Get Started with Options Trading 101 if you need an Introduction to Options Trading.

Options Trading 102

Here I want to explore a couple of strategies for building equity in your accounts, and how I went a little to enthusiastically into the land of Options Trading and (be careful as I lost $12,440 in a single trade, well actually, I haven’t lost it until Friday – so fingers crossed Citibank!)

Useful Terms

- Strike – the agreed price to buy or sell the option is the Strike Price

- Expiration – The duration of the option, the further away it is the higher the Premium

- Premium – The amount you pay to buy an option, or receive when selling an option

- Time Value – The amount of monetary cost for the length of time before Expiration. A call that expires tomorrow will have less chance to fluctuate and therefore there will be very little Time Value

- Intrinsic Value – The amount of monetary value in the option between the Strike Price and Market Price of the underlying stock.

- In the Money The Strike Price is below the market price, if you sell the option today you make a profit on the difference between these prices, plus any Time Value the option has Intrinsic Value

- At the Money – The Strike Price is equal to the Market Price, if you sell then you are only receiving Time Value, however closer to the money will create a multiplier effect on the Time Value so it will cost more, but still has no Intrinsic value.

- Out of the Money The Strike Price is above the Market Price, you are receiving only Time Value, less than At the Money as a large price movement would be needed to earn Intrinsic Value

- LEAP– Long Term Equity Appreciation Securities these are options that have very long Expiration dates, often up to as far as 3 years in the future

- Bid – Ask Spread – The Bid is what people are willing to pay to buy the stock or option, the Ask is what people are asking to sell it.

- Options Contract – Typically a block of 100 shares

Buy Writes and Covered Calls

These are one of the more safe forms of trading options, but be prepared for some risk and knowing when to get out of your trades, i’ll talk about the risk in this at the end of the paragraph.

A Covered Call is selling someone the Option to buy your stock at an agreed price until the date of expiration. As the seller you receive a premium from the buyer for this opportunity, and if the Option expires worthless then you pocket that Premium and move onto the next trade. If the Option expires In the Money then you have to give up your shares to that person, at that price.

Example – You buy 1000 shares in Citibank for $42.75 per share, the net cost is $42,750 you later sell the option for someone to buy Citibank from you at $44 per share by March 2013.

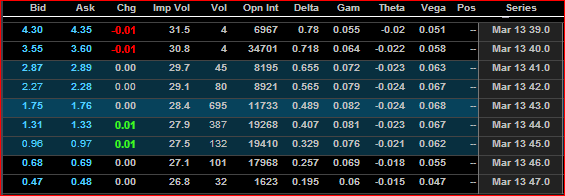

What you see from the above is the Bid Ask spread for the trade, it is quite tight at just 2 cents and lots of volume, people love this option right now. Lets assume a fair market price of $1.32 for this option (in between $1.31-$1.33) and then work out what that means to your investment.

If you sell a covered call for the full 1000 shares you will be selling 10 Call Option Contracts (10×100 shares) for which you will receive $1.32X1000 IE the price you see is the amount PER SHARE that you will be earning on this trade. You get paid on this right away and the cash is deposited into your brokerage account, to the tune of $1,320

For that price, you have to be willing to part with the stock at $44 until March 2013; therefore if at any time the stock goes over that amount you could get called on it, and have to pass it over to the buyer, who would pay you $44,000 for the privilege. If your Option is Exercised like this you would receive a total of $45,320 for your investment of $42,750 for a profit of $2,570 Not too shabby. However, the buyer of the option is of course hoping the stock will go WAY above that $44 mark and you would lose out on any additional gains by giving up the Options Right. This is an example of an In the Money Covered Call.

If the stock remains constant, or even if it fluctuates but the option is not exercised and the final price in March is below $44 then the Option will expire worthless, so you would keep the Premium and decide if you want to write another option for further down the line. If the price of the Stock goes up from $42.75 to $43.99 this is the best possible solution, as your underlying stock increased, but the option still expired worthless and you can sell it again.

If the stock price drops, then you can be more comfortable in the chance that the option will expire worthless, and also can look at the Premium as downside protection, as you are reducing your basis by receiving the Premium. However if it drops violently your can get stuck holding the stock and the (albeit worthless) option contract. If you brokerage account isn’t set up for the highest level of trading (writing naked calls) this means that you cannot sell your stock until you sell your option. It is a bit of a pain, and can impact you if you are planning to put trailing stops on the account. People sometimes place a Married Protective Put on these trades to hedge against that scenario, and it is important to note that if you do not have the protective put you should closely monitor your position in the event of a stock dropping and you needing to manually cover and sell the position.

The good news is that Stocks tend to drop and pop on news, so if you are keeping abreast of current affairs in general, and your stock in particular then you should be aware of what is happening when. However you will also have to learn to track connected stocks too, as events with them can affect your own stock.

The biggest impact on stock price at the moments is Quarterly earnings and guidance, this is when the company will report not only what it recently booked in sales, but also set expectations for the future quarter or year. Positive news here gets a good pop in the stock, and negative news crushes it. Right now we are in a very unstable time in the market, which means a little good or a little bad news seems to have a much more dramatic effect than might be normal.

These are the basics of a Covered Call. A Buy/Write trade is one where you decide to open the stock position and immediately offer the covered call, so it is a nested transaction. The value in such a trade is that you could potentially buy more underlying stock using the Options Writing to supply you with additional capital.

Leave a Reply