Many people seem torn whether to contribute to a Roth or a Traditional IRA, this post explores some of the characteristics of both, and how even with the potential for future tax increases, deferring can still be a smarter move.

There are two broad categories of retirement account in the US that you need to know about. The ones where you pay taxes today, but the money gets to grow tax free (ROTH plans) and withdraw without tax consequence in retirement; and ones that are Tax deferred, in that you get a tax deduction today, but pay money on the back end when you withdraw, such as a 401(k) or Traditional IRA.

Tax Deferred growth: You avoid taxes today, you build up a sizeable portfolio over time, and when you withdraw it counts as Income for tax purposes. Minimum age to withdraw without penalty is 59 1/2 (early withdrawal is permissible in certain circumstances)

Tax Free growth: No tax benefit today, you put in ‘after tax dollars’ but that next egg grows without tax consequence. Furthermore, you don’t need to take a ‘required distribution, so it can be considered an Estate Tax vehicle.

The problem that many people struggle with is which account should they pay into, this post will help with the decision. Let’s start with the simple stuff:

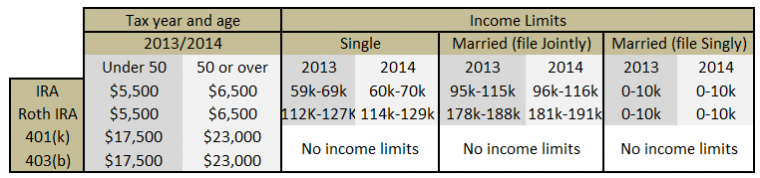

Luckily, there are no income caps on 401(k) contributions, if you are earning over the IRA limits then clearly you have a good income, and you should load up on the 401(k) to the full amount.

Pro Tip: Should you fit within the income limits, you can contribute the full amount to the 401(k) and also fund an IRA in the same year.

Many employers offer a ‘401(k)’ match where if you agree to put in a certain amount of your salary to the 401(k) they will also kick in money, opting in to an employer matched 401(k) is the same as accepting a pay raise. However, even if they don’t offer a match, the ability to put away larger sums of money each year towards retirement while reducing taxes is by itself worth doing.

What if I defer into a higher tax bracket?

I just heard this on my post “How to know when you are being screwed over by your Investment fees, and how to fix that” and it is a valid concern. Let’s dig into it now.

There could be an argument for future tax rate raises when we consider national debt, since we are at an all time high of $17.6 Trillion arguments for austerity and increased revenues. However, history has shown that many times where deficits have reduced have not been correlated so much with taxation, indeed, it is more common to see the elimination of expenses to be the key driving factors. This can be seen if you watch the debt levels after protracted wars have ended.

It’s too hard to make a firm decision too far in the future

In a world of absolutes, time increases opportunities for bad things to occur. Just like the classic calculation that many learned in High School: Speed = Distance over Time. If you have an equation where time is very short, it is very hard to cover distance without a disproportionately high speed. However, if you have all of the time in the world, great distances can be traversed with ease.

This same simple equation can be transposed into financial decision making, where we can exchange the variables as follows:

Uncertainty = Amount of Change over Time. If we look forward just 1 year from now the risk on tax rate changes is low, because the time vairable is low, for the risk to be high change must be disproportionately high, and because the probability of this change occurring we feel safe. For example, for the top rate of tax to return to 90% next year would require an increase of 50 basis points, or more than double the current rate – probability of this happening are very low indeed. But for the rate to increase by 1-2 basis points per year over 30 years, it could easily reach a 90% bracket.

Three Key Factors that change the equation

There are three key factors that will help you make the decision on what you can do today, the first is understanding a financial term called future value. If you can understand and calculate future value, you can make an informed decision. The second key factor is that you can adjust the time and amount that you opt to withdraw from any of these accounts, it is the withdrawal or ‘distribution’ that is a taxable event, so you can pick to make that event happen when you think it is best. Lastly, one of the most powerful factors is that you can defer now over a 35 (or more) year time horizon, and actually shift the deferral time horizon by shortening it at any time.

Future Value

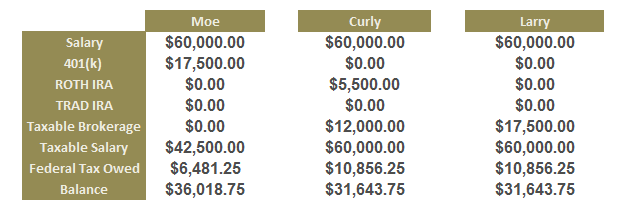

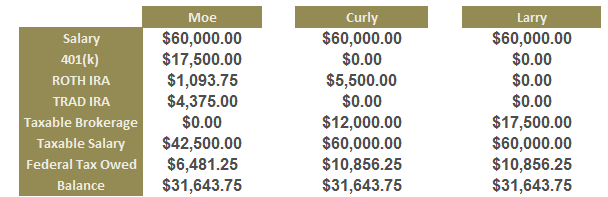

Let’s look at three Brothers, Moe, Curly and Larry. They are all 25 years old and all earn work for Stooges Inc as handymen, earning $60,000 in Salary. Moe wants to max out his 401(k) Curly doesn’t want to put anything into the 401(k) but wants to put $5,500 into a ROTH, and a further $12,000 into a Taxable Brokerage and Larry wants to just put $17,500 into a Taxable brokerage account.

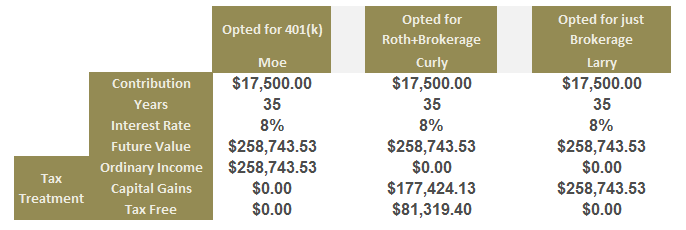

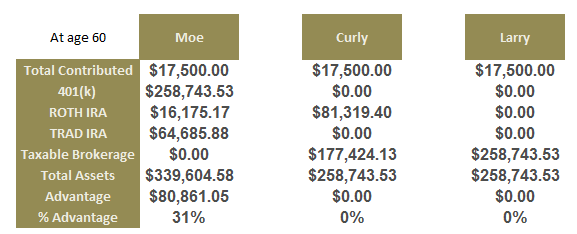

All 3 got into the market, and for the sake of this example they could all be in the same Mutual Fund. After 35 years the three decide to retire, lets assume that the stocks have all appreciated at 8% average over time, the future value of their $17,500 would be $258,743 due to the power of compounding (that’s just from 1 year of contributions!) however, due to the different approaches to the investment that they all picked when they were 25 their future tax liability would look like this:

We have established the power of compounding, and can see that by opting for different asset locations we have different tax treatment on the way out. Moe would be taxed as ‘Ordinary Income’ like salary, and both Curly and Larry would have Capital Gains to worry about.

Controlling time and amounts of Withdrawals and Distributions

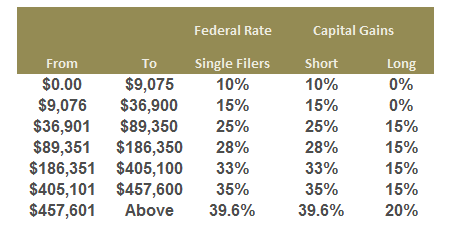

A common mistake here is to look at the total amount and calculate tax on that, we must remember that withdrawals can be deferred over time, indeed the purpose of the 401(k) or other retirement account is to provide a stream of income over retirement, so that $258,743 that Moe has as ‘ordinary income’ could be withdrawn slowly, keeping him in lower tax brackets. The same strategy could be deployed by Curly and Larry, and they could wait until a year where they were in lower brackets to sell their taxable brokerage holdings.

IRS Required Minimum Distributions mandate that after 70 1/2 yrs old you must start drawing down on you tax deferred accounts, which does put pressure on timing the withdrawals into lower income years more difficult, but again you are still only drawing out small amounts, the table for RMDs is here <IRA Required Minimum Distribution Worksheet>

Changing the deferral time horizon

Earlier we discussed how the long, 35 year time horizon makes it challenging to calculate the risk of selecting to defer taxes today. However, due to IRS regulations we can circumvent this 35 year horizon, thus nullifying its impact. The ability to roll over from a tax deferred account, whether it is a work sponsored 401(k) or a Traditional IRA to a Roth IRA at any time, for any amount allows us to control the financial decision making process. I spoke recently about how I did just this, here are two posts on the subject:

- Converting to a Roth IRA – using Partial Transfers to reduce Tax Costs (theory of the process)

- Last Day of 2013 to Convert to a ROTH IRA (a post on the 4 steps required to do this in Fidelity)

So what that means is that if Moe, Curly or Larry had decided to load up Tax Deferred 401(k) plans when earning $60,000 they could keep monitoring future income, and should they have a year where they decide to take a sabbatical, or get laid off, they can use this year to partially rollover. When I did this myself in 2013 I deferred my taxes by just 2 years instead of 35 and in doing so pushed $15,000 out of several tax brackets, netting the balance in a refund.

The ability to rollover at any time, and for any amount means you can feel more confident about putting deferral money in now, and can capture the same benefits throughout the 35 years as if you had not. If for example the Government just drops your tax rate one year, you can partially convert in and it means you saved money.

The most powerful factor of all – Present ownership of tax revenue

When we look at the three stooges here, the biggest difference wasn’t that Moe, Curly and Larry had different tax treatment on the back end, it certainly does matter on some level, but since we still don’t really know what will happen to capital gains and ordinary income I think we should withhold any judgement between which of the two is better. I think we can agree that tax free sounds good though.

However, what Moe did with his $17,500 tax deferral was gain present ownership of the taxable portion of his income, both Curly and Larry didn’t do this, so while Moe’s ordinary rate in the future is subject to change, he has a hell of a buffer in case it does.

Moe managed to keep $4,375 more of his $60,000 salary today, let’s project that forward to look at its future value, assuming the same time and interest rate variables, remember, if you max out your 401(k) you can still contribute to a IRA providing you meet the salary limits:

So as you can see, Moe’s initial $17.5K contribution being directed into a Tax Deferred 401(k) account means he could put in an addition $4,375 into any of the other options that Curly and Larry used, for free. Additionally, if he had decided that he wanted to contribute to the Traditional IRA, he would have got more tax back from the government again, receiving a further $1093.75 in Tax refunds for this year. To keep things simple, lets throw that into a Roth IRA (you can have a Traditional IRA and a Roth IRA and a 401(k) all in the same year, as long as the total between both IRA is no more than the annual cap for either one, IE $5,500 in 2014.

Balance sheets

The argument over uncertainty of future rates remains, but while your brothers Curly and Larry are fussing on what future tax rates might be, you have captured a 31% advantage over them in terms of wealth. In doing so you retained the right to roll over portions of the tax deferred income to any window of opportunity that may have arose on the way to retirement. At some point, most of that 31% (barring the $16,000 in the Roth) will be subject to taxation, but in the interim you have just borrowed that money from the Government for free, for 35 years and have got to inflate the value of it by the power of compound interest, so it is a much better deal.

A major impact for all retirement consideration are the fees you pay, I recommend trying out the Guide Wealth Management Portfolio Analyzer, it is free and will show you how to optimize your account and the savings you can capture. Personal Capital is an affiliate partner of Saverocity.com, we may receive compensation from them.

Just emailed a link to this post to my kids, since it makes me think they should each be doing a 401K as well as a Roth. Thanks, very illuminating!

Absolutely, and this is only looking at the worst of the 401(k) plans. If they have access to company matching (quite possible that they do) then it becomes even more advantageous.

ugh, embarrassed about asking a pretty basic question (or two), but… what if you fall in the middle of that range of income limits for contributing to an IRA. Does the amount you can contribute phase out, or does it go from $5500 to zero?

Also, if I contributed to a traditional IRA today, could I deduct it on my 2014 taxes?

If you are in the middle it is indeed a phase out, I don’t have the table to hand but will get it for you. Today we are worried about 2013, you can only deduct 2013 against 2013, but you have another year to get the 2014 contribution in.

Jamie,

I couldn’t find a good phase out calculator for you, the best thing would be to check with your plan provider or CPA, however, here is how you figure it out, from Investopedia:

Jack and Jill are married and file a joint tax return for 2013. Jack is an active participant, but Jill is not. Their modified adjusted gross income is $100,000, which falls into the $95,000-$115,000 phase-out range for Jack, so the highest and lowest dollar limit for this range is $115,000. Jack is under age 50 and is therefore able to contribute $5,500 to a Traditional IRA. Using the formula above, Jack calculates his maximum deductible amount:

= ($115,000-$100,000) x [$5,500 / ($115,000 – $95,000)]

= $15,000 x ($5,500 / $20,000)

= $15,000 x 0.275

Answer =$4,125 ( rounded up to $4,130)

Note: Calculations are rounded up to the nearest $10. For instance, a calculation that results in $555 would be rounded up to $560.

Nice analysis. Certainly points to why tax-deferred growth beats taxable growth. But I think I’ve missed something. You’ve compared Moe who initially invests 100% of his money into a tax deferred (retirement) account, Larry who invests 0% of his money in a tax deferred account, and Curly who invests 31% into tax deferred account. It seems like you’re comparing the situation of tax deferred growth vs taxable growth.

When I read the title I thought you’d be discussing the possible present and potential future tax implications of one’s retirement accounts, which are typically either tax deferred and/or Roth – not a brokerage account.

Was the angle here more along the lines of why tax-deferred growth outweighs taxable growth?

I see what you mean. I actually wrote it in response to a reader expressing uncertainty about a 401(k) contribution in relation to future tax rate changes. Admittedly I could have used a Roth 401(k) in my numbers to show a different angle, and I may in the future, for today though I was attempting more to show the power of the 401(k) in this article. Titling of it may not be most accurate.