A good way to meet minimum spend on credit cards is to prepay certain monthly bills and carry a credit balance with them. This is touted as a good way to generate spend, but there is some cost to spending that should be considered, and this post will consider both some ideas to help you meet your spend, and the opportunity costs associated with them.

Ideas for Prepayment

- Prepaying your cellular bill is a great option for cards that offer multipliers for this category. The best card to do this on is the Chase Ink Bold that offers 5x on Telecom purchases.

- Cable TV is another monthly cost that can be prepaid, and again the Ink Bold offers 5x in this category.

- Certain commuter train tickets can be pre-purchased, an example of this would be the New York City Metrocard. Monthly travel is currently $112 and the card itself would cost $1. The card lasts for 30 days from the first swipe. I wouldn’t recommend more than 10 cards per person as periodic devaluations occur that trigger expiration on cards like this. The Chase Sapphire Preferred offers 2x for Travel, including the Metro. For other commutes, check the terms and conditions regarding expiration dates on tickets.

- Forever Stamps are a good option, and can be purchased at Grocery stores and pharmacies; certain cards can earn up to 5x in this Category, such as the Sallie Mae card. You’d have to buy a lot of them to make any sort of meaningful spend, but you have ‘forever’ to use them up.

The above options can easily allow you to meet the minimum spend on cards when other options are not available, or are outside of your comfort zone, but in doing so you are agreeing to lock up you money, and providing an interest free loan to the credit card companies.

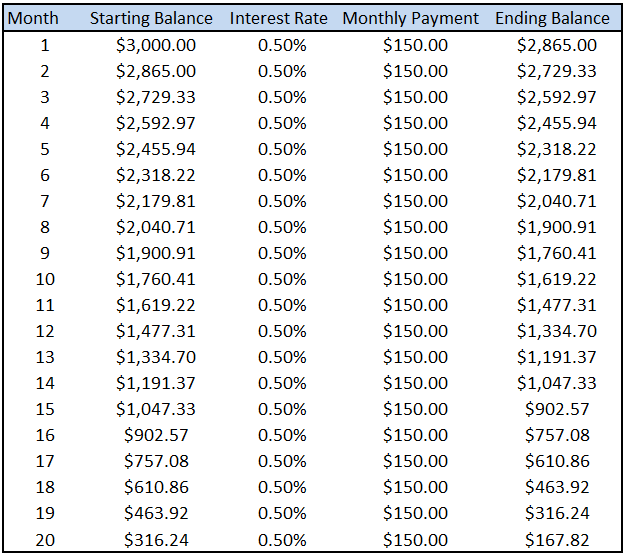

If you were to lock up say $3,000 for Cellular and have a monthly bill of $150 it will take 20 months to erode that account credit. Needless to say, you would have had to use cash to pay off the bill before the 20 month period, possibly in month 1 so you incur no interest, or perhaps at the end of an interest free introductory period (which is a clever use of arbitrage, but requires discipline). Lets look at the case where you pay it off in month 1, and assume that your money could have earned a conservative 6% in the stock market. Note I am compounding monthly in this post so the effective rate of return will actually be 6.1678%.

It is worth noting that in a short term period the guarantee of your earning 6% is not certain as standard deviation is very high over short time periods, and the stock market could fluctuate wildly on a month to month basis. However, in this conservative example of earning 6% stock market returns (against a historical average of 10%) you can see that if you had invested the money in the market, and paid out your cellphone bill of $150 per month instead of prepaying $3,000 you would have $167.82 more money in your pocket.

The time to pre pay is clearly when you are coming towards the end of the 90 day spend requirement on a new card and you really think you aren’t going to be able to make the threshold in order to trigger the bonus. If making the prepayment triggers the bonus it very likely is worth it to you, and it is worth losing the $167.82 in the example above, however it might also be a clue that you have bitten off more than you can chew in your latest card application and you should be more conservative in the future.

How much would $3,000 of Arbitrage be worth?

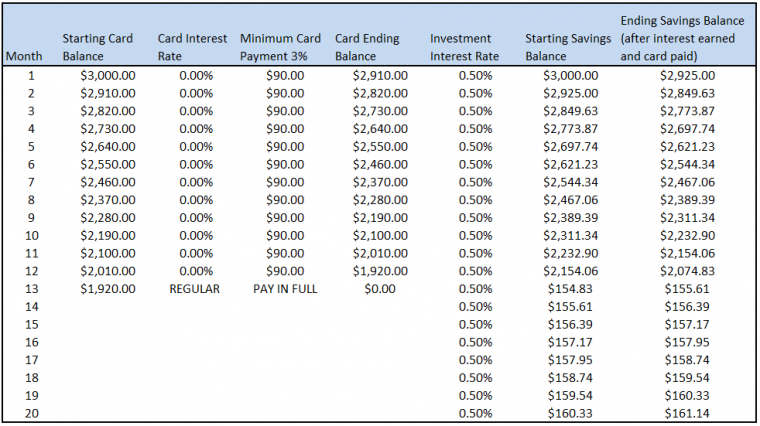

Just for fun, here is an example of putting $3,000 of prepay onto a card with 12 months of interest free credit, then paying it off at the end of that month to avoid the interest being triggered… it is playing arbitrage and you are basically lending the telecom company on behalf of the credit card company and sitting in the middle of the transaction holding a liability of $3,000 and an asset of $3,000.

It seems clever to leverage the ‘free money’ from the 12 month interest free period of the credit card, and pay only the minimum monthly payments of 3% ($90 per month) however, by the end of month 12 you are left with a balance of $1,920 that must be paid off in full (else it will incur interest at a super high rate). So if you took just $90 per month from your investment money of $3,000 which was earning 6% (0.5% per month) it would grow in value, but then you are still facing the same problem, of prepaying and locking up your money.

The end result in this situation is that you would have a balance remaining of $161.14 if you leveraged 12 months of free money, which is a lot better than if you had just prepaid and cleared the balance in full at the end of month 1, but it might surprise you in that it is less (by $5.68) than if you didn’t take the free loan and just kept your money in brokerage and paid the regular phone bill of $150 per month from your funds.

The reason that the interest free loan is negated is that you are still forced to send over a prepayment to the telecom company. When you make the end of month 12 payment of $1920 to clear off your credit card the following things have occurred:

- 12 months of saving $60 per month on payments plus an interest free loan of $3,000 from the card company to you= Gain of $154.83 from the Arbitrage, this amount then grows to the final amount of $161.14 via compound interest over the final 8 months.

- 8 months of loss from lending the Telecom company the $1,200 (you have to pay $720 catch up on the $60 x 12 you didn’t pay when you were making the minimum monthly payments, and then also prepay the next 8 months at the cost of $150 per month).

In other words, your free loan from the credit card using the 12 months of interest paid you $154.83 MORE than not prepaying at all, but at that moment when you need to pay off the card in its entirety the free loan that you send to the Telecom company means your asset basis is reduced to just the $154.83 which when earning 6% per year grows at a much slower rate than the non prepayment option, and the additional money remaining in that that asset gains interest faster, eventually over taking the free loan by the end of the 20 month period.

Of course, from the telecom’s perspective they had your $3,000 the entire time, and the credit card company floated the money, but once you pay off the card in full it becomes an equation between you and the telco for arbitration purposes.

In summary you would have the following costs:

- Don’t Prepay and earn an additional $167.82 from your investment appreciation

- Prepay $3,000 and pay off in full (end of month 1) opportunity cost of $167.82 over Best option above

- Prepay $3,000 and pay off after 12 months of interest free credit opportunity cost vs paying off in month 1 produces $161.14 additional income from the arbitrage, which is still $5.68 less than not prepaying at all.

Summary

Pre-paying is a great way to meet minimum spend requirements, but be mindful of the opportunity cost of doing so. Typically this opportunity cost will be more than offset by the additional points/miles that you earn from this strategy, but you should be aware that it is not a case of spending on things that you would otherwise have done. You need to be conscious of the time value of money, and giving it to another organization in advance has an impact on your own wealth generation.

Abritrage Opportunities for using 12 month free credit can be further leveraged if at month 12 you roll the old credit into new credit – this will help avoid the need for you to make the interest free loan to the telco company, however they are still getting a loan for free, whereas you are losing the opportunity value in that you aren’t playing with the free money yourself. Furthermore, it isn’t easy to keep track of multiple ‘roll overs’ like this and missing the timing on it just once, forcing you to incur an Interest Payment at regular rates can destroy a year of hard work.

Prepaying in days of gc pins seems archaic. A quick trip to drug/grocery and you can meet almost any spend requirement.

A fair point Paul, but still there is value in understanding what happens when you lock your money up. Either for other situations, or for the situation where the giftcards go away.