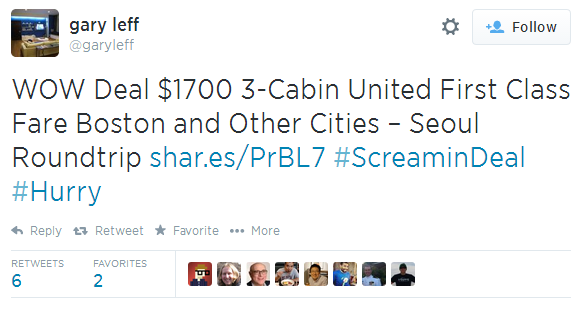

Twitter is going Bananas! I even posted a link to this flight deal in The Forum… gotta keep the readers happy don’t you know? But I also wrote today about the bigger picture… F.I.R.E.!! Financial Independence, I shared some details on how I made money, not to brag, but to open up about the value of earning money rather than hoping to get lucky in the stock market. I’d like you to join me on the journey and share ideas and tips on how to reach Independence together. I’ll be using the skills I learn in the CFP to help us all understand the system better.

So let’s get to this AMAZING DEAL ALERT!!!!!!

Hashtag ScreaminDeal

Hashtag Hurry

How about Hashtag #Bollocks #to #you?

The deal, that is, not the tweeter, he is just sharing what his readers want.

Let’s explore this, with a scenario. It assumes that you actually get off the plane, stay say 3 nights, and get out of your hotel room… of course you might just want to fly there and back which is just magical, and I wish you good speed….

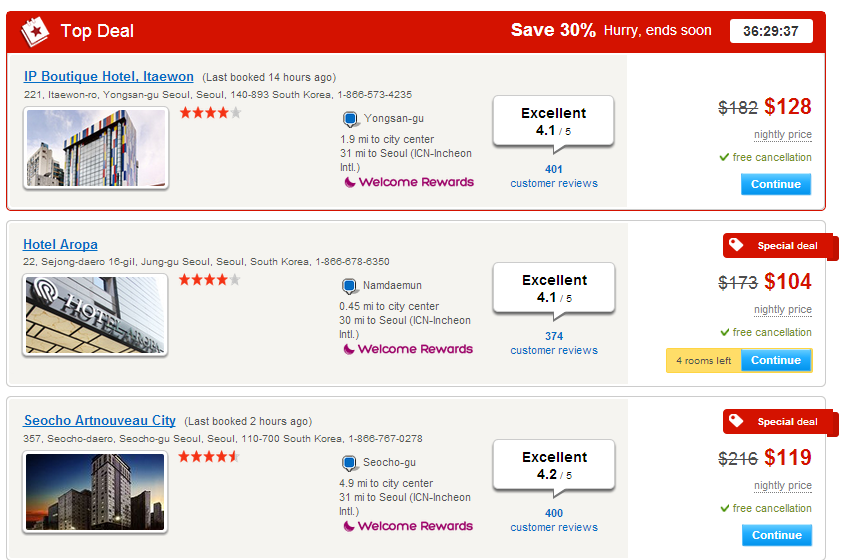

You just flew Global First, lets assume for a minute that you don’t want to now stay in a hostel. Hotels in Seoul are actually pretty reasonable, you get a 4 star on hotels.com for about $125+ when you add on taxes and fees. Or you could stay on points, but either way points have value right? So lets call it $400 for the room.

$2100

Now, lets add on $100 for transport – from your home to airport, airport to hotel, hotel to airport, airport to home… that’s a lowball price.

How about $50 per person for F&B per day? 3 nights, 4 days $200 per.

Grand Total $2,400 for a 3 night trip per person…

What does spending $2,400 do to your life?

- If you don’t have an IRA – you could have an IRA… if you were 30 and invested it in a Roth you could have $35,489 of tax free savings by the age of 65 at 8% interest.

- If you are 25, and invested it in a HSA for 40 years at an average rate of interest of 8% in the market you could have: $52,139 for your retirement, this could be for healthcare or for other expenses.

- If you just bought your home and have a $300,000, 30 year mortgage at 4% to pay, you would be able to pay off your mortgage 5 months earlier, and save over $5,400 in interest.

- If you have a student loan at 6% with a 10 year duration, you could save $4,366 in interest payments

- You could donate it to Charity and deduct it from your taxes, making a difference to your neighborhood, or your planet, and getting a tax break.

Don’t forget… that is $2,400 per person – so all those numbers are worth double (more than double for the debt payments) if you actually have a friend or significant other…

The voice of doom and gloom

Yeah I get it, I am the miserable fecker that nobody wants to hear, but I will ask you to ponder this. You can travel the world for (almost) free using points and miles from signup bonuses alone. If you keep on chasing F because some other idiot does then you aren’t going to get to a place where you can really enjoy your life, because you will be loaded with debt and working a job you hate.

First Class bragging rights – you can keep them. I’ll keep my $4,800 and use it to load up another retirement vehicle,#bollocks #to #you

Yup!

We must remember why we got into traveling for less to nothing.

If you wouldnt have gone there or if you wouldnt spend the money anyway if it werent for miles and points, then I would say its not worth doing the trip.

If you are wealthy and wanna go for less, then yah maybe.

But i dont want to spend $1700 for any plane tickets–even ones that should have cost say $9k or something

Matt,

You make a good point, but while all of those things are great — paying the mortgage off earlier, Roth IRA (and I thought market average was 9% compounding, not 8%, but the economy has been tough), student loans, etc. I think you also have to consider folks that may have allocated some “play money” and may be going for status. Yes, this is where my argument comes off the rails, because it is United where 1K status pretty much means nothing, BUT, for the sake of the argument, lets consider this.

The flight alone at $1700, is roughly 6.8 cents per EQM, since last I knew, UA gives 1.5 EQMs for premium cabins, which equates to 25% of the necessary miles for 1K status.

Again – you make a great point, but sometimes when status plays into the game, the math changes… but I can’t make much more of an argument for United, as kicked ’em to the curb with their latest devaluation and introduction of PQMs.

I intentionally pulled the numbers down to make it more conservative. I would be fine to say 9-10% but I wanted to focus on easy numbers as they still hammered the point.

Topic close to my heart. The only reason I stumbled upon this was in my original quest for fiscal independence, ironically. (The places blog links will take you!) With two boys growing up fast and trying to plow through student loan debt, we were on a once every two year schedule for travel. Now, I’m so grateful to have a little more leeway for at least once a year trips (low bar for this crowd, I know, I’m a little embarrassed!!), but we’re working on it. I think young and single is so very different from not young with family. :). I wouldn’t do the $1700 myself, but certainly support living large if you stay in the green and that’s what makes you happy. 🙂

We see these enticing ads for sandals and beaches all the time

But other than the flights, we cant justify the costs of the trip itself, all inclusive or not. Even if trying to employ some capital one or arrival use

But when we go to the Cayman islands, we know we can get the flights and hotel, and use the cap one card for most stuff we do–snorkel trips or stingrays or dolphin center etc, and the room charges.

Our 7-8 day stay can cost me a few hundred out of pocket where other families have paid like $12k for the same trip

MM- Excellent comment. I need to fine tune my skill set a bit to get a handle on what’s doable. Full time work, parenting and sleep are slowing me down!! And what’s with the cap one card? The partial redemption thing drives me nuts.

I forgot to mention we bring our two kiddos with us. We are definitely not DINKs although I am sure I am considered one by Bancorp lol

Anyway, cap one: everything can be coded as travel

You just gotta call em and make it so

Nicole, you’re learning, which is more than those who lament “I can’t afford to travel” do.

My beef is just more that much of what passes as family travel “advice” is a mix of sales pitches and just drivel.

Nicole – don’t get me wrong – its not for everyone — Rose and I are “DINKs” — Double Income No Kids. Having a family to support (and for that matter, having 2 more tickets to have to buy) significantly changes the math — hope you can get up to twice a year trips soon!

Me too!! 🙂

How dare you bring the voice of reason into the points blogosphere! =)

This has to be one of the best posts of the year. It’s amazing how some simple math can provide valuable context to a “deal”.

The argument about status always surprises me. How much is status worth? 5-10 grand? Same with the idea of “play money”. How much future time is your play money worth?

Context in the now and planning for the future can make a lot of current choices look very different.

Alex — Status is worth the value you get out of it. I go through stints where I travel every other weekend; I used to go through stints where I would be on travel 6 work weeks straight (home on the weekends). Greater comfort was really worth it back then.

So, I work a balance between retirement savings and carpe diem. I’m well ahead of the average on retirement (it scares me when I hear how low the average is though), but, what good is money or miles / points for that matter, if you can’t enjoy them? I have colleagues that are working into their 60’s – no fault on them–my plan is not to be that unless I truly love what I do–that are still talking about their bucket list… I won’t be that.

Awesome post, Matt. You nailed it today. I like me some international lie-flat travel… but not at the prices it costs in $$ out points. I’d rather take twice as many trips -and save for retirement!

Glad to hear it – cheers!

Probably wouldn’t do it for UA first (which isn’t that amazing) but the costs for the other aspects of travel in Korea could be significantly reduced. Airport to hotel/hotel to airport could be done on the train and if you want to avoid hostels or couch surfing, there are perfectly comfortable and reasonable clean “love motels” in Seoul for closer to $40 or $50 a night. Sure, there might be a sex toy vending machine in your room, but the room itself is probably not bad. For food I think you could cut that in half or at least by a third if you are willing to visit some local kimbap shops or street vendors — and will probably have a more authentic (allbiet less luxurious) experience!

You’re missing the point so hard right now

This is a hypocritical, nasty post.

1) As I loaded this page, I was served ads for Holland America, La Quinta Inn, and visiting Oklahoma. Those made you money. You are pushing things similar to what you’re criticizing. If you want to be Dave Ramsey, get rid of ads like this on your site.

2) I work with several people from South Korea. They can’t apply for US credit cards. They can’t participate in the secretive quasi-moral structuring of “manufactured spending”. They routinely ask me for ways to visit their families. The standard price in COACH is $1500 – 1700.

For them, yes, it is a fabulously great deal.

I criticized people buying this as a weekend flight to brag about First- what has that got to do with 3 adsense ads?

I think you have your agendas crossed.

Have your Korean friends contact me, I’ll help them get to Korea for less than $1700

Ohhhh mate you had better present us with a really serious detailed explanation as to what you mean by:

secretive quasi-moral structuring of “manufactured spending”.

Then tell us what you do for work.

;)MM!

Good job Matt !

When I sit down and write my priorities,

paying mortgage, funding retirement accounts, saving money for kids’ education are high on the list

and flying first class with champagne and caviar served are at the bottom of the priorities.

Thanks Chandu, glad to hear your priorities are in order!

Pretty sure United doesn’t serve caviar 😉

It’s one of those things I’ll never know for sure, but I’ll gladly take your word for it. I’m sure I’ll fly in F one day perhaps with a screaming kid for fun 🙂

Wait, is this the airline with the amazing hamburger in First Class? Shoot! Just missed on this great deal to eat it!

I’m going to have to say I agree with GL on this one. This ‘deal’ is catered to certain people and obviously you are not one of them. If I had that kind if play money I would consider it. You are very nice and gracious to offer your services to the Koreans though! 😉

I’m Absolutely sure that there are people who can afford this.

I just don’t think that the vast majority of people who will do this are in that bucket.

I don’t think you could put people all into one bucket. I reached financial independence in 2008, which was significantly sooner than normal retirement age. I planned, saved and chose my financial priorities all through my working life. Not that I am in this position I absolutely want to be able to take advantage of things like this. This doesn’t a) put me in debt or b) keep me working in a job that I hate, which is what you wrote.

I think maybe my message didn’t come through – I want to help all my readers get to where you are. But you are very much in the minority. However, people will fall over themselves to take advantage of this because it is promoted without pause for thought.

Most of the people who are objecting towards my position have debt, and jobs. I’m pleased to have you not in that place and hope you have a fantastic trip.

Well, for the record, I’m not going since I live on the wrong coast and I can’t justify the extra hassle of getting to Boston. But if I lived on the east coast…

And I hope that it’s not true and that people with credit card debt aren’t doing this. I must admit, I assumed that the only people that did were people that had their act together…

It’s mainstream now, and it attracts a lot of people who are looking for an easy solution- just not all of them have taken care of the basics.

Of course, my message will probably turn off many such people, and some others who are in your shoes if you discard it without thought (thankfully you did not) but focusing on finances, debt and wealth are much more long term than points and miles or a allegedly cheap fare.

Hope they have a similar one on your coast- but on Cathay or something 🙂

Friends don’t let friends pay for first class (that’s what miles and points are for!). Even as a (almost retired) mileage runner I don’t see the value in this ticket. Butt-in-seat is butt-in-seat and even at 1.5x this isn’t THAT great of a deal. Besides, Korea?

What is with the negativity towards the destination? More tourist visited South Korea last year than Japan.

I guess I should clarify. More international tourists visited SK last year than Japan.

Is there something you find particularly unappealing about Korea? I spent several months there over the past couple years and really enjoyed it for the most part. Might even return again for an extended stay.

Personally not my favorite place, but I’d certainly recommend going there. For me it’s purely a food thing, I don’t love a lot of the cuisine there.

I did enjoy our visit- we went for a weekend and I found the people nice, the culture cool and the blend of old and new enjoyable, just like Japan.

Thanks — I was actually asking about Michelle’s comment (“Besides, Korea?”) but I can understand that Korean food doesn’t appeal to everyone. That said, I have definitely developed a taste for a few dishes myself 🙂

You are so the voice of reason in this hobby. I have just been coming around to thinking what you have said here.

Last weekend we had to use up those 2 free Hilton weekend nights from the credit card signup that were about to expire. We spent Avios for a first class flight last-minute. All that was free or close to it. It was a nice trip but I added up all the other costs, transport to and from airport and hotel, food, sightseeing, nothing extravagant, and we spent $600.

How does that add up to a free trip? It didn’t really get me ahead to sign up for that credit card when I didn’t have a meaningful idea of how to use those nights beforehand. I have been tricked by all the bloggers pushing credit cards into doing some pretty dumb stuff. I’m going to try not to let the tail wag the dog from now on.

Ha! We just spent those vouchers too- stayed at the conrad in Chicago- hated it! The city, the need to spend the vouchers as they were expiring, everything…

But- I’ve has some good stays too- it’s just not all roses and we should keep perspective- for example I just decided not to apply for the 100k AA card because I can’t see a need for it now, even though I only have 20k AA miles…

I’ll take cash any day of the week though!

Thanks for stopping by, appreciate your comment.

How is much is lifetime gold worth for you? Outbound leg of this award is enough to get you star gold for life. I call that a worthwhile investment. Not to mention if you go to Asia annually, its pretty much a no brainer at around $400 over economy fare.

This is one heck of a deal

It’s a fair point- personally I don’t value it highly, as I fly award tickets. But it is noteworthy.

Personally I think cash money that is growing with compound interest is better than status- let’s remember that gold can be for lifetime, but they can change the value of gold at anytime, whenever they want.

It is a great deal and I miss it. Actually go to Asia 3 times a year to visit parents.

If I were able to get 3 of these for the timeframe tha I need to go to Asia, it would be perfect consider that I am 1k and pays my own money to requalify 1k. With the bonus eqm and rdm, this is cheaper than redeeming miles to fly in economy…

The math here is illogical – if $1700 is cheaper than redeeming miles in economy why is the average ticket price in economy less than $1700?

Or are you saying that using miles for economy is not good value?

1700 comes with 50K miles and status miles which I value at 1c each. Assuming I value each UA miles 1.5c and each staus miles 1c cent each. The redeemable miles is 750 USD and status miles is 250 USD, so the flight cost is 700 USD, and I need to go to Asia anyways, and this is fully refundable! I don’t know of any way to spend 700 USD to fly business class or first class to Asia round trip.

Of course, this is assuming that one has to travel to Asia a few times a year, and money is not a problem – am single and earns over 100K per year with zero debt and networth over 1M.

Your last comment makes me fine with your approach here- if you are in that good shape then absolutely I can agree with your perspective.

As for flying at that price- yeah, it can be done for pennies on that price. I’ve been flying business (not first) for the past 4-5 years and haven’t bought a mile or paid for a seat in that time.

The people in the mileage game I think can easily do this using card signup bonuses and spending- and they can focus the cash on debt and savings.

That’s why I like frequent flyer programs- for (somewhat) free flights- when I see a cost it’s typically between $10 and $200 for fees and that’s all. That’s why this deal makes no sense to me.

And as buzz mentions sure I too could ‘afford’ it but why would I pay real money when I can (we all can) fly to where we actually want to, using airmiles?

I don’t know how people can generate over 400K airmiles per year for sign up bonus. Many deals are one off, and it is not possible to MS in every state. I do buy a lot of miles like US share miles and lifemiles so that I fly business class for my travel. I also Mileage run (making delta diamond for 1200 USD). Since I redeem tickets for 5 people and I am the only person generating miles in a significant way. (none of my parents and siblings can apply cards in USA.)

It’s possible to do that in a month – but it can be a full time job! Sure I hear you about carrying it for all, and I can see in your case this makes sense- I just don’t think you are the majority- though those who cannot afford it but still do it aren’t going to say so.

Maybe I am not seeing it, but the only reason to mileage run or go for status in my mind is:

~if you have the money to do so (are wealthy or maybe single so have no other commitments like kiddos or a house payment, or are retired or something). Obviously a relative term–or maybe you have some luxury cash stashed away for just this sort of thing. I do not. I save up enough for our family to get ski passes at our favorite ski season for the entire winter every year instead with that sector of money. But we each have our own likings and desires.

~if you have a job where you need to travel a lot anyway so you need like 1-3 more flights to make it make sense

~own or work in some corporation that reimburses your travel anyway

~reallllllly love flying for the sake of it and you are a plane enthusiast.

Otherwise, I cannot see why someone would go for status and justify the throwing out of cash.

Now I know not everyone can do points and miles in the world, but if you can, I would just use enough to FLY Business/First rather than pay actual cash I could use somewhere else.

But that’s just me.

I MR because I can RDM cheaply. It is not possible to get VR or BB in every state. In fact, prepaid Amex is not possible in many states. If you can MS cheaply, good for you, but I can’t. I redeem a lot of miles and I I don’t MR, ami expected to pay for the miles? I am in Fiji currently for 40000 UA miles from Japan in J. Those miles at obtained via MR at 3cpm (eqm), and stay in pointbreak at Suva.

When I MR on weekends, I get upgrades and eat at lounges for lot of fruits which I don’t buy when I am at home. I save on meals, transportation from just eating and drinking at lounges. (I have to spend money to do things otherwise.) This year, I spend 70 nights in my usual home, the rest I am n my travel either MR or going to new places and countries. And I mostly fly in J using miles to get a bit more comfort and to fly to interesting places on multi airline tickets (and sleep in airport to save cost). I have spent over 500K miles on m parents this year, and it does not count m own travel.

While I agree with you almost entirely, I have one nit. I don’t count meals and transportation costs as travel expenses because one incurs those regardless. Yes, cooking at home is generally cheaper than eating out at restaurants, but there are usually inexpensive ways to eat while traveling too. And people who aren’t traveling are probably just as it is likely to splurge and eat out at restaurants in their home city.

Partly b/c I live in a high-cost city, I often actually *save* money on food when traveling. Same with transportation costs — between gas prices, tolls, etc., it’s usually cheaper to get around using another city’s metro system than driving in my home city. There is no palatable (to me) public transport option in my home city, whereas there often are in my travel destinations. But for a handful of cities, I think most American cities are car-dependent to some extent. And even in those handful of cities, the local public transportation isn’t free or necessarily cheaper than abroad.

A voice of dissent! How dare you 🙂

Personally I find a lot of airports are outside of cities, so there is a greater travel cost- in NYC I never take a taxi, but when going to the airport I do take a car service- destination wise it depends on the infrastructure – I’ll try out public transport if it seems doable.

I definitely spend more on food traveling as I find dining to be part of the experience- the only exception is when on business (and not entertaining) when I eat cheaply.

But hey- I’ll allow you to shave 80% off my food and transport estimate if it helps 🙂

Wait a minute. I have millions of miles in the bank. Why would I pay $1,700 for a plane ticket…like…ever?

Yes I can afford it. I can afford lots of things. But I prefer to burn miles for plane tickets and points for hotels.

TBB

#1 Voice of Reason

Matt can be #2 as long as I am #1 LOL

You’ll always be no.1

Enjoying the debate between you and Gary and glad to see this blog doing so well. Since I have kids, I can never really jump on deals like these, but that is probably for the best for my family’s long term financial health. The extent of my great deal jumping was booking three tickets during the recent fall Southwest fare sale down to Disneyland. $59 each way. Baby flies on my lap for a flight that short. Going to go stick a few more bucks in the 529s now. By the time my daughter starts college in 2027, I’m fully expecting it to be $500,000+ for four years.

Glad to hear it- and good for you! I’ll be in your shoes very soon and somewhat terrified of traveling with the kid- I’ll check out how to do it from your blog.

Congrats on the soon-to-be addition and glad to welcome another slightly-scared-but-nevertheless-not-deterred traveling parent into the fold. Only recently discovered your site and am really enjoying it. I’ve been the frequent flyer guru in the family (I’ve wasted months of my life on FlyerTalk) and my husband is the personal finance geek (he’s wasted months of his life on the Bogleheads forums), and now we can have something to read together. Brilliant.

Great point of view Matt! I agree that 1700 dollars can be MUCH more useful put into any of the places you described. I also agree that the only way I would use this deal is if I was already going to Seoul. I am not but I do indeed intend to visit in the future–using miles and as little cash as possible.

Matt, bullocks is a little too rough, me thinks. It’s (was) a solid deal. Not drop everything you’re doing deal, but a great deal for folks who had been looking for some vacation time in Asia.

I couldn’t agree more that chasing premium seats for the pure pleasure of being pampered is ridiculous, or at least it’s ridiculous to me. I’m with you on that.

However, this fare was insanely good, and you could get a stopover for slightly more. $1800 for travelling to Japan and South Korea minus 25,000 miles, whatever they’re worth even in an “inferior” United first class (LOL) doesn’t sound half bad to me. Since I am extremely flexible about my destinations, I was tempted. Would’ve been even more tempted if I didn’t have my schedule filled up till the end of the year.

The choice between paying for flights and flying on miles only seems to be a no-brainer until we remember that not everyone is in a position to churn cards or spend an inordinate amount of time to MS. And yes, there are folks out there who might yearn for that once in a lifetime first-class experience, and there is nothing wrong about it, either. Well, that, and I do not subscribe to “earn it and burn it” philosophy.

And I don’t know; we can, of course, invest pretty much everything toward retirement, but then there is no money left to live NOW. 🙂

Hey Andy,

You can have your own opinion, I forgive you 🙂

Everyone who reads the blog should be able to fly for points, and earn a good wage – I do think that people who aren’t high up on the salary side should use points to fly economy, and use cash back to boost savings. I’m cool with people having aspirational travel experiences – but that can be done with a little thought and a little planning and cost nothing like this. I do it, tons of my readers do it, why can’t others?

Earn and burn – its the only way to treat miles and points… else you will get caught with your pants down when they devalue.

Oh and its Bollocks, not Bullocks – the latter are Bovine animals and the former are those sometime hairy things we make most of our decisions with.

Thanks for sharing – and I’m happy we can disagree!

Bollocks! Those poor Bovine animals… 🙂 (had to look up Bovine/palmface).

Matt, I’m happy too, but there is one thing about this earn and burn debate that bugs me a little. Well, a lot, to be honest. Just to illustrate my point, I’ve argued about it in my little blog.

To sum it up, I don’t care how much or fast you can replenish your miles with MS, because as you have mentioned yourself, there is also 5% cashback. We’re all losing out when we’re MSing to meet the spend or buy points on the cheap. I know that earn and burn is a catchy phrase, but this whole idea is more relevant for the kind of folks who won’t go coach even if their life depended on it.

Earn-and-burn, if you think about it, applies only to premium class travel. In years, if not decades, mile redemptions on coach travel have changed very little or not at all. If I burn all my miles on first-class travel, next time I might be forced to pay real money to fly where I want to be, or lose money trying to manufacture spend in order to achieve more short-lived comfort, I could easily do without on a 6-8-hour flight. I understand where earn and burn is coming from, but it’s dangerous when anything turns into a dogma, IMHO. 🙂

I don’t ms miles personally – never needed to. Cash all the way.

I think this is (was) a screamingly fantastic deal. I would have jumped on it if I had seen it before it died. Admittedly I love Korea and Korean food a(nd just came back from a week in Japan & Korea). Obviously if you have no interest in the destination then you are not interested AT ANY PRICE, but if you are like me and can find culture and museums to explore just about anywhere in Asia, you’d be intrigued by the deal.

One other way to look at the deal. United charges 80,000 each way on its own metal for a 1st Class trip NA to Japan/Korea. So if the destination interests you your choice is between paying $1700 (and getting huge amounts of RDMs &EQMs and status benefits for those of us who care about those things – and I do) or 160,000 miles. … I’m pretty sure very few of your readers would redeem for 1 cent a mile.

Now if your argument is that one should never pay the extra miles or cash to go first or business class because that money could instead be used for investments or more coach trips … well OK, that’s a long running debate and there are strong opinions on both sides and no need to rehash all of those arguments here.

Of course one should have their priorities straight – pay your bills, fund your investment plan – but I think many people (like me) at the beginning of the year figure I have $XX to spend on travel this year and then try to spend it wisely on memorable experiences (which for me very often includes the ride). Earlier this year there was a great cash fare business to Easter Island, a place I had no immediate plans to visit but longtime on the bucket list. I jumped on it. I see this deal in the same spirit.

Hi Matt! Great article!

As Alex and Claire wrote before, and I agree with them, you are the voice of reason in this game of miles and points.

It’s a pleasure to share with my Brazilian readers, in my blog Meu Milhão de Milhas (My Million Miles) your brilliant opinion on those “deals”.

It is an honor and a great joy to know that we share the same thoughts about this crazy world of miles and points.

Congratulations on your blog and success!

While I completely agree with the sentiment of preparing for retirement, and focusing on good financial habits, I think the arguments presented in this article are largely fallacious. Here’s why.

The issue at hand is whether or not $1700 is a good deal for the flight in question. The issue is not whether or not a person should be spending $1700 on such a flight instead of using it for other, potentially more important, things. While I could agree this is a valuable matter of discussion, it has been framed incorrectly here. Both concepts can coexist.

The truth is that $1700 is an amazing deal for this flight AND perhaps many people should not spend money on such a deal. Setting up the concepts of mutually exclusive is just plain wrong, and unless it was done intentionally for effect, I’d say it’s the source of the controversy here.

Josh said it much better than me! Fully agree.

I think you laid out a great point, but I don’t know that I agree with you.

$1700 is a ton of money, until it isn’t a ton of money, IE you are financially independent and have enough assets and income streams to afford this without taking away from debt service payments or building such assets.

To say that $1700 is a bargain for the flight doesn’t add up from that perspective, and if you want to take the approach that in isolation it is a great deal then I have to also disagree with you. I personally have flown to Asia (Tokyo) many times, probably 10-20 round trips, mostly in business class on AA, UA, JAL, ANA and my out of pocket for them has been no more than $200-$300 for annual card fees and a fuel surcharges. I simply accept that $1700 is a great deal for a flight in Global First when I can fly 5-6 times in Business for that.

I think that last line is a bit flip. Those card fees and the miles earned through signups have a opportunity cost and value as well.

I’ll agree with you $1700 isn’t a great value if indeed you could fly business for $300 total (not just $300 out of pocket, valuing miles, 1 time sign up bonus opportunities and credit pulls at 0), but I don’t think you are saying that.

I don’t know… what is the opportunity cost of a signup bonus? I am saying that I don’t value the miles from signup bonuses as opportunity costs.

I can travel more than the average person of my age, yet have never run out of miles, and I get most of them from signup bonuses. What’s more, I don’t sign up for that many cards- my last two apps I only applied for 1 card each time. I guess you could need more if you took super short trips – or were totally into just the flight portion, but I would rather fly somewhere and enjoy it for a bit.

The miles don’t have an “opportunity cost” necessarily, but they do have a cost. You could use those miles for another trip. To pretend they are free, or that the money portion of a business class award is the only cost, isn’t quite right. To compare apples-to-apples, you have to compare the value of the miles you redeemed and the money against the $1700.

In addition, you have to compare the relative value of what you got for those. In your example, you only got business class, while for $1700 you could have had United Global First. I’m not sure if that’s great or not. I think it’s probably comparable for many other higher end business class products.

The point is, if the question being asked is “is $1700 a great deal for this flight” then all you have to do is see what that flight would normally cost you, and compare. Regularly, the fares are far, far more expensive, so it’s a great deal.

There’s a separate question of “should you take this flight” which involves many other issues that were raised in this post. These things include your overall financial picture, the relative quality of the soft products we’re talking about, your travel goals, etc.

All I’m saying is that the two concepts really are distinct, and should to be discussed separately. They each have merit, and they are each interesting.

I have to disagree with you, but only because i am at a different point in my life, at 54, where I can afford the spend and it makes sense if you are trying to achieve status–and in fact I need to go to Korea to clone my dog –REALLY. So, yeah the $100k to clone the dog might be the better issue to discuss, but i visited that facility once before. Sure, people will say i could donate the money to charity or use it for something they think more appropriate but it’s my money, and I am not stupid enough to think they keep the surrogate dogs alive, so i have to arrange for a home for that dog too. I don’t expect the clone to be just like my existing pet, but I think there will be some commonality of traits, especially if the older dog (a spry 11 year old beagle mix) “raises” the pup. No soul transference is expected and i understand clones don’t live as long.

I need 35k UA miles in 75 more days to keep the UA 1k temporary status match. That’s worth a couple of roundtrips, and korea is perfect.

It’s also why I fly from The Maldives to the US on Cathay business class ($2500 MLE-NYC rt and 33,750 PQM’s for US or AA). Plus i enjoy the Maldives and free stopovers in HKG.

My point as to the fare is you should only judge whether it makes sense for YOU.

I’m not going to run out of money because I made it all trading securities (registered in the industry but with no clients), and i spend time evaluating investments also.

I honestly don’t have a high opinion of the CFP unless one wants average returns…but that’s another story entirely I’ be happy to discuss with anyone privately.

You’re ‘not going to run out of money because you earned it trading’?

Why does where you earn it matter regarding running out of it or not?

The CFP for investments is weaker than the CFA but both are superior to the series 7. And don’t forget that the CFP has many more components than ‘trading’ it’s about holistic wealth management, tax planning, estate planning, retirement planning and many other things.

Now, as you point out, if you do have the money then it’s great to spend it as you like.

I wish I was better friends with ppl who could afford 100k for cloned dogs. Those are ppl I wanna part with. As for CFA or CFP I would work hard to learn how to manage your own money and piece meal out the little parts you are skilled at.

Correct me if i am wrong but isnt the basis of CFP that one cannot achieve excess returns in the Long run and should therefore diversify? Isnt it an EMH on the steroid of diversifcation? I am totally in favor of as much tax and estate planning knowledge as possible.

No- that’s passive investing strategy- it’s a completely different thing.

My investments topic professor from the CFP class owned an actively managed firm, would create cash flow from options trading and created investment strategies based upon correlation coefficients, and data from research firms.

A completely different beast.

I guess i am just fed up with brokers getting some wealth mgt certification then presenting me with a computer generated wealth mgt strategy. sorry.

And yes, that happens a lot, and I can completely understand your perspective on it.

Looking forward to the followup post, “$1200 for a coach ticket to Australia is a great deal.. Really?”

http://saverocity.com/arewethereyet/great-delta-summer-fares-australia/

😉

Thanks for reading! I’m busy with doing really fun things right now, home buying, parenting etc.

Cheers,

Matt