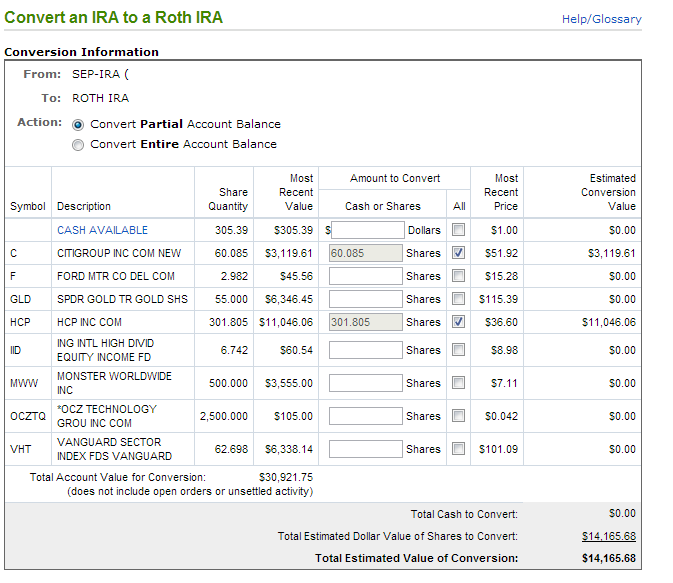

I just quickly converted $15,000 into a ROTH IRA for the year, using Partial Transfers you will bring your income up by the amount of the Transfer, but in doing so move the Traditional IRA money that was growing Tax Deferred into a ROTH IRA that grows tax free, and is more favorable in estate planning.

The other benefit for doing this is to adjust how much your tax burden is for the year. I personally deployed a C-Corp double taxation strategy that allows me to defer taxable income to when I want to receive them this year so that I kept my income low, paid into 401(k)s and IRA’s to reduce AGI further, and then actually did such a great job of lowering my taxable income that I needed to pull money back into the AGI in order to take advantage of all the non refundable tax credits.

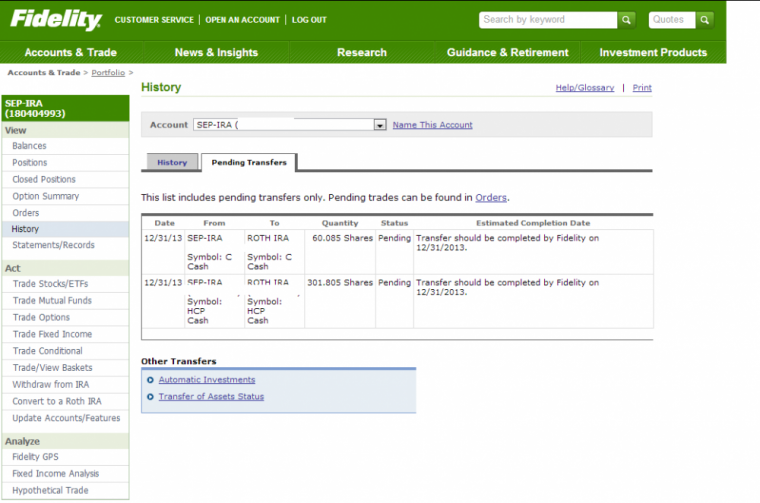

As I discussed here, non refundable tax credits will only bring your tax liability to zero, they will not create a positive tax credit from the IRS. So sometimes you actually need to earn more money, in order to claim the deductions that bring you back down again… sounds weird – but in doing so by transferring the into the ROTH you achieve the goal of still ended the year with no tax (or perhaps even a credit) whilst shifting your retirement accounts around. The process with Fidelity was simple, and it took me no more than 3 minutes start to finish online.

Words of warning

You don’t transfer into a ROTH by withdrawing from your IRA and Adding to a ROTH – it has to be seamlessly done where you never touch the money, else the IRS will call it a distribution and penalize you.

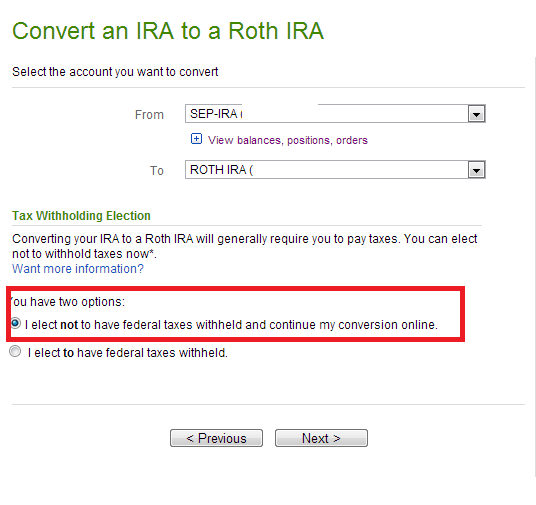

Also, do not elect to have any taxes taken out in the rollover, this kills the value of the account, instead be ready to absorb the extra tax bill. You get the extra tax bill because year to date you have earned and paid X in taxes, then suddenly on the last day like I just did, your salary jumps by the amount of the Partial rollover – so the IRS expects an extra lump sum of taxes from you. You may need to pay estimated taxes to them in order to avoid a penalty here.

4 Step Process

When you elect to transfer to the ROTH from this page, it automatically opens a ROTH IRA to receive the money, once done you follow these steps to transfer in.

Converting to a ROTH isn’t for everyone, but it works doubly well for the way our finances are structured, both to raise our burden up higher so we can then reduce it again by claiming certain business and capital loss deductions, and later, as it grows in a better way for our estate planning and retirement needs. To learn if it might be right for you check out this post explaining more: Using Partial ROTH conversions for Tax Management

Call your broker for more advice on this, it can be a very savvy play if done correctly, but like everything, can be messed up if you don’t calculate the tax impact correctly.

I do not quite understand why I would pay any voluntary income taxes by converting my traditional IRA to a Roth. I only do it in order to stuff my bracket so I never show a negative income. No one gets credit for a negative income because that turns in to a big fat zero.

There are two types of credit, ‘refundable’ and ‘non-refundable’ the latter would give you no credit for a ‘negative income’. More accurately, the non-refundable credits will only take away from your tax liability, however, the refundable tax credits will pay you even if your liability is zero. As such, you can create situations where you owe nothing, and they pay you, but you need enough income for that to work out.