This is a great way to give back to your Charity of choice, whilst leveraging massive tax benefits in the process. The ability to donate appreciated stocks to charity provides double dipping savings on tax as follows:

- You would be able to claim a deduction based upon the current fair market price of the stock.

- You would be able to avoid Capital Gains Taxes on the profit from the stock

It is worth noting that this method only has value on Long Term Capital Gains Positions – which means a stock that has been held for more than 1 Year. Donating Short Term Positions means that you cannot claim the appreciation in the Deduction, examples:

- $1,000 stock position grows to $5,000 in 8 months Donate $5,000 in Stock to Charity allows you to claim $1,000 deduction on taxes.

- If that same $1,000 stock position is held for more than 12 months it becomes a Long Term Capital Gain Position, donating $5,000 will allow you to claim a $5,000 deduction on Taxes.

This 12 month rule that puts the investment into Long Term Capital Gains range makes it easier to compute value – Long Term Capital Gains is 15% for those in the 25% Tax Bracket or higher (0% for those in the lower brackets) so in the above examples, if you have invested $1,000 in Stocks that have appreciated to $5,000 you will owe taxes of 15% on the $4,000 Gain, for the tune of $600.

That is always the problem when it comes to Investments in Taxable Accounts – when they go up what to do with them to cash out? As soon as you sell you have to face taxes on the gains.

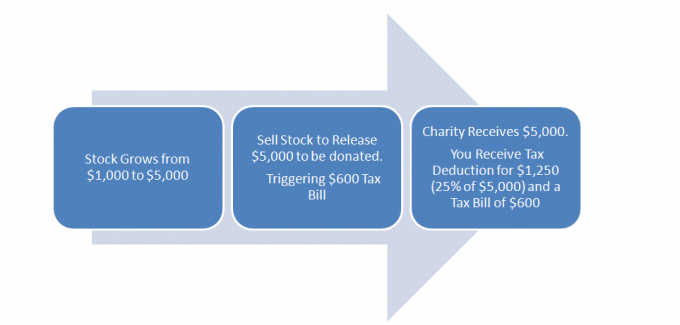

Now, let’s assume you want to donate $5,000 this year to Charity and you are at the 25% Bracket for Tax, if you sell the stocks you would have the $5,000 and with it a tax bill for $600, you could donate the $5,000 and deduct it from your income for this year, you would result in a Net Savings of $650 from Taxes.

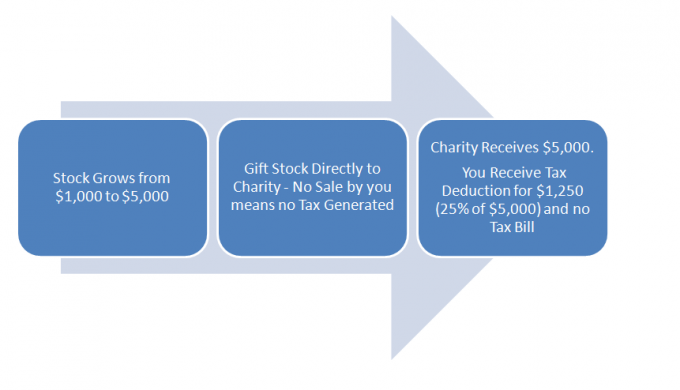

And here is the same stock being used to donate to the charity but rather than selling it and triggering a Tax Bill you Gift the Stock to Charity Directly. As you can see in this example your $1,000 Investment is allowing you a $1,250 Deduction.

Of course, your situation might not be as pure as that – it might be that you have more than enough money to donate the $5,000 today without needing to sell the stock, but think about it big picture. If you donate today and EVER need to sell the stock then that is an opportunity lost if you don’t Gift the Stock instead of money. I would say, if you have any appreciated assets and give to Charity this is by far the best way to do it.

Limitations

- Generally, you cannot claim more than 30% of your Annual Salary in deductions of appreciated stock. Excess amounts can be carried forward for up to 5 years.

- While all Charities can accept donations of stock by law, not all of them have the proper infrastructure in place with Brokerages to do so, as such if you want a simple solution your charity choices are more limited.

Brokerages that facilitate Charitable Donations of Stock

Many Brokerage houses offer this feature, some of the ones I checked and do so include:

- Fidelity

- E*Trade

- TD Ameritrade

- Vanguard

In closing, make sure that the charity that you seek to support has 501 (c)(3) Status – if they are listed as default options by your Broker then they do so, but if you are working with a Broker that allows you to name any charity then make sure they have that Tax Exempt Status. However, I urge you to look beyond just the 501(c)(3) status when selecting a charity and make sure you are working with one that is actually using the money well, in order to help a cause that is important to you. There are a lot of companies with 501(c)(3) status that are, in my opinion, a scourge on our society. Please do your research carefully.

Almost a year later and I get first!

came across this after reading As the Joe Flies’ post today. Great post, I never knew about any of this and will definitely use it in the future. Thanks for the resource!

You are welcome – and first after a year! I need to work on my social media campaign 🙂

I also came here via Joe Flies, although on reading it I remembered seeing it before.

We have been doing this for years, but with a little twist. When our parents died, we had a small windfall and decided to open a family fund at a charitable foundation. Each year we gift some stock to the foundation. We get the full tax write-off, and the foundation invests the money on our behalf. We can then direct the foundation to make charitable gifts to nonprofit organizations of our choice. The advantage is that we can give smaller gifts to multiple organizations at the time of our choice.

We replenish the fund as needed and as our tax situation warrants. The main issue we’ve faced is that it is best to initiate transfers a few weeks before the year ends. Sometimes there are delays and we’ve had to scramble to make sure the gift was credited in the proper year. As long as we start the process in time, it works quite well for us.

Just clicked on another link in Joe’s piece and I now understand that Fidelity Charitable and its Giving Acct functions just as the foundation does for us, serving as a donor-advised fund allowing donor directed gifts. Good show!

Yep, glad you like it – the Donor Advised Fund is a great idea, I actually don’t have one currently, but it is on that list of mine…