I’ve been giving more thought to the post written by MilesAbound here, it challenges whether we should use Credit Cards for regular spend or purely for Manufactured Spend. The post is sound, and you should find time to read it if you own a credit card. In fact, reading it for me was one of the catalysts for reflection and I changed the way I deal with Credit Card links within my site thereafter.

Many people think that they are in ‘control’ of their credit card simply by paying it off in full each month, and indeed that does avoid interest and fees (other than the annual fee) but the point that Phil raises is that regardless of your automated systems, just having access to the line of credit will encourage you to spend more. This isn’t something that he just pulled out of his backside by the way, it has studies to back it up. I want to add in my own childlike psychology lessons here as to why people deny such things happen:

- Agenda – some people are compensated by the sale of credit cards and the money is more important to them than the facts.

- Denial – some people simply don’t want to admit lack of control of their money as it challenges their status as a functional adult.

- Obliviousness – some people just don’t know that they are spending more.

Agenda is huge – If you, like I do, write about finance and budgets and also receive credit card compensation you are walking on thin ice, it is very easy to start downplaying the risks that come with credit card ownership and focusing on the positives only. If someone brings up the challenges of budget control when using cards you simply must accept that this point is vastly more important than making a small rebate on the POS transaction, if not you shouldn’t be talking about budgets or credit cards. I am particularly dismayed by the use of anecdotal defenses to these such as ‘Our Family has no problem’ because that by its implication is a passive aggressive way of challenging a persons ability to manage a budget and operate a family.

Let me be clear here – if you are attempting to be an expert in the field of personal finance, budgets or saving advice and you ever rely on a line ‘oh well it works for me and my family’ rather than embrace the very real concerns that a reader brings up, then you have lost touch with the value of Credit Card rewards – remember, they offer between 2-5% rebates on regular spend, which for the average family really isn’t that much at all, and I would argue is completely meaningless if that average family cannot control its spending and budgets because of the overflow a card allows. If you are being compensated by promoting card use, and you still can’t see this, it is possible that your sight is obstructed by a conflict of interest, and you are in danger of becoming part of the problem that you first sought to help.

If you aren’t claiming to be an expert and you use the same line, well, I love you for reading, but you should perhaps reconsider that statement, because on one hand you are discounting a very real concern, that is very logical, and has studies to support it, and also, you might just be oblivious to your own management of money, I know I am to an extent.

Obliviousness is an interesting one, for example with our family I know that I will not go to certain restaurants on a regular basis because I ‘cannot afford them’ but I do know that I will go to others and happily have no budget for food or drinks once seated, and will frequently pay whatever the price is for the wine that I want. If I was all cash I simply couldn’t do that. By avoiding the expensive restaurant and going to a slightly cheaper one I can kid myself (Denial) that I remain in control of a budget while holding a card.

The point that MilesAbound raises is simply to use cards much more clinically – rather than allowing me to buy the $60 bottle instead of the $48 bottle, forcing cash into the equation would mean I would have to be on a budget – and being on a budget doesn’t mean that I couldn’t set my price point per bottle at $80, it would mean that if I did that I would have a proper understanding of the impact of the lifestyle I was living on my overall goals. I could still have credit cards, but I would refuse them entry into my budget, so I could take those attractive $500 signup bonuses and apply them as I saw fit, but I could also ensure that the budget inflation that they encourage wouldn’t be able to drift into my spending plans.

There is no way that this is a bad plan for a budget.

You would clearly be ‘leaving something on the table’ in terms of certain spend, for dining we are typically talking about 2% (more when rotating cards like the Freedom or Discover kick in) but what is that really? Funny that percentages confuse people so much… if you are dining at $100 per head then we are talking $4 for a couple – do you really think that going in with cash and stating you wouldn’t slip up $12 or more on a bottle of wine is an inferior strategy? Or perhaps when you get to coffee/dessert that you have one instead of two because of the budget?

As you might know, I am not one who advocates a bare bones budget, I personally enjoy dining in Michelin starred restaurants, but that doesn’t mean walking in with a stack of $100 bills isn’t a smarter move. You can make a game of it too, forcing yourself to pay cash and seeing where you can save say 6% on your bill and coming out ‘ahead’.

For my own budget, if you took dining out from the equation my lifestyle is quite low cost, so if I went fully all cash I would probably be looking at something like $10,000 per year (excluding utilities/gym memberships etc that are on recurring monthly payments) as such, my loss from going all cash would be about $200-500 in rebates (I have a 5% card for Groceries, Gas and Drugstores which takes up a lot of that).

Perhaps the Gift Card Diet could help?

Gas and Groceries are my main expense after dining, while I can earn an attractive 5% cashback from them, I do so with that unlimited spending cap and no budget control. Perhaps a different alternative would be to acquire giftcards and stick to a budget on them, if you want to be really hardcore about this, you could get to checkout with a gift card and if you didn’t have funds have to go through the embarrassment of putting back items you ‘couldn’t afford’ that would be a tough emotional thing to attempt, but if you could master it that would be incredibly empowering too.

On the less extreme scale of things, you could always have some cash or a back up option available in your wallet, so if you really couldn’t bring yourself to rely on just gift cards in your wallet in case of the fear of shame from society, you could just go back home after ‘cheating’ on your diet and make sure you sit down and re-evaluate what went wrong and why you needed to draw the backup funding from your wallet.

The advantages of carrying a collection of Gift Cards rather than just cash in your wallet is that you would get some of the credit card perks – for example if your regular routine involves going to Starbucks or Subway for a certain portion of your monthly spending, you could seek to acquire cards from Staples.com and earn your 5x at point of sale, turning the food transaction into a 5x earner. Of course, not every store will work for this method, but if you can gain a number of 5x cards then you could offset those that don’t accept a multiplier on purchases.

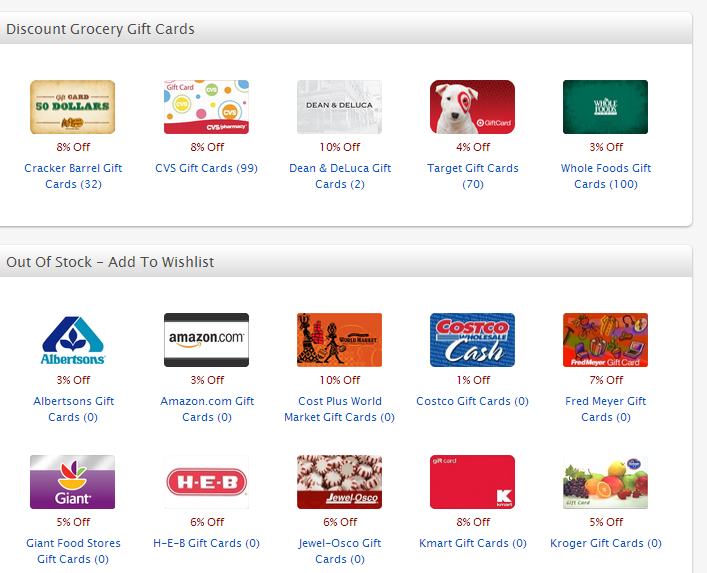

Another option to acquire cards could be something like Cardpool.com and purchase discounted cards – as you can see they offer 8% off CVS here, which trumps any 5x card available, plus if you are buying the gift card with a points earning card at the start of the month you can double dip – find a site that offers portal rewards and perhaps a triple dip option is available.

The Purpose

The gift card approach to your wallet could offset the small loss you are facing by switching regular spend to all cash – it may not cover every option, and certainly the nicer restaurants out there don’t have an option to buy a card from Staples, but you can likely swap out a number of things to giftcards, at between 2%-10% savings, which would on average offset your monthly perks, and at the same time fix a rigidity to your spending. It will also start you thinking more – if you simply need to commute to work with a car, how else can you reduce that fuel cost? It should start you thinking more about efficiency, and perhaps finding a cheaper option, a smaller engine vehicle, or car pooling.

Implementation

You need to know what you spend before you can implement a budget, I would recommend using something like mint.com to track your monthly expenses – you need to watch out for peak and trough spending months, so make sure you look back at least 3 and ideally 6 or more months to get a feeling for an ‘average’ spend for:

- Groceries

- Gas

- Daily Dining (lunch etc)

- Social Dining

I wouldn’t track your monthly gym memberships or utility bills here – these you can leave on auto-pay linked to credit cards (paid off in full) each month, there certainly are saving opportunities here, but they aren’t part of the Gift Card Diet, that is more about what you pull out of your wallet each month in physical transactions.

Once you have an average monthly spend you have to make a decision – is the number acceptable, or do you want to reduce it? It may be that the number is low enough and your income is high enough that it isn’t worth the effort, one thing to be mindful of when ‘averaging’ is that if you have a really disparate data set: eg for no good reason you spend $1000 in dining in March, but $220 in Feb, you might be overly spontaneous with your spending and having some sort of health budget may be worthwhile implementing.

Duration

I would argue that you could approach this as a fad/crash diet and just play with it for 3-6 months and compare your habits with before – if you have managed to change the way you shop and be more in touch with budgets at restaurants or grocers then perhaps you could swap back out to regular card usage, coming back to this idea once a year as a ‘cleanse’. Ultimately it is all about ensuring that loading your wallet with credit doesn’t make you lose sight of limits- it happens to most people so it probably has happened to you to an extent also.

Personally, I am not against spending above your means on a credit card if it is done knowingly, for example people like myself earn income on a 3-6 month scale, so sometimes I will use credit prior to payouts to cover a gap in income, if done consciously this is acceptable, but if lifestyle inflation is creeping in unwittingly then it is good to take a snapshot of your spending, put your wallet on a diet, and start taking control of your money again.

Audience

I would recommend considering a budget for anyone who is holding any type of debt, other than those who have truly elected it for arbitrage. So even if you are on second year lockstep earning $170,000 but holding student loans, you might still want to put your wallet on a diet periodically so you gain ownership of spending, especially until you get free and clear of that debt, it will make a big difference to your future choices. The way I see it, if you aren’t already fully financially independent and using debt only to finance your next big business opportunity then there is real room in your life for spot checking your budget.

As a final thought, between the ages of 20-45 I put higher emphasis on earning than budgeting, so don’t make any budget decisions that impede you ability to make money from your job or business, but if you can trim the excess every now and then, you will be much more efficient at keeping your wealth.

You might want to read studies number 3 and 4 in the journal article you referenced. These two studies specifically point out that the tendency to overspend is just as present when using “scrip” in the form of gift cards as it is when using credit cards. It appears the only way to really align the “pain of paying” with an actual purchase is to use actual cash.

Worth noting thanks – I’d add that my concept here is you buy giftcards for the months budget, when you are out you are out- their fixed nature forces a budget… Just a thought for those not willing to go all cash

I have a hard time reading your blog– font is small and grey and blue color is too pale. Any other complaints?

What do you mean any other complaints? You want to start a thread about what people dislike about my blog! 🙂

Sorry it isn’t working for you, try holding ctrl and scrolling in to zoom, should help the font.

I have noticed that we absolutely spend more when we use a cc–especially if we’re working on min. spend. My method of controlling the spending is to do $500 ATM withdraws from my BB and use that for our actual expenses. I stick the cash in a envelope and my spouse and I get a set amount each week.

The cash gets spent on our discretionary purchases, making us more likely to slow down our spending.

I know it’s not perfect and it’s not a maximum return strategy, but It works for us. It’s simple and we helps us keep our spending in check. (As long as we stick to the plan) I’ve been in debt in the past never want to go back there again. I’d rather keep my finances in check than squeeze every point out of my spending.

The gift card plan looks like a good option as well. We might be able to work some gift cards into our plan as well. Thanks for the thoughtful financial advice!