happened to $twtr yesterday?

Shares of Twitter dropped from $51.21 at 3pm Eastern to $41.80 by 3:45pm. A drop of 18.38% The reason for the drop was based upon the earnings report released. Unfortunately for many people, the earnings were due to be released after the close of the market, and an error meant that they hit the Twitter […]

Understanding averages and investment returns

An average is given to a series of numbers for us to attempt to make order from chaos. There are several ways to calculate an average, though the term is most commonly associated now with the arithmetic mean. This mean is calculated as the sum of numbers divided by the number of numbers in a […]