This post will explore retirement options for holders of TIAA CREF accounts, with a focus on the RMD impact of holding vs rolling over to a lower cost option. If you know an education professional approaching retirement age please share this with them, and I’d be happy to answer questions in the comments.

Understanding RMDs

Required Minimum Distributions (RMDs) force account holders to deplete their balances by distributing a minimum amount each year. It is worth noting that these rules apply to traditional IRAs and also work based plans, but there are exclusions from the rule if you remain employed, where your RMD would start after retirement.

In most cases, the first RMD is required to be made by April 1st in the following the year you turned 70 1/2 yrs old. However, there is a special provision with certain older accounts.

Contributions made to 403(b) plans prior to 1987 are excluded from RMD calculations until age 75. 403(b) plans are generally offered to those with City jobs, and are particularly prevalent within the teaching profession. This offers value to the account holder as they can use the opportunity to roll over other accounts during the window until age 75, thus lowering total RMDs thereafter. The reason for this is that Roths (the destination of the rollover) are not subject to the RMD rule.

Note that the RMDs themselves cannot be used to rollover. You have to take that money out first, and then rollover further amounts.

Calculating RMDs

RMDs are based on actuarial tables (longevity) and start with the divisor of 27.4 at age 70. If you had a Traditional IRA with a balance of $100,000 you would be required to distribute $3650. Note that the table actually starts at age 0 which can be used for non spouse beneficiaries to calculate ‘stretch IRAs‘.

Impact of rollover strategies

Rolling over money from tax deferred to tax free (Traditional to Roth) is a taxable event. You receive 1099 income in the year of the transaction. However, If you do manage to rollover money from Traditional to a Roth you would lower your future RMD. The reason for this is that Roths are exempt from RMD rules. In the case where a person has $100,000 in IRA’s, if they had rolled over $50,000 from Traditional to Roths strategically, over time, then their RMD amount would be reduced from $3,650 to just $1,825. Controlling when you pay the tax (on the year of partial rollover vs when you must RMD) can control the tax bracket that you reside in when the money flows from the tax deferred account.

When this matters

Let’s remember that TIAA-CREF is a plan focused on education professionals, who might also have income from other sources in retirement, such as pensions and social security. This can mean that tax brackets are already forced higher due to required income distributions, and therefore using sabbatical to rollover to Roths may offer long term value.

TIAA CREF Pre 1987 Plans

IRS regulations for treatment of pre 1987 403(b) plans differ from other types of tax deferred savings plans. This can offer advantages, but only in a very small and unique set of circumstances. Many people who have held accounts for this period of time will (thankfully) have earned significant growth due to compound interest. This means that the vast majority of the balance of the account does not benefit from the prefential treatment. As an example, RMD Calculation for TIAA CREF Pre 1986 plan of $100,000 with $10,000 of grandfathered contributions would be $90,000 /27.4 = $3285.

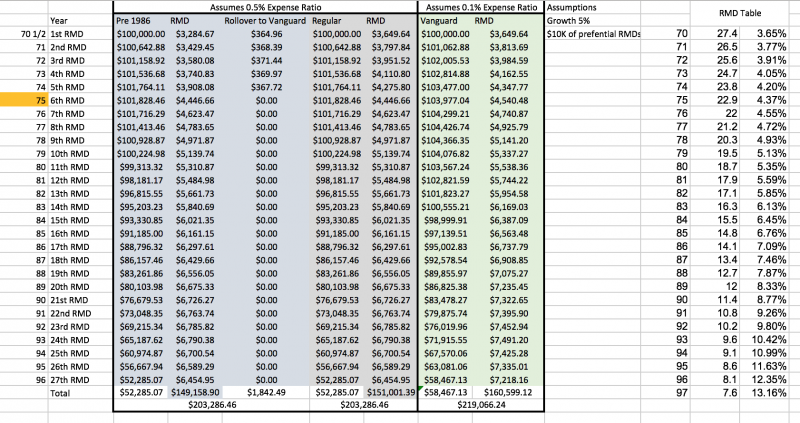

Below is a chart that shows the opportunity to rollover funds if you had a lowered RMD amount. The first column shows how the lowered RMD amount creates a small window of opportunity to rollover, but because of the rule that forces Pre 1987 money to roll out first, the value in this example is very limited. Note the third column, with Vanguard funds to provide perspective of the lower fees available, and how that can offer better value than TIAA CREF as the CREF funds are relatively much more expensive.

Pre 1987 money rolls out first

In theory, lowering the RMD amount would allow a person to rollover a small amount into a roth with the same tax impact as another person who simply took the RMD from a non 1986 plan. However, due to the rules on the rollovers, anything you roll will come first from the balance of pre 1987 money, so it does limit value. In the case above, I have two people with the same balance of $100,000 at TIAA CREF, one using the $10,000 of pre 1987 money to rollover, the other without such pre 1987 money in their account. As you can see, the value of the roth is only $1,842 from this, which does reduce future RMDs, and does offer estate transfer value, but not by much. I did not inflate the amount in the Roth going forward, though that is a consideration.

TIAA vs CREF Investment options

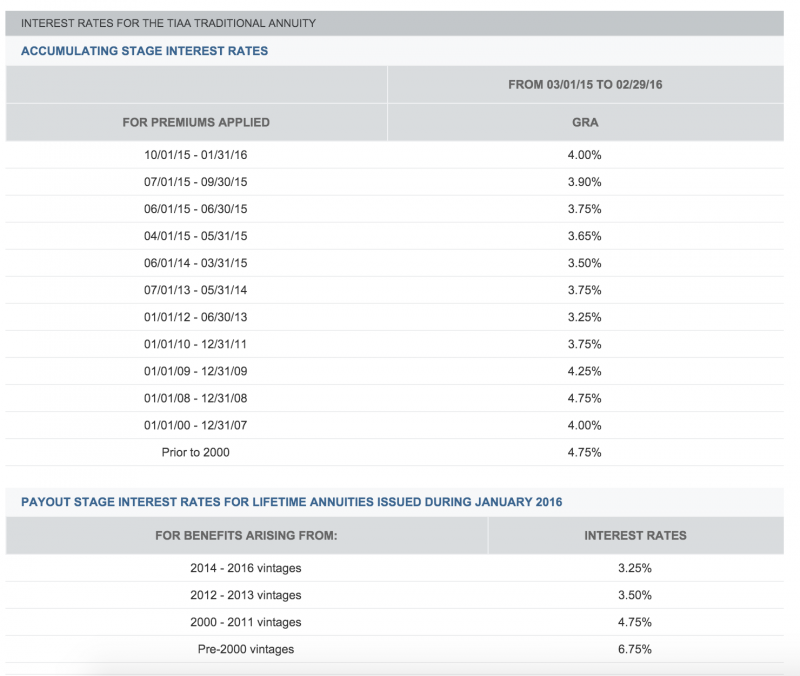

CREF offers an array of fund options, including stock funds, bond funds, REITs and others. In addition, TIAA has an investment option called the ‘TIAA Traditional Annuity’. Each period a rate of return is offered for the fund (known as a Vintage) and money invested (or reinvested) into the Traditional fund during that period is guaranteed (by TIAA CREF) to offer a fixed rate of return. The most attractive vintage could be has high as 7% for older funds.

The Traditional fund works with a bucket like system, where interest generated by one vintage will be poured into a new one, potentially at a different rate. Therefore a 6.75% vintage account with an initial balance of $10,000 would generate $675 in interest this year, this interest would not earn 6.75%, rather it would earn whatever the current vintage is being offered, which is around 4% at this time. This means that an individual will many buckets of money within the Traditional account all earning at different rates. TIAA will not allow you to cherry pick which bucket to withdraw/rollover and prorates all withdrawals across all buckets.

Generally speaking, this guaranteed rate of return is more favorable than many other options in a low interest rate environment, and as such is one of the highlights of the TIAA CREF investment options. Though it would be much more attractive if they allowed you to move out the poorer performing accounts and keep those offering the highest levels of growth.

CREF Fund options are expensive! R1,R2,R3 funds

The other fund offerings (stocks/bonds/etc) from CREF are denoted by the term R1,R2,R3. Each ‘R’ level represents a different level of expense ratio, all of which are considerably more expensive than a low cost index fund offering from the likes of Vanguard, Fidelity, or Schwab. The R rating that you are offered is dependent on the relationship between the university and CREF, R1 being the worst for the customer, and R3 the best.

In terms of cost difference, each fund offers a different expense ratio, but it is not uncommon to see 0.6% for an R1 graded fund, and perhaps 0.3% for an R3 graded fund.

Conclusion

The age 75 RMD rule for pre 1986 accounts is an interesting nuance of 403(b) plans, and some people will find value in retaining their accounts within TIAA CREF for this reason. However, many other people might find that the added cost in terms of expense ratio from the R1,R2,R3 rated funds makes it a smarter option to forgo special treatment of the RMD.

The key considerations:

- Rolled over funds reduce 1986 treated money first.

- Fees at TIAA CREF are high in comparison to low cost index funds.

- TIAA Traditional Annuity funds can offer value in a low interest rate environment.

- TIAA Traditional Annuity pro rates withdrawals from both good buckets and bad ones, so you can’t cherry pick and leave only those offering the highest rates.

Depending on your circumstances it may be better to keep all your funds with TIAA CREF (a small subsection of people fit this criteria) or roll everything out to a low cost broker, or to roll out the stocks/bonds R Rated funds, and keep the Traditional accounts intact.

Great explanation! I am sending a link to my professor husband and will suggest he share it with his colleagues.

I don’t understand this:

“Note that the table actually starts at age 0 which can be used for non spouse beneficiaries to calculate ‘stretch IRAs.”

I’ve never heard the term “stretch IRAs.” Maybe a one sentence explanation in the post to clue others like me in?

Love how thorough you are! Thanks!

Glad you liked it! A stretch IRA is a topic in its own right, and ideally I’ll write up a post on them, then can link to it. The basic premise of this is that the RMD number is based on age, so if you pass IRAs to younger generations they get the benefit of the long term growth while minimizing the forced requirement to distribute (RMD).

Typically, if you think of the RMDs in your life time as depleting the account, the ‘stretch’ aspect slows that depletion, to the point where the funds may grow at a pace (or faster) with the low RMD amounts thus maintaining the IRA and the benefits of tax deferred growth for longer.