Robinhood is another stock trading startup backed with heavy venture money. CNN Money states “Robinhood wants to eliminate those commissions and make trading as easy as ordering a car on Uber or Lyft.” great… just what this economy needs.

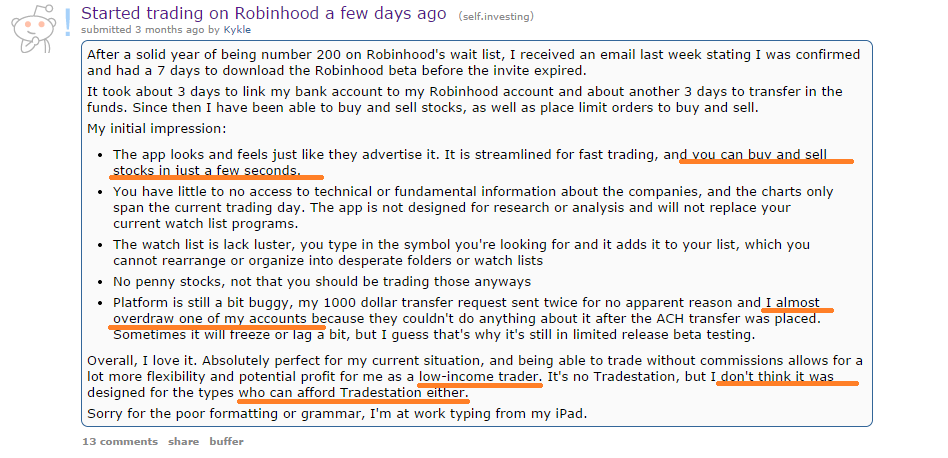

Lowering the barriers to trading brings in more cheap, and dumb money. Build an App with zero minimums and zero fees to trade and you are inviting people who shouldn’t be in the game to dive right in over their heads. Robinhood is still in Beta, they are bringing new customers in slowly, here is a review from one such investor on Reddit:

You’ll note the highlighting I hope.. this person has less than $2000 in his bank account, and yet is ready to kick off with a $1000 trading account. Robinhood’s marketing copy describes such people as ‘investors’, per below.

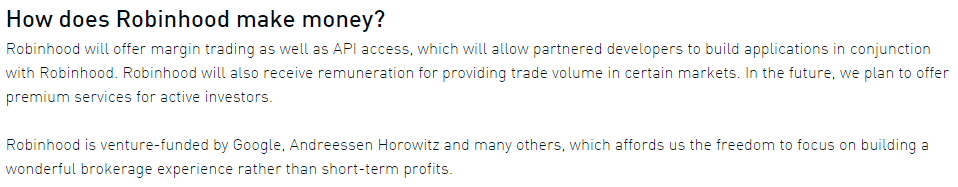

But I hope that you will see the real investors are listed below, the venture firms who are going to clean up from all the dumb money that comes into the market. That they plan to make money from their clients who not only can’t afford to trade, but need to borrow to facilitate it is quite sickening. Yet another firm out there to take advantage of the lack of financial education out there, and keep another generation in debt.

A huge opportunity indeed, and I am sure that the guys at Robinhood are going to do very well for themselves. For the people out there who think they are the next Gordon Gekko, I recommend you get yourself a cat instead, it’s cheaper, and you can upload videos of it to YouTube.

All of the orders will just be sold to HFT algos who will just front run the shit out of the trader. Citadel will become a little more rich, Virtu may finally be able to publicly issue, and mom and pop will lose again.

Yep, other than it will be Jnr who is losing the money rather than mom and pop – these products are aimed at a young market.

Started using the app a few days ago as well, and so far I really like it. As a college student with less than 4,000 in my trading account, $10 commissions in my TD Amertirade account were taking a toll.

As the reddit poster says, the app is pretty basic and straightforward: watch list quotes, portfolio positions and performance, bid/ask spreads and some account management features are about all you’ll find. You will have to rely on other websites/resources to do your due diligence and research.

I haven’t had any bugs or account errors to speak of – fingers crossed. For the trade I have made thus far (purchased a few equities and some ETFs), my limit orders have all executed flawlessly, so no complaints there either.

Wait a sec- you are a college student with zero debt who paid his own way into school? That’s fantastic!

How did you get to be in this position?

To be honest, most of the people using tradestation shouldn’t be trading either. When you look at annualized returns over a long period of time, a low risk mutual fund will almost always win out. I don’t think lowering the barriers to entry is necessarily a bad thing, what’s needed is more consumer education on how to make low risk long term investments.

That’s not sexy and doesn’t sell. Just like telling people to eat right and exercise doesn’t work for people wanting to lose weight. People will always look for a quick fix unfortunately.

Why isn’t lowering the barriers a bad thing? Think about how many people can’t afford to trade and why that is. The people with the financial education to make this decision properly are certainly able to afford a $5-10 trade fee.

It’s just like letting younger people into a casino.

I don’t think your comparison at the end is fitting. A better comparison would be if Casinos didn’t let people under a certain income in. I think you missed the general crux of my argument though. Rather than having a debate on what trading fees should be, the debate should be around who should be trading in the first place.

I don’t think anybody should be investing in stocks unless they are consistently able to beat the market, unless they are willing to admit that what they are effectively doing is gambling. I think the number of people who can do this is frighteningly small when you account for pure chance. Hell, even most investment companies fail to do this when you look at a suitably long time frame (even more so when you take into account any fees charged).

Lowering trade fees lowers the barriers to entry, but it also makes it less expensive to invest for all investors and increases market liquidity. Yes, more people who shouldn’t be trading will trade. Which is why we should be properly educating consumers rather than using high trade fees to try to keep them out of a market.

I think regardless of trade fees, people that shouldn’t invest will. Keeping those people out of the market isn’t a good enough argument for not striving for lower trade fees for ALL consumers.

I’m fine with not allowing low income people into casinos too (or to buy scratch cards and whatnot) but age is as important as income. There are very few young people who have the asset base to invest, or the financial savvy, that are actually going to benefit from the lower fees.

Liquidity does indeed increase, as dumb money flows in.

Now they just need to allow purchases with a credit card so I can max those out AND drain my meager savings account

I have a couple of invites if anyone wants to skip the line. You must have, or have access to an iPhone to use the app.

Greetings, your post here was really good. I wanted to ask you something though… Do you know if insder trading is the same thing as a trading scheme? I want to get into trading but I’m worried I might get into trouble without realizing I’m doing anything wrong. Eagerly awaiting your reply.