I’ve been known to have a punt on occasion, and when playing in casinos my favorite game was Blackjack for quite some time. Blackjack, for those of you unfamiliar with it is, is often considered to be a game of ’21’ in that the goal is to get as close to 21 without going over and ‘busting’. The secret to Blackjack though is that it isn’t about getting to 21 at all – its about winning.

How it works

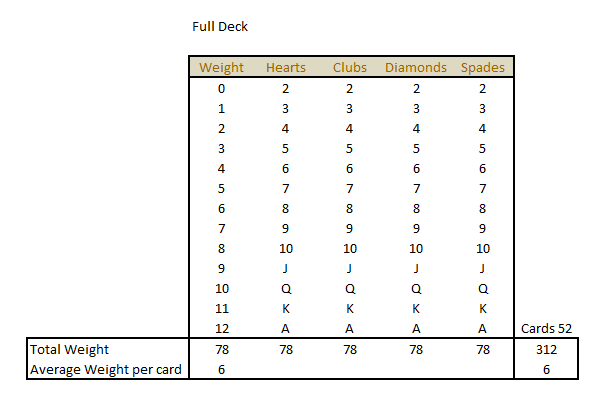

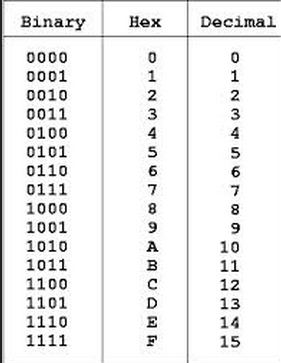

A deck of cards is actually a replicated numeral system, the most common form of numerals is the decimal system, from 0-9 and other well known ones are binary, 0,1 and more so with the computing age Hexadecimal (Hex) 0-F. Once you can wrap your head around the Hex system this makes more sense. Here’s a chart that shows how these work together:

I find the best way to explain conversions between decimal and hex is to look at the number 17. Hex is a Base 16 numeral system, so 17 is reflected as 11 in decimal:

1x 16 and 1x 1 = 17 therefore 17 decimal=11 hex

Likewise 24 would be:

1x 16 and 8x1 =24 therefore 24 decimal = 18 hex

A deck of cards works off a Base 13 numeral system, and the ABC are represented by the names, Queen, King, Ace. Jack is a 9, and 10’s are 8s- I know it is a little ugly, but the fact is that our counting systems start at zero and don’t have 10, but cards don’t have zero and do have 10… so you need to take a leap of the imagination here.

Therefore truly adding together a Jack and King would result in a B13 addition of 9(b13) and B(b13) which would result in a decimal value of 20 (9+11). Understanding this concept is the root of card counting. The deck of cards has a finite number, and a finite number of values are represented within the deck (4 suits) being able to manipulate this knowledge allows you to learn if a deck is heavy (high numbers) or light (low numbers) and based upon the rules of the game, can change the odds completely.

Counting Cards

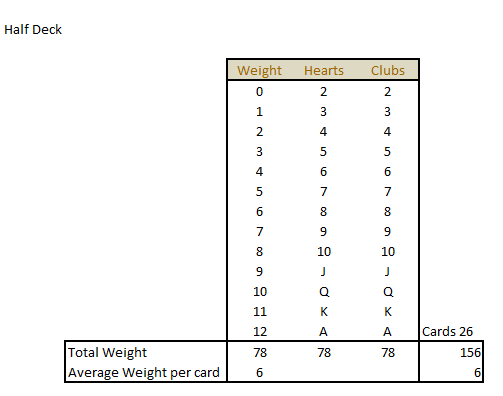

Most counting systems are simplified, because keeping track of the true numbers is hard if you aren’t Rain Man, and there are myriad of methods built around this. The other piece of the puzzle to a successful count is knowing when you have reached critical mass, and the weighted average of the pack has enough substance. If we decided that it was at the halfway point through the deck, a geomertically neutral for example purposes would be to strip out Diamonds and Spades, leaving 26 cards that offered the exact same weighting as the full deck.

However, if the cards came out in a random order, it is possible to see how this influences the weight of the deck.

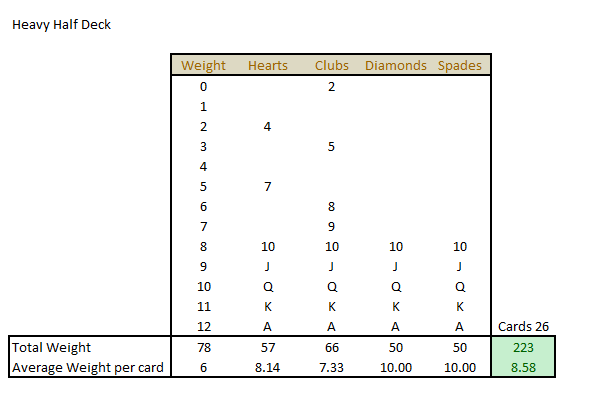

For example, if you took a single, 52 card deck and the first card dealt was the King of Hearts – you would know the pack was ‘lighter’ than if it was the 2 of Hearts. However, the impact on the weighted average would be minimal. If you could get through half a deck and had counted out 26 cards of the following randomness:

- 2 of hearts, 2 of spades 2 of diamonds

- 3 of hearts, 3 of spades 3 of diamonds 3 of clubs

- 4 of spades 4 of diamonds 4 of clubs

- 5 of hearts, 5 of spades 5 of diamonds

- 6 of hearts, 6 of spades 6 of diamonds 6 of clubs

- 7 of spades 7 of diamonds 7 of clubs

- 8 of hearts, 8 of spades 8 of diamonds

- 9 of hearts, 9 of spades 9 of diamonds

You have a very heavy deck. Sure, there are a few small cards remaining, but out of the 26 cards in the deck 20 of them are a face value of 10 or Ace, and this is a hugely player stacked deck, if played correctly. And as the half deck progressed the random nature would decrease, further increasing accuracy. The casinos use the Cut Card to reduce the impact of counting.

Blackjack Dealer Rules

In order for the game to be professionally run Casinos have opted to follow a very simple format. They must draw to 16 and stand on 17 or above (some will hit soft 17, it will be printed on the cloth) this has nothing whatsoever to do with the players actions. Therefore if all of the players have been dealt 20 and the dealer flips over 18 they will accept defeat and payout, even though in theory there is no downside in them ‘hitting’ to take another card and maybe getting a 3 to win everything.

It is that rigidity that applies to the game that makes the ‘heavy’ deck favor the player, because lots of smaller cards = lots of sneaky ways that the dealer will hit (as they must) hands of 16 and under and get a total that is under 21 without busting. With lots of 10s, there are many chances for natural 2 card 20’s for the player, many chances for Blackjacks (10+Ace) and many chances to sit and hold and hope when the dealer is showing a drawing hand, for that dealer to bust out.

Blackjack is the best casino game for the player

Blackjack comes in many variants, at its best the house edge is only 0.28%, this is the best bet you can get in a Casino (other than a high odds crap table at full bet) and it is pretty close to even money. Actually, you might wonder how the house makes much of a profit at all?

As a player you are not bound by any drawing rules, you can hit 20, you can stay on 4, the world is your oyster. The more stupid your decision, the better for the house. So since not many know how to optimally play Blackjack the house edge swings up. That also means, if you wanted to, you could mimic the dealers drawing rules and always draw to 16 and stand on 17 and above. Surely the house wouldn’t pick anything other than the best strategy right?

Well… interestingly if you play the ‘Dealer Strategy’ you actually lose more. The reason for this is that the Dealer drawing rules are not the best strategy for the game overall, they are the best strategy given blind conditions based up on forecasting and table position. The best player strategy is to react using a more complex ‘if, then, else’ approach:

- Dealer: If total < 17 hit, else stand

- Player: If Dealer card <4 and Player total < 13 hit, else if Dealer card <5 and Player Total <12 hit, else stand (plus double and split) etc..

The optimal strategy for a player correlates the dealer total and the player total because the dealer has taken a predefined ‘position’ in that they will draw to a rule. Therefore, if the dealer is showing 5 we know they must draw, we know that drawing could mean they ‘bust’ and therefore it is better for the player not draw above 12 because the risk of catching a 10 and busting is greater than the risk of the dealer not busting.

Where’s the Edge?

You’d think that since the player can operate in a real time reactionary manner they would have an edge? Well, this is the crux of the house advantage, and where Blackjack, and Annuities share a commonality. The first to die rule. In Blackjack, the house edge comes in its entirety from the fact the player has to act first. If a player ‘busts’ the dealer doesn’t need to draw to 17 anymore, he takes it as a win. That is the edge. And it is just the same with an annuity.

Annuities Explained

An Annuity is a policy that you pay for upfront with a lump sum, which then returns a payment for the natural life of the policy holder, it could be a fixed amount, or a variable amount. There are some variants that will pay the holder, and then pay the surviving spouse, but these are still the same concept, they just have a longer average time horizon, and therefore pay you less annually than a like for like single annuity.

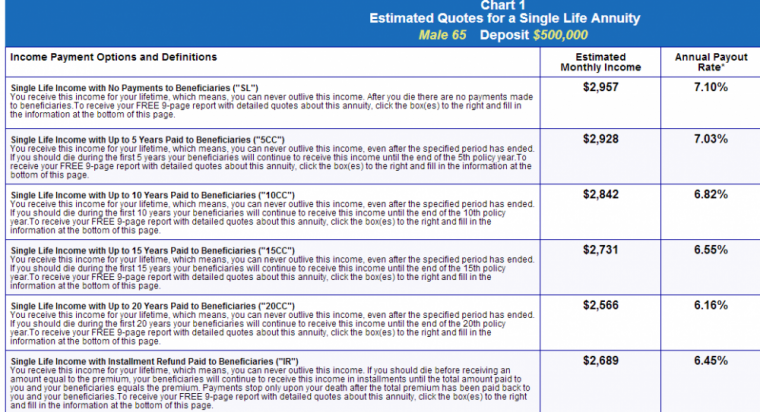

Simple Example: Over the course of 30 years you pay in $300,000 to an annuity program from your employer. It is actually invested during this time so you can allocate it to mutual funds. Let’s say due to the market appreciation it is now worth $500,000 and you are now 65 and ready to retire. At 65 the $500,000 switches out of the funds you were in, and ‘buys’ this annuity plan. The plan offers a fixed return of 7.1% for life. And you can see that it offers a monthly payment of $2957. However, just like in Blackjack, you can ‘bust’ first.

This is a single life annuity, when you die, the plan ends. Nothing passes forward to beneficiaries. If you bust before the house gets to play its hand, then the house wins. With the data presented in this place we can actually calculate the break age that you must live to in order to start having the house make a payout. The pertinent variables for time value of money are:

- Time, Interest Rate, Present Value, Payment, Future Value

- Time:? We are seeking this variable

- Interest Rate 7.1%

- Present Value $500,000

- Payment $2,957

- Future Value 0 (you die, the plan dies)

What the picture shows is simply the interest rate of 7.1% x $500,000 = $35,500 per year, which is $2,957 monthly. But only monthly until you die. So if you received payments for 3 years you would have paid out $500,000 and received in return $106,500, the insurance company made a profit of $393,500 PLUS they had the advantage of holding your $500,000 from day one of the plan earning interest in the market.

The rate of interest that they offer (which in turn generates the monthly payment) is calculated based upon actuarial tables of life expectancy, which they then apply a selection of fees to in order to boost the profit lines.

Let’s take a different look at the same data in order to compare what would happen if we kept the $500,000 in a blend of fixed income instruments, such as treasuries and corporate within an IRA, and lets put a time factor in.

- Time: 249 Months

- Interest Rate 4%

- Present Value $500,000

- Payment $2,957

- Future Value 0

It would take 21.6 years for the amount to reach zero with this risk profile. But more importantly, if you were to die around half way through the plan, at the 12 year mark:

- Annuity would have paid $390,500 and there is no value to the plan

- IRA would have paid the same $390.500 and there is $262,016.76 left in the plan.

So where is the break even point? It occurs at 21.6 years, when your 4% IRA dries up, the annuity keeps on ticking. Incidentally, if you were to increase the risk profile from your IRA and target a well diversified 5% return, the fund would last a lot longer, pushing the longevity to 24.43 years.

Blackjack and Annuities are very similar at their roots. And the ironic thing is the more ‘exciting’ both games become (add a side bet with that?) the less they payout. So if you were to be sold an Annuity that offers to give payment to a beneficiary on your death, akin to my IRA example here, you might be tricked into thinking you had a deal. But all the company does is shave down the amount they give you right off the top, making sure that they will always do better than the 4% IRA example.

The secret to it all… behind the scenes, Insurance companies are using your money to structure something very similar to the IRA, and then they sell it onto you. Now, some people are going to win, and some people are going to lose… but never forget that the house always takes its cut. Ironically, the only person I would recommend getting an Annuity would be the compulsive gambler who tried to count the deck using the Base-13 logic I outlined in the dusk part of this post, because it is a good way of protecting payment flows from people who are high risk, providing they cannot sell the policy.

Fees are the number one killer of any retirement program, you can check what your 401(k) is costing you here, by using the Free 401(k) analyzer from Personal Capital they are an affiliate of Saverocity and may compensate me for new account signups as they seek to build a market share.

Wow – That is an incredible analogy with great info! HOW did that ever come out of your brain? LOL

My brain is an unusually cultivated thing, and every now and then the craziness emerges 🙂

Timely post given the recent Afleck Flack… I’ve always thought of annuities as sucker moves in the current low interest market–but I once met a guy who’s dad bought one in 1980 and is still kicking, and enjoying big returns. As you outline in the post most of that is a product of his long life and the interest rates of the time the annuity was purchased. Should higher rates come back would an annuity be more valid? or equally stacked against you since you’re taking average returns for the IRA?

An area I’m totally disgusted by and would love to read more from the POV of an investment professional would be life settlements. Beyond my ethical investing threshold, but I’m fascinated by the types of people who get involved in it. Nothing is safe from investors–not even your life.

Out living the actuarial life expectancy is the only way to win. If rates go up both the annuities and the underlying assets (bonds, stocks etc) move with correlation. You can lock in 30 year bond durations at the same high rate, but without the fees.

Life settlements, aren’t always awful. It depends on the spread. If there is a housing downturn and an owner has cash-flow issues, perhaps not wanting to sell then releasing cash could keep them going and still allow their heirs to inherit the property (or any other assets in such a scenario).

You can add clauses to life insurance now that allow access in the event of chronic illness, which reduces the use of Life Settlement companies, but they tend not to allow access for cash flow needs.

Conceptually, just like annuities they are good, but when the fees come out they can become abusive.

I was gonna say, shouldn’t Ben Affleck’s pic be up there instead of Sheen. I know you were going for the whole “Winning” thing but in light of Mr Affleck’s recent removal from the Hard Rock Casino’s seems like he’s earned that spotlight on Saverocity.

If I watched the news I could be more in touch with such things- as it is the latest bad boy I know of is Sheen.

Excellent article though you almost lost me in the first few paragraphs. This is very easy to digest in the part on down from “where’s the edge” (and maybe the paragraph above for people who aren’t at all familiar with blackjack). The part above it unnecessarily complicates (IMHO, YMMV I suppose!) your very good points and analogy.

I’ve never really thought through the connection between an annuity which ends at death and one that has a contingent beneficiary. This makes it very clear exactly how both are being structured to get the insurance company past some actuarial profit point. Thanks.

Thanks Neil, I was just throwing out a crazy analogy in a Dusk Til Dawn type approach, thought it might be fun to share the same concepts from a different approach, but I can understand that it could become confusing, glad you stuck around to read it all!

On a regular basis you may get several tips and prompts and also you

are likely to study some strategies to gain more.