I am wondering today if I have crossed a line, perhaps you can let me know from your perspective. I have a decent ability to achieve things when talking with customer service. I find that I go into conversations with right attitude, understand what I could get from it, and then have this horrible trait where I sometimes want to bend the rules to my advantage, like a Jedi Mind trick, but have I turned to the Dark Side?

The American Express Platinum Card is a fascinating credit card. It has an annual fee of $450, which alone should preclude it from ever entering my wallet, yet here it is, a trusty companion after several years of fee paying. The card has a number of interesting travel related perks, and I think the annual fee can pay for itself if you are the type that uses air travel frequently.

A big help in reducing the impact of that $450 is the $200 airline ‘incidentals’ fee credit, you pick your carrier of choice, mine is American, and when you get charges to that carrier that fit within ‘incidentals’ you get them removed from your statement (up to $200..) however, Amex and I disagree with what makes an ‘Incidental’ charge, they talk about ‘things like checked bags fees, and inflight refreshments’. I mean, I do enjoy a beverage, but even I don’t fly AA enough in Coach to need that many Coors Lights.

The limits on how to spend the $200 always bothered me, so when I found that there was a loophole that allowed you to buy AA Giftcards from AA.com and get the money back, I was pretty happy, and used these for a couple of years, but to be frank, I don’t spend them, I have them somewhere as e-certificates and I never pay for flights these days, so they aren’t much good to me.

Due to this Epiphany that the ‘free giftcards’ are gathering dust I thought to actually use my fee credit for fees (how novel) Since I was booking a flight (MRY-NYC with a 9month ‘stopover’ to see the sites then onto Madrid for 50,000 AAdvantage each in Biz, a steal!) I thought instead that I could use them to pay for the associated ‘incidental fees’ that come with booking an award trip, there are all sorts of silly fees, that in this case added up to $114.40 per person (rather close to $200 I thought).

So, having purchased the tickets on the Amex Platinum, I waited for a bit and didn’t see any ‘auto credits’ to wipe that out. A quick glance at the terms and conditions shows that Award Tickets are excluded:

Statement Credits: Incidental air travel fees must be charged on the enrolled Card Account for the benefit to apply. Purchases made by both the Basic and Additional Card Members on the enrolled Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $200 a year in statement credits across all Cards on the Account. Incidental air travel fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s airline of choice (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental air travel fees charged prior to enrollment in this benefit are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the incidental air travel fees under the appropriate merchant code, industry code, or required service or product identifier for the charge to be identified. Please allow 2-4 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. We rely on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 4 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges. To be eligible for this benefit, Card Account(s) must be active and not in default at the time of statement credit fulfillment. If a charge for any incidental air travel fee is included in a Pay Over Time feature balance on your Card Account (for example, Sign & Travel), the statement credit associated with that charge will not be applied to that Pay Over Time feature balance. Instead, the statement credit will be applied to your Pay In Full balance. For additional information about this benefit, call the number on the back of your Card.

Bolding Mine since for some reason Lawyers don’t seem to want to bold out things that are useful to the consumer when creating such things….

So here we are, I put the fees on my Platinum Amex thinking I could wipe them out, and instead the lawyery folk over there thwarted me. If I had known this in advance I would have put the Award Ticket Fees onto my Citi AA card, since then I would have earned 2 miles per dollar which is, to me way better than the 1x Membership Rewards I did earn.

Deploy Jedi Mind Trick

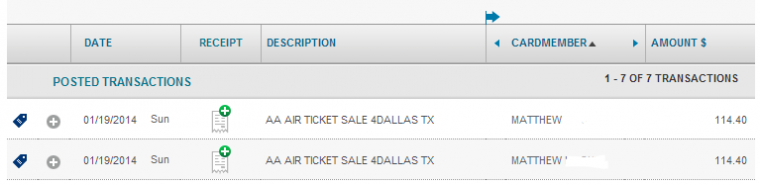

I tried to write a post about how I do this, and it didn’t sound right, but I will try again, but in short, I complain really effectively. I tend to win the fights I go after, and not fight some battles at all. In this case I called up and talked with the pleasant rep, and I innocently asked him why the charges hadn’t been offset for my recent statement. As you can see from the image Amex coded them as tickets, so to the observer it seems like an invalid item for rebate.

However, being the social person I am I took a moment to share the excitement of my journey with the rep. I would be flying from Monterrey after our ‘babymoon’ to Big Sur, and then we would stop in New York and head on over to Madrid. By sharing my journey, he was able to quickly conclude that a trip of that magnitude (in First and Business Class) would be a bargain for $114.40 per person, and there must have been an error, it clearly wasn’t the price of ticket.

At no time did I mention that it was an award ticket, the subject wasn’t raised. All I did say was ‘these were the fees I was charged by making this reservation over the telephone’. Which was true. But the actual telephone booking fee of $25 per person I had already got waived by a similar trick… so this was pure award ticket fees.

Anyways, the Rep was helpful, and told me that they could credit my account, there are rules in place for this, but I would have to wait 14 days from the charge to get it manually applied, I ensured this was notated on my account and hung up. I called back tonight to follow up and another rep worked with me to apply the credits, he told me that they would appear as -$114.40 and -$85.60 within 48hrs.

The extra $500 confirmed

Earlier this year Amex Platinum announced an end to their partnership with American Airlines Lounges, it was the case that if you held the card and an AA Boarding Pass in Economy you could still enter the lounge, but that is changing in March. I called in when I heard the news, since people were talking about getting $500 credits to offset the change, I did a similar mind trick to here, where I allowed the person to ‘find the answer’ I was looking for, and then locked it in, a $500 Statement Credit for American Airline Charges. I was a little concerned since I never received an email confirmation that I would qualify for the credit, but the guy I spoke with for the $200 credit confirmed it was there, and that this was separate.

I truly believe I did not qualify for the $500, but I managed to get it, and I know that I did not qualify for the $200 against Award charges, I feel a little guilt I suppose, but also I think that if I didn’t get these it would have been unfair, am I wrong to abuse my Jedi powers, or is it OK to decide when you ‘deserve something you think is fair’?

I say take em for everything you can every day every time til you cant any longer. Guilt is only for the guilty. As for the AA gcs, befriend a mileage runner or two and do trades or deals with them. I have found this set of folk are always in need of airline credits and youll get money back from the right people.

I read that in a Pirates voice ‘argh! Take them for everything they’ve got!’ though you are likely quite right, since it does help level the playing fields.

This is all well and good but you are a mug if you are paying $450 year in year out without recycling the card, which I wrote about a few weeks ago (http://milesabound.com/my-updated-american-express-platinum-strategy/). Of course my blog post would never appear on any web-site that has or hopes to have Amex affiliate links as they specifically prevent you from discussing churning in the T&C

I know about that churning, but I like Amex and I think churning is such a horribly unfair thing to do the poor credit card company.

I did consider canceling my Amex this year, but the month my fee hit was the month they told me I would get $700 of statement credits, so I stuck around.

spoken like a true affiliate 🙂

“I truly believe I did not qualify for the $500, but I managed to get it, and I know that I did not qualify for the $200 against Award charges….am I wrong to abuse my Jedi powers” Justification is a funny thing. Dishonest, lying, stealing are the words that come to my mind – then bragging & wanting others to make you feel good about it. FANTASTIC heads up to anyone intending to do business with you – BEWARE: I’ll screw you over if I can justify it in my own mind! (obviously, deleting bookmark)

I’m asking for opinions rather than bragging, yours is appreciated. Sorry to see you go.

It is in no way wrong to make a phone call and a friendly request something (anything) as long as you’re ok with being told no at the end of the conversation. Which sounds like the case here, and I think (hope) you are grateful for excellent and generous customer service rather than feeling entitled.

I’d be lying if I didn’t say I felt entitled to some sort of compensation for the removal of the AA lounges after I heard other people were receiving them. If I hadn’t received some sort of credit I would have taken my business elsewhere.