People often ask me if investing in gold is a good idea. Having progressed through some of the finest financial planning education in the US, I like to give the answer ‘it depends’. I personally hold a position in gold, and this post will explore the logic behind it, some perils and pitfalls, and the savvy way to do it should you decide it is for you.

The first consideration you need to make is that gold is considered a commodity. This class of asset is loosely defined as ‘a raw material or primary agricultural product that can be bought or sold’. Some other forms of commodity would include other precious metals; Silver, Platinum, Palladium; Industrial Metals such as Copper, Aluminum, Tin; Energy, Oil Gas; Agricultural; Corn, Sugar, Soybean Oil. These are just a few examples of the asset class.

Understanding the Gold Spot Price

The ‘spot price’ of gold is the explicit current market price at which gold is trading. Very much like Foreign Exchange rates you won’t actually be able to buy at this rate as a consumer, but it is part of the equation that flows into the final purchase. You will have the spot price+premium to create your final price.

Physical Gold or Gold Funds?

When investing in gold you can select to invest in physical gold, in the form of coins or bullion or you can elect to invest in funds that own such gold. Further afield there are investment options in the industry, such as gold mining firms, but that is a separate conversation.

Considerations of Physical Gold Ownership

Many people like to hold real, physical gold rather than the promise of such gold in the form of a fund. This is a valid way to hold gold but comes with some very serious considerations:

Acquisition Premium

The cost to acquire over the current spot price. From my research it seems that despite Gold being measured by weight, each of the forms of Gold has it’s own price to spot and associated premium. This is a reflection of the liquidity and market interest for the medium.

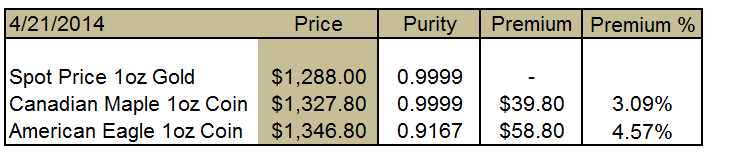

You can see just from this simple example that the American Eagle 1oz coin retails on Kitco.com for more than the Canadian Maple:

Let’s look at that compared to Spot:

As you can see, the Canadian coin has more purity, but due to supply and demand is cheaper. This is an important consideration when looking at holding physical gold.

Risk of loss

If you own physical Gold you need to secure it. If you were just to tuck it all away into a secured safety deposit box at a bank and there was a theft you wouldn’t necessarily have proof of ownership. It is likely that you would need to find a dedicated storage vault for the gold, and that would come with an annual maintenance fee. Further to which, recently there was a scandal that uncovered many gold bullion bars were actually filled with Tungsten, so your gold was stolen even before you stored it…

In summary, holding physical gold comes with acquisition spread costs, maintenance costs and risks, but no investment is truly without risk.

Consideration of Gold Funds

People who wish to avoid some of the hassle that comes with holding physical gold have gravitated towards Gold Funds. There are many of these now, and I will highlight three of the most interesting:

- SPDR GLD- It is an ETF with an expense ratio of 0.4%. 1 Share of GLD is roughly equivalent to 1/10th of an ounce of real gold.

- PHYS- This is a not an ETF, though it does trade with a similar level of liquidity. It was issued with a load fee, and has certain other redemption considerations to be mindful of.

- GTU – This is a gold trust fund, like PHYS but has a lower management fee.

On a high level, the difference is that PHYS and GTU took an allocation of actual Gold in a vault and issued shares on it. They have a finite amount that correlates to the initial share price, as the price of real gold increases, so does the price of the fund. GLD has a similar underlying physical gold store, but if more people wish to purchase the GLD fund the ETF will acquire more gold in order to create a parity with the price of gold.

I hold a position GLD and will use that for reference in this article.

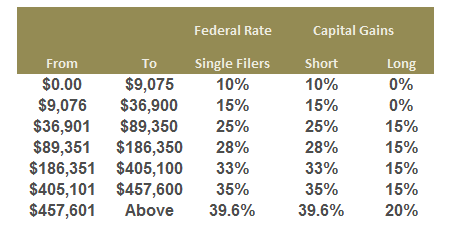

28% Long Term Capital Gain Tax Treatment

Despite the commodities you see above being placed into an overall set or class, the IRS in its wisdom has deigned to delineate commodities into ‘collectibles and non collectibles’. This is very important to understand when it comes to investing in gold (along with some other precious metals) as a Collectible, because the manner in which you decide to invest in gold will impact your tax treatment. Collectible capital gains rates are set at 28% for long term, rather that the tiered schedule that you see below:

The IRS lumps gold in with the other collectible’s such as artwork, wine, antiques and more ( here on the IRS Website)

It is critically important to realize that this also applies to ETF’s and funds such as the popular GLD fund.

Insulate the investment from Capital Gains Tax

By storing your positions in GLD within a tax sheltered account, such as an IRA you are able to remove the capital gains tax from the equation. I would suggest if you are planning to invest in gold you do so within the GLD ETF within such an account.

Warning- you cannot buy physical gold or other collectibles with a regular IRA (Roth or Traditional), you need to create a special ‘self directed’ version of the IRA in order to hold physical assets. Buying physical gold by writing a check from your regular IRA will be considered a distribution and incur penalties. ETFs and other funds are allowed.

Why Buy Gold?

Gold does not kick off an dividend, so the only growth you will see from it will be from capital appreciation. Therefore buying and holding gold can actually be a harmful strategy against inflation, should the price remain static. However, most people consider gold to be an hedge against inflation so they do acquire it prior to or during periods of inflation making it rise up in value and thus fulfilling its destiny as a hedge.

Gold, other than its decorative purpose has some industrial demand, and is useful in electronic manufacturing. As such we could assume increased demand for gold when moving through a positive economic cycle. However, it also has considerable value within a negative or declining economic cycle as people flock to gold as a safety net.

How I play Gold

I personally consider gold to be a defensive purchase by many, and as such I like to acquire it towards stock market historical highs, (when it is cheaper) so that when things do cycle downwards again I see increased interest in my asset, and subsequently unload it. As such, I take a speculative approach to gold. I do not want the hassle of holding physical gold and therefore keep a position of the ETF GLD within my IRA. I currently have no more than 5% of my investible assets in gold, a number that will reduce sharply when I liquidate some personal use assets.

Holding physical gold can be a good strategy too, but it needs to be at volumes which make the storage costs minimal, and you have to remember the premium over spot for acquisition, and the risk that come with it. Broadly speaking, I wouldn’t recommend ownership of physical gold in quantities less that $50,000 as part of a portfolio of least $1,000,000 in investment assets.

I kind of agree with Warren Buffett…

“Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce — gold’s price as I write this — its value would be $9.6 trillion. Call this cube pile A.

“Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

“A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops — and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.”

Could you please stop making sense about how it isn’t a great investment as I am trying to load up on it now to sell onto the masses in the next market panic!

And like him or love him, that is why the guy is a genius

Mate! That is the nicest thing anyone has said to me… Ever!

5%? I wouldn’t put 5 cents into gold. Go put up a longer term chart and see how gold has been a terrible investment that rarely offers a hedge against inflation. The big rise over the last decade was at a time of very low inflation. So why did it go up? Was it because Goldman et al realized gold market was relatively tiny and susceptible to manipulation? Nah. That couldn’t be why. Yet even the Gold Bugs realize the market is rigged – but they think there’s a conspiracy to depress the price of gold (and silver) due to the nefarious Black Hat World Domination Secret Cabal at the UN (insert picture of tin foil hat nutcase holding an AK47 in a room full of automatic “hunting” rifles and his bars of gold…). Me, I’m betting on those Ivy League-educated scions of finance doing what they do best – skim billions from unsuspecting rubes.

Fair points Paul.

Personally, I like to play soccer. I don’t like to play with my investment portfolio although I hear it can be great fun, especially when you buy low AND sell high 🙂

Hey you told me the market was going to crash at 3pm today so I thought it would be a good time to get into some Gold and sell into the hysteria!

“The first consideration you need to make is that gold is considered a commodity”. Says who? The people who buy the vast majority of gold (Chinese, Indians and others in the East) don’t think it’s a commodity. They think it’s money and a store of value.

Randall,

Says me.

As I understand the definition of money, it relates to the currency of a nation, its coin and currency. The people you cite here all have money that is not made of gold.

Great advice. Especially using your IRA to hedge your taxable portfolio if you are feeling nervous about the markets going down. Zero sum game…

Well, I can’t say your definition is wrong, but those people have a different definition of money than you do and that was my point. To them, money, among other things, needs to a)have an intrinsic value and b)be a store of value, it’s part of their culture. As such, that automatically takes Rupees and Renminbi out of the equation as money-good because paper itself has no value and their paper currencies have gone bust in the past or have been/are inflated away. So, sorry, but you don’t get to define what’s money for the whole world.

In that case, what is the intrinsic value of that Canadian Maple?

You’re asking the question wrong…it’s not what is the intrinsic value of 1oz of gold, the right question is does 1oz of gold have an intrinsic value? That’s like asking what’s the intrinsic value of oxygen, it can’t be answered. What is the proper price for gold, is a different question entirely, and maybe that’s what you’re getting at. The piece of paper in your pocket with an old dude’s picture and a bunch of numbers has next to no intrinsic value. It’s just a piece of paper, that can be reproduced an infinite amount of times. Gold, unlike a sliver of paper, has properties that give it intrinsic value in two ways…1)obviously, as industrial metal for filings, electronic parts etc.; 2)it’s the perfect form of money (along with silver). It’s durable, divisible, consistent, convenient and (very) limited. There’s a reason gold was chosen as money for thousands of years across a variety of cultures that had never integrated, it’s because of those exact properties. Paper currency has some of those properties but most importantly it’s supply is unlimited, so over and over paper currencies get inflated away and many people don’t trust them. That’s why Indians and Chinese put a good chunk of their savings in gold and don’t trust their government currency.

Nope, I knew what I was asking. You posited that people think for money have an intrinsic value in order to be considered money, and that gold fit that description, so I want you to tell me what the intrinsic value is.

Now, I would caution you about discarding the importance of trees. Let’s step back a thousand years or so, just before the founding fathers set foot in this beautiful land, to when God was here.

God created trees (raw material) which man then turned into timber (commodity) and then into paper (product) and then the government assigned a value to it, money.

God also created Gold Ore (raw material) which man then turned into gold (commodity) and then turned into coins, bars etc (product) and then the market assigned a value to it, not money.

Gold isn’t money because the value of the end product is not controlled by a single, centralized bank, but that doesn’t make it more important than paper.

Let’s take your two points for intrinsic value: gold can be used as an industrial metal. This is something I did highlight in my post and I can recognize. Let’s remember the game Paper, Rock, Scissors for a moment, you’d think that Paper would always lose right? It’s not hard like a rock, or sharp like scissors – yet paper wraps rock and it wins.

There are many times when paper is more powerful than gold. On an elemental level if you were staying on a deserted island and you were asked if you wanted 10oz of gold or say $10000 in dollar bills and a match – what would you pick? You could burn it for warmth or insulate yourself by stuffing it down your pants, vs, just being able to look at something shiny.

Your second point, it is not the perfect form of money, the price can inflate or deflate on demand alone. If you had put all of your wealth into gold a year ago you would have lost 20% of your wealth – can you tell me how inflation compares to that from a stability perspective?

This will be my last response, you seem to want to parse words and win a debate no one cares about rather than learn something about how the cultures that buy most of the gold…think about their gold and add that to your tool box. Says a lot about you. Whether you agree with them, me or not, isn’t the point. I like how you mixed in the paper-rock-scissors game and the meaningless deserted island scenario, that was cute. But hey, you “progressed through some of the finest financial planning education in the US”, so that means you know everything.

Since 1913 the US Dollar has lost about 98% of its value. Gold has gone up several multiples, so yes, I’d say it’s quite clear that gold holds it’s value much better than paper money over the long-term. But you go ahead and spin that fact with one of your silly, made up scenarios that has nothing to do with this. I’ll give you this much, you’re great at that. Short term anything can move around for any number of reasons. Why don’t you review some charts of inflation, debt, manufacturing jobs, etc before/after 1971. I’m sure to you that’s just a coincidence that all those things suddenly got so much worse at the same time the dollar was no longer backed by gold.

Let me know when you figured out the intrinsic value of oxygen, that will be the same time I figure out the intrinsic value of gold. This was like trying to explain basic algebra to my dog.

I didn’t know you had a dog! Mine prefers belly scratching to algebra. I am just trying to help you see that the value is relative. And yeah I do like to argue. You are the one that came here and decided to tell me that Gold wasn’t a commodity, but was actually money, then ripped into my definitions… I think you should consider if you are right about that.

Now – you cite India and China, but I think you do so with broad strokes that do not explain what is really happening. Lets take China:

How much physical gold is bought by the people VS the state? You say that it is because the people are fearful of inflation by the state… but is it really the people that are buying?

What about jewelry? If you look at the breakdown of what is being bought, over 50% is in jewelry, which is even further removed from currency as the price is overly inflated with the actual gold value being a tiny proportion of the ticket price. This is not an inflation hedge, this is just an effect of mass affluence. If you want to see currency inflation (and lifestyle) decisions don’t look to gold from the Chinese, look to NY Real Estate.

Same applies to India, 50% of the purchases are for wedding gifts and sure there is a connection to gold having value, but it is simply more appropriate than giving US dollars based on culture and tradition. And again, if it is in the form of a necklace the residual value is marginal, I would feel very confident in saying that dollars are worth more than jewelry.

I know you aren’t stupid, but gold is a commodity, and greenbacks are money.