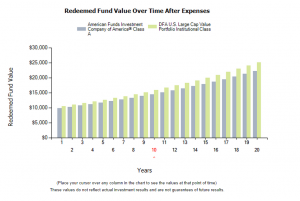

We had a conversation recently in the Forum about picking funds from MorningStar Reports. Let’s breakdown what is happening here, and hopefully provide some ideas and education on the way. Firstly, some formalities:A Mutual Fund is a collection of individual stocks, or funds that is most often actively managed by fund manager/s. Each fund has a philosophy […]

Goal Based vs Transaction Based Financial Planning

I received an email over the weekend asking me how to invest a substantial cash position. As I am not yet designated yet as a Registered Investment Advisor,I couldn’t provide specific advice. However, I found my response to be an interesting example of the differences in the planning world, it highlights not only the difference between transaction based […]

Two good ways, and one really bad way to rebalance your portfolio

I recently posted a top 100 list of ETFs by expense ratio. We must remember that these ETFs are the tools that we plug into an investment strategy to implement it, rather than the end goal themselves. There are a plethora of strategies out there, they are based around the concept of the efficient frontier, […]

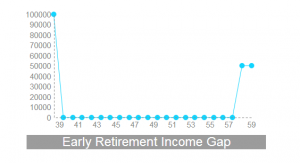

The dichotomy of early retirement and tax advantaged savings

I am a proponent of the FIRE concept, Financial Independence, Retire Early. Though the first part of the statement is the key, and once you have achieved financial independence you don’t have to start knitting, it just means that you have options. Options that can include taking a year (or a lifetime) off to sail […]

Repair Ratio – Assets, Income and Correlations

Recently, in The Forum, I was discussing the strengths and weaknesses of dollar cost averaging (DCA) vs lump sum investing. While many think of DCA as a powerful financial mechanism, there are two key flaws that arise from its implementation. The first is lazy money syndrome. DCA drips money into an investment over time. that […]