Discover it Card, the Game Changer! This card is making a lot of buzz, mainly from Discover’s marketing team thus far, so lets dig into this to see if it really is as good as it gets. As far as being a Game Changer, for a Travel Hacker that is a pretty tall order since the 5x Points my Chase Ink gets me at Office Supplies stores, and the Sapphire Preferred with its 2x Dining and Travel are pretty much what I am look for any new card to beat

Discover it Card, the Game Changer! This card is making a lot of buzz, mainly from Discover’s marketing team thus far, so lets dig into this to see if it really is as good as it gets. As far as being a Game Changer, for a Travel Hacker that is a pretty tall order since the 5x Points my Chase Ink gets me at Office Supplies stores, and the Sapphire Preferred with its 2x Dining and Travel are pretty much what I am look for any new card to beat

Lets get the lowdown on this card, full terms are at the bottom of this post.

- No Annual Fee – great thing that means you can apply and keep this card in your wallet forever without having to worry about what it costs you. Many cards will waive the fee in year one but in year two will sting you for it.

- No Foreign Transaction Fees – meh, from what I hear Discover is much less widely accepted than Amex, never mind Visa and Mastercard. I would not recommend you take it with you on your travels. Plus if you are travelling the most likely Credit Card charges will be food and transport – so get those on your Chase Sapphire Preferred, since that card is a Visa and is actually accepted worldwide, plus has no fees and 2x points on these categories.

- No Pay by phone fees and pay up to midnight by phone – huh? Who pays by phone? Get it on autopay and get it on pay in full ASAP, this is a weird one for me but if they think it is a perk and you love to actually call your credit card company to pay the bill then this is the card for you!) I do like the First Late Payment has no penalty (no fee and no bump in APR) just in case that Autopay is forgotten for some reason and so you don’t get stung here – great thing to offer Discover!

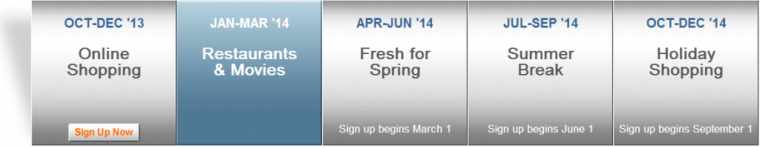

- Generous 5% Cash Back on Rotating Categories. There is a cap on this but if you hit that $1500 spend then you have just got $75 Cash Back which is awesome.

You know, based on that I can see the card being very useful during the Holidays, and if you happen to be working on the house in Q2 then its a go to card, and who isn’t planning some Summer Fun?

5% Cash Back is as good as it gets in the Card Game, so it would be wise to use the Discover it Card for any of these Rotating Quarterly bonus Categories, but once you hit the cap of $1500 then switch off to another card that offers better perks – the 1% offered is OK, but I would rather 2% or more from a specific category.

The 0% Balance Transfer – Do not touch this with a barge pole. It comes with a 3% fee of the total balance upfront, so if you push 10K on the card thinking it will be interest free you will be paying $300 for the privilege – remember, if you cannot pay off the 10K in full then the last thing you should be thinking about is applying for more cards, you should be working to get your debt and spending under control. 0% on New Purchases… well… OK it is good if you have self control.

As a kid perks like this meant to me ‘free money for 6 months, spend as you like’ then the 6 month mark came and I had spent the money required to paydown the bill, therefore creating credit card debt. This is such an easy trap to fall into so if you plan to use free credit make sure every month until the 6 month period is up you are stashing away the money to pay it off in an interest bearing account so you can earn a few bucks, but never get caught with debt.

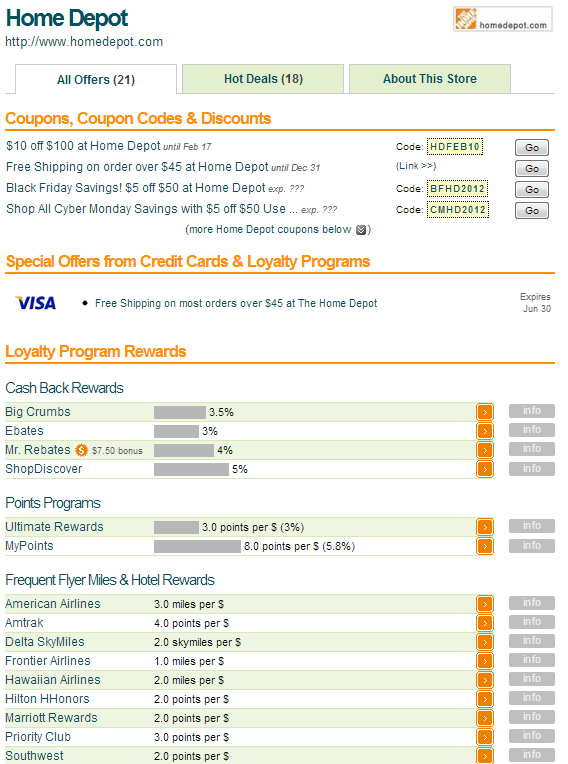

Without a doubt the best thing for me about the Discover Card is it allows access to the online shopping portal from Discover, this seems to consistently offer the best Cash Back, or close to it, often beating Bigcrumbs that I like a LOT Discover can offer up to 20% Cash Back on their online portal, which could stack with your 5% rotating bonus to get you 25% back on your purchases – simply put that alone is enough for me to get this card right away.

Check out the Home Depot for example – if you shop with the Discover Card in Q2 you would get 5% for the Rotating Bonus and another 5% from the mall – you can ship to store (then pick up) to save lines and you are also making an extra 5% for buying online. ShopDiscover frequently comes up trumps, battling with Bigcrumbs – the answer to which is best? Have both! Bigcrumbs and the Discover it Card are both free, so if you have access to both you will always get the best offer from your online shopping.

This card is a great addition to your wallet if you don’t have a Discover already, I highly recommend using it for the rotational categories and the online shopping – if these things are part of your spending habits. Please note that signing up for the card through the above link will result in Affiliate revenue for this site, thanks for your support.

Nicely laid out. Since we really do not plan ahead much more than a year, if that, I have not been able to decide which programs to focus on, and more often pick a card to get based on a good bonus. I would like to get more organized about it. I am also starting to think that perhaps I should focus more on hotel points since they are so much easier to redeem, and just buy air tickets. Already had one change (for the worse) in our Israel/Turkey trip when a flight cancelled. Alternatively, perhaps I should buy miles when the deals are good, so I can book awards that do not have to be saver space. That might allow me to travel in Bus for the price of coach, depending on how cheap/expensive the miles are. Finally, maybe I should focus on Chase URs. Meanwhile, I am speeding through the minimum spends on the cards I got in mid May. I hope I have a better plan before the next set of apps!

Hi Elaine,

I’ve only just started planning so far ahead, but once you start booking more trips it becomes natural. I still have a solid base of Avios for last minute long weekends, where we plan to fly less than 4 hrs (don’t want the weekend to be spent on a plane).

You are right that one of the biggest issues when using miles is equipment changes, I actually lost (without notification) several legs of my last few flights, it seems to be exacerbated by Partner travel.

As for Hotel points over miles… tough call there. If you plan a long trip, like your Israel/Turkey one with few flights – hotel nights ratio then saving on the hotel makes sense, but for us we move around a lot in short hops, so the hotel is typically the cheap part (plus we are willing to stay in cheaper hotels than you would find on the programs like Hyatt).

I would definitely think about URs as an addition, they are not as good as SPG for redeeming, but easier to earn due to multipliers. Drop me a note if you are having problems meeting spend, i’ll be happy to help.

I agree that building up balances on hotel cards limits the kinds of hotels where you can stay. My husband much prefers cheaper, smaller and more personal hotels over the chains, and we often rent a flat for a week or so when we travel, but in some cases the chains are best. When we flew out of Milan a few years ago, we were able to drop off our rental car at the airport the night before and stay at a hotel that was literally in the terminal – so convenient for an early morning flight and we saved on the car rental too. We booked that on an OTA last minute, but I could see using hotel points for something like that in the future.

I do have a question for you about award travel – what happens if you are en route, flying on an award ticket with multiple legs, and something goes wrong such that there must be a change. For example, a flight is late or cancelled. Are you then limited to an alternative that has award seats, or do they rebook you the way they would a paying passenger? And who does it? For example, what if something goes awry in Athens, when we are en route to TLV on a US Air awards ticket? Will they get us on something or am I left trying to contact US Air for help? Thanks!

I think it is case by case regarding the cancellations, personally what I have done in the past is try to deal with it on location, as that is, for me, easier to grasp the needs when talking in person with someone at the airport. However, there are times when that won’t get you to your goal, so you need to call up the HQ in the US. For that reason it is always good to have the contact numbers of the most helpful desk, even if it is above your current status.

In the past my Star Alliance partner awards have all been booked through the Round The World Desk – these are seasoned pro’s that get the system and are good people, trying to help. I would call a desk like this if the airport doesn’t help. I’ve not flown through US Air (yet) but would look for the equivalent or their top status desk – Chairman. So I would take with me 2-3 numbers, my current status line; Chairman status line and if they also have a dedicated RTW desk line, that too. I would start at the top and work backwards. I find the higher the level the better equipped they are to help you out, though some airlines, like British Airways, won’t even let you talk if you aren’t at the correct status and dial in above your level.

Overall SNAFUs like this require tact, patience and politeness to resolve. One time I was in Paris CDG after flying in from Cairo, our flight was delayed and we had ongoing flights on another airline – AA (separate tickets) that we were sure to miss now, as our arrival into London was pushed back – the people on Air France booked us all the way to New York on different flights -free. Just by being nice. The people next to us were having a fit, with the DYKWIA attitude, and they got stonewalled….

So while there may be “rules” it is often at the discretion of the rep at the airport or that airline’s policy. I didn’t plan to have a phone with me to be able to make phone calls en route – well, I’ll have my iPhone but usually we do not use it out of the US – I typically carry an old flip phone into which I can put a SIM card for the country I am in. I guess I better figure out Sprint’s policy on international calls! I wonder if Twitter would be a good way to go too. But I will be sure to locate whatever numbers I can find for help desks with US before I leave. I am starting to think that cash-back may be a lot easier than award travel!!!! I just posted the question in the “Star Alliance booking using US Dividend Miles” thread on Flyertalk. I’ll let you know if I get any other good advice from them. Thanks, Matt!

Sounds good – also, you might want to get the Skype App for your iPhone, I find that very useful when travelling, many hotels have free wifi, as to some airports.

Great idea! I will get it for my ipad too. I should have thought of that. Thanks!

Matt in addition to being redeemable for hotel or airfare aren’t Membership Rewards and Ultimate Rewards redeemable for a close approximation of cash, specifically as American Express or Visa gift cards or statement credits? Did you consider this in your example “if cash was tight…”?

I didn’t really consider that to be honest. But know I do I am not sure… the reason is that they would get less than 1c per point I believe? I forget the rate, but believe the Gift Cards are not even 1:1 ratio?? I had thought that it wasn’t a good use of points due to the multipliers not being applicable, but I don’t do a lot of OD/Staples GC purchases, so perhaps you are onto something here – if we could earn 5x and redeem at a little under 1:1 there might be some money here (working in costs of acquisition of course) time to get a spreadsheet out!! Thanks Will!