As many people know, credit card companies often offer a Retention Bonus to their existing customers to incentivize them to not close their accounts. By properly using this knowledge you can often offset or eliminate annual fees, which is a nice touch indeed.

In the increasingly competitive discount brokerage world savvy consumers are now taking this approach to their investment accounts and garnering attractive retention bonuses to stop migrating assets to a competitor. Whilst you could simply bounce your money back and forth every year to capture ‘churnable’ bonuses, it is a lot easier to just call up your current broker and threaten to do so (I use threaten in the politest sense of the word) and have them make you an offer to stick around.

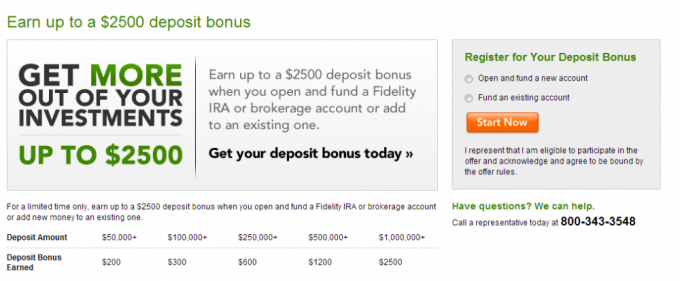

The two main players in this game are Fidelity and TD Ameritrade, the benchmark numbers to look for are the new customer bonuses that are offered as per the below schedule:

TD Ameritrade offered the same amounts, but in the form of Gift Cards or Gifts, which aren’t as good as cash to me, and I think both will come along with a 1099 for the amount received.

The TD official offer above has expired, but that is where the negotiation comes in – if you have X in assets as a Fidelity customer and were to call TD to discuss transferring over, they would certainly entertain the conversation that the privilege of you bringing your assets to them should come with a bonus at the levels mentioned above. These are the ‘BATNA’ numbers you need to go in discussing.

This post is about retention, not attraction bonuses, so being that Fidelity customer I would then simply use the comfort of the knowledge that a transfer away from them would benefit you to be the motivation to call up Fidelity and discuss you thoughts on moving.

The secret to negotiating Brokerage Account Retention Bonuses

When negotiating you need to build a strawman argument, the purpose of this is to distract from your real agenda, of getting the extra cash bonus. If you go in just talking cash it is the only point you have to argue. What that means is the bonus levels seen above, EG $2500 for $1M USD accounts would be the negotiation point, and then it would be a back and forth about that, perhaps you would get a percentage of the $2500, but not the full amount.

Start the conversation pleasantly (and keep it pleasant) with the thought that you might move over to TD as you have heard they have a more robust trading platform that is easier to use for (insert trade type here EG Options Trading). Chat about it, then also mention that when you spoke with them there was a discussion of new account bonuses, and that you knew that Fidelity offers new customers X from the advert above. This is your primary agenda, but you want to shift focus from your primary agenda in a negotiation.

So, after talking about some cool new feature that your buddy told you about for a while (you don’t even have to understand it, just make them out to be someone you respect and someone that moved from Fidelity to TD Ameritrade and knows what they are talking about) go onto the second point:

I have spoken with TD Ameritrade and they told me that I would be eligible for a joining bonus. I understand that Fidelity offers something like that too, and will pay new customers up to $2500 (say the number that applies to your balance, but don’t demand it, let them offer you) for the amount of funds in my account. [offer stage 1] you can gain something between 70-100% of the $2500 if the company is prepared to extend the terms of new customer bonus to existing customers (in Fidelity’s case they are, every single year…)

At this point, you may get an offer of $2000 to stay, this is where you sound happy, but uncertain, and can circle back to your strawman of the trading platform:

That is very kind of you, but they are offering more than that to move (offering the full $2500 for my Million) AND they are also seem to have a better platform. It seems to me that all things being equal they are just a better place for me to keep my money. [insert softener] However, I have really enjoyed the support from you guys over the years and really do appreciate the way in which you take care of my needs on the phone. I’m just at a dilemma where it comes down to the most sensible place to keep my money.

[pause] allow them to come back with a better offer. Decide if the offer is worth it to you, at $2,000 or if they have bumped it to $2,500 accept it. If you aren’t totally sure on the offer thank them for being so flexible and helpful and say you want to talk it over with your wife, and if they would be willing to annotate your account (this locks in your offer).

In other words, what you have done is this: Allowed them to come to you with an offer, with value as follows:

- New Account Bonus of $2500 for an existing customer = upto $2000

- Trading Tools being not as good as TD Ameritrade = upto $500

- Customer service being better with Fidelity = the real reason you stay….

Don’t lock in a failure

If you hit a grumpy person on the phone who wouldn’t offer you a deal, or offered you a really crummy retention bonus then hang up and try again. Just say thanks, you’ll think about it and noncommittally state you will be in touch. You don’t want a low ball offer annotated on your account because you can try to call back in and get a different agent, and you want them to not be attached to offering something low again.

Your Mileage May Vary

This is an unofficial offer being negotiated, your ability to negotiate, plus the ability of the person you are dealing with to do the same will dictate success. If you strike out don’t worry, you lost nothing. Also, I don’t know how well it works for people on the lower end of the balances, it should in theory work at each level, whether you have $50,000+ and are striving for a $200 retention bonus, or if you have $1MUSD + and are aiming for the $2500 level, I personally have only seen it working at the top level, and have not tried it at the lower level. It works every year.

Also, if you really hit a complete failure in terms of getting cash out of them, you could also try for some Airline Miles. Fidelity has a program for new customers for these, so they are able to access them and might be able to compensate you in this way, for being a loyal and happy customer of this fine financial institution.

Leave a Reply