If I had a dollar for every article I have seen lauding the magic of compound interest I’d be able to go have a nice steak dinner somewhere. Or I could invest it, and over time, magically become a millionaire. Compound interest really is a fantastic thing, but we need to understand the components, and […]

Understanding your retirement number

Your retirement number is the amount that you need to have saved in order to retire. I want to dive into this today and explore some really important things that come along with this. I’m going to define it ‘my way’ and bring in concepts such as the Investment Policy Statement, asset allocation, risk taking, […]

It’s Not only a paper loss…

While chatting with an established financial advisor earlier in the week he brought up a line that I hear propagated within the planning community. The line is The biggest financial mistake that people make is selling at the bottom of the market. This really isn’t an accurate statement, and while some people know the difference, in the […]

European ETFs – Hedged vs Unhedged

As I continue to realign my portfolio, the next investment I will be focusing on is international exposure. I have decided that I want to be more focused in Europe and will do so via an ETF strategy. The overall weight of my portfolio will remain in US equities at this time, so I am […]

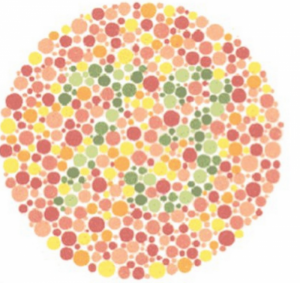

If you fail this test, you don’t understand money.

That’s fine though, failure is needed on the path to success. If you feel strongly about this I advise you to: Argue. Listen. Change. I promise to do the same. You should not accept anything that is written as the truth, you should seek to challenge it. In the end you will either confirm your […]

Granulation of investments for Tax Loss Harvesting

I was reading an article this morning by Kitces on Tax Loss Deferral (something I do currently with partial Roth Rollovers) which had a line in it that really caught my eye: Broadly speaking, this means that the more diversified a portfolio is, and the more granular the positions are (in the extreme, holding each […]

Free $20 Amazon Gift Card for first 1000 signups #BlackFriday

Personal Capital is offering a $20 Amazon Gift Card to the first 1000 people that sign up using this link. In order to qualify for the the $20 you must sign up, and then link up your accounts to the profile, I believe just one will trigger the bonus. Linking more will allow you to […]

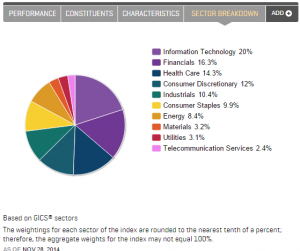

Man Vs Robot – How my portfolio stacks up to the Robo-Broker

Firstly, I am fan of FutureAdvisor. They are a robo broker that competes with Betterment and Wealthfront. I think that they hold an edge over these two since they are willing to look at your holistic (held away assets) portfolio – whereas the other two players don’t care to. I signed up for an account […]

My Favorite Personal Finance book

I’ve been asked many times to share my favorite finance book, especially for beginners. Until today I have struggled to say what it was, but I think I have cracked it. The book I recommend is 7 Habits of Highly Effective People by Stephen Covey. This post will explain the reason why I found it such […]

The Stock Market – 10 months with no gains?

I read an article this morning by Barry Ritzholtz at Bloomberg that started off with this humdinger of a statement. “Here we are, 10-plus months into the year, and we have nothing to show for it.” Then quickly caveated with an “At least, that is the case if we measure our progress by the gains (or […]