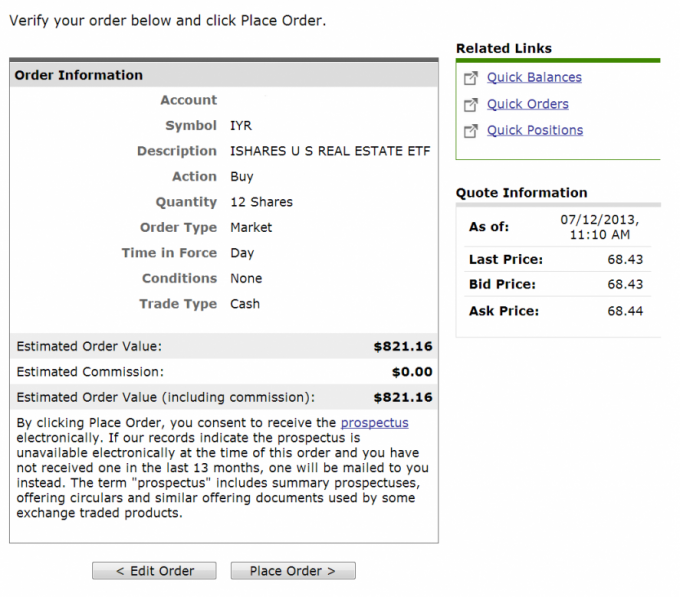

I set up an Account with Fidelity in April 2013 with the mission of building a Brokerage Account with a value of $5,000 funded from Cash Back from Credit Card spending, I also kicked things off with a $250 that I had saved by cutting cable early this year. Today I made my first Asset Allocation and invested my Cash Back into my first Brokerage position. The amount of the investment was $821.16 which got me 12 shares of IYR, a Real Estate ETF from Fidelity.

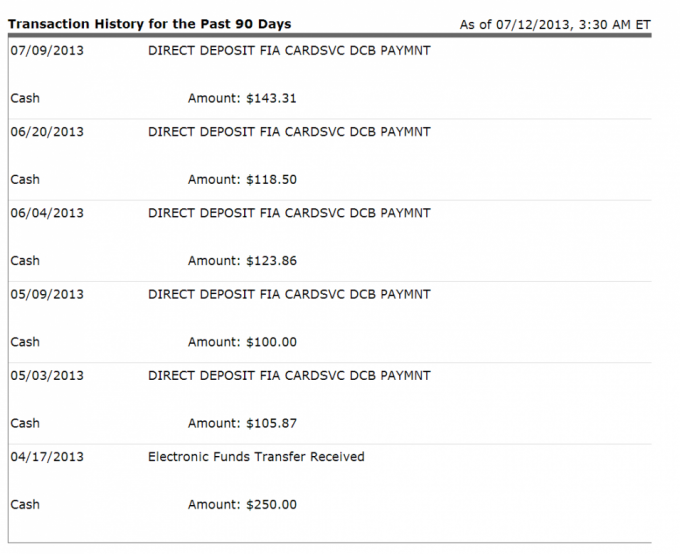

If you want to join me in the Challenge, please check out post #1 which will get you started, talking about how to set up the accounts and credit cards: $5,000 Brokerage Account Challenge – Building a portfolio using Cash Back and some savings from household expenses here are my deposits thus far:

Biggest Threats to our Success: Fees and Lack of Capital

The two factors that worry me most in this challenge reflect regular investing too, are Fees going to eat up my profit, and am I saving enough to hit goal. I don’t want to just save the $5,000 I want to save as little as possible and gain as much as possible from the Market’s contribution. That said, it is important to have realistic expectations from your investments, and frankly anything more than 7% gain would be remarkable.

To reverse engineer that, I would need to achieve savings of approximately $4,800 in year one, or $1,200 per quarter. At the end of my first Quarter now I am behind that target by around $380. I have made a decision not to top that shortfall up with addition investment, rather focus on earning more next quarter and hopefully making the goal.

Fees, as we know from examining Traditional Mutual Funds vs Indexed Funds and ETFs are one of the most damaging factors to asset accumulation. Typically, when we look at Fees they are a percentage of the account balance, as most balances are larger, however in the case of the $5,000 Challenge we have very small purchases, so the concern for us will be flat trade fees. We will be doing our trading within Fidelity, which charges a trade fee of $7.95 each way on trades – that means if we decided to put our Asset allocation into a mix of say 5 individual equities we would be hammered with a $40 Trade fee- which would take a 5% bite out of our $800 investment. If we invested like that we would never make any money.

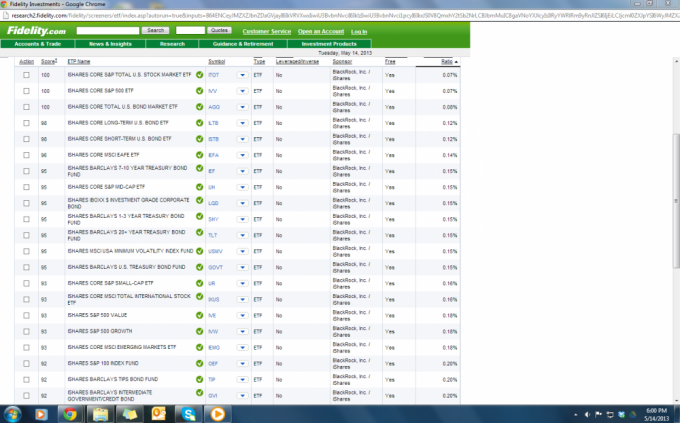

Fee Free ETFs from Fidelity

Luckily Fidelity offers 65 Fee Free ETFs, these are funds that contain a blend of equities, some are stocks, some are REITs, some are Bonds. These offer an excellent solution to the Micro Portfolio approach, because we don’t pay an entry price, so keep all capital, and we get a broader position than our small $800 investment would normally allow.

Prior to selecting my first investment with Fidelity today I screened my current investments to identify where I had gaps, by linking up my current Retirement Accounts, ROTH IRAs, 401(k) and Brokerage Accounts I was able to quickly snapshot my overall investments and it gave me a recommendation for investing in a Real Estate fund. Based upon that and the present value in the Fund I went ahead and invested fully in IYR. Here is my review of Personal Capital where it saved me several thousand in fees for switching out of a high cost fund, they are a free service that adds considerable value to your investment planning, it really becomes useful if you link up all your different accounts as it shows where you overlap, or where you are gapping in your investments – plus it offers suggestions to save money in fees, and what they will do to your savings over time :

Personal Capital Powerful Free Tool To Examine Your Investment Accounts

If you want some help finding the Fee Free ETFs and why I picked IYR for my initial allocation here is a video of me using the ETF Screener on Fidelity to explain my thoughts further:

So, 3 months in, and a little behind target for me, I hope to increase spending, and since IYR has been declining recently perhaps it will be good timing to enter for a rebound, and make additional profit there too. Even being behind schedule, it was very nice today to be able to purchase 12 shares of a Real Estate Fund for $821, at absolutely no cost to myself.

Leave a Reply