Portfolio Rebalancing is a key concept to the Passive Investment Strategy, ironically it is the time when you actually actively trade your portfolio which may seem counter intuitive at first when advocating a Passive approach, however it makes a lot of sense once we understand the concept. Portfolio Rebalancing is the process you go through to bring your investment percentages back to your planned amounts after movements in the market.

Portfolio Rebalancing is a key concept to the Passive Investment Strategy, ironically it is the time when you actually actively trade your portfolio which may seem counter intuitive at first when advocating a Passive approach, however it makes a lot of sense once we understand the concept. Portfolio Rebalancing is the process you go through to bring your investment percentages back to your planned amounts after movements in the market.

Determining your Ideal Asset Allocation

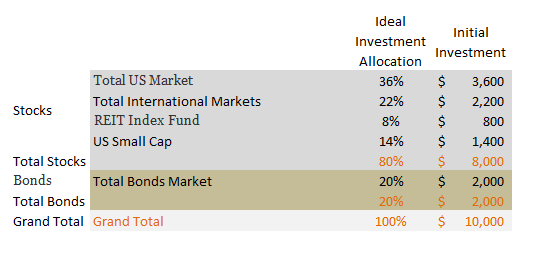

When you put together your investment strategy you will decide on how much of your portfolio to put into Equities; how much into Bonds; and how much into Cash or Cash Equivalents. This further breaks down into sub categories such as a specific Index, like a REIT Index, a Small Cap Index, or an International Markets Index. What you are creating is a stable base of plain vanilla for the majority of your porfolio, and adding on a little chocolate sauce and a cherry with the smaller Indexes – these are higher risk (because they are a smaller section of the entire market) and higher reward because Risk and Reward are intrinsically linked. More information on Asset Allocation is found at the end of this article.

Portfolio Tracking

Once you have created your ideal investment plan and allocated assets to it accordingly, it is now important to keep an eye on it to make sure that your positions within the plan remain within the scope that you initially decided upon. When your assets are held within a variety of Brokerages it is advisable to use a service such as Personal Capital which will allow you to track your overall position by showing you all your balances on one screen and track performance overall, here is a link to them and sign up is free: Personal Capital Free Signup

Portfolio Rebalancing

Once you have established your ideal positions and are using a tool such as Personal Capital to track them you need to consider how frequently you wish to engage in Portfolio Rebalancing, since doing so involves buying and selling your positions which come with fees it is important to make sure you don’t kill your profit by doing this too frequently. Two good methods would be a time method and a Percentage Moved Method.

Periodic Portfolio Rebalancing

Simple as deciding to rebalance Annually or Quarterly; personally I think Annually would be fine, but keep an eye on the market and if things are very volatile then consider bringing forward the evaluation so you can adjust due to big swings.

Percentage Change Portfolio Rebalancing

Requiring a more close eye on the positions, if you see something move aggressively out of alignment then you should rebalance accordingly, a good benchmark is a 5% move from your goal amounts.

Examples of Portfolio Rebalancing

Example 1 Portfolio Basket 80% Stock 20% Bonds (My Target Portfolio) With an initial investment of $10,000

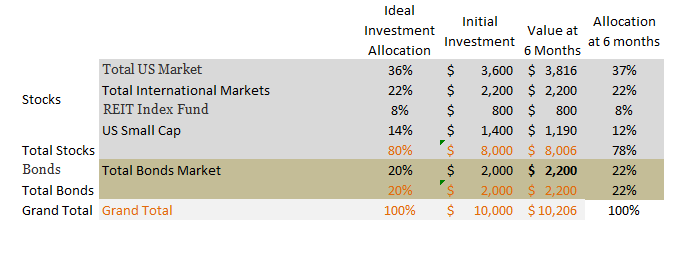

Scenario 1 – After a period of 1 year, the Bond market has done very well and the Total Bond Market fund is up 10%, unfortunately the US Small Cap Market Fund has done poorly and is down 15% and the Total US Market is up 6%. The other positions remain unchanged. Your new positions are starting to skew a little away from your initial plan and now look like this after 6 months

This drift is small at the moment, but unchecked over time it can start getting out of control. Already you are holding 22% bonds rather than 20% bonds in your portfolio however, it is still fairly small over all, but lets see what happens next in two scenarios based upon a Bond Market Crash (which might not be that much of a leap of the imagination unfortunately).

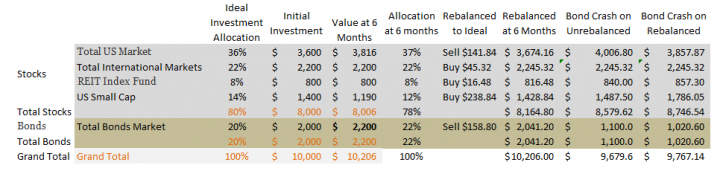

Scenario 2 Bond Market Crash-

- Bonds drop 50% and Stocks do quite well

- Total US Market up by 15%

- US Small Cap rebounds up 25%

- REIT Index Fund up 5%

Lets looking at the effects of this if you had taken no action at 6 months or if you had performed Portfolio Rebalancing.

After 1 year the rebalanced portfolio has lost $233 and the unrebalanced one has lost $321, which doesn’t seem like a massive difference, but if you take this idea of ‘Portfolio Creep’ it really can make a huge difference over time. Just in the 1 year time frame by not adjusting the Bond exposure when a crash did occur the impact to the portfolio was greater- likewise when the US Small Cap fund rebounded from its earlier loss there was less money in there to grow so the difference to that Fund alone was quite large – the portfolio that had been ignored was less able to react to the market as its value at 6 months was reduced to $1190, meaning the gain of 25% only brought it up to $1487 whereas when we undertake Portfolio Rebalancing so that we can take advantage of the US Small Cap market the fund grew to $1786 – a huge difference.

You might want to look at this like those extra couple of pounds that add onto your waistline, it doesn’t seem like much, until you have a hot date and can’t squeeze into your jeans anymore… keeping an eye on your portfolio to make sure it stays in shape is a critical part of your Investment Strategy.

Is the “Total US Market” invested into a Total US Market index fund, or is it just a label for a variety of stocks you purchase? What about the “Total International Markets”? I am very new to this, so I apologize if my question doesn’t make sense.

Hey Jordan,

Good question, makes a lot of sense. These names are labels, but at same time they are indicative of the purpose of the fund. The Total US Market does try to emulate the US Stock Market – the Total International Market name tends to be used for all stocks globally, excluding the US.