You may have heard the classic story of the Shoemaker’s children having no shoes, or the phase Physician, heal thyself.

But who is wurs shod, than the shoemakers wyfe, With shops full of newe shapen shoes all hir lyfe? [1546 J. Heywood Dialogue of Proverbs i. xi. E1V]

It is a very real phenomenon that dedicated professionals are so busy do their job and looking after their customers, that they let their own situation slide. I’ve long been a proponent of simple, low cost ETFs in a model portfolio, and of avoiding single stocks, but in tandem I’ve also held a couple of single stocks in forgotten accounts.

I remember recounting to FQF my emotional rollercoaster from holding Twitter stock (TWTR). Last year there was a huge pop in the value, with news of a potential buyer, I got excited, then looked for my position and couldn’t find it, so figured I’d divested long ago. Later that day, I realized it was sitting at another custodian all along, and therefore I had made profit!

The entire event was quite distracting, which is one of the reasons I finally found the time to clear house and move my assets to my own management model.

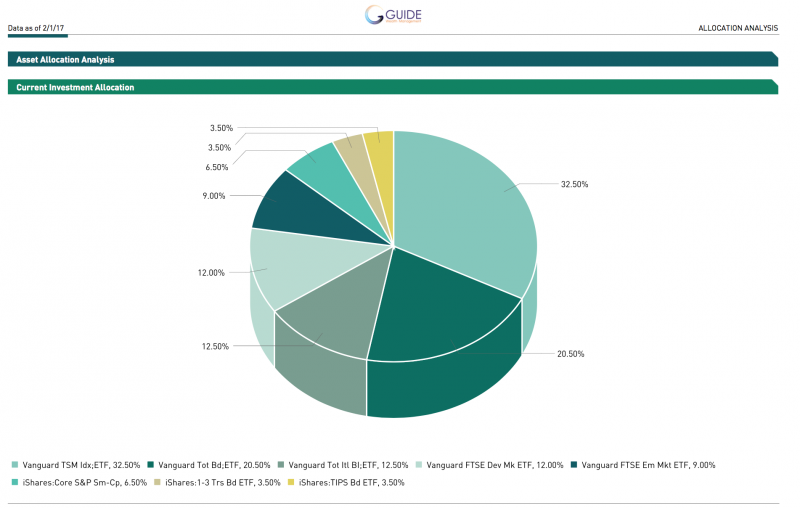

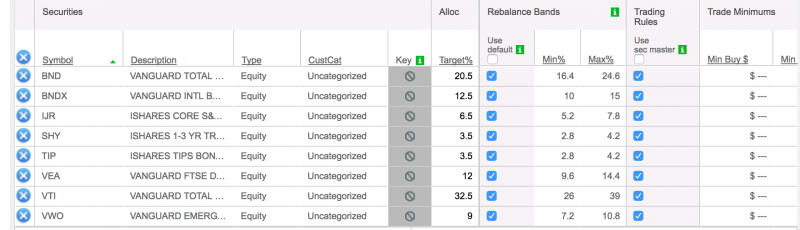

One of the reasons why I didn’t do this sooner is that it really wouldn’t matter to my financial future if I sold or held these few stragglers (the other being Tesla) so it wasn’t that important. My core investments were always held in low cost funds, but now they will be rebalanced and tracked more accurately, using institutional technology. Without further ado, here’s my allocation:

60/40 Portfolio

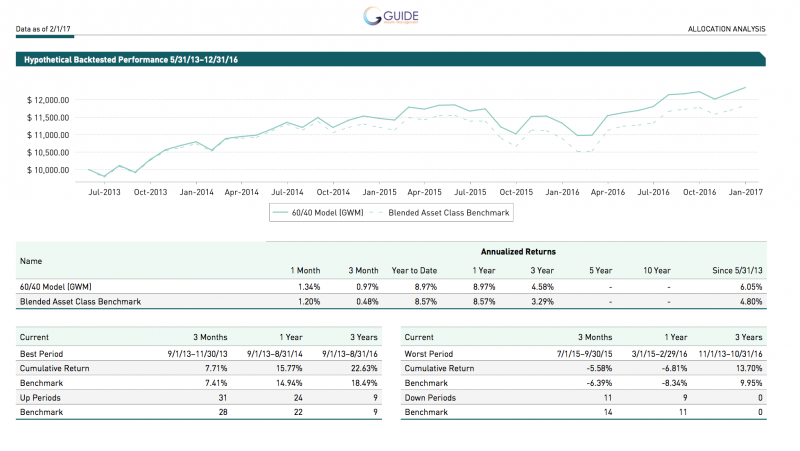

Back Testing

Note, backtesting is over-rated, but it can be helpful in illustrations. This chart shows the performance of the entire portfolio, including Best and Worst case scenarios.

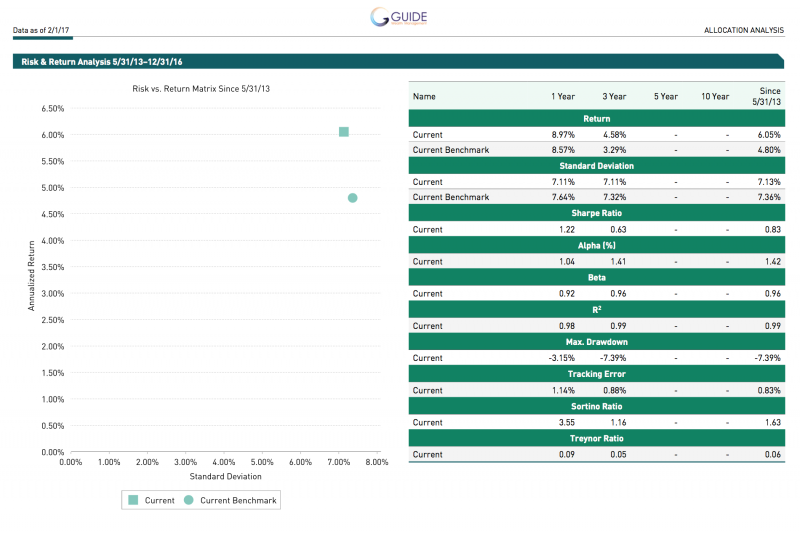

Modern Portfolio Theory

This chart shows Modern Portfolio theory and the concept of risk/reward. Risk is measured here as Standard Deviation, IE how much returns fluctuate from the expected. The goal is to get Annualized return high, and keep Standard Deviation low. This is where I could manipulate the portfolio to match better back testing, and create what appears to be a more attractive return. This would be by avoiding International Stocks. However, I think that International Stocks are vital, so I’m ‘ignoring’ their past poor performance in selecting them going forward (buy low, sell high?)

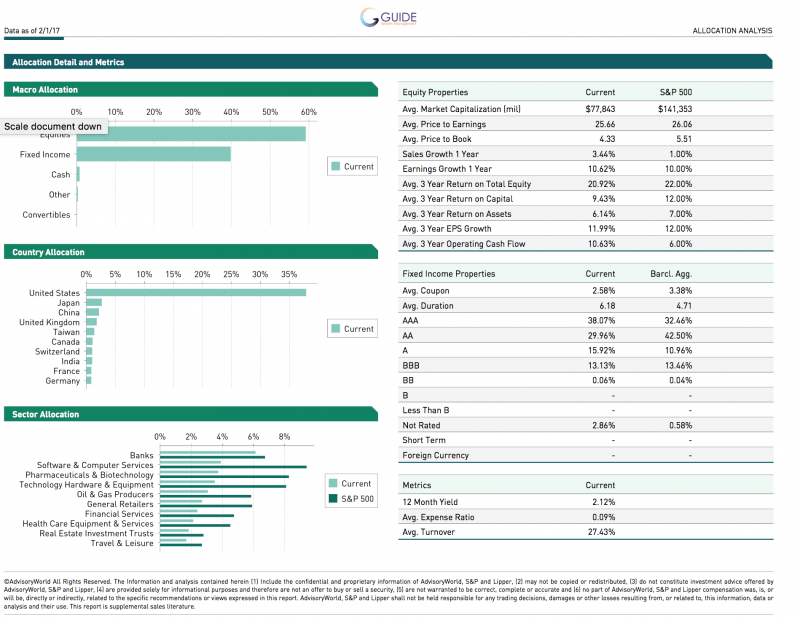

Macro Allocation

I’m comparing the Macro Allocation to S&P500, and the Fixed Income to Barclays Agg. This isn’t a great benchmark to use because my asset allocation is international, but it is a good way to show the difference in terms of exposure on a Country level, and how that impacts the underlying Sectors.

Rebalancing

That’s it. We’re currently ‘all in’ using this model, we have cash for spending, cash in businesses, and everything else is here in a 60/40 allocation. I use rebalancing tolerance bands to keep the portfolio on track, with a 20% spread, for example, if I start with a target allocation of 32.5% VTI, I will allow it to raise to 39% or lower to 26% before forcing a sale.

While the numbers sound high, the accounts are rebalanced periodically in addition to this, when new cash is introduced, it is targeted strategically to top up any positions that are drifting away from target. For taxable accounts I would also periodically run rebalances for tax loss harvest opportunities.

The solution is simple, takes less brain power and emotional power than stock picking, and is highly efficient in terms of cost and tax impact. I’m monitoring performance closely, and do make changes, but at the model level, rather than at the ‘stock picker’ level.

Are you using a robo? If not, how are you monitoring the 39% trigger, is there a way to automate or are you just checking everyday?

I use institutional rebalancing technology to periodically check for any opportunities. It isn’t a ‘robo’ per se, it is more sophisticated than what you can get at the robo firms because I am able to construct around held away assets.

You know this was coming. What software program are you using?

Thanks!!

I use a lot of software for different reasons.. which are you referring to?