Firstly, my approach to all insurance is that it is a bad bet, Insurance is a bet that for every 1M times something occurs a certain number of those events will go awry. Insurance Companies crunch the data and find as good an estimate as they can and then add on a premium that is their profit.

Insurance sells through the Fear of ‘What if’ and everybody and their uncle has a story of how insurance literally saved their lives one time, though not so many have a story about how much they pour down the drain on insurance that is never used every year. Having said that, there are times when it seems to make more sense than others to have insurance, and for me, most of the time, travel isn’t one of them.

Insurance doesn’t Double Dip

You can’t profit from insurance (they like to be the ones making the profit), the first thing they do is look at your total claim and deduct any carrier compensation. In the recent case on the Cruise From Hell on the Carnival Triumph where passengers were stuck at sea for days in horrible conditions (I’ve been in some equally bad ones myself, minus the poop streaming down the walls) the Cruiseline offered the following: Full Refund of Cruise, Free Future Cruise, $500 Cash and most onboard expenses (I would imagine excluding Cash advances from the Casino) were reimbursed by the ship.

When that happens, what is left for the insurance company to do? You’ve got your money back, so the deal is done. They wouldn’t also refund the cruise, they would take into account what you have already received and make good on it (if you are lucky). There wouldn’t be any real advantage in having insurance for the cruise vs not having it. One area where perhaps you could try to squeeze them for reimbursement would be if your Cruise from Hell also arrived into home port late, and your flights were missed. Frankly I would say that the airlines wouldn’t charge you to rebook you in such circumstances, but on the slim chance they did then perhaps you could get some coverage here.

Even in the case of the flight fees though, if Carnival had labeled the $500 as ‘for misc other expenses’ there is a good argument from the Insurance company to say you have to spend that on your change fees and again they get away without paying up.

Frequent Flyer Miles and Hotel Points are both Insured and Insurance Vehicles

Using Hotel Loyalty Point Balances as Insurance Programs

If you don’t have insurance and are stranded somewhere you can book a hotel for the same night with your Hotel Loyalty points, there is no charge to book close in, and you can typically go from website/phone booking to check-in within about 15 minutes. Sure you are using your points, but only in the event of an emergency, which means every time you don’t have an emergency you can put that insurance policy premium back in your wallet.

The favorable refund policies mean that you will not lose your money (check the terms!) in most cases

Hotel programs also allow for free cancellations, whilst the programs all differ many of them will allow you as late as 24hrs prior notice to cancel without a penalty, so if your trip needs to be cancelled through whatever reason you can just redeposit your points without any loss.

Cancelling your Hotel Mid Trip?

I spoke with both Hilton and Hyatt about their policies here (for either a Cash reservation or an Award Stay) and they both confirmed the following:

- If there is a possibility that you trip will be cut short by an emergency, for example if your better half is Pregnant and expecting soon make sure you tell the Hotel at time of check in that this might happen. If you do this they will generally allow you to exit mid trip without a penalty.

- In the event of an unforeseen emergency, the Hotel will generally waive any penalties and be understanding to your needs – an emergency in this case means something medical or a death in the family.

- In the event of trip cancellation for other reasons, such as your work requires you elsewhere, or you are just bored, most hotels will allow you to break the trip but require terms of their cancellation policy to apply – typically this 24hrs notice, so if you just tell them you are going and walk out immediately you will likely pay one night of penalty, and get the remainder refunded.

I then called up Starwood Hotels SPG program and they explained that some hotels have an early departure fee, but they do tend to waive it in emergencies, again I would follow the same policies as above and you should be ok.

Very Important Point – Do not be obnoxious about this, these things can be offered by some hotels, but others might not have the same policy, I suggest checking with the hotel and chain at time of booking. Remember even within a Chain individual hotels do not have consistent policies. And most importantly, you catch more flies with honey than with vinegar… be Nice, and be calm and be respectful, if you do this it is very likely that you will be able to work things out with the hotel without problem.

So, to an extent it is possible that you could lose the extra nights you have booked if you need to come home early from a trip, but everybody I am speaking with is telling me the benchmark is that they will work with you to figure it out. This benchmark is very different from the expectation that you would lose everything and therefore the Trip Interruption Insurance becomes a lot less important.

Remember – no double dipping, so if you get all the additional nights reimbursed by the hotel the Insurance company pays nothing, in making a call on insurance or not I would use the chance that you might lose 1 night max vs the chance that the hotel figures it out with you and reimburses everything – doing so shifts the balance in the question of value significantly.

Airline Policies on Refunding Non Refundable Tickets in Emergencies

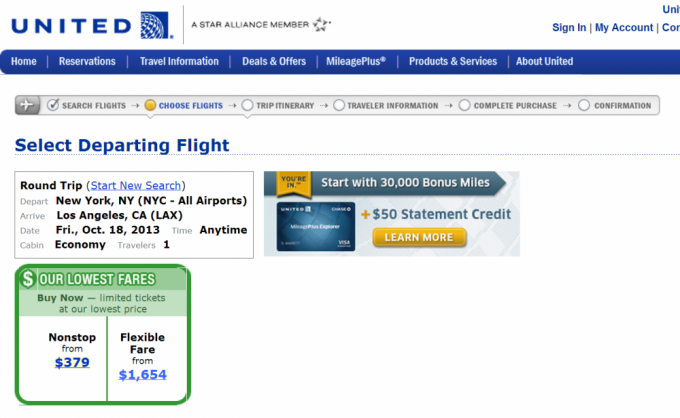

Most of us who purchase tickets on Airlines will purchase Non Refundable fares, simply because the difference in fare price is ridiculous between a non refundable and fully refundable fare, here is one from NYC-LAX on United as an example, both of these are booked in Coach (though the more expensive is does also come with a greater chance of being upgraded into First:

Because the upgrade is not guaranteed, and less likely if you don’t also hold Elite Status, you are effectively buying the ability to cancel and change your flight at the last moment with these fares. The price difference is ridiculous, it is almost $1300 more to book a ticket that you can refund – again this is insurance at its most despicable – if you fly the the ticket you have paid almost 5x the price of the guy sitting next to you in Coach (and don’t even think about the travel hacker sitting in First on a points ticket!)

In the event that you need to refund your ‘non-refundable’ ticket the general policy is that they take the price of your ticket, and apply change and cancellation fees to it – anything left over will remain as a credit in your account for future travel.

Insurance in this example seems like a great idea – buy the cheaper, non refundable ticket and insure the trip – coverage for a $1000 trip ($300 on the flight, $700 on the Hotel) would come in at about $40 for the week. But lets look at some situations where you might need it:

1. Your flight is cancelled due to mechanical problem or weather

You will be rebooked onto another flight by the Airline at no additional cost. If there are no more flights that evening the airline will cover your hotel and meal vouchers for the evening and fly you out in the morning. It is the responsibility of the airline to make good on this. Plus you are double insured if you hold Hotel Loyalty points as you can book a room on the same night you need it with them. Why would you require insurance if the airline does this as standard procedure?

2. You cannot fly due to an emergency, you or your family is taken ill, or there is a death in the family.

All airlines have different policies on this, so make sure you check, here are the policies of the airlines, the key will be ensuring you keep extensive documentation to support your claim, and it typically will only suffice if there has been hospitalization.

United Refund Policy for Emergencies

United will refund change fees and tickets in certain cases. All requests must be received before the expiration of your ticket and must be accompanied by proper documentation (see below). If the refund request is approved, a refund, minus a $50 USD processing fee*, will be provided to the original form of payment. This policy applies in the case of illness or death of the traveler, traveling companion, or immediate family member, as well as customers actively on jury duty at the time of planned travel.

*Except where DOT 14 CFR Part 382 applies

Delta Refund Policy for Emergencies

Delta, unlike United does not offer refund of fees in emergency situations, you also may be able to get fees waived, but their standard policy is to not waive fees for these circumstances. They will charge $200 to cancel a non refundable fare within the US.

American Airlines Refund Policy for Emergencies

American Airlines does not offer refund of fees in emergency situations, you also may be able to get fees waived, but their standard policy is to not waive fees for these circumstances. They will charge $200 to cancel a non refundable fare within the US.

Southwest Airlines Refund Policy for Emergencies

Southwest has a great policy where their fares aren’t refundable, but they are reusable if cancelled – they would issue a credit that you can use on future flights, without it needing to be an Emergency.

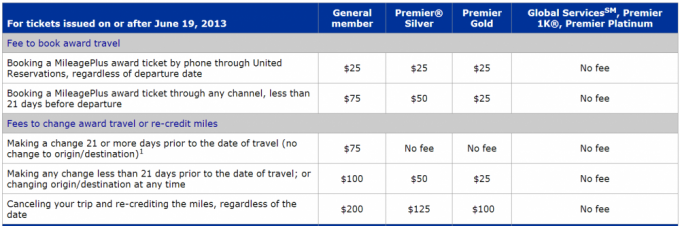

Award Ticket Cancellations

When it comes to award travel you can always redeposit your miles into your account, however that does often come with a hefty fee (up to $200 now from United) but again, you can have those waived with United in a medical emergency. More importantly would be to factor in your status, as certain Elite Status with the airlines would reduce or eliminate change and redeposit fees, which would again act as a form of insurance, and make the purchase of insurance redundant.

So perhaps if you have a non refundable flight with Delta or American then you can expect to pay $200 per ticket if you need to cancel and don’t have status. That is your calculation for the value of insurance – if in this one situation would you pay 1/5 of the trip price to insure the trip, or would you roll the dice and hope you don’t fall ill? Breakeven point here is only 5 trips without a cancellation, which is not difficult to achieve.

When Insurance might be a good idea

1. For Health Insurance Coverage outside of the US – check your medical insurance before you decide on the necessity of this, some policies will cover you globally and some will not. If you were to fall ill whilst on vacation it would be wise to know if you are covered.

2. If you have good reason to think your trip will be cancelled from an external factor – if you are travelling at a time when a loved one is sick, and you might need to suddenly change plans to be near by at home your odds of needing to be flexible and encounter change fees increase, and the choice to insure would be better.

3. If you are entering a very volatile environment. Travel to regions of recent unrest such as in the Middle East or Africa where political upheaval, terrorism or protests may be more likely to occur.

Personally, unless one of the three factors above might be very relevant at the time of my trip I would not take Travel Insurance and instead rely upon the good will in place of the Airlines and Hotels, they rarely leave you in the lurch and if they did, having loyalty points on flights and hotels will be a further policy.

For flights booked last minute with points, you will also be likely to incur a fee for booking within 21 days, exceptions to this would be if you have Airline Elite Status, and certain programs such as British Airways Avios, which are incredibly powerful tools to have in your travel kit as you can book a last minute flight fee free. Perfect for if you miss the departure of your cruise and want to catch it at the next port (a direct flight if it exists would only cost you 4500 Avios per person to join the ship)

Credit Cards come with Travel Insurance too!

Lastly, depending on the card you have you might well have built in Travel Insurance – cards like the Chase Sapphire Preferred and American Express Platinum offer excellent supplemental travel insurance as standard – just remember you need to put the full payment on the one card you want to use in order to qualify.

Leave a Reply