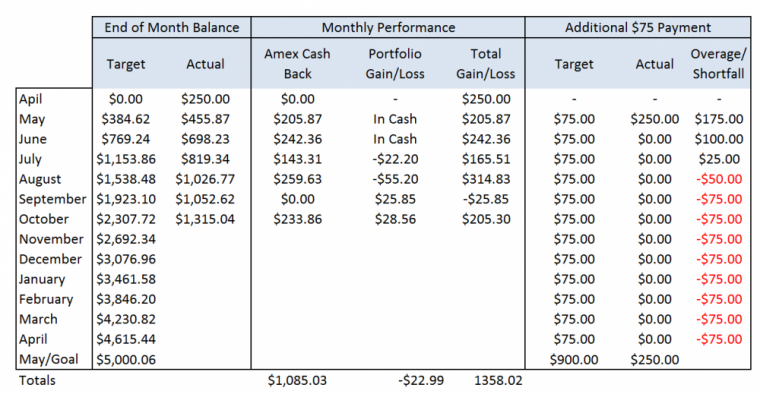

Earlier this year I decided to challenge myself to create a Brokerage Account with a value of $5,000 within 12 months, using a combination of two things: Cash Back from Credit Card spending, and an additional deposit of $75 per month that I released from my budget by dropping Cable TV.

This is the third post in the series, and it’s time to check in with the performance to see where things stand, and unfortunately in this case… what went wrong, followed by some ideas to rectify things.

My current balance on the Brokerage Account is $1,399, and I set it up in May of 2013. My goal balance, for the end of November is $2,692.34, so I face a shortfall of $1293.34, and I’m only slightly over half way to where I should be if things were on target.

What went wrong

Unrealistic Stock Market Expectations

Firstly, my target was too high, and I had unrealistic expectations when it comes to working out the numbers. In my initial calculations I had claimed that I would be able to spend $14,000 per month on the Fidelity card using Manufactured Spending techniques, and would then add another $75 per month from the household saving on Cable. My monthly contribution should therefore have been $355.

In order to achieve my target of $5,000 whilst contributing $355 at the end of each month (when the Cash back hit my account) I would require an effective annual return of 34.39% per year. Now, since we are still in a period of recovery and growth such returns have been seen, it is a ludicrously high number to expect from the market in order to achieve goal.

When I set up the goal I didn’t calculate this number, I just though, I can put this much away, and the market will make it happen. I also didn’t really care if I made that $5,000 or not, it was more of a ‘lets run with this’ mindset, since if I ended up with just $3,000 at the end of 12 months i’d be happy, since its free money. This is sloppy thinking and it defeats a lot of the value from the challenge.

Lack of Diversification

I went into this with the idea that I would add on an ETF each time I got to about $700 in cash, so every few months. The ETFs themselves were free to trade by selecting from the 65 funds available from Fidelity with no transaction cost (they do build in a management fee into the ETF which increases its expense ratio to balance this out… nothing is free!) with this in mind, I was in Cash until July, and then I opened a position in a REIT (Real Estate Investment Trust) fund.

Whilst the fund itself offers great diversification within the sector, it’s still a sector, and as such broader economic change can impact considerably. The biggest economic threat to a REIT is a change, or a perceived change in Interest Rates. This is because they are in the Real Estate business and they are leveraged using Mortgages and other real estate lending which becomes more costly as interest rates rise. Whilst the rates themselves haven’t risen a lot, there is considerable speculative trading on the likelihood that they soon will.

My fund is down 8.8% YTD, but has come back well in the past few months from an even weaker position.

This month I am up to the point where I can open my second ETF position, which helps mitigate the diversification issue, and I just purchased 9 shares of the ETF DVY which focuses on Dividend paying large companies.

Lack of Time

The type of investment you select requires alignment with Time Frame. Any investment that has a high level of volatility or standard deviation requires time to balance it and provide the ‘average rate of return’. When people talk about the stock market they frequently state that the historical average is around 10%, which is accurate and could be used for planning purposes (though I like to take it down to 6-8% to be conservative) however one year the market can be up 50% the next down 30%. In many ways, aiming for a $5,000 goal in a year and leaning on the stock market to make it happen is a dreadfully bad decision, and one that many people make.

For any investment shorter than 5-7 years we should only consider a fixed income strategy, such as guaranteed returns from CDs or Bonds (that mature before the end of the investment period) relying as I did on the stock market is ridiculous, since as we can see a move of 8.8% downwards, rather than the 20% gain I really needed has hammered my performance.

Sloppy Investing Habits

I committed to investing $75 per month on top of my Cash Back. But in reality I opened up the brokerage account with $250, then I forgot to add the monthly $75, this means the money wasn’t working for me and I would have been able to buy fund number 2 DVY that much faster. This is the primary difference between a 401(k) performance vs a regular brokerage account, since deductions are removed from your paycheck automatically they never fail to build the value of the account.

Impact of Lack of Income

In September I made zero cash back. My manufactured spending tactic vanished and I also was focused on spending on other cards, this meant I contributed no cash back to the plan, which is a great way to see the impact of losing your job, or other such events on your savings. If you are planning long term you need to realize that there could be times when you simply cannot pay into a savings plan due to other life events. This should be built into your planning.

Behavioral Aspects of failure create further risks

Discovering that your savings plan is not on track creates a lot of negative thoughts, worries and concerns. Luckily in this playful example all I am worried about is looking stupid and my own pride, but if this was your retirement plan it would be a serious concern indeed.

In order to resolve the problem we have the following options:

Increase Contributions

If you consider the current balance of $1,399 and the 5 month time frame to reach $5000 I could add a lump sum payment now, which would benefit from the time value of money and bring my portfolio back on track. However, as we already discussed in ‘unrealistic expectations’ above just bringing $1,399 to the expected November amount of $2,692 by adding on a lump sum payment of $1,293 would bring us up to target only until this month, when we would start slipping backwards again since our monthly contribution of $355 is too low to achieve goal. Furthermore not in any month thus far have we managed to achieve the payment of $355.

Increase Risk

Typically this is something that people turn towards, but it is probably the most destructive force on any portfolio. And people fail to realize it. By increasing Risk I can gain access to higher level of upside (this must be the purpose to increase risk in a portfolio). However, the problem lies in that I have a flawed plan. I was invested in a REIT ETF, which should provide an annual return of around 10%. To increase risk I could decide to select a single REIT company, rather than a basket, and bet the farm on them performing. However, by reducing diversification I increase downside risk considerably, and upside is simply beyond our grasp.

In fact, in order to realistically project a Rate of Return of 34.39% that I really needed then I am going to need to leverage with super high risk derivatives such as option trades. The real problem with this is that my plan and forecast needs to reduce reward expectations, so increasing risk exposure to achieve this is dichotomous.

Increase Time

This is the easiest and safest way to rectify the situation, by allowing the account more time in the market it will be able to achieve its value goal, however, again think about your feeling towards this if you were 64 years old and planned on retirement starting next year, by failing to calculate a realistic rate of return and by being sloppy with my investment habits I have messed up a game here, but if I was 64 I would have messed up my retirement goals, and I wouldn’t know until it was too late.

Getting things back on track

This is the time to look hard at your projections, and accept that things are screwed up. You cannot keep on going back to Mr Market and asking him for 50% or more returns in order to make up for your lack of planning, you need to make the numbers conservative, set the goal again, and decide on a strategy to make it happen. Here’s my plan:

- Setting Rate of Return 7% from the Market

- Establishing a monthly ACH from checking to Brokerage in the amount of $75

- Ensuring I use my Fidelity Amex exclusively until I reach a monthly spend of $14,000

- Making a catchup payment from the $75 monthly addition that I have missed for the sum of $300

- Changing the date of goal to 8.5 months from now, with a new date of August 2014 rather than May 2014 for $5,000

Capital Loss Harvest Opportunity

Additionally, as it is December, and my portfolio has decreased by 8.8% I am going to sell my REIT ETF and capture the Capital Loss, this is a strategy called Capital Loss Harvesting, and is very valuable since I can use it to offset other capital gains to the extent of the gain, and then up to $3,000 per year against my regular income, which reduces my income tax.

By selling at the loss of $66.36 I should be able to add around $28 to my income for the year in tax reduction, which I will kick into the Challenge Account as a little booster.

There is a rule called the Wash Sale rule that states I cannot enter into the same, or substantially similar asset within a 61 day window (back and forth) therefore today as I re-evaluate my account I sell IYR, buy DVY and will buy a second ETF FENY in a couple of days once the funds from IYR are cleared.

When you are looking at selling to gather Capital Losses, or to rebalance your accounts it is vital to have a clear snapshot of your investments. I use Personal Capital for this, it is link Mint.com but targets your Brokerage Accounts to show you an overall position, a very handy tool. They are an affiliate partner of mine and I highly recommend trying them out, you can sign up for a free account here.

When you are looking at selling to gather Capital Losses, or to rebalance your accounts it is vital to have a clear snapshot of your investments. I use Personal Capital for this, it is link Mint.com but targets your Brokerage Accounts to show you an overall position, a very handy tool. They are an affiliate partner of mine and I highly recommend trying them out, you can sign up for a free account here.

You really should look at capturing as many losses as you can each year, even though there is a cap of $3,000 that you can apply against regular income tax, that carry’s forward. I currently have a large amount of Cap Loss Carry-forward and will always seek to add to it.

Conclusion

I am still happily in the <1% of people in America who have such an investment as a brokerage account made for free from manufactured spending, but the purpose of this exercise has always been twofold, to not only take the principles of manufactured spending learned through other avenues, but also explore wealth accumulation and retention strategies, it’s been a fun experiment thus far, and has yielded some very valuable lessons.

Here’s hoping my more realistic view of my investment plan will get me to my goal of $5,000 by August 2014!

Want to get started with your own account? – read my intro’s

The $5,000 Brokerage Account Challenge

The $5,000 Brokerage Account Challenge Part 2 – Asset Allocation

I love this idea–and the thought that you’re pushing such discipline with CB is impressive (and important). Too often we think of CB as “free” money, “Oh I can go out to dinner a few times a month more, I get all this cash back.” That’s danger zone thinking.

This is just another way that the FIA card pushes good financial habits. Important; especially for you young’uns), to start those investment accounts early. Imagine a low earner, young, just starting out, who opens a Roth IRA, pushes their first $2k per year of CB into it… and then has Uncle Sam credit them back via the Saver’s Tax Credit to the tune of 50%! That first $2k is not only tax free but turns into $3k via the Saver’s Tax Credit (Income limits apply, consult your tax professional). That’s like a 3% FIA card courtesy of the US Gov’t. Oh to go back in time 10 years and do it all over…

Thanks Sam. I’m cheap – I see every penny that comes in as money, and everyone that goes out is money too. Free or not otherwise.

I agree about the savings aspect, I recently talked about a way to generate $100 in cashback every month via this card and described it as something that could put your kids through college (as part of a bigger strategy) and I like that Savers tax credit too, I was trying to get it for myself this year by crafting an elaborate system but its based on a special MAGI so I am not sure if I can make it happen, I am digging more into the rules now.

Matt: Not Cheap–Frugal. 😉 Earning money is hard work–spending it should be as well.

Saver’s credit goes from 50% to 20% then 10%, I wish it was a little smoother stepping from 50 to 10 percent. I too don’t get to claim the credit, but it is important for those who do to take advantage of it while they can.

I’m just hoping some 22 year who makes under $35,500 (or can get under that with a Traditional IRA contribution) is reading this right now, gets with the program and puts together a Roth or Traditional IRA. Putting $2k, and getting the matching $1k as Saver’s Credit, net $3k per year. Do this for 10 years (paid for with CC cashback). Stopping at age 32, and letting the money grow at 7% annually, by 65 years of age it will be $261,458.12 (tax free with the Roth too).

Yeah Frugal – that’s the one!

Yes, a person earning a lower salary like this could benefit amazingly. I think (and am checking) that if you drop your AGI via deductions it may not qualify under the MAGI rules for the savers credit. I have something set up where we are dropping our salaries down rather dramatically using a bunch of tools, such as holding corporations, SEP IRAs, 401ks etc, but if they don’t allow these deductions when figuring the MAGI here it wouldn’t help in my case, though I may be wrong and plan to sit down this week or next to work this out for certain.

If there are young 22 year olds reading this ignore this comment, as it’s for something a little down the line when you are working on advanced tax planning 🙂

Get your free money matched by Uncle Sam, and you will be ahead of 99% of your peers and well on your way to a comfortable retirement!

I know that IRA Contributions count, which is why I used that in my above example.

Source:http://www.irs.gov/Retirement-Plans/Plan-Participant,-Employee/Retirement-Topics-Retirement-Savings-Contributions-Credit-(Saver%E2%80%99s-Credit)

“Example: Jill, who works at a retail store, is married and earned $30,000 in 2013. Jill’s husband was unemployed in 2013 and didn’t have any earnings. Jill contributed $1,000 to her IRA in 2013. After deducting her IRA contribution, the adjusted gross income shown on her joint return is $29,000. Jill may claim a 50% credit, $500, for her $1,000 IRA contribution.”

I can’t help with your more complicated advanced techniques. 😉 But I did sign up for your newsletter.

The thing with that example that bothers me is that Jill earned 30K in that example, if she had earned 37K and then she could claim 50% because the 1K took her to 36K I would be happier… that’s why I want to dig a bit more.

Another thing I am playing with this year is dropping salary right down by 401(K) and other things, then Roth Converting back up to Tax tier levels – but if I can get away with a Savers credit I wonder if the conversion offers as much value as 2x savers credits, it probably would be better to convert higher amounts and ignore this credit, but I like credits more than deductions for obvious reasons and thought it would be neato to get me a couple of grand extra by doing this 🙂

Welcome to the newsletter – it is where all the cool kids are!

Yeah, I love the Fidelity AMEX too. I honestly never thought it would last this long in terms of a reward program. the Schwab VISA came and went so quickly. As of this month I have ~$2,350 sitting in Schwab ETF’s that came about largely as a result of the manufactured spending I did in the now-defunct US Mint $1 Coin Direct Ship program. The Fidelity AMEX is my catch-all card so I don’t pay as much/enough attention to the rewards dollars building up at Fidelity. I think it’s all in an interest-bearing savings account. I should probably move that over, but it feels so nominal. Perhaps if I had an easy manufactured spending approach I could make it worth my time. Care to share yours? Bluebird?

Yep it’s a great card. I am embarrassed to say I missed out on the Mint, I was living overseas back then… and it’s one I would have love to have working for me. My thing with the card isn’t Bluebird, but I think I will be using that too.

Mint broke my back. VR weighs nothing compared to 500 dollar coins.

Yeah, they were pretty heavy. And the stares from the bank tellers each month. Good times.

Matt, I loved this idea when I read it a few months back, and we decided to start putting all cashback and other cah bonuses into a segregated account. We’re nearing $1000, thanks to a couple of $175 credits Chase gave us for adding new money into savings accounts, plus a few assorted Staples rebates, TopCashBack and Ebates checks. So far so good, but it’s hard to see how we’ll get to $5000 in a year. Most manufactured spend goes toward miles and UR, but it’s primarily BB and AP. Any hints or ideas about upping the ante on MS would be a boon!

Hey Carl,

Well, firstly you could switch off to focus everything on CB from your existing strategies.. but that does come with opportunity costs. This post might be interesting:

http://saverocity.com/travel/pay-75-100-month/