Let’s kick things off with a value judgement. You need about 20 single stocks to be diversified, and you need to be able to explore correlations within them to ensure that you didn’t just acquire a slim sector that is highly at risk. As an arbitrary number, I would suggest you don’t need single speculative stocks until you have at least $250,000 held in invested assets, stick to low cost funds and ETFs from Vanguard til then.

But once you have that critical mass, or if like me you don’t always want to follow sensible advice, the location of your speculative stocks is an interesting question. Every trade we make is subject to fees, be they transaction charges, or taxation. If you are trying to get rich trading in $100 positions then a round trip sale is going to cost you at least 10% of your profit. With that in mind I would further suggest that you don’t own a single stock position valued less than $10,000 (and ideally $20,000) anything lower – stick to Vanguard!

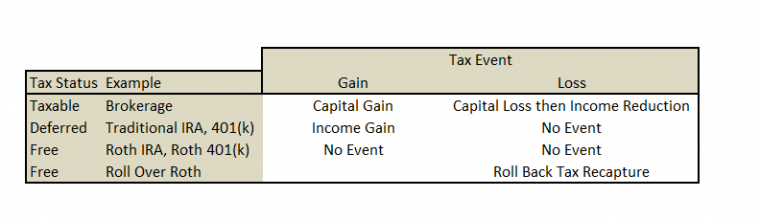

Once you are trading at levels where the transaction sale charges are insignificant, the concern will be on taxes. It is interesting to note that the location of your speculative stock results in different tax treatment, the purpose of this post is to create a philosophy in order to make the best choices based on this:

Remember we are talking about location not allocation here, the latter talks about how you split things up into different types of assets. Location talks only about the holding vessel for the assets.

What’s so special about speculative stocks?

They are a gamble, pure and simple. People are driven by greed and want to find the next Apple or Google so that they can give up their miserable existence and move to the Jersey Shore. They are no different from Scratch Off cards. An example of a speculative play would be Twitter. The company has never made a profit, and just announced another quarterly loss of $132M on inflows of $250M. Yet, there is a large market for the stock because people speculate that if they can ‘get it right’ on the monetization side then the large user base could suddenly create masses inflows of wealth for the company,and the stock will skyrocket.

The gambling nature of this investment means it can go down as well as up, and for every Google there are hundreds of firms that go belly up and bankrupt. So we have to think about the following outcomes:

If the stock devalues we have lost money. If the stock appreciates we have gained money. Using the tax treatment chart above here is what we have to worry about when things don’t go to plan:

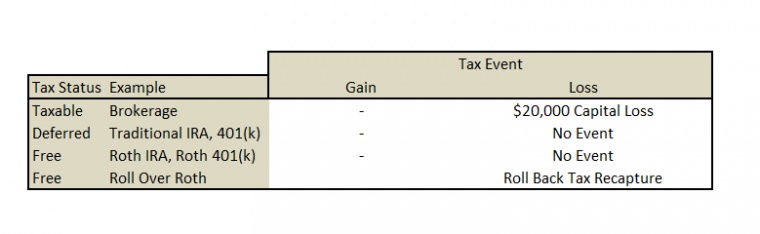

Stock loses $20,000

The chart tells us that directly storing the high risk stock in a Taxable Account can be a good idea if it depreciates, because we can collect the Capital Loss, which can later be applied to offset Capital Gain, or better still, Ordinary Income ($3,000 per year until the loss has been used up).

Deductive Logic: Since we know that most tech firms aren’t the next Google, and that most will fail to deliver, we might want to put all speculative purchases into Taxable accounts. When they do fail we can at least harvest the capital loss, something that is not possible within a Traditional Ira or a Roth IRA due to their tax gain advantage status, which by design makes them tax loss disadvantaged.

Rollover Roth Tax Recapture

This is an interesting thing indeed. Take note.

If you roll from a 401(k) or Traditional IRA you have a taxable event in that year. I use partial Roth transfers strategically to defer my tax rate, in a nutshell if you wanted to have a speculative play on Twitter for $20,000 you could open the position within an IRA, then roll the position ‘like for like’ into a Roth.

You’d pay income tax on the $20,000 for that year, but if done as I outline in my post above, that income tax is lower than when you earned it, and you filled your Roth (tax free growth) buckets. Now you have a position where you have $20,000 in Twitter in a Roth. If Twitter turns out to be a dead duck, you cannot claim a capital loss on it, because neither the Tax Deferred (IRA or 401(k) account it originated in, or the Roth allows a Capital Loss claim.. but you can change your mind about the rollover.

How it works

If you were in the 25% tax bracket and rolled Twitter into a Roth you would receive a 1099-R from your broker, and an income tax liability of $5,000 for that year.

If you rolled positions into a Roth that then went onto lose value, such as Twitter going to zero – you could file IRS Form 8606 which would over-ride your initial decision to roll over. Note that you have a ticking clock here as you must meet the deadline of October 15th of the year after your Roth Conversion takes place else it is permanent.

Outcome

Your Twitter stock would still be worth zero and you still lost $20,000 from that, but you would no longer owe the IRS the $5,000 you created by opting to roll into the Roth, so you would, in essence, be able to harvest a rebate of $5,000 on your failed transaction. Note that you can also ‘reroll’ back into the Roth after 30 days, so this is very similar to a capital loss harvest, with associated wash sale rules.

What if you strike Gold?

Of course, nobody would buy a speculative stock hoping it goes to zero, but the above is the most effective way to protect it should it go down, as you can capture tax savings from both the Brokerage account and the Roth Rollover Account. If it turns out to be the next Google and goes through the roof, then the best location for Twitter here would be the Roth, and the Roth Rollover (they are exactly the same other than the recapture option on the latter) there would be no tax due on either Capital Gain or Income Tax from a Roth.

The next best would be Tax Deferred, but even in a Taxable Account it is not the worst thing in the world to have to worry about how to harvest your gains with minimal taxation. And by correctly structuring income you can release profit over time, protecting gains with short term Put Options.

Conclusion

Speculative stocks are very risky, but can hit the Jackpot. Your best location for them would be in a Taxable account as most will go to zero, after which I would suggest starting them out in the Traditional IRA or 401(k) and using them as the rollover into your Roth in order to create a a hedge in the form of the rebate. Note – these strategies do not have to be used for speculation only, if you were to rollover a safely allocated index fund account to a Roth and the markets tanked, you can use the roll back rules to your advantage also.

These strategies involve careful timing of taxable events, I would recommend consulting with a tax pro before attempting them, I am not a tax pro, so think of this as fodder for conversation with your Accountant or Financial Planner.

I hope you didn’t really buy TWTR.

Nope, but I did buy ocz

Matt – interesting post, but for those of us that don’t have $250k, why are you so big on Vanguard vs. some of the other options out there?

I’m not so big on them, they are good enough is all.

I’m big on Vanguard. They’re one of my favorites for buying ETF’s, as they have so many with fees are low and when you trade the ETF it’s free. They offer “unlimited” ETF trades, but I use that loosely because like MS, if you abuse it I’m sure they’ll cut you off

Really appreciate the information! I will restructure some of my funds @ VG. If nothing else you just saved me $ in fees. Again – Thanks.

That’s great feedback, I am very happy to hear you saved some $ !