It seems that there’s lots of focus on your ‘Retirement Number’ but recently my family has been thinking hard about estate planning, what happens in the unlikely event that both of us parents should die while our Son is in the age of minority?The big questions for this surround guardianship. However, this topic can be […]

Who wants to be a Millionaire?

I came across this story today, promoted on twitter by a Financial Planner, using it as an example of what appears to be a great strategy to follow…. Janitor dies at 92 with $8M saved. You can read it here. My synopsis: someone worked all their life, drove a crappy car, dressed in clothes held […]

Can you afford a Financial Advisor?

There is a real battle on right now for new clients for financial advisors – the battleground is at the Generation XY level. Let’s bust through some of the bullshit, and discover who actually needs an advisor, and what fees are really worth.Firstly, we need to acknowledge that everyone is playing around with the benchmark […]

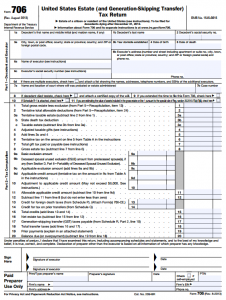

Portability in Estate Planning

I brought some Estate Planning concepts into a post talking about Frequent Flyer miles in order to help people re-frame their risk models. One of the matters that was discussed was Estate Taxes for amounts that are above the 5.34M basic exclusion amount. I only wrote about it as an aside, yet some of my readers picked […]

Basic Estate Planning

Estate planning is something that many people think of just for the wealthy. I would argue that at the very least, anyone who is about to become a parent needs an estate plan in place. Here are the minimums, and the minimum costs I could find for coverage: Last Will and TestamentThis document contains your […]