Should I pay off my Mortgage early? That was a question asked of me this week, and the answer wasn’t easy for me to give. I think it’s a common question, but the problem is complex and involves a lot of quantifiable and non quantifiable factors to consider, which makes it quite fuzzy. In this post I am going to attempt to tackle both sides of the equation in depth, to see if we can answer the question, which I believe lies somewhere between emotion and mathematics.

Common Reasons to want to pay off your Mortgage Early

- Owning a Property outright feels more secure than holding a mortgage – if you lose your job you don’t have to worry about mortgage payments and possible repossession. The gain here is feeling secure. [Emotional Driver]

- Interest Payments over the time of a regular 30 year mortgage cost a considerable amount of money that could be used elsewhere. [Mathematical Driver]

Common Reasons not to want to pay off your Mortgage Early

- You lose out on opportunity by locking up your capital when it could be used for investments.

- Mortgage Debt is treated unlike standard debt in that the interest is tax deductible.

Factors you need to consider

Age of Mortgage

Mortgages tend to initially amortize Interest heavy- that means for the first part of your loan every monthly payment is primarily paying just interest and a very small amount of the actual principle. What that means in the decision making process is that whilst your payments remain the same throughout the length of the loan, the annual deduction from Mortgage Interest Payments will be greater earlier, and progressively smaller as the loan continues.

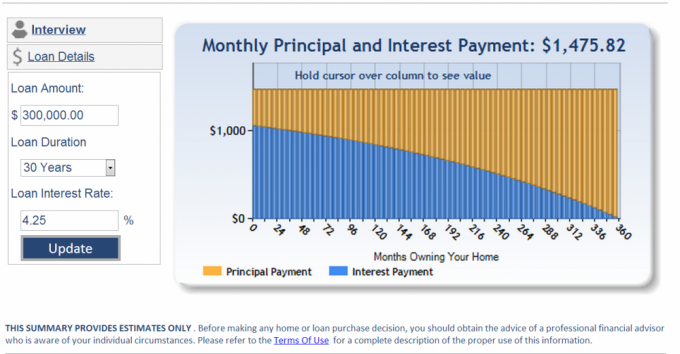

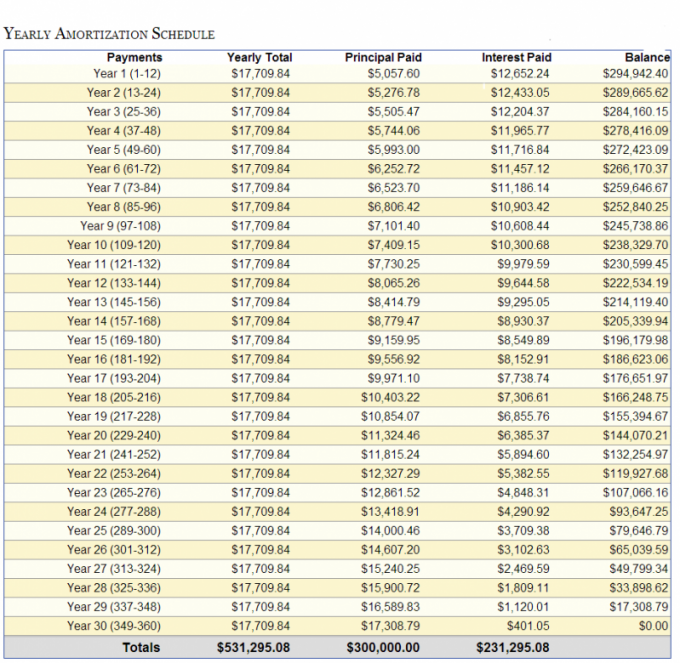

An example of how this affects your decision can be seen if we look at different phases of a 30 year $300.000 loan at 4.25% Interest:

- Month 1 Payment is $1,475.82 of which $1062 is Interest and $413 is Principal

- Month 300 Payment is $1,475.82 of which $282 is interest and $1193 is Principal

Over the course of a year (with some rounding) we can see that you get about $12,000 of Mortgage Interest for your payment of about $18,000 in Year 1, whereas you get about $3400 of Mortgage Interest for your payment of about $18.000 in Year 25.

Your Mortgage Interest Payments are deductible at your rate of Tax – EG if you are paying a rate of 30% you can expect to gain back $3,600 from the $12,000 in interest in Year 1 or $1,020 back in year 25 when you have paid $3400 in Interest. Some people will say that this deduction is an excellent thing, and whilst it certainly is helpful, it doesn’t take away from the fact that you are paying out massive amounts of interest still. If we were to snapshot that first year and look at it like this instead:

You have a debt of $6000 that if you spread over one year will be valued at $18,000 (12x$1475.82) That if you pay off in full on day 1 of the year you would avoid all interest on the debt – you could clear it off for $6,000. Would you do it?

That was overly simplified, so lets now bring in mortgage interest deductions:

If you have that same debt and opt to pay it over 12 months for $18,000 you would gain back $3,600 Total Cost $18,000 total money from Deduction $3,600 = net cost of loan $14,400

That makes the question – would you pay off in full now for $6000 or spread over a year for $14,400?

Again, the answer seems obvious to me, and hopefully to you too. The reason that mortgages do offer value is in Leverage.

Leveraging Profit through Other People’s Money (OPM)

From the above examination of mortgage amortization schedules I think most of us would feel that clearing down that mortgage debt early makes a lot of sense. However the reason that mortgages make sense is that many people cannot initially afford a property in full. Or, if they can they want to go above their needs through lifestyle inflation.

For example, common thinking for a person with savings of $300,000 and an income of $200,000 would be to put down a deposit and mortgage a loan on a property valued at something like $600,000-$800,000. Assuming that would be 25% Down we are talking about $150,000-$200,000 plus mortgage payments. What they are hoping for is sufficient gain from the resale value to cover the costs of the mortgage payments made and net a profit – whilst this is possible, it is not guaranteed, because like anything the value of properties can decrease just as easily as increase over a short period of time. Leveraging is gambling, and if it works out you can make a great profit, but if it does not you can lose out just as easily.

Considering that example, if the property values overall were to increase by 10% the person owning a $250,000 home outright would gain $25,000 whereas the person mortgaged on a $800,000 home would earn $80,000, the $55,000 would be used to offset the extra money paid on interest over the years.

Whilst this is something of a side issue, it is important to question this when embarking on a mortgage, because I would say ideally you shouldn’t embark upon leveraging unless you feel you have sufficient funds to keep things running until you can gain a sale price that covers your mortgage costs or if you can pay off in full. However, leveraging here can more than make up for the additional cost of interest on a mortgage loan if you get it right and get lucky.

Opportunity Costs and Opportunities Lost

Better Value in the Markets?

I constantly hear that at these record low mortgage rates people would be crazy to pay off early, and instead should be building wealth in the market. However it is important to note that the market doesn’t come without Risk, and whilst I am told I shouldn’t do this, I believe that timing the market is prudent, which I will return to shortly.

Breakeven Point on Return

The Breakeven point that you need to find is The net cost of your mortgage interest (the cost after tax deductions) In the previous example we used 4.25% Interest Rate and an income tax bracket of 30%. That would produce a net Interest rate of around 3% – if you can earn more than that in the market from your investment your interest earned would exceed interest paid and you would be better off.

The Catch? That 30% Income Tax level again, because if you were earning in a non tax advantaged account, which is most likely then your gains are taxed, which pushes the number back up to 4.25% that you need to breakeven…

Risk Free Investments

Nothing is completely without risk, but the higher return you seek to gain the higher risk you will expose yourself to. Unfortunately, in this current economic climate most risk free investments options you have would actually lose money on an annual basis due to the interest rates paying less than the rate of inflation. For June 2013 the US Inflation Rate is listed at 1.8% so anything that pays less than that will result in a net loss for your money. And as you might know, finding a savings account or CD that pays anything close to half of that rate is a real challenge. TIPS (US Treasury Inflation Protected Securities) are a good option; they are Bonds that are guaranteed to return a small profit + Inflation rate. But you are looking at tiny profits here. Also, they are structured to produce a taxable payment each year that counteracts the inflation protection. Furthermore neither of these pays near the 4.25% we are looking for.

In short, paying down the mortgage early provides a risk free guaranteed interest rate higher than what can be found from the market. Because you know that the cost of the loan is 4.25% Gross (3% Net) and you cannot get those rates from a guaranteed investment in today’s market.

However, you are able to find yields greater than this in both the Bond and Stock market – the risks associated are higher, but the rewards can be also.

Have you got a Windfall, or is it a gradual increase in monthly disposable income

There are two scenarios to consider when looking to invest your money or pay down your mortgage:

- You have a lump sum windfall allowing you to pay off in full (the example above would mean $300,000 or more.

- You have an increase in monthly wages allowing you to pay off additional each month

If you opt for the investment route with your money in the first scenario I believe that you are able to expose yourself to excessive risk from the market. Investing a lump sum of that value (in proportion to your other assets) is too dangerous, and you need to actually drip it into the market over time, keeping a broad mix of asset classes- dropping it all into stock could see a nice gain this year, but if the market tanks next year your losses could be massive, and beyond your ability to regain. The opportunity Cost comes into play whenever you lock up money in full – either by paying off the mortgage or by investing fully into a market – by keeping some liquidity and separate you are positioned to be able to take advantage of changes in the market – such as stocks losing value and buying them at a bargain price, or perhaps a second piece of real estate that comes on the market at the right price.

In scenario 2 above, things are a lot safer, as you might have an additional $1000-$2000 per month to put down additional mortgage payments OR invest. Investing at this rate is steady and safer as you are able to maintain dollar cost averaging. The opportunity Cost risk is lower because you couldn’t do too much with that money in the first place.

Compounding Interest Earned or Compounding Interest Paid

The way I see it, having a mortgage means you are on the losing end of Compound Interest – you are paying out money over time to someone else – this is what I think of when I hear Other People’s Money – you are feeding their accounts – personally I would much rather play the banker and would be a lot happier if people were paying me every month for their loan repayments. In fact that is what I am currently doing with Prosper.com (Affiliate Link) where I am currently earning a 15% Annual Yield.

Let’s look over time at the difference in wealth you could see from taking two scenarios, sticking to the 30 year time frame, $300,000 loan at 4.25%. For the sake of realism let’s assume you started out with the mortgage not being able to pay it down in full, but your $300,000 windfall occurs in year 3 of your mortgage.

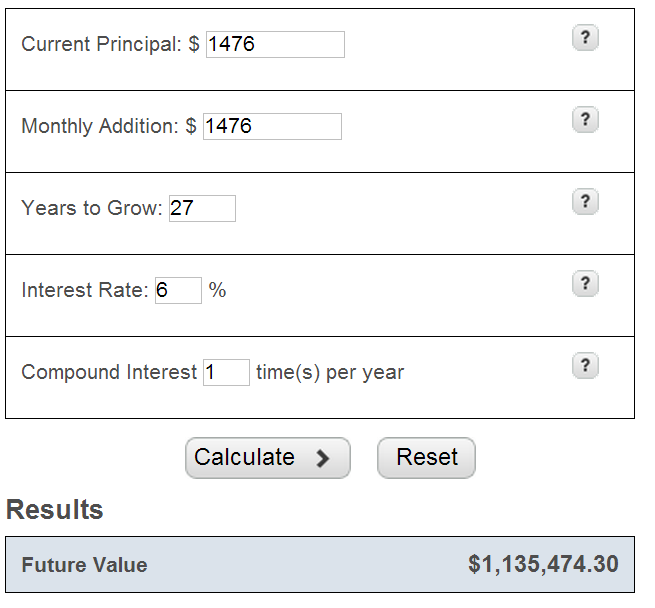

By this point, you have already paid $25,000 in interest towards the mortgage, so you have $206,000 of Interest Payments remaining on the loan. Let’s run a scenario where instead of making those payments you pay down early, AND then assign the monthly mortgage payment to a monthly savings plan linked to the market. In essence, what we are seeking to do is reverse the flow of the Compounding Interest from a payment to a gain. And whilst the market can lose money, the safest way to invest in it would be to pick a good fund and drip money into monthly, as if the price drops your monthly purchase gains more equity – this is dollar cost averaging.

Assuming 6% Return on average (achievable from low cost funds and a long term strategy) investing $1,475.82 (equal to your old mortgage payment) you would earn:

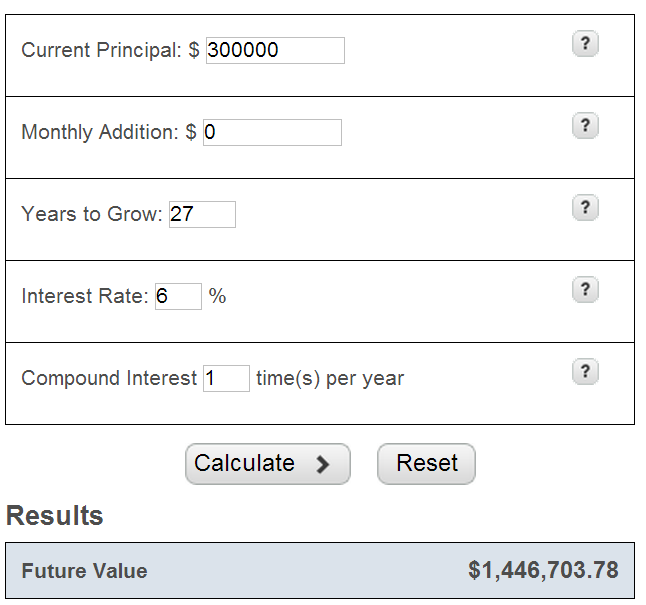

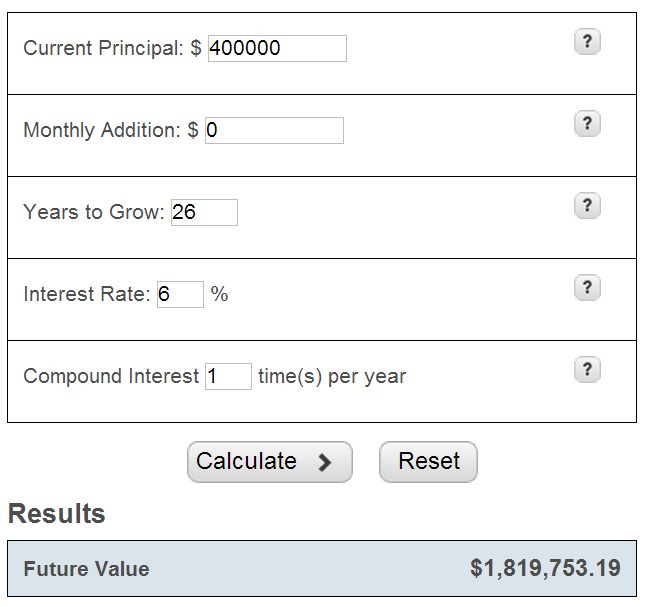

For a comparison lets look at putting the full $300,000 into the market in a lump and watching that grow over 27 years:

As you can see, the latter earns more (but note we aren’t looking at standard deviation that occurs when the market swings upwards and downwards) risk is far higher with this strategy than with investing monthly – for example if we ‘time the market’ poorly and say next year our investment drops by 30% to 210,000 we then only have 26 years to gain back our losses, the result of that drop would be catastrophic to our investment plan:

And let’s remember, that if we opted to put the full amount in the market rather than pay down the mortgage you would have to deduct Interest Paid from the Mortgage from your profit, meaning that the 1.4M would become 1.2M and the 995K would be 760K

Of course, what went down could also go up, if the markets continue to rise it is possible to earn a lot more from your 300K right now, lets look at a case where they go up to 400K in one year, then have 26 more years at the average of 6%:

As you can see, an excellent result. However, you are really playing with your money here and you have to decide upon your risk tolerance. This is the emotional side of things. To embark upon a high risk strategy you need the composure and willpower to handle when things go wrong. For example, if you are going for the final scenario of putting your money ‘all in’ you must be comfortable when:

Within 1 year you lose your job, the market crashes and your money goes from $300,000 to $150,000 and you need to make your mortgage payments, but can no longer afford to pay it off in full. If you can handle that without adjusting your Investment Strategy then by all means go aggressive, but there are very few people who can.

Conclusion

If this was me, and I have a windfall sufficient to pay down my mortgage today I would do so, but I would continue assigning the money spend on the mortgage as a ‘cost’ or liability and pay it every month into the market. The worst thing you could do for your wealth would be to pay down the mortgage then rest on your laurels – you still need to work and still need to set aside the savings for your future. The windfall today at that level doesn’t change your life fully, but if you deploy it in the best manner possible you can certainly come out further ahead of the game than the $300,000 spent otherwise.

If it was an increase in disposable income then I would make sure that other factors were fully covered first, such as tax advantaged retirement accounts, emergency funds etc. And I hope it goes without saying, but if you have any other debt at a higher rate, such as a Credit Card or Loan then absolutely they should be cleared down in full before you even consider paying additional money towards the mortgage.

Leave a Reply