I talk a lot about the Fidelity American Express, it is one of the very best cash back cards you could get, offering 2% in all categories, and with no annual fee, should be an addition to everyone’s wallet.

A well structured, and therefore more complex Cash Back strategy would include other cards, such as the (Affiliate Link>) American Express Blue Cash Preferred as it earns 6% Cash Back on groceries, so you would target a mix of cards depending on where you are shopping that day.

Earning Fidelity American Express Rewards

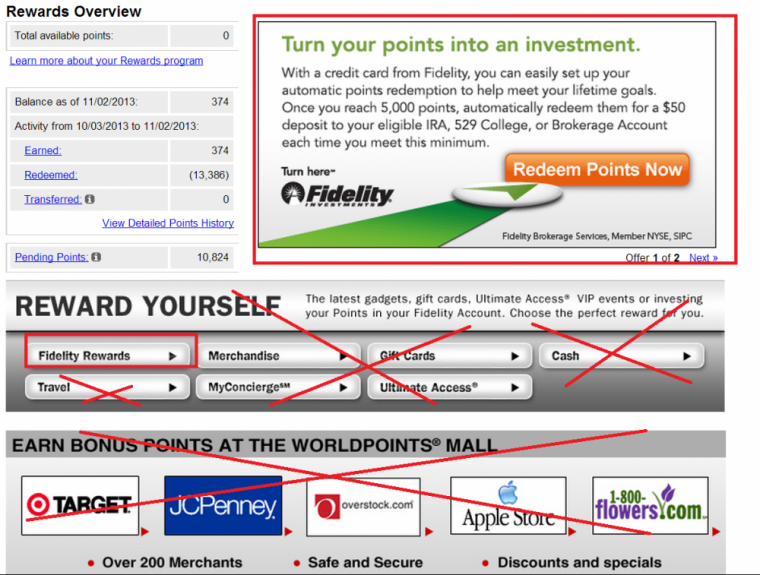

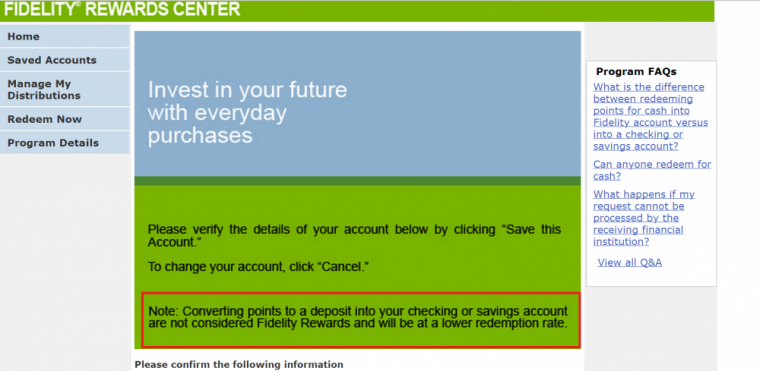

As mentioned you earn 2% everywhere, and when you do they come in the form of Worldpoints. There is actually an extra step required in order to gain the full 2% value in that you have to send your Worldpoints over to a linked Fidelity Account, doing so will net you 2% cash back, doing anything else will earn you less, likely 50% of the value.

There is something of a dirty trick here in that it allows you to select CASH as an option but if you do this you lose half your value. You need to put the money into a Fidelity Account.

There are many types of fidelity account you can link, including retirement accounts. Personally I avoid any tax deferring account like that as you need to track your monthly contributions to the account, which will be random amounts based on your spend, and at year end declare how much you put into an IRA, plus there are all sorts of complications based on your salary as IRA contributions, both Traditional or Roth are capped by Adjusted Gross Income (AGI).

I have always sent my rewards to a brokerage account, and then I trade with them, but for others who want the cash out of the account the best option is the Fidelity Cash Management Account.

The Cash Management Account from Fidelity

This is the account you need in order get access to your credit card rewards on a short term basis. It offers all the features of a checking account, including a Debit/ATM card that reimburses ATM fees (you need at least one card in your wallet that does this, other good options are Ally or UFB Direct).

Account Features:

Fidelity released a video today that explains the interface of the Cash Management Account further, so if you are interested in the card but weren’t sure on how to access the rewards you earn check it out for a good explanation.

Fidelity Cash Management Account Video

Every time you mention this account I want to learn more, specifically, how you can get cash if you prefer not to invest/trade with the cash back. Thanks for taking the time to explain and for linking to the video. Hope you had a good Thanksgiving!

My CB goes into a Fidelity brokerage account as cash. You can then transfer it out to any account you want whenever. It’s one extra step, but one you are likely to go through pretty rarely. I’ve actually just left mine there in cash. A little over $500 at this point. Probably should dump it in an ETF.

How do you specify your Cash Management account as the destination? I just tried and it said that I cannot have letters in the account number, but cash management accounts include in X the account number.

Thanks for the help!