I know. The whole 1% thing is so negative, but bear with me. Personally, I am totally cool with people becoming super wealthy and going on to spend their money as they see fit. Having money itself never impressed me, so seeing people with their fancy boats and shiny American teeth has always been a bit ‘meh’ to me, I am not jealous. OK maybe of the teeth but anyway, making money, That I like a lot. Let’s talk about making money the easy way.

Money comes to money

I remember my group of childhood friends were quite bitter about life, they would see the ‘rich getting richer’ and a favorite saying for them was ‘money comes to money’ – I disagree. Money in the sense they were talking about comes in fact as a symptom of implementing best practices. Do things right, and it will come, do things wrong and it will go. And it all stems from two financial documents: the balance sheet and the cash flow statement.

Many people make the mistake of thinking balance sheets and cash flow statements are complex documents, or worse still only used in large corporations. They really are not. You can start with the most simple list, and as your wealth grows the list can refine, gaining precision in a constant cycle of improvement. Shu Ha Ri.

Naming your money

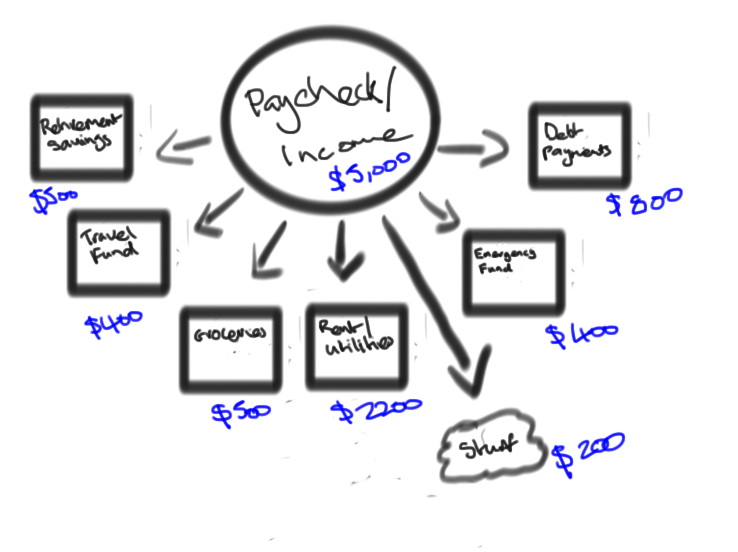

In two previous posts I discussed the power of naming your money and knowing when to break good habits, the purpose of this was to look at your expenses with precision, and therefore create a more controlled budget, or cash flow.

Shifting from Earned to Unearned income

This is the golden ticket to Wonker land. Making ‘money come to money’ when we look at the balance sheet most people will start out in life with nothing but salary on one side of the equation. And often by the time they come to reading a post like this one they already have traded an education for debt. The problem that is faced is the time value of money is working against them, and getting their head above water for long enough to create income generating assets isn’t possible.

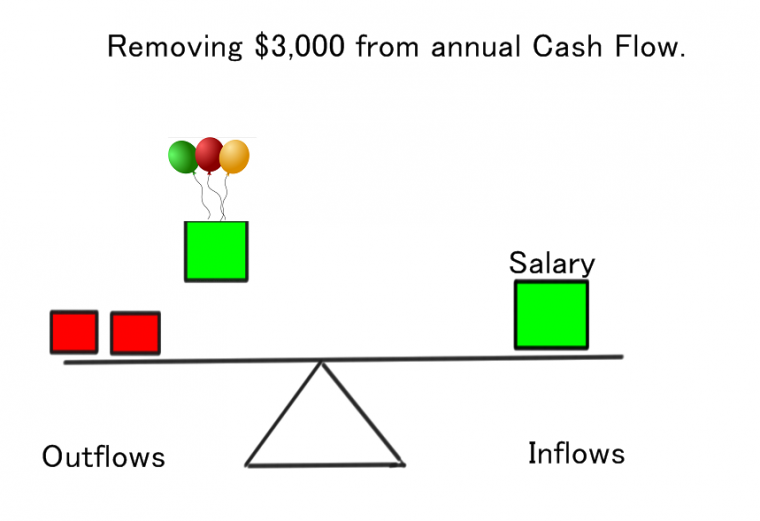

The answer is to lift things away from the liability side of the balance sheet and, most importantly, reallocate the additional income into inflows and assets. Let’s look at that balance sheet as a see-saw, if you are balanced correctly you should hover horizontally, whenever more wealth streams in you should acquire an asset that produces income or capital appreciation:

Travel

Starting with the one many Saverocity readers can associate with: lifting vacation and travel expense from the liability side of the balance sheet by offloading it to credit card points. Simple enough. We go from needing to allocate say $3,000 per year for travel to zero. But if you lose sight of where the $3,000 goes you haven’t really saved the money. It would be better to actually keep an account called ‘Travel Fund’ and keep funding it. Relabel the account ‘Travel money saved fund’ or if you have debt that isn’t optimized correctly direct the funds at attacking that. That would keep the ‘see-saw’ above in balance, and allow you to use that fund to acquire an income producing asset or get rid of debt, whichever is better.

Retirement Funding

I was reading this neat article by Milenomics on the Fidelity Amex card where he mentioned my $5,000 brokerage account funded by Amex Fail in the post Sam mentions that you can turn the 2% Cash back offered into 3% if you can leverage the Saver’s credit. Reader Paul commented:

As for the 3% Savers Credit, your income has to be paltry to qualify. If you are spending time fooling around with 2% cb and you qualify for the 50% bracket, you’ve got your priorities vastly out of whack. Time to get educated and a decent job.

Au contraire mon frere, if you are still working when you could be retired early and getting the savers credit, you have your priorities out of whack! In truth, Paul raises a great point, and I agree with it. However, the ultimate goal is to remove all reliance on salaried income, so the job part is a phase we need to move through as quickly as possible, acquiring large income producing assets and exiting as soon as possible.

It is worth noting that if we do use credit card cash back to fund an IRA we lose the chance to put spend on a Travel credit card to help cover my $3,000 of travel costs.

My philosophy is that there are enough generous credit card signup bonuses to cover my travel needs, so all spend goes on cash back.

Shelter Costs, Debt Reduction, College Savings, etc

The fact of the matter is that all of these things can be offloaded and lifted from the balance sheet, some of the smaller items like by credit card rebates, and the bigger ones by asset accumulation. The key to this is understanding the time value of money, which is basically compound interest calculations. The key is to look at your balance sheet a little differently, and add a ‘compound interest frame‘, and also playing with liability relocation strategies. This will be the subject for subsequent posts.

The cardinal rule for becoming wealthy

If you have something on the asset side of your balance sheet that is not appreciating, get rid of it. If you have something on the liability side of your balance sheet that is appreciating, get rid of it. The only exception to this rule is defensive money that you have decided to sacrifice to protect your larger assets – commonly known as an Emergency Fund. This is a firewall between your wealth and sudden demands to liquidate it. The order in which you attack this rule is important. Dave Ramsey uses the Debt Snowball method which ignores the amount of interest paid and focuses on clearing debt from smallest balance to highest- this is very powerful for feeling achievement, but as Dave himself acknowledges it is not the most optimal from an accounting perspective.

Avoiding a value judgement

I’m trying to move away from the approach of ‘you shouldn’t travel First class when Business Class is just fine’ I can understand that people all value things differently. However, I think it is important to start exploring ‘what if’ situations and modeling alternative solutions to living an enjoyable life today, while being able to make real progress towards financial freedom.

The pieces of the puzzle are:

- Budgeting (reducing cash outflows)

- Creating new cash inflows to ‘lift’ the need for income to pay for expenses

- Reducing liabilities strategically by understanding their impact on your balance sheet

- Doing all of the above with a constant view on tax advantaged routes

Future posts in this series will include:

- Creating a Tax Aware Personal Balance Sheet

- Recognizing the impact of appreciating, depreciating and stagnant assets and liabilities.

- Building the Debt Snowcone – a snowball with a pointy end

- Using Time Value of Money to calculate your route to financial independence

If you want to make a head start on financial freedom and are still at the free travel while in debt phase, why not take a moment to write down how much your travel budget would be for the year, how much you therefore saved, and start thinking about what to do with that money to make you wealthier – Pro Tip: don’t go thinking your first class ticket was really valued at $15,000 else you will be eating rice for the rest of the year!

Hi Matt,

I love the elegance of the ideas in the post! Really love. It inspired me to dig deeper, bouncing back and forth between here, Milenomics, and a couple of your older posts. Thanks for the good stuff.

Ah I see what you did there! Glad you liked it, and the other posts.

Trust me, being in the 1% won’t make you feel wealthy. Only the 0.1% will. And to do that, you have to be extremely talented/lucky and/or a thieving scumbag (or more than likely, all 3).

And you’ll never get into the 1% following conventional hackneyed financial advice – you have to take significant risks beyond what is comfortable for most people.

You know, the only thing that will make you feel wealthy is a state of mind. People worry about money regardless of their Net Worth.

I agree it is not easy becoming extravagantly rich, but it does start all at the same place, understanding money. Not everyone I know who has a ton of money inflowing from business knows this, so some of them are quite poor when you turn off the tap. The key to wealth is knowing about the balance sheet and having that ability to tap into inflows effectively, such as starting your own business etc.

Being Wealthy is such a subjective term. From the lower tier “wealthy” is the guy higher up the rung. That goes for the 25k salary person saying if we made 100k we’d be set to the guy making 400k looking up at the 1.5m a year guy.

Which is why cash flow is key – if you are making 1.5M but spending 1.5M you might not be in the best of shape in the long term, as you aren’t acquiring income producing assets to take over your salary need.

Wealth is indeed state of mind on a relative scale. But to be wealthy is to be worry free about your money (from my perspective as someone in the bottom end of the 1%). Getting into the 1% means $400K income. That’s a reasonably successful small business person or high achieving professionals, but hardly wealthy if you live in high cost areas (like on the coasts where most of the 1% live). CNBC had a recent story about the gargantuan difference between low end 1%ers (like me) and the 0.01% that I think most associate with the 1% http://www.cnbc.com/id/101540240

As for you disagreement with “money comes to money”, you are misinformed. Once you get that first million, doors open. Banksters call you. You get freebies. Brokers cut/eliminate commissions. You get preferential interest rates. You get access to the best investments with the highest returns (and we aren’t talking just a few percent difference either). Your Country Club/Alma Mater/Fraternity buddies have jobs for your underachieving/coddled children. You send your kids to private schools. Your children get access to Ivy League schools if you kick in a donation. Walk in the door and managers come to greet you personally. Credit card companies shower you with offers just so you put your spend with them and have a “relationship” (which means cross selling wealth management products). You set up Trusts to shelter your assets. The list goes on and on.

Add it all up and having money has outsized advantages that has little or nothing to do with talent. And if you can get your wealth to sufficient scale, you become modern day royalty – you descendants will never have to work because the tax code has been rigged. You’d think that the 99% would vote to change the gross inequities – but they don’t – they lap up the rubbish spewed by scumbags on Faux Newz and vote against their own interests because they are distracted by meaningless hot button issues like abortion/marriage equality/fatuous “war on Christmas” etc etc. All the while the rich get richer and the middle class stagnates.

Oh I agree, I’ve been getting that attention for a long time now. You don’t need to actually have the wealth to get the love though 🙂

I’m going to be sharing more and more concepts to get people to the stage where they need trusts, and go from there.

My current coursework in school gets bonus points if I can reduce tax to zero on wealth of 25m+

Love the way you’ve laid this out and looking forward to reading the rest of this series.

Nice post! Looking forward to reading the entire series and will share this with some friends and family. I’ve long learned these principles, but I can see this being helpful for them.

Cheers

Absolutely love this and can’t wait for more!

This is lovely, Matt.

An elegant and simple to implement way of allocating one’s funds. And here’s the interesting thing: while objectively, wealth can be measured and meted out by fractions of the population, in practice, “wealthy” means having enough to do the things that you want to do, with enough left over to fund a future where your passive cash-flow gives you enough to do the things that you want to do.

If that means traveling internationally–well, we all know how to do that for very very little actual cash, don’t we? If that means living in a huge home by the ocean–there are darn nice ocean front homes in countries that are only a few hours away from wherever you live right now by plane.

The biggest issue for most of us is to get out of the salary mindset, and to start creating our own wealth, however we define it. Thank you for continuing to point that out to us, while sharing practical ways to do so in a scalable fashion.

Glad you liked it, I had to re-write the post many times to try to get to that simple thought, as it is part of a powerful strategy. Now, let the race for retirement begin!