Investors in Index funds are typically following a low cost, long term strategy that is tax efficient by nature. Index funds are funds that track one of the Major Indices such the DJIA, S&P 500 etc… (the etc part is important, and will be the crux of this post). Index Fund investors who follow a passive investing strategy typically have a lower overall Tax cost to their Investment Strategy as this process eschews short term trading to lock in profits – doing so also locks in short term capital gains tax on the trade and therefore hurts your overall performance come tax time.

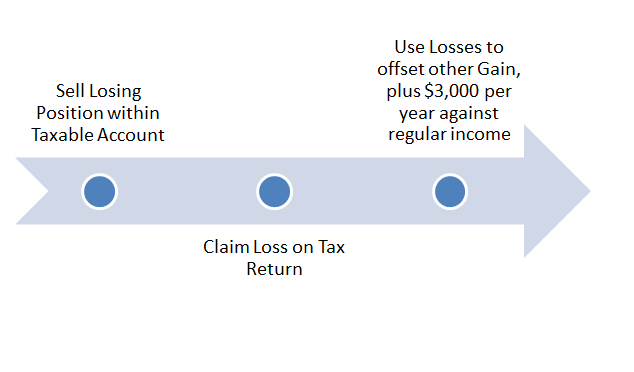

However, this strategy of slow and steady buying of assets excludes the trader from taking advantages of down turns in the market, in the form of Capital Loss Harvesting. this is a strategy that allows you to lock in losses and use them to offset your gains, and furthermore allows $3,000 per year to deduct from your regular income, which is a great benefit.

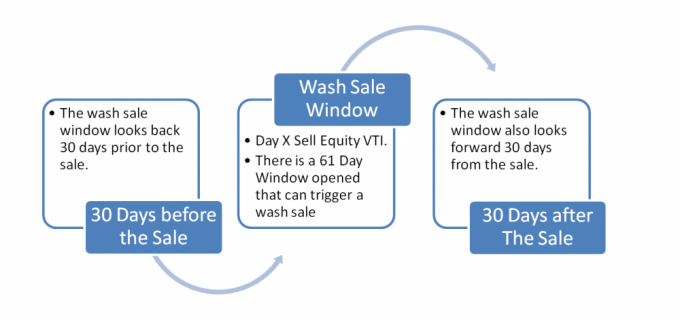

The IRS set up the Wash Sale Rule to prevent Taxpayers abusing the system and claiming losses, here is the overview of it, the full rules can be found within IRS Publication 550 on Page 59:

You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities. A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

- Buy substantially identical stock or securities

- Acquire substantially identical stock or securities in a fully taxable trade

- Acquire a contract or option to buy substantially identical stock or securities, or

- Acquire substantially identical stock for your individual retirement account (IRA) or Roth IRA.

If you sell stock and your spouse or a corporation you control buys substantially identical stock, you also have a wash sale.

Here’s how to Capital Loss Harvest:

A very simple process- it only complicates when the seller doesn’t want to be sitting on a Cash position, and instead wants to remain in the market, in a large Index fund. This is where the Wash Sale Rule prevents them from “entering into the same, or a substantially identical position.” So there needs to be an alternative solution.

The good news is, that with Index Funds being so broad in their range, changes that are noteworthy enough to make the holding substantially different will likely do little in terms of impacting risk, though each one should be done with care and consideration to your overall exposure.

It is worth noting, that the IRS doesn’t have a firm and clear line as to what is considered different when it comes to Index Funds, so be prepared to justify your choices with them (and don’t blame me if they lock you up, this is a journalistic site and I’m just sharing some ideas here, be sure to back them up with Professional Advice before embarking on anything like this).

Ways to make a Index Fund Substantially Different

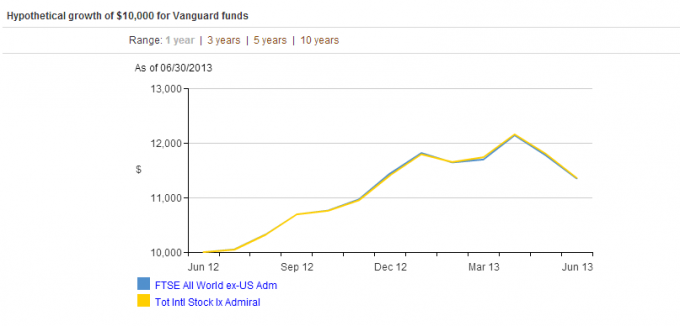

Remove a class of equity from your new fund – eg eliminating Small Cap companies – this can be witnessed here with the holdings of VFWAX and VTIAX; both of these Funds focus on International Stocks (ex USA) but the VTIAX fund does not hold Small Cap Stocks, making the performance almost identical, but the structure of the Funds substantially different.

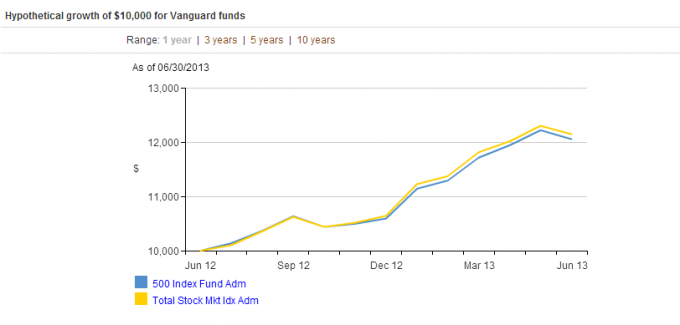

Even if you make what could be considered a massive change to your fund profile, and move from a Total Stock Market to the S&P 500 whilst you seem to have a much changed exposure and profile actual performance is intrinsically linked and you will notice very little changes over the time. The time limit to be concerned about is 61 days roundtrip – eg from buying the Fund, to selling it and re-buying it – 30 days between each step =61 days.

The primary reasons for the shifting of fund allocation making less impact comes from the time factor – Index funds by their nature are slower moving than an individual equity, so within a short space of time the addition, or removal of a higher performing (and higher risk) sector such as Small Caps from your fund will have little overall impact. There just isn’t going to be a time when two funds, both with substantial holdings, but with minor blend differences will drift in completely different directions in a 61 day period, one might certainly outperform the other, but the discrepancy between the two will be marginal in comparison to the benefits gain by capturing the Tax Loss Harvesting.

Leave a Reply