Converting your Traditional IRA into a ROTH IRA is a very attractive concept for many people, it can save you thousands during your retirement, however, even more importantly is doing it the right way can save you thousands today.

When you convert you will be faced with an immediate tax bill for whatever you pulled out of the Traditional IRA which will be assessed as Ordinary Income. With that in mind, it is important to decide whether the hit now is worth if for the long term benefits of the conversion.

There are several reasons why you should convert to a Roth IRA and they are all related to tax benefits. A Traditional IRA will grow Tax Deferred whereas a Roth IRA will grow Tax Free which means when you enter retirement and start to draw upon the funds from your IRA if you have a Roth all of that money is tax free, whereas with the Traditional IRA it would be taxed like it is your income.

The second big benefit of the Roth is that you can pass it to your beneficiaries without them incurring any tax on the account, which is a good consideration when Estate Planning.

Considerations when Converting to a Roth IRA

Can you afford the Tax Bill Today

When you convert to a Roth IRA your Broker will issue a 1099-R for the amount of the conversion. This will be reported to the IRS as regular income for the year. The real consideration here is can you afford to pay the bill with other savings if you decide to take the tax payment out of the Roth IRA account value you kill the deal, and there is no point in converting to the Roth.

Did you lose your job, or leave the workforce? This is the best time to convert – if you can handle the tax bill

One of the best times to convert to a Roth IRA would be if you leave the workforce, or if one member of a Married, Filing Jointly couple did so, perhaps to be a stay at home parent. The sudden, short term drop in annual household income would put you into a much lower bracket, allowing your conversion to a Roth IRA to happen at a much cheaper rate. This is especially useful if the years prior and later appear to be ones where your income level were much higher. Other times where you might see this would be the first year of setting up a small business. Again, this is the best time, but you need the reserves to be able to pay the tax on the amount, perhaps a Partial Transfer would be the solution.

Using a Partial Conversion to avoid entering a new tax bracket

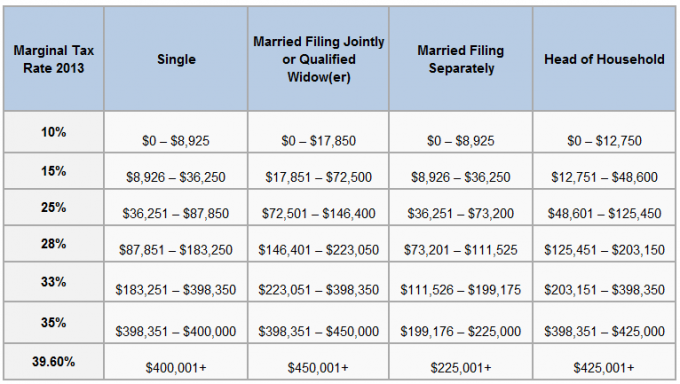

The US Tax System is set up in brackets – as you enter each new bracket you pay more tax on the amount over the threshold. Deciding to convert enough to bring you to the threshold, but not over it could save you a lot of money. The idea here being that you would do a partial conversion every year you have the chance to top up, until you have converted the full amount. You need to look forward and decide what you think your annual income will be in the next few years for this to make sense for you. These don’t need to be subsequent years, simply opportunistic transfers whenever you have a gap between total income and the next tax bracket.

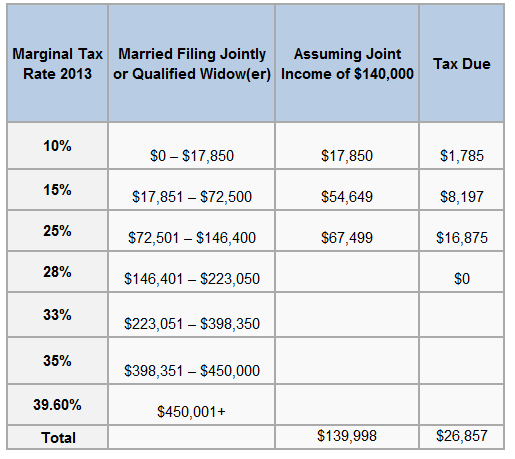

Example: Married Couple filing Jointly with a Traditional IRA valued at $200,000 and a joint annual income of $140,000 their taxes without converting, based solely on income would be as follows:

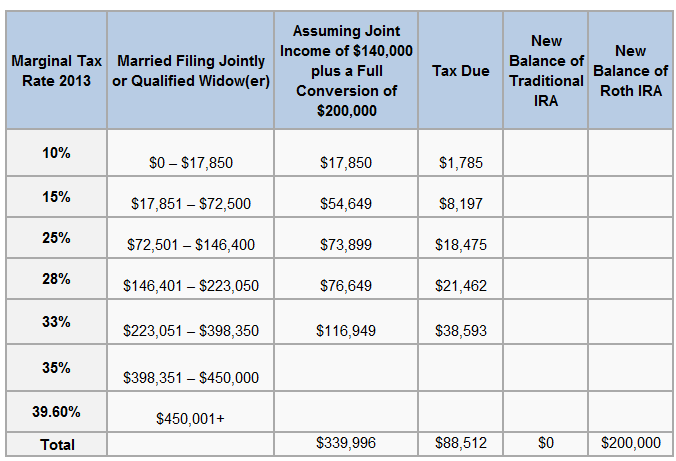

If they decided to do a full conversion the tax cost in 2013 would effectively mean an annual income of $340,000 and would result in a tax bill as follows

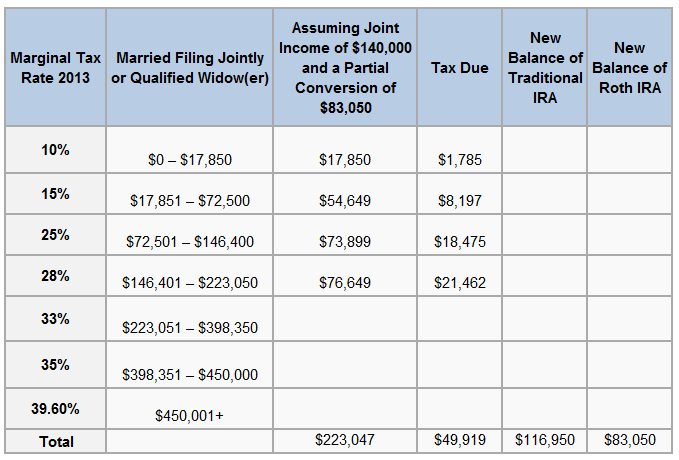

Alternatively, if they decided to partially convert and keep under the 33% bracket of 223,050 and spread the conversion over the next 3 years they would pay the following in tax:

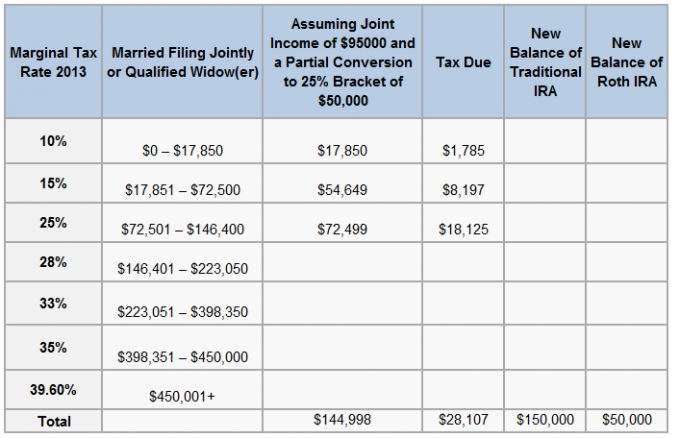

How about a situation where one of the couple left the workforce mid year to be a stay at home parent, their income dropped to $95,000 allowing them to either partially convert to the 25% bracket over 4 years.

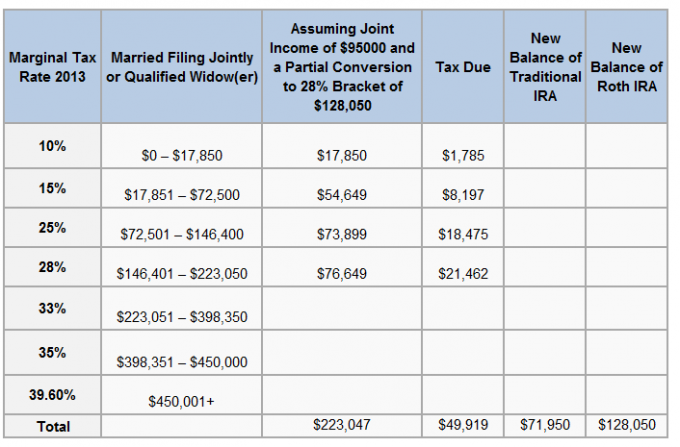

Alternatively they could transfer more aggressively, up to the 28% Cap Level in order to spin off the Traditional IRA faster – useful if the joint salary is expected to return to a higher level after 2 years:

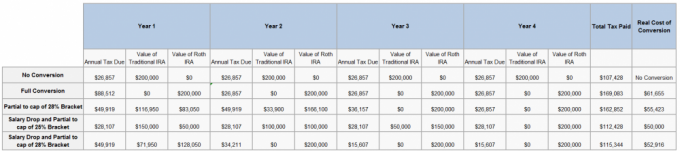

In summary, the same couple, timing the conversion differently could pay quite a range of amounts in tax.

The Range of tax paid on that $200,000 based upon your circumstances and approach to the transfer is between $50,000 and $61,655 – timing is everything! I really recommend looking at your tax caps and picking your time wisely, and also, plan ahead by thinking about times where you could have a drop in salary, such as starting up a small business or having a child. If you have enough savings set aside to cover the tax bill you can really benefit from a little planning.

Don’t opt to Pay Taxes at Time of Conversion

You will get a choice when Converting to a Roth IRA to pay or withhold taxes now – don’t do this, as you will get doubly penalized, firstly it will draw them out of the amount of the account, meaning you will never recover the value and should just stick to a Traditional IRA. The extra penalty comes from the IRS who will state that the money you pulled out of the Traditional IRA to pay the Taxes before converting to a Roth IRA was actually an unqualified distribution – so they will slap a further 10% penalty on the amount you pull out to pay the tax bill with! Instead, opt to pay the taxes later; they will be rolled into your next years tax payment.

Watch out for underpayment of Quarterly Taxes

It would be prudent to make an additional Estimated Tax payment in the Quarter that you make the Conversion, you already know that you tax bill for the year will be higher by the amount of the Conversion x current Tax Rate so pay it off now, this will avoid any chance that the IRS looks at your income for the year and decides you underpaid.

Deadline for Converting to a Roth IRA

12/31 of the tax year you wish to convert in. You can convert at any time you like, though I would recommend the best time to convert would be during the month of December, since by that time you will have a good grasp of what you annual income is for the year, so you can really understand how much the tax impact will be, and if you want to do a full or partial conversion. Also, doing it in the last month of the year helps for the Quarterly Tax payment as you aren’t locking up those funds for the entire year.

Whenever you adjust your investment accounts I recommend using a tool like Personal Capital to help keep track of things, especially useful over a multi-year conversion as it keeps all of your different accounts in one place – the free tool will reduce costs and help you manage your investments, you can sign up for it here, note this is an affiliate link and I may receive compensation should you sign up using the banner below, your support is greatly appreciated.

Great and timely post. We have done partial conversions in previous years, depending on current income, and were just wondering if we should do more this year. I think I will call TIAA-CREF on Monday to see if we can still do it – ideally by phone – but I have a feeling we may need to get them signed forms. If so, we may just hold off for now since we’ll be in Vegas from tomorrow til Friday. And we’ll have other things on our minds!

Also, does it really matter, if we expect our income to be about the same in retirement? Our accountant recommended it a few years ago – maybe because she wanted us to do it while tax rates were low? – and then we didn’t for a year or so for bracket reasons. But your post reminded me to look at it again. Thanks!

It’s a good idea for the following reasons:

1. If you are under a lower tax bracket threshold you can top up your income to that level – makes it a cheaper transfer, but only if you plan to be earning more later in retirement.

Earning more though is deceptive, since it ignores future potential tax raises, if you plan to earn what would be now the 25% bracket in retirement and that becomes 35% due to tax increases it adds value to lock it in now tax free.

Furthermore, it is good for people who didn’t earn a lot in this year, since some deductions are considered ‘nonrefundable’ which means if you have taken a certain number of them you can not take others unless your income is high enough – so earning more allows you to deduct more.

Also, ROTHs act differently in Estate Planning, so if you are considering passing money to your heirs a ROTH can offer interesting tax free options to transfer wealth (though that is part of a bigger plan).

Since my investments are such that I won’t know what my adjusted income will be until after 31/Dec, I never know whether or not to do this!. I don’t understand why is the deadline for this 31 Dec. rather than 15 April like for IRA contributions, for example…