We had a conversation recently in the Forum about picking funds from MorningStar Reports. Let’s breakdown what is happening here, and hopefully provide some ideas and education on the way. Firstly, some formalities:

A Mutual Fund is a collection of individual stocks, or funds that is most often actively managed by fund manager/s. Each fund has a philosophy or goal (other than making money) in that it might follow a particular segment of the overall market, or perhaps more broadly covering entire markets. In order for a fund to be considered actively managed the fund manager must make buying and selling decisions based on factors beyond the simple movement of the benchmark index. Mutual funds were created to allow people ‘low cost’ access to more broadly diversified investments. They are still very popular, but I would argue that you can replace them completely with a well designed portfolio of ETFs.

According to the ICI Factbook There are over 8,000 mutual funds available, and with so many options, you might wonder how an investor might know how to pick one. Enter the Rating and Reporting Agency’s. MorningStar is one of the most well known reporting agencies, and like all analysts, they seem to follow a two pronged approach to monetization of their research. Firstly they sell access to individuals, and secondly the other is to sell to the funds themselves, or their sales people, who then in turn use the professional data to help convince clients that this is the ‘right’ choice for them. This takes us to the first lesson of reading A MorningStar Report:

What version are you reading, and why?

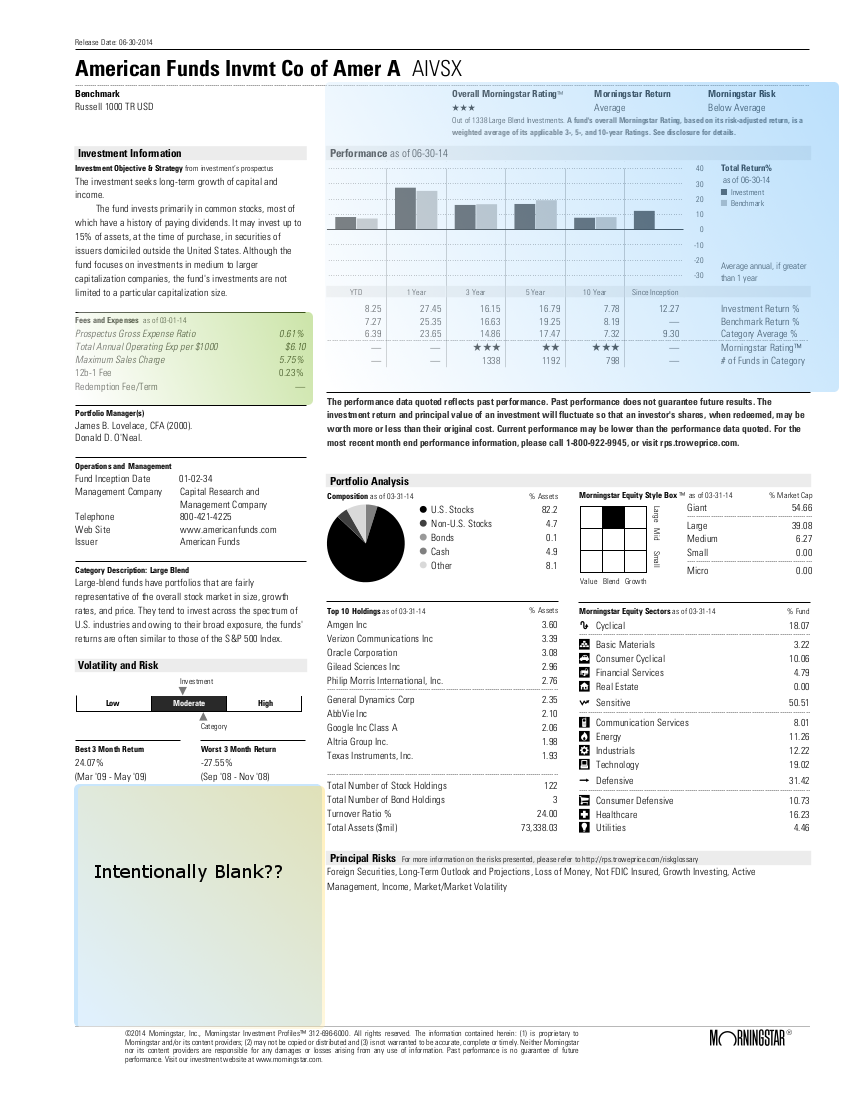

AIVSX Version 1 (from T-Rowe Price)

This first one, I picked up from the T-Rowe Price Website. This fits into the category of ‘Reports sold by MorningStar to people/firms who use them to sell a product’.

I’ve highlighted in color some areas of interest. The first thing I want to ask you is do you notice anything about Front Load Fees here? I highlighted this in the green box on the left. There is a front load fee of 5.75% with this fund.

Front Load Fees are Hilarious to the sellers of a fund, and YOU are the joke.

What I find interesting about this front load fee is the verbiage used by MorningStar in a report designed to be used to sell a fund. They actually seem to avoid the use of the phrase Front Load Fees, they replace it with ‘Maximum Sales Charge’. That’s a little weird right?

There’s actually a ton of information that is missing from this report compared to another report I will show in a moment. One wonders if this version (paid for byT Rowe Price) has data presented in a different manner for a reason? After all, reporting agencies are designed to quickly collate a slew of data, and then present it in a manner that is easily digestible. But it is quite clear that you could take the same underlying information, and present it in many different ways. It is clear that you could influence perception by selecting what to include and exclude, and how you phrase your data. This is marketing 101.

So, if you think you can pick a fund from a MorningStar Report, you better know what you are reading, and why you think it is a good fund.

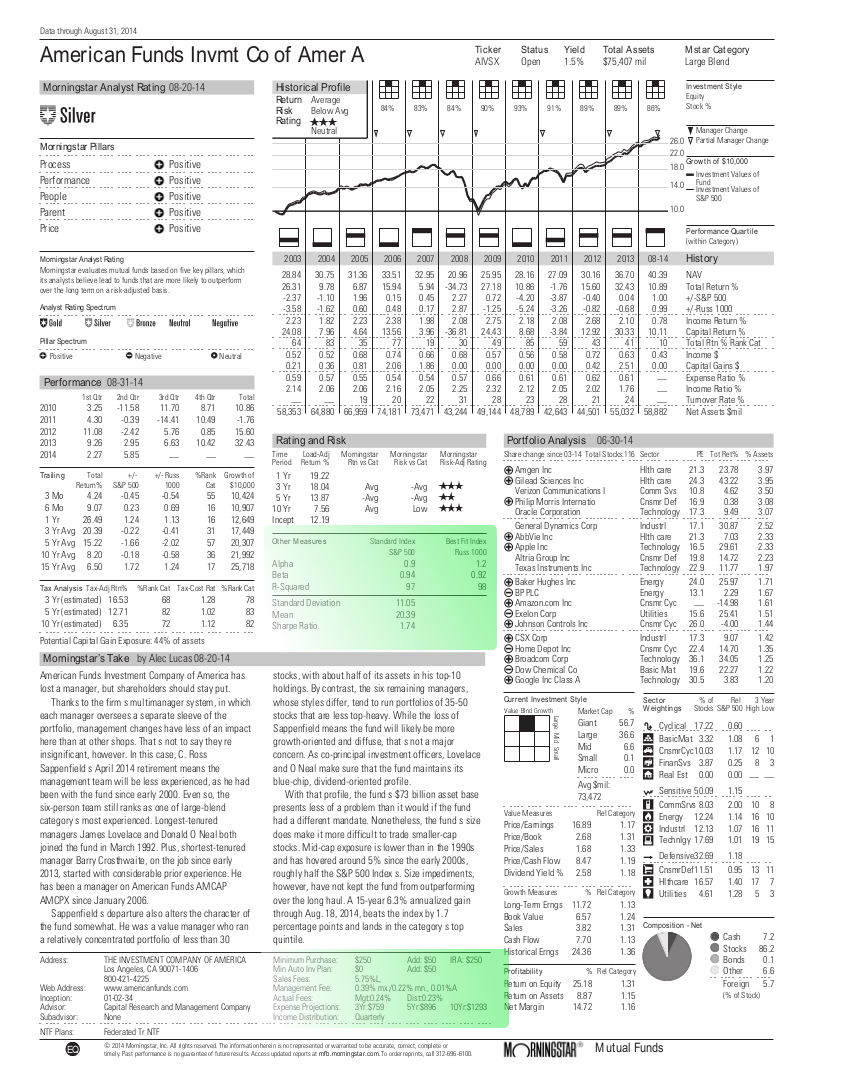

AIVSX Version 2 (from MorningStar.com Premium)

I signed up for a premium membership of MorningStar.com to see how data was presented here. While it is more in depth I think we should still consider who the target market is here, is MorningStar Premium, at $199 per year, something that is aimed at individual investors, or is it aimed at advisors? If the advisor is proposing funds with load fees attached they are being compensated by such fees, it it is something to remain mindful of.

However, all things considered I see a lot more data on the Premium Version, which is a good thing, and they do go into a bit more depth on the fees.

I do like that they extrapolate the expense projections over years, which is helpful, but again, it doesn’t really show where the money is going (the 5.75% load fee is used to compensate the salesperson of the fund, the management fees to compensate the fund company). FINRA does a lot better job of explaining your fees here. A $10,000 investment into this fund will cost you, with a 5% rate of return your first year fees would be $633, and despite the fund appreciating by 5%, you’d lose money because you paid your ‘advisor’ a lump sum upfront.

I also like that this version brings in more statistical information. And this puts us back into the ‘Can you read a MorningStar Report? Topic.

What you should know:

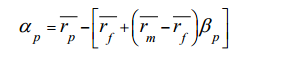

Alpha – performance against the benchmark – how much ‘upside’ has the fund manager provided with savvy decision making? This is intended to calculate actual returns vs the benchmark. Alpha is something that can be easily manipulated by tweaking its components. There are two places you see Alpha discussed:

- If you see alpha described as a number, such as 1.0 then the fund has outperformed the perceived risk by 1%. Alpha of 0.0 means the return is equal to the risk, and a negative Alpha means that return is lower than expected for the degree of risk taken.

- Alpha represented as a percentage is often given when calculating projected return using models such as CAPM. If a fund has a projected return of 8%, but actually produces 10% in a year then it would be reflected as an Alpha of 2%.

The key to manipulating Alpha is to use indexes that are tightly correlated to the risk profile assumed. You will see this when people attempt to compare a funds performance to what appears to be a substantially similar underlying benchmark, but in fact has a different risk factor associated with it. This can be done by swapping around the S&P with the Dow Jones, or any other index.

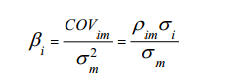

Beta – Beta is a measure of risk and looks at how an investment should perform against a benchmark. You should think of Beta as a reflection of how an investment will react to a

moment of the underlying market. A Beta of 1 means the investment has a movement akin to the benchmarked market. In this case, if the market should drop by 2%, so should the investment. A beta of less than 1 means that it has less movement. This would mean the investment is more conservative. A Beta greater than 1 means that it will move at a greater rate. For example, a Beta of 1.5 would mean 50% more movement, so if the market moved 2% here, the investment may move as much as 3% (in either direction).

Beta is an important component of the Alpha calculation, in the sense that if you manage to slip in a different beta, by using a ‘wrong’ benchmarked market, you can improve the perceived Alpha.

R-Squared – this refers to goodness of fit, more specifically it is a regression analysis for the co-efficient of determination. This is reflected as a number between 0-100, with 100 meaning that you have a perfect correlation. This is a useful tool to determine if the underlying benchmark is to be trusted, but it is limited in that it doesn’t know if the benchmark is the correct one to have been used. However, if we can determine that the underlying benchmark is acceptable we can say that a high R-squared is good, and a low one is bad. Anything under 70 is considered a low r-squared number.

If you have a low R-Squared number it means that the benchmark index is an unreliable source for comparison. This is an important thing to note, as it means that Beta is now an untrustworthy metric, as is Alpha, and Treynor. So this one number can throw off all of your assumptions based on the other data you see.

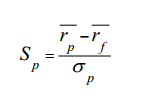

Sharpe Ratio –The Sharpe ratio is a method of exploring portfolio performance, while it can be used at any time, it is most effective when R-Squared is below 70, as at this time, ratios that are derived from Beta fail.

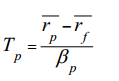

Treynor Ratio –Treynor ratio is almost identical to the Sharpe Ratio, the difference is that it divides by Beta rather than Standard Deviation. If you have a R-Squared above 70 Treynor tends to be preferred over Sharpe.

Conclusion

MorningStar also has several proprietary scoring systems, the Star System, and the ‘Medallion’ system. You get to see, in their opinion if it is a 1-5 star fund and a pewter-gold medallion. I would advise you to not make any decisions based on this alone. While 1 one star fund should likely be avoided, it is very possible that a 5 star gold fund is not right for you either.

You need instead to look at the factors above to assess the reliability of the data presented, and then drill down into how the fund works with your investment strategy. For that you should explore overall exposure. For example, if you have decided that you want no less than 80% of stocks within your investment portfolio, how will adding in a new fund with a mix of stocks and bonds shift your total allocation?

If I can be frank, I would argue that picking from MorningStar is almost as foolhardy as picking from watching an episode of Cramer, but hopefully now you can see a few more pieces of the puzzle. The most important rule you need to follow is keeping costs low, and assets diversified, all within your own personal risk tolerance level.

Lastly, there is no good reason to pay a fee to front load or back load your investments, arguably anyone who tells you otherwise is being compensated by that fee, or has been sold by someone compensated by that fee. If you want to see the impact of mutual fund fees on investments I would recommend the FINRA tool.

The Morninstar Report presented is not from TRowe Price. TRowe Price sells no load funds only. The report presented is from American Funds Company.

Yes it is managed by American Funds, but the prospectus was shown on TRowe Price… Nice of them to have this if they don’t sell load funds..