This is a series of posts on the concept of adding a car to the family.. I am going to explore buying, leasing, financing and secondary lease markets to find out which will provide the best value for us.

We’re getting to that phase in life where schlepping ourselves for 2hrs in either direction, often dragging a dog on public transport is starting to wear a little thin. And whilst we do appreciate the amazing transport options available in Brooklyn there are times when a car would be so useful for us. Of course, Mrs Saverocity is the driver in the family these days since I started to crash… rather frequently… I thought it best to hand over the reins.

Looking at options we see the following cost considerations: Gas, Insurance, Purchase or Lease Price point. Pretty much all of these are tied to the model of car we select, and whilst some models certainly do depreciate slower than others there are few things in life that lose value faster than a new car. We are looking at small cars right now as most of our trips will be short commutes.

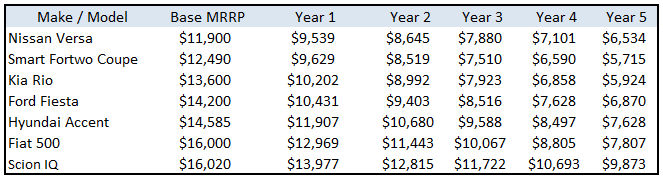

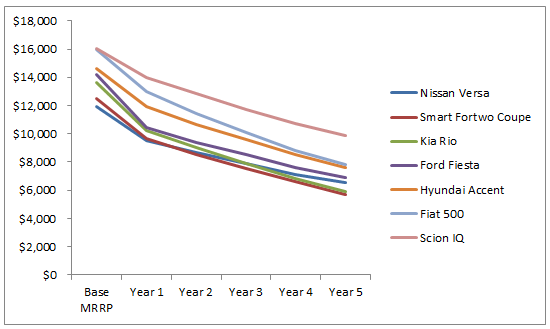

A good thing to consider is that depreciation levels off after a few years, so there can be a sweet spot for purchasing to hold the most resale value – though this is somewhat model dependent there are clear similarities. I have compared the top 10 Small Cars by resale value over 5 years taking Depreciation into account.

As you can see, the sharpest decline occurs on year 1, and then tapers off to a fairly consistent annual decline from there. Note that there is a little debate over the actual depreciation figures, because some of the models were not around 5 years ago, however I took the depreciation from Automobilemag.com and they have used extensive data to come up with these guidelines. Regardless, take them with a pinch of salt.

We have established that once the car rolls off the lot and starts to lose that lovely ‘new car’ smell then its value dips aggressively; too much so for the purchase of a New car to be a viable option for us. Assuming that Insurance and Gas are constant as we compare a Purchased model or a Leased Model, the calculation we need to look at is how much will the car cost us over the term of ownership.

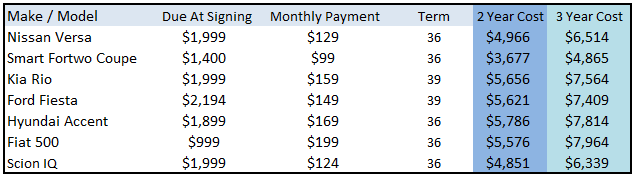

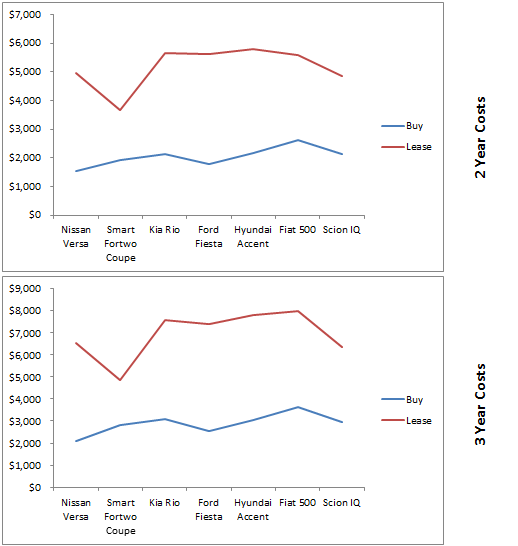

The easiest way to do this is to use the Lease term of 24 and 36 months and compare lease payments vs loss in value at resale time, also not all leases are created equal and some are a lot more attractive than others, below are the current lease deals I could find for the models in question. It is worth noting that these are both seasonal and location specific so depending on a variety of factors you might get a slightly different deal from these.

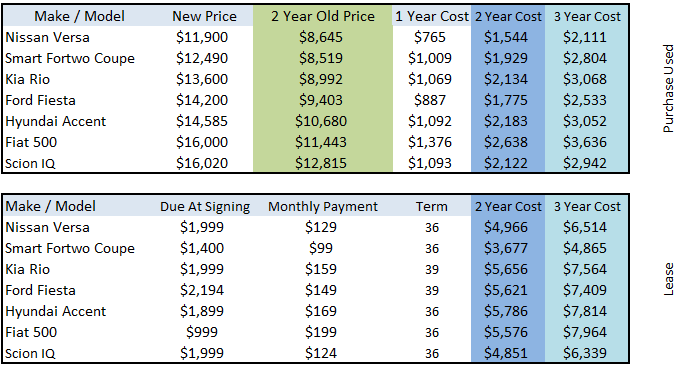

So, both of these ownership methods are costly, even for a budget car like those I used for examples here, but since have accepted that the car itself is a luxury that we think it is time for, how do the methods stack up side by side? To calculate a fair comparison I am going to pick a 2 year old car to compare with the lease, whilst it isn’t going to smell as fresh it is a much fairer comparison when it comes to costs because I already stated the Year 1 Depreciation is just too prohibitive to this purchase.

For data, I am going to use the suggested price after depreciation, since cars like the Scion IQ and others don’t have a 2010 model so I cannot check with the Kelly Blue Book (a great pricing resource for used cars, and they are online now) so since we are working on projections, some numbers might be a little off when we circle back on this, however they are good indicators.

For the more visual, here is a graph of the data over 2 years and 3 years, the stark difference in costs, somewhat surprisingly from a cost perspective is how much the cheaper it seams to purchased used and resell. As deprecation levels off the loss per year is quite low, and much lower than the Lease Fees you would be paying. However, it is worth remembering that this assumes you are able to sell your car at these sorts of prices, and if not then the equation does change somewhat. Further to that, it is worth noting that exiting from a lease is a lot more convenient (at its term) than trying to find a buyer for your car, so how much is that convenience value worth to you?

Next in the series I’ll be exploring what impact there is when you purchase Vs Lease in terms of locking up Capital that could be used elsewhere, investigating the TCO for Financing a deal like this and also explore some of the more novel options for Leasing.

Leave a Reply