Valuing points seems to be more difficult than proving Beal’s conjecture though if you have some time on your hands, the latter is worth $1M, which might be better for you than getting the Hawaiian Airlines card, but barely. It is sad to see people claiming that points are worth any more than the price they can be acquired for, because it means they totally lose sight of reality. I’ve spoken about this in the past, and here is an Infographic on valuations for those who have trouble reading, but enjoy pretty colors.

Today I transferred 7000 ultimate rewards points to Hyatt in order to book a room for my mother’s last night in NYC, since traveling down from upstate is a trek, and it allows for some site-seeing in Manhattan. I typically carry very low balances of points, at the time of this award I didn’t have enough hotel points for a stay in any single chain. My strategy is to keep (if possible) anything up to 100,000 variable points in programs like Ultimate Rewards, Membership Rewards and SPG. The latter is a hotel chain, but I tend to think of them more as a way to top up my American Airlines balances instead.

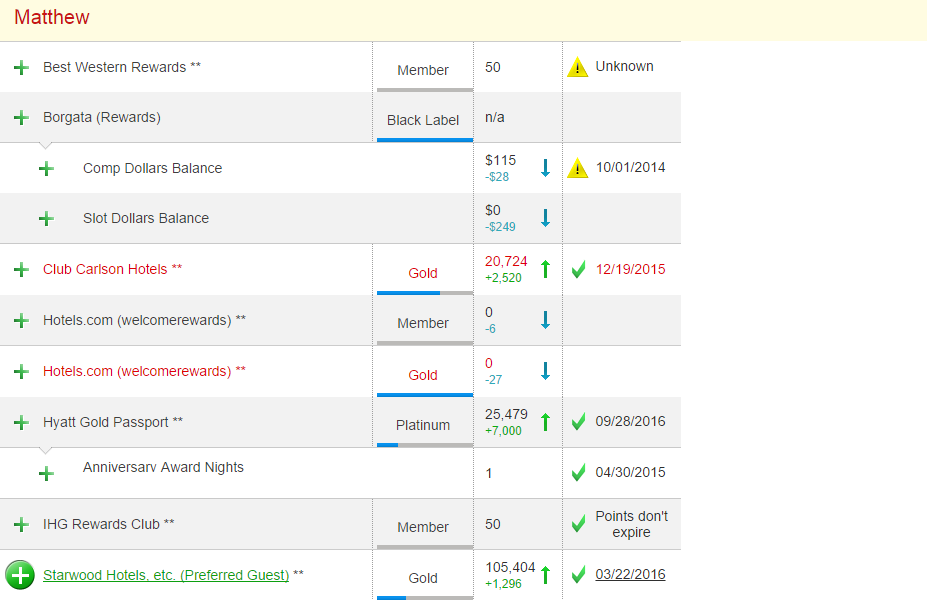

I store all my balances in AwardWallet, it is a great App that allows you to link all your accounts together, somewhat like a mint.com for miles, and also has autologin to the individual sites.

Variable Value when Burning

You most often consider the variable value on the earning side. This is the root of the Mileage or Mattress Run – where people pay for flights or hotels they don’t ‘really need’ in order to push them past a status tier. However, when looking at options today I thought about the variable nature on the burning side. My options were as follows:

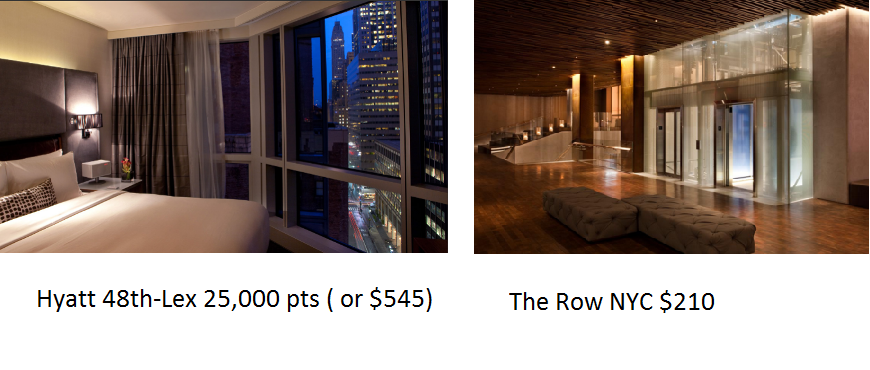

- Pay cash for a room in NYC – since I like my mum I would probably go for 4* or higher, the rate for that would be around $255 on Hotels.com once you add in Taxes/Fees etc. And then once you back out rebates, probably netting about $210 (welcome rewards+2x points on Credit Card+portal).

- Pay points from one of my programs:

- Club Carlson – far too short, plus no viable transfer partners

- Hilton – I have about 30K, would need to transfer 30-40K Membership Rewards for a night…

- Hyatt – 18K – would need to transfer 7-12K Ultimate Rewards for a night.

I did try to book the Park Hyatt NYC for 30,000 per night as a ‘treat’ but they had no award space. Ultimately we settled on the Hyatt at 48th and Lex, for 25,000 per night. Now, the hotel rate for the night was $545 so I’m sure someone would love to claim I got 2.2 cents per point value… but I would never have booked a hotel at $545 per night, so that is, as the French would say, bollocks. The 0.84 cent valuation I gave this award was to compare it to the $210 room I would otherwise have had to pay cash for.

The variable nature being that you’d pay a lot more for a flight if it made you a top tier status flyer, with perks for a year, so you are paying more good money for points/status. The reverse is that when you think about points as a way to protect your money, you’d be happy to lose the points and keep the dough. I’d always lean towards keeping dollars in my pocket, and low points balances.

I see orphans everywhere

No, I am not Mother Teresa, I am talking about Orphan Points. The ‘industry’ definition of Orphaned Points is those left over remnants that you can’t do much with. My Hyatt points weren’t technically orphaned because lower down the award chart I could use them for a room. However I see orphaned points as any points that are locked into a specific, non transferable program.

These points are sitting there doing nothing, other than offering a little opportunity value if I need a last minute flight somewhere. However, I hate holding onto points like these. Because I hate getting caught out with devaluations. That is why I recently booked a ton of Avios awards, because I had close to 150K through two programs, and it was just too much exposure. Tickets and ‘free travel‘ I love. Points balances, not so much.

Conclusion

By wiping out my meager Hyatt balance, and losing some Ultimate Rewards at 0.84 rates, I get to keep $210. My balance of 100K Ultimate Rewards can buffer this outflow, and will rebound (using regular spend) before I need to tap into again.

Ironically, I think that many of you might also think that 25000 for a $545 hotel was great value, and we both might have booked the same hotel. The difference is that if you think about it ‘the other way’ where it is 2.2 cents per night, you don’t mind buying, or ‘manufacturing’ points at a price below that.. to that line of thinking ‘buying Ultimate Rewards’ at 1 cent each would be a bargain, but when you do the math, perhaps it isn’t so cut and dried. For those who fly First and take a lot of trips, I can see the value in paying more for their points, but for the ‘average joe’ paying a net cost for your points, even one that appears discounted can be a real mistake.

Be careful when reading others valuations, if they are ‘selling’ a lifestyle you might find that their logic might work, but also you might find yourself buying points for more than you burn them for. I’m not offering 1M for proof otherwise, but if you think i’m wrong to value at .84 cents I’d be glad to hear why! And yes, there must come a time where the value ‘isn’t worth it’. For me the math on that is the spread between point acquisition and for an acceptable alternative.

I see your point, and recognise that it makes sense to compare the points redeemed for the cash you would have been prepared to pay for what you obtained with your points (flights, hotel, etc…). However, I think that the cash one is prepared to pay can vary according to circumstance. Let me give you a personal example. My family is in Europe, so I go back every year to see them, and I am perfectly okay doing so in coach, In that circumstance I would use the lowest coach price to get my cents-per-mile valuation. However, I recently had to have major surgery, prior to which I was on crutches and would not have been able to go home in coach as it would have been physically impossible. The only way home was in flat-bed business. Under that circumstance I would not have wanted to pay the many thousands of dollars it would have cost to go home as i wouldn’t have been able to afford it. Thus for me the valuation of those points was enormous (over and above the actual mathematical cost) as it allowed me to see family and friends prior to surgery.

Ultimately I think that there is no one-size-fits-all method for valuing points, but it is useful to think about how to value them under a variety of different circumstances.

The key is being able to quantify your phrase:

“Under that circumstance I would not have wanted to pay the many thousands of dollars it would have cost to go home as i wouldn’t have been able to afford it. Thus for me the valuation of those points was enormous (over and above the actual mathematical cost) as it allowed me to see family and friends prior to surgery.”

Absolutely it was great value to you, points are great value to me as I don’t need to spend my $210 this week. However there is a price you can find. For me, it is the price it costs to acquire these points. For example, you can buy airlines at prices that vary from 1.1 to maybe 3 cents each. If you needed 120K of them at 3 cents then your ticket cost would be $3600. That is your max value, financially.

However, my strategy of keeping about 100K in each program, plus some ‘bits and pieces’ of maybe 10-30K in other programs allows me to book a flight like you needed. And I find with some careful planning I can ensure I have enough points in the reserves to not need to pay very much at all for them… I am talking Annual Fee type rates, such as 50,000 for $95.

I love miles and points as much as the next person, but we should keep an eye on burning them faster, and with less attachment to their perceived monetary value.

Get well soon!

This may not have helped you, but I sometimes find great hotel value using my AA points. I was in Barbados and was looking at the local Hilton property (works great with kids). 50000 HH points, $230 USD or 10000 AA points. The choice was easy, I used AA points. Elite status may reduce the cost.

http://www.aa.com/carandhotelawards

Good point – I never remember that option. For this one it wasn’t viable (just checked) with the nearest hotel (3 star) coming in at 38,700 AA for the night. But can be great at other times.

Bollocks? Hardly. I’m in the camp of earning way more cheap miles than I can use (as in multiple millions). Why? Because of the flexibility. If I want to go somewhere, I want the best options available, not restricted by whatever few points I may have lying around (ie my time is more valuable than taking indirect/convoluted flights at odd times, or stay in mediocre properties just to save a few points). And because I earn so many so cheaply, it matters little if I don’t maximize value – if I want F or J on specific dates, I have plenty to cough up Standard rates if need be. But because I have so many options, I rarely have to pay those high rates – I choose another hotel or another airline alliance. And since I earn miles/points so cheaply, there’s rarely a time when using points is a more expensive option than paying cash – so it’s a no-brainer to always use points. I suspect you’d have similar attitude if you could earn as many cheap points.

I think we have crossed wires….My attitude is the same, to always use points. Unless perhaps at some awful rate that I’ve not encountered yet.

If that’s how you value the points, you’d have been far better off purchasing The Row at $255 using Chase UR at 1.25 cpm travel redemption, which would have only been 20,400 UR instead of 25k.

As I mentioned – the variable nature for some points, as they are near an award means that they are worth less in smaller quantities.

IE I don’t mind burning 7000 UR at 0.84 because I have the base of 18000 hyatt. I’d rather use up points within programs like that, and keep more variable points.

I think what you’re willing to pay for something has no bearing on what your points are worth in a case like this. Hyatt doesn’t price their rooms at what we think they are worth but at market values. It that hotel room cost $545 and you used 25000 points to pay for it, then your points were worth $0.0218 each. You can’t say that your points are only worth $0.0084 because Hyatt wasn’t selling the room for $210.

You can’t allow the vendor to control the pricing. It creates a disjointed understanding of value.

If there are two candies in a store, a Snickers and a Kit Kat. If the Snickers is $1 and the Kit Kat is $10 but you could also pay 500 pts for the Kitkat, are the points therefore worth 2 cents each?

If you think like that you’d be happy to buy 500 pts for $5 from the kid outside, and think you have a bargain, because you got 2 for 1 value.

I don’t think you’re example is a valid comparison, but I guess we will just have to agree to disagree.

No, I refuse to agree 🙂 Let’s disagree to disagree…

No wait…

I hoard away, and spend *almost* without the need to economize. If standard awards have a schedule that trumps saver, I go for it (domestically). I sometimes pay cash on hotels if its a short stay and fulfills a promo. E.g. Marriot 2 stays for 1 certificate. Its not unusual for me to have an odd number of work stays and a personal night could earn the promo, I view that as a beneficial shift. Otherwise, I strive to keep the cash.

“Man is a rationalizing beast, not a rational one” – Heinlein.

“Bollocks” is British English, baby! The corresponding term in French might be “putain” (look up the youtube vid — hilarious).

Since you put it out there in a photo, how’d you accumulate that many SPG points if you don’t mind sharing? MS, blog referrals, AE kickbacks for blogwork, etc, actual paid stays? Just curious, know how difficult they are to get, despite applying for and receiving the SPG promo cards.

2k per month AP, 2 spg, 3-4 referrals (refer a friend/ for all card holders) some regular spend for biz. I don’t get kickbacks from Amex and I don’t do paid stays.

I rarely redeem for rooms, but do for top 20k txf to airlines when needed. They’re actually at an all time high…

Thanks for such transparency Matt. Too bad about AP, I guess tomorrow is the beginning of the end. The only other really easy way I know of now, is Serve, doing $1,000 of credit card loads or $1,500 if signing up through Isis/Softcard.

Yep- that’s a good one. I’ve also used it for other bits and pieces, but I don’t like to manufacture spg as they cost money generally, even though they are valuable. My goto tends to be fid amex.

Oh and regarding the Park Hyatt NY. Similar situation. I don’t know of anyone who has gotten a reservation on points. Despite that frustration, I got an e-mail from Hyatt offering me a suite for 30,000 points PLUS $400 if I called them. No thanks. Went to site again though, no points allowed.

Yeah- called in and no joy. Interestingly twitter asked me for my GP number so I wonder if they might open it for some people…

Shame, would have been good bragging rights, and mum wants to do the museums up there, would have saved a bit of a walk.

Oh well…

Hopefully soon, once all the fanfare dies down. I tried to do the same with Hyatt Playa del Carmen today, the new hotel in Mexico. Same issue, availability for cash but couldn’t find availability on points, at least for my dates, Summer 2015.

Thanks for your article Matt, I really like your strategy of saving some 100k points in UR for emergencies, the problem is I have about 500K now. What would you do with the 400K leftover if you don’t have any travel plan in the future? I have to see them rotting in my UR account. Thanks

What a horrible problem to have… Go on vacation? Fly First class? Generally spend them 🙂

I think as of 10/25/14 (according to an e-mail I received) they are changing the rules of the UR program. Most noticeable is no more cash back or paper checks will be allowed, the way I read it. Not sure if you are thinking about redeeming any of that $5,000 worth of value but be aware.

Per the e-mail: “You can continue to redeem your points for cash through a statement credit or direct deposit into an eligible checking or savings account. However, Pay Yourself Back will no longer be available after 10/25/2014, and paper checks will no longer be available after 11/15/2014.”

Not sure if that means statement credit will still be available after 10/25/14 or if that will also be eliminated.

I missed this post.

I think of points the same way, I think. I like to keep about twice as many points in my flexable programs, but that is because I’m booking for 4-5 people and almost always book 2 rooms.

I just burned a bunch of my UR at 1.7 cents. Southwest flights for a last minute trip. I was happy to do so. I tend to think of them as a fairly unlimited resource since they are so easy to earn quickly and cheaply.