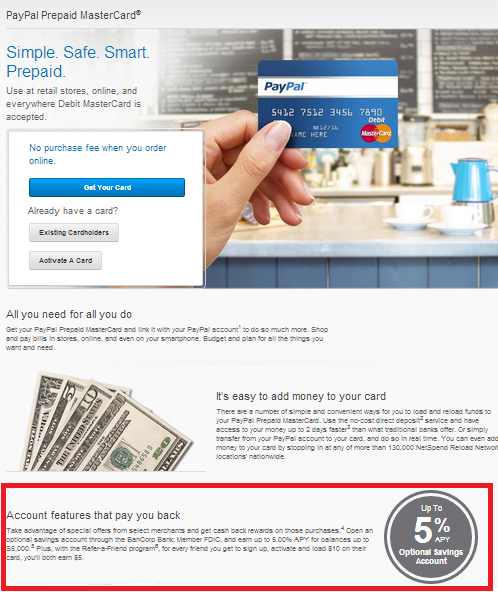

A word of caution, this strategy is for people who can afford to float the money should things not go to plan, ready to play with Credit Card Arbitrage? This post will highlight how to leverage a couple of tools to our advantage and result in a rather attractive net profit. Also, for full disclosure, both of the cards in question, the PayPal™ Prepaid MasterCard and the Barclaycard Arrival™ World MasterCard® – Earn 2x on All Purchases are Affiliate links of mine in this post, if you decide to use them I will earn a commission, thank you.

OK lets go!

The Savings Account

The opportunity here comes with the bolt on service that the Paypal Prepaid MasterCard offers, it is a savings account which earns 5% APR for deposits up to $5,000. That is a pretty sweet deal considering that most high street banks are currently offering no more than 0.2% on a savings account (though you can get some better deals with online options such as Ally). For those with $5,000 setting up the Paypal card to access the savings is a simple way to earn a nice additional profit on what the market offers.

The benefit of the savings account is mitigated by a monthly fee of $4.95 to keep the Paypal MasterCard operational. Annual P/L from this alone would equate to the following:

- Savings Account of $5,000 at 5% = $250

- Monthly Account Maintenance fee of $4.95 x 12 = $59.40

- Net Profit = $190.60

- Effective Annual APR after costs = 3.812%

But wait, it gets better.. let’s throw arbitrage into the equation.

The arbitrage comes from the Barclaycard Arrival offering 12 months interest free credit on new purchases. The card comes with a 40,000 point signup bonus when you spend $1,000, valued at $440 in travel expenses or $200 in Statement Credits (cash back).

The Barclay Arrival card has been rebranded, to rather a mouthful of: Barclaycard Arrival™ World MasterCard® – Earn 2x on All Purchases because those shrewd marketing folk know it’s pretty neat to get 2X everywhere, and I have to agree.

If we were to buy $5,000 worth of ‘stuff’ on the Arrival our net points earning would be 50,000 points (for new card members) or 10,000 points for existing card members. If that ‘stuff’ happened to be Vanilla Reload Cards that we then used to load our American Express Bluebird Card we would have to pay the Vanilla Reload purchase fee of $3.95 per card (valued up to $500 per card) as follows:

- $5,000 earning 2x points for 10,000 points (valued at $110 for travel, or $50 for statement credits/cash back)

- 40,000 point signup bonus ($440 for travel, $200 for statement credits/cash back)

- Vanilla Reload Fees of $3.95×10 for $39.50

- Net Profit

- If used for travel and a new card holder = $510.50

- If used for cash back/statement credits and a new card holder = $210.50

- If used for travel and an existing card holder = $70.50

- If used for cash back/statement credits and an existing card holder = $10.50

The process explained

We are not going to load the PayPal™ Prepaid MasterCard with Vanilla Reloads, instead we are going to load the American Express Bluebird Card and then use that to fund the Paypal Prepaid MasterCard as a direct deposit. You can fund it either as a Billpay or by check.

Step by Step

- Apply for the Barclaycard Arrival™ World MasterCard® – Earn 2x on All Purchases if you don’t already have it.

- Purchase 10x Vanilla Reload cards from CVS valued at $5,000 ( you can spread the purchases over several days if that is more comfortable).

- Load the Vanilla Reload cards to your American Express Bluebird account, this is done via the vanillareload.com website

- Open the PayPal™ Prepaid MasterCard account and apply for the savings account.

- Deposit $60 to the Paypal Prepaid MasterCard (this will cover your fees for 12 months)

- Deposit $5,000 to the Savings account by either using a Bluebird Check or Billpay.

Remember that you will need to maintain minimum account payments on the Barclaycard Arrival, which at 3% will equate to about $150 per month, at the end of the 12 month interest free period pay off the remaining balance ($3,200 if you make 12x $150 payments) and net the profit from the points and the interest on the savings account.

Total Profit from this plan would vary, as follows:

New cardholders:

- Travel Cash $550

- Real Cash $151.10

The Barclaycard Arrival is a great card when used for Travel related expenses, I would not ever recommend it for Statement credits, so my final analysis includes only Travel Cash earned, and Net Real Cash earned after all fees are paid.

Interesting post – I would assume (don’t have the Paypal Prepaid Mastercard, so can’t confirm) that you could use the Paypal My Cash cards I would go that route, this way your Bluebird is still free to fund from Vanillas

I thought the same, I think you could buy the paypal My Cash Cards, load your Paypal account, then transfer to the Paypal Prepaid, I went the BB route as I think it is more proven in terms of account shutdowns and whatnot, and I don’t know how PP would react to $5K of My Cash cards loaded to PP. I thought just to capture the $5K from the Bluebird in a proven way and therefore avoid some uncertainty.

Good points! BB is awesome in reliability for what we do

In a very similar vein, the Momentum prepaid card also offers a high interest savings account. The rate is supposedly 6% APY. Maximum $5000 in savings (like Paypal). You can get the Momentum without any monthly fees though. Also it has bill pay and can be funded directly by VRs (though I’ve heard it has a deposit limit of $2500 per month through VR). You are right of course that VR loading on things besides BB is less tested.

The main inconvenience with the Momentum card is that it seems like you have to sign up for it in person. From what I can tell on https://www.momentumcardbalance.com/DFC/locations.html – it may only be available in 14 states.

Very cool. Thanks for sharing that!