I’m not looking at your cash, I promise, in fact it really has to do with what happened to me today… I wear ‘daily’ contact lenses, this morning as I popped open the lens I noticed it was a little misshaped, so I made a decision. Do I toss it out, open a new lens pod, or do I try to push it in, saving me some money if it turns out that just being in my eyeball gets it back into proper shape.

So, in that decision we looked at risk, it may work or it may not, the impact of that risk – if it works I save money, if it fails I probably can just toss it out, hopefully without permanent blindness… simple enough, and something most of you might have done in my position. Certainly some would have not attempted it and just tossed it out, some would not have noticed it at all, these are basic risk tolerance events.

So I popped this misshapen object into my eyeball, and sure enough, it hurt like hell and I did what all rational people do, rubbed the heck out of it and swore in three different languages whilst squatting repeatedly. Thankfully, as often is the case that remedied the problem, and now I have two functioning eyeballs, and made the ‘right choice’ by taking a chance on this dodgy sliver of plastic, and I felt pretty good for at least 5 minutes…

Warning – you may wish to stop reading now if you are weak of mind or stomach

Suddenly, I experienced pain worse than childbirth, a pain so awful no woman could possibly fathom… my eyeball was on fire, I raced to the bathroom and plucked this evil Djinn from my eye, only to find that it was not misshaped at all, it had regained its regular shape with my process of yelling at it earlier, but what had also happened was I had some how detached… yes, you guessed it, an eyelash, and I actually had an eyelash in my eye.

Being a pretty tough cookie, I actually dealt with the problem myself rather than calling an ambulance, I like to think that is what any of us would have done, but I am sure some of you might not have the spirit for it, that is OK, acceptance of our weaknesses is the first step to mastery.

So what is this all about?

The purpose of sharing my brush with death is to explore the concept of correlation and causation. It is important to realize that from a financial perspective, in an increasingly interconnected world, diversification of risk is an incredibly complex matter. What many people fail to understand is that they must first breakdown their investments by type, but then rebuild them together into an whole, big picture assessment.

Taking this from the most simplistic, lets look at a Lazy 4 Portfolio:

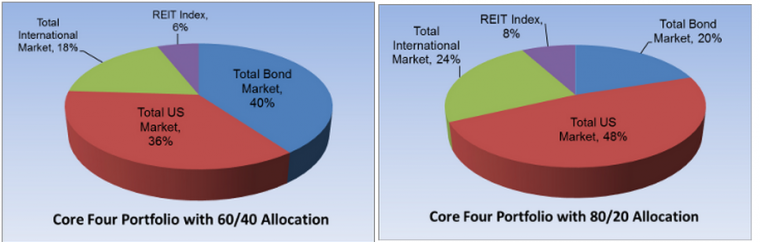

Here are two examples, that I ripped off sourced from Bogleheads.org, it is helpful to see two charts, because that will show case asset allocation adjustments within the the portfolios, the left has a person with a 60/40 (60% Stocks/40% Bonds) allocation, which is generally considered to be more aggressive than the same 4 funds allocated in a 80/20 format as seen on the left.

This Lazy 4 could be found in any account that can hold such funds, so that means it could be a retirement account, like a 401(k) or IRA (either roth, or a traditional), or a taxable brokerage account. The purpose diversifying into 4 different funds, as shown below is to reduce correlation risk:

- The US Stock Market

- The US Bond Market

- REITs

- International Stock Market (non-US)

The concept is that if you had all your cash in the US stock market, and it crashed, all your cash would drop by the amount of the crash. Whereas if you split that between Stocks and Bonds, then it is likely that one will not crash when the other does. The addition of The REIT and Non-US stocks is that they provide greater returns, and if the US market crashes, they won’t.

That is a big issue.

More accurate thinking is that they wouldn’t crash as much. For example, if there is a war between North America and Canada, likely the Stock Market in the US will take a hit, but that shouldn’t affect China right? Well, the correlation between the economy of China and the US has grown so much over past years, that actually it would, because they rely heavily on the US for export sales. The more interconnected that things become, the less value there is within diversification of assets in this way.

The big picture

When looking to diversify risk, people look for alternative investment opportunities, for example they may invest in a Rental Property, something on the side from their Lazy 4. However, the Rental is very highly correlated with REITs (real estate investment trusts) which both can be impacted by variable mortgage rates.

Furthermore, the rental is also dependent on the ability of the Tenant to pay the rent. If they have their own money tied up in the Lazy 4 and they lose a large amount of it, this impacts their cashflow and ability to pay rent, so the stock market can affect the standard deviation of the rental property income.

Another example of alternative investments are sites like Prosper.com, where you ‘become the bank’ and buy up other peoples debt by offering a restructured loan to them, my investments there are doing nicely, I put $1000 in there some time ago to play around with, and the repayments are creating 2-3 new $50 loans every month now. But what happens when the 2007-2008 financial crisis strikes these people? When a deep recession hits the market plummets, but also people are suddenly unemployed and struggling to make home payments, certainly this ‘diversified alternative investment’ is one of the first to be defaulted on.

Collating All Assets

Your assets go beyond your 401k, they include cash, personal use property such as your home, and anything that has resale value. If you have most of your money in property, even your own, you probably should not have any investment in property within the market, since a property bubble would impact you severely. You should collate everything from a big picture and make sure that your assets aren’t correlated too much, however, most importantly, you must realize that no matter how well you think you have diversified correlated risk away from your investments, it will always remain, and will have an impact on you, perhaps more so than you first expected.

A good tool to look at your entire holdings and suggest where you are over allocated from a risk perspective is Personal Capital, it works like Mint.com but is focused on your investments. For full disclosure, if you use this link to join and track your investments for free they might send me an introduction fee, which I may spend on wine.

I would suggest that at the very least everyone should take the traditional steps towards diversification, but we all must take this time to realize that even our best efforts to diversify away risk it is an ever increasing challenge to do so as the world we live in becomes progressively interconnected. What thoughts do you have to avoid this in your investments?

Oh my. An eyelash and a contact lens in the same eye at the same time – agony..

See, you know my pain 🙂