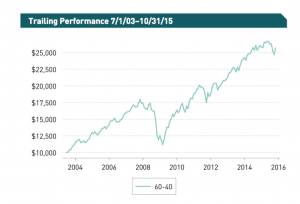

I’ve spent most of this week working on growth projections for financial plans, and wanted to share some of the results with you for your own planning needs. Those hit most by this will be the people working with financial planners (or brokers) who have been given a growth projection by some fancy software.Unfortunately, using […]

Why Mutual Funds Suck

The first US based Mutual Fund was created in 1924, called MITTX. The theory was that it allows an investor to buy a broad array of stocks without having to buy 1 piece at a time.. IE it makes diversification affordable. Great idea. Both active and passive funds hold stocks which are traded by the fund’s […]

Where my assets are located

What a great post idea, tell the world where I buried the loot! I read a few posts from around the web recently from these ‘personal finance bloggers’. For those of you who don’t know yet, a personal finance blogger is more likely a person who wants to earn an affiliate check from a finance […]

How much is a fixed rate of return worth to you?

Here’s one of my classic questions to advisors, and to arm chair advisors. “Should I take out a Home Equity Loan to invest in stocks?” My gut feeling is that most people would say that this was a bad idea because it is ‘risky’ and perhaps ‘gambling’. But in the same breath, they’d have no problem recommending […]

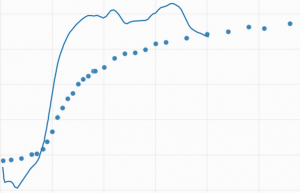

Should you hold, or sell?

There’s a lot of froth in the markets right now, and one common theme that I hear repeated is ‘don’t buy high and sell low! Variations on this include holding for the long term, not worrying about volatility, etc etc.It’s all solid advice, but in one situation, I might suggest that selling is a better […]

Did the Robo sell when the master said hold?

I’m not trying to Roboadvisor bash here… there’s enough of that going on. This is a sincere question. Do you know the answer? I don’t, and it would be great to find out.Roboadvisors like Wealthfront and Betterment “sell as a virtue” the idea of automated, algorithm derived tax loss harvesting. This sounds amazing, but what […]

DIY rebalancing

The markets are pretty rough today, reflecting a strong sell off in China. If you have a 401K account you have a couple of smart options: Don’t look. Just keep working. Rebalance. Option 1 isn’t the most efficient, but it offers value for those who might get emotional over the results (a very natural reaction) […]

How to get out of a bad Roth IRA

Reader Eric commented on my ‘Experience opening up a Roth IRA‘ post to ask if he had been sold a poor investment for his Roth… sadly this is an example of where something that has great publicity (the Roth) and is now a necessity, has been taken to the extremes of money making by the […]

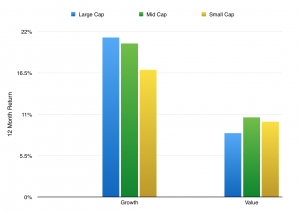

Building Model Portfolios -US Equities

I’m currently building model portfolios for my new firm. When looking at US Equities as part of a portfolio the question is how far to stratify them in an attempt to create management opportunities, it is my belief that the more we can granularize a product, the more opportunities will emerge, however this comes with […]

What happened to $twtr yesterday?

Shares of Twitter dropped from $51.21 at 3pm Eastern to $41.80 by 3:45pm. A drop of 18.38% The reason for the drop was based upon the earnings report released. Unfortunately for many people, the earnings were due to be released after the close of the market, and an error meant that they hit the Twitter […]