The title for this post was inspired by the folk at Frugal Travel Guy. They wrote a post yesterday that made my eyes bleed, and I was so enraged that I wasted 14 seconds of my precious young life reading it that I thought to write a retort. For those of you unaware, and there will be many, Frugal Travel Guy (the Blog) is basically a front for selling credit cards. Therefore they will churn out any old bollocks in order to promote selling you a card that they earn commission from.

Let’s start with the basics

It seems clear that Frugal Travel Guy aims content at ‘noobs’ because beginners are low hanging fruit for credit card conversions. So, noob, here is the first thing that is not mentioned at all in a ‘Face off’ between these two cards:

The Fidelity American Express is a personal credit card, which means that is designed for your personal use. If you are weighing it up against another credit card you have to weigh it against another personal credit card. The Chase Ink Cash (and the entire Ink family) is a Business credit card, meaning you have to have a business to get one. Of course, you can lie and pretend you have one, nothing wrong with that at all, as long as you are cool with it.

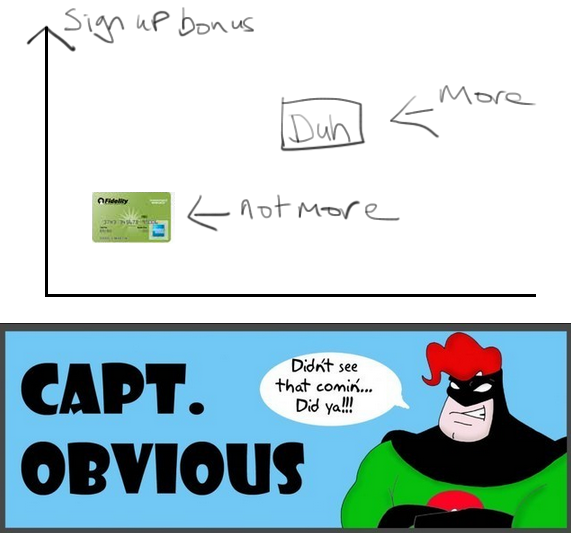

Next up, if you compare a card like the Fidelity American express with any signup bonus it will fail in year one. So the entire face off is complete nonsense from the start. I don’t want to be accused of not doing a thorough study here, so please see the chart below to back this up.

The reason that the Fidelity American Express is touted as the best credit card is simply that for zero annual fee you get 2% cash back everywhere. What that means is that it is your best card for ‘everyday spend’. The new family of American Express cards aptly named the American Express Everyday cards. These too are inferior to the Fidelity American Express because they don’t pay 2% everywhere.

Everywhere means Everywhere else

In the credit card world category bonuses are great – specifically coded stores (using MCC Lists) are designated into Categories, a notable collection is termed the GGD Group (Groceries, Gas Stations and Drugstores) these are all separately coded under the MCC list, but frequently great credit cards will target a high earning multiplier to all three. A great card is the Old Amex Blue Cash that pays out 5% on all three after you meet $6500 in spend. Restaurants are another area that bonuses are targeted towards, cards like the Chase Sapphire Preferred offer a 2x bonus here.

But what about that store that is generic, that you aren’t sure how it is coded? Such as your local wine shop or clothing store? Those are the ones where you use the Everyday Everywhere spend type cards, and those are the shops where the Fidelity Amex is king. A challenger is the Barclaycard Arrival as it offers 2.2% back (but only for travel spend vs 2% straight cash back on the Fidelity) and I could entertain an argument on which was superior long into the evening.

This is the second post I have written in response to the drivel produced at Frugal Travel Guy, they also pumped out some crap about the best card for low spenders, I actually took the time to respond to this one with charts and data a little more in depth. Check out my version of the post here, it touches on all the same issues as this Strawman comparison does, and explains the rather obvious fact that in year one $300 is better than not $300… In this post the Fidelity American Express beats out the Barclay Arrival, which offers an even higher signup bonus than the Chase Ink Cash card.

Stay tuned for my next post, on why a spoon is better than a hovercraft.

As someone who reads many blogs (including the one mentioned in your article), I completely agree with you. Too many bloggers are selling cards that are not actually beneficial to the consumer. Kudos to you for spending the time and effort to point this out.

Love it!

There is no spoon.

I must be a little behind. Why is this SO infuriating? I get that different cards excel in certain situations dependent on our spending/MS methods, but is this post really that bad?

Well nothing is really THAT infuriating… but the post was complete crap. Basically the notion is to take any concept you like and spin it into a way to sell a certain card that pays money. In the case of this post, the entire argument is stupid because they are trying to compare a Fidelity Amex with a card that you would never use in place of a Fidelity Amex – the reason that the community loves the Fidelity Amex is because it offers 2% where other cards offer 1% (including that Ink card) nobody in their right mind would say that 2% flat is a good as fluctuating bonuses, so its just a daft post, with no value offered at all.

You forgot one important point in your post – the FTG blog, almost every week in the “Travel Challenge” used car salesman post, the blog recommends redeeming the post for 1 or 1.25 cpp. Just yesterday

Your analysis sounds like it’s pointing out why the comparison is stupid even when treating UR points the way the optimally would. In reality though, if the targeted newbies redeemed the points the way the FTG blog “shows them” how to, the comparison is far dumber than even you let on

That’s a fair point, I hadn’t taken the time to get that far into things, perhaps I need to crack out my HP Financial Calculator and design some further charts…. they seem to have a real gift over there.

Shouldn’t be too tough, just value UR points as 1.25 in your analysis, since the same blog peddling the CIB card rarely (if ever) will show you how to redeem that OMG!!! AMAZING!!!! 60K bonus for any more than that

What is an Ink card, I never heard of it, I wish someone in the blogger community would do a nice write up of it! 😉

Cheers,

PedroNY

Ha! Totally will if you promise to get two

Keep them honest, Matt! I read and reread the post at FTG the other day. I couldn’t seem to understand what I was missing turns out it was the almighty dollar.