Reader Eric commented on my ‘Experience opening up a Roth IRA‘ post to ask if he had been sold a poor investment for his Roth… sadly this is an example of where something that has great publicity (the Roth) and is now a necessity, has been taken to the extremes of money making by the big financial firms. He was contributing monthly $458 to make up the $5500 limit, and was being stiffed with a 5.75% load fee every month.

The situation is all too common, so here are some ideas on how to remedy it.

Step 1 Cut them off.

First thing you should be able to do is cut contributions off. Check to make sure you haven’t been tricked into some elaborate clauses against this (It’s very doubtful that this could happen, but prudent to re-read what you signed.) and stop the deposits to the bad Roth. You can start depositing to a ‘good Roth’ right away, or take a moment to figure it out.

- Roth contributions can be made until April 15th of next year for this year, so you have some time, just don’t blow the money you were saving in the meantime!

Locating the ‘Good Roth’

Many people hold up Vanguard as the gold standard, and I agree that broadly speaking you’ll do well there. But they are not alone in this, and other firms can offer low cost ETF options. You should be shooting for no more than a 0.20% expense ratio on ETFs, and closer to 0.05% for things like the broad US market.

Note – Vanguard is both a custodian and a ‘creator’ of funds and ETFs. This means if you want to invest in Vanguard you don’t need to send your money there, you can invest in Vanguard’s products at Fidelity, TD Ameritrade, or any number of other brokerage firms. Typically you will be faced with a stock trade fee to buy a Vanguard ETF from other brokers, and you can find their own products to be quite competitive when compared.

Recap:

- Vanguard, Fidelity and TD (along with others) can all custodian your money (you can deposit and hold your account there)

- The above 3 tend to all have competitive solutions, but you might be best buying Fidelity ETFs at Fidelity, and Vanguard at Vanguard as they let you trade their in house products without the commission ($7.99-9.99 per trade).

If you make monthly contributions to an IRA, the trade fee aspect of ETFs is important to avoid.

Step 2 How to exit the bad Roth

In Eric’s example he is 7 months into the bad roth. This means he can push the remaining 5 months into a ‘good roth’, but he has 7 months of $468 (minus those load fees) sitting with the bad investment. Note that the investment he is in has two major fees, the load fee, and the expense ratio.

- Load Fee (5.75% in this case) is paid with every account deposit..

- Expense Ratio (X% in this case) is an annual fee paid in addition to the load fee…

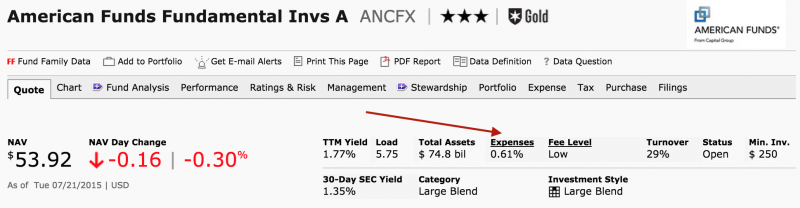

If you google the ticker (4-5 letter name of the fund you can easily find the Expense Ratio. Here’s an example with American funds, showing a 0.61% annual expense ratio (this is the number I suggest keeping under 0.2%)

Note that certain ETFs will have higher Expense Ratios, this occurs with more elaborate holdings, such as foreign based ETFs, and can be worth paying the extra fees for, but for Domestic US, it should be lower than this.

Decide whether it is worth getting out or not a big deal.

Run a quick calculation, EG, lets say there is $3150 in the bad roth. That means each year you’d pay out $19 in fees ($3150*0.6%). If you swapped to an ETF mix averaging 0.2% then it would be about 1/3 of that, or $6.30. Is it worth moving the money out to save $12 per year?

How to move the money out

The best way to move an IRA is to move into another IRA, because this avoids the risk of penalty and fees. There are two ways to move the money:

Transfer – this is custodian to custodian level transaction, often times it involves a direct transfer and you never see any money, but you might also receive a check from the ‘bad roth’ made out to the ‘good roth’. Watch out for ACAT fees here (explained below)

Rollover – A rollover means you pull out the money and redeposit it within 60 days. In this method, your custodian would write a check to you, and you would deposit this into an intermediary account (your checking) and then you write a new check to the new custodian. Basically you are taking receipt of the assets invested for a period of time. The risk here is that if you don’t offload them into a fresh account again within 60 days it is considered a void rollover, and you may face a penalty for taking an early distribution (explained below)

Recap

A transfer is safer than a rollover as there is less chance for you to not complete it in time, however, some ‘bad roths’ may charge an ACAT fee for the transaction, which can really hurt small accounts.

The withdrawal penalty

- You pay taxes + 10% on any gains on withdrawals prior to regular retirement age for the Roth.

With a Roth that has substantial gains this is important, but if you catch a ‘bad roth’ early, such as 7 months into a poor market, you may find that there are no gains. Those fees actually help here somewhat, as they increase your cost basis. Another quick and dirty calculation is simply:

- Add up what you actually contributed (not what they deposited after taking the front load fees) and compare that to current market value. Note the actual reporting may differ from an accounting perspective, but that’s a good way to eyeball it. With 5.75% load fees, the account may be less than the contributions, and contributions are always allowed to be withdrawn without penalty (the penalty only applies to the gain portion).

The big downside of withdrawing (and not transferring to the new Roth) is that you kill your annual Roth limit for the year. You’d pull out whatever is left over, somewhere around $3.1K but couldn’t go on to fund a fresh $5.5K to a new ‘good’ Roth for the year, you’d be limited to the balance of $2.4K.

ACAT Fees

If you decide that you really want to move the money away from the ‘bad roth’ and don’t want to just withdraw it you’ll be looking at doing an institution to institution transfer. The problem with this is that you might find your ‘bad Roth’ charges you a fee (ACAT fee) to process this, it may be as much as several hundred dollars. Vanguard is one firm that will not reimburse this fee, so if you move from Bad roth to Vanguard you’re going to have to eat that fee – which might make it smarter to keep the funds with the bad roth….

Promo’s and Deals

Remember when I said you can invest in Vanguard without using them as a Custodian? Well, if you really want out of the Bad Roth and into Vanguard, you could custody with Scottrade, who will reimburse up to $100 of NorthWestern’s ACAT fee, then buy a Vanguard ETF for $7 (note that Scottrade also has an ACAT fee, so be sure you are OK with them!). The hope here is that you make enough $7 trades to claw back that money they saved you.

How about recharacterization? Sounds like this will help you undo the whole thing.

Isn’t that for rollovers?

Either rollovers or contributions, but it does seem you can only change Traditional to Roth or vice versa, not undo the whole thing.

Well a contribution is a rollover right?

The angle I see for recharcterisation is for high risk assets- rolling back out of Roth after they depreciate.

Great post. I really like your financial blogs, easy for most to understand with good info.