I remember vividly a lecture in school regarding the exploitation of miners, not only we’re they forced to work long hours, but rather than being paid in real money they were instead compensated in tokens that were redeemable only at the company store. What stuck with me about this situation was how ingeniously evil the plan was.

Firstly, the mine owner would be the only game in town, often the employees would be Freeman, or slaves who were working their way to buying their freedom, but they had little in the way of options and not much in the way of hope. In small towns there was a monopoly from the employment perspective and furthermore the employer would force you to buy from a limited selection, at a price designed to confuse and confound by being in it’s own special currency. This is known as the ‘Truck System’. One of the most painful effects of this is the rationalizations that people would go through in order to survive, and get through a situation where they were well and truly screwed.

When I look back at that I think of how unfair it was, and I naturally start to think of changes that can be made to adjust the rules of the game to make it fair for these people. The solution is quite simple; increase competition by having alternative employers and increase opportunities by having alternative outlets to spend your hard earned money.

History has a funny way of repeating itself…

Yesterday, when reading a post from Travel Summary which I disagreed with I found this same feeling rationalized, he was talking of the merits of the Ultimate Rewards travel portal and comparing earning on the Chase Sapphire Preferred with the Barclaycard Arrival. The thing that caught him and a lot of others out is the ‘bonus feature!!’ of the Ultimate Rewards Travel Portal.

Here’s how it works:

- You earn Ultimate Rewards points by spending on the Chase Sapphire Preferred card (2x for Travel and Dining, 1x for all else) plus a 7% annual bonus for paying your annual fee. This is the working in the mines part. You are being rewarded for your efforts (loyalty perhaps) with Tokens.

- These tokens, the Ultimate Rewards can be spent in several ways, including points transfers into Loyalty Programs which is pretty neat, but if we look at just the Ultimate Rewards Travel Portal for a moment it will help explain the problem people face.

- The kind folks at Chase offer an incentive to spend the points through their portal: a 25% bonus on your points!!! (!!!) this, is the Company Mine store that sells you a bottle of ketchup for 4 groats rather than a buck fifty.

The counter argument, from Travel Summary was that ‘the prices seemed pretty close to me’ which is a tough one to argue since it is anecdotal, however, I am not going to allow that to deter me.

Here is why it is wrong to value the Truck System of Ultimate Rewards Travel:

- You walk into the virtual ultimate rewards store and are offered to exchange your points (tokens) for their products at prices they set. This is major – you are living in a Truck System right here, sure you can maybe find a deal every now and then, sure you can rationalize it’s ‘OK’ but the reality is that you cannot buy from a fair market, you have to accept whatever price they deign to give you.

The rationalization process kicks in as follows:

- The prices are close to what I would expect, and the points are free so what the heck. AKA I have no other way to spend these tokens, and what I get for it seems close enough.

When the rationalization process kicks in everything else flies out the window – for example, when comparing the prices between providers we know we need to factor in the following:

Short Term Promotions – Often in the form of Promotional Codes that offer a discount for the booking. An example would be with Travelocity using their DEAL10 Code that knocks 10% off the price of a hotel booking valued over $250.

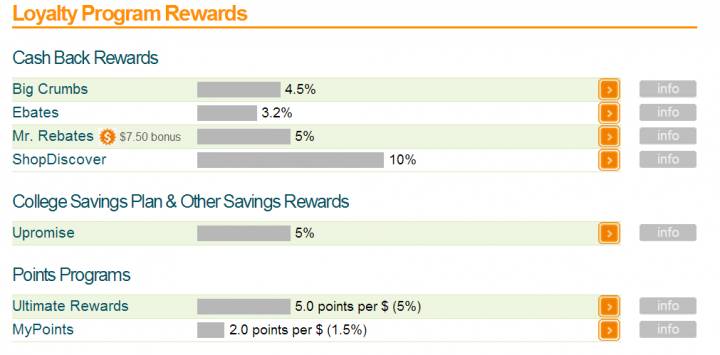

Shopping Portals – You can only earn shopping portal bonuses when you buy with a card through them. Most of the major online travel agents offer this; a quick search on evreweard yields the following for hotels.com – a huge 10% cashback from using your Discover card with the ShopDiscover portal, or a nice 5 Ultimate Rewards using any card through the UR portal.

Third Party loyalty programs

A site like Hotels.com has the Welcome Rewards program that offers 1 free night for every 10 booked. If you pay for your hotel through the Ultimate Rewards Travel program you cannot earn these, but if you book it through Hotels.com using your Barclaycard Arrival (or any card) you qualify – this is effectively worth 10% back in rewards.

Pure Markup from the Company Store

Even if you leave every single thing above off the table (and you would be crazy to do this) the price alone that is manipulated by chase averages from 17-25% above the prices you would pay by shopping around sites like Travelocity and Hotels.com, by the time you factor these things in also, it doesn’t even come close.

How the Barclaycard Arrival Works

You earn a 40,000 point bonus after spending $1000 on the card, and earn 2x points everywhere (not just on Travel and Dining) you then have the ability to ‘purchase erase’ from your statement anything that is in the Travel category. So you go and book on Hotels.com, earning the cash/points back from the Portal, earning Welcome Rewards towards a free night with them etc, and then when the charge hits your account you wipe it out using your points.

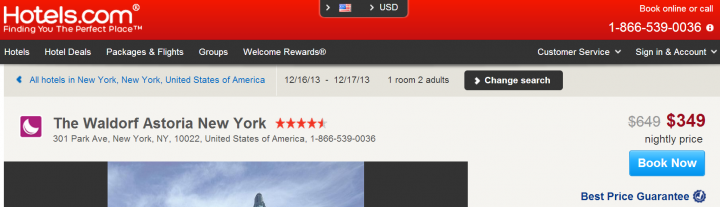

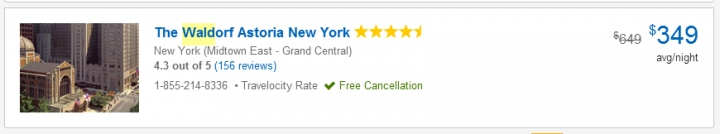

Whenever you do use the BarclayCard Arrival for this you also get a points rebate of 10% of what you spend, lets look at that quickly, picking a random room, at the Waldorf Astoria New York using different payment methods:

Example 1 Hotels.com, shopping through Ultimate Rewards Shopping (5x) with the Arrival Card

Nightly Rate $349

- Arrival Points Required to erase purchase = 34900

- Arrival Points Rebated for Travel erasing (10%) = 3490

- Ultimate Rewards Earned = 5×349 for 1745

- Welcome Rewards (from Hotels.com) 10% of Free Night earned valued at $34.90

Total Outflow 34900 pts, total inflow 5235 pts and $34.90

Net Cost (assuming 1 pt valued at 1 cent) = 26175

Example 2 Travelocity, shopping through uPromise Shopping (10% Cash Back) with the Arrival Card

Nightly Rate $349

- Discount Coupon Deal10 for 10% discount, new price $314.10

- Arrival Points Reward to erase purchase = 31410

- Arrival Points Rebated for Travel erasing (10%) = 3141

- uPromise Cash Back earned 10% $31.40

Total Outflow 31410 Total Inflow 3141 pts and $31.40 Cash

Net Cost (assuming 1 pt valued at 1 cent) = 25128

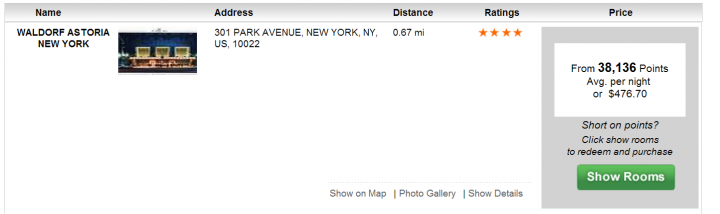

Example 3 Ultimate Rewards Travel, spending Ultimate Rewards Points with a 25% bonus

Nightly Rate $476.70 (yes, I picked the same night in all examples)

- Points Required when boosted to 1.25cent value = 38,136

To recap:

- 26175 pts using hotels.com coupled with UR Shopping, Welcome Rewards Program and the Arrival Card

- 25128 pts using Travelocity with the coupon, the Upromise Cash back and the Arrival Card

- 38136 pts using the Ultimate Rewards Travel portal even with its 25% extra value.

Conclusion

If you are forced to buy from the company store you lose the opportunity for the market to provide better value, you can rationalize all you want, but your options are limited, and you are at the mercy of their price setting. The advantage that the Arrival Card offers is that it allows you to shop around to find the best price, then purchase erase the cost, so you capture the cash back and other benefits of paying with a card too.

To read more on a comparisson of costs between Ultimate Rewards Travel and a site like Hotels.com read this post: Fracking Ultimate Rewards

Take a look at the post on Travel Summary and let me know what you think, I like this guys writing, but we can’t always agree on things like value!

The price isn’t even set by Chase, they use the same travel portal provider as Citi Thankyou program, and they tend to inflate hotel prices, but car rentals are priced competitively (usually) and flights are most often about the same as you’d buy elsewhere, although they’re missing a lot of the discount carriers like SW, Air Asia, Jetstar, etc..

Good to know Rick. Though your still trapping yourself to the company store, even if it is outsourced.

Where does the profit for a booming using points go? Do you think Chase gets some of it or not?

Yes! I saw the blog you reference too and appreciate your research here. I have virtually no experience with redeeming UR points for travel. My limited attempt to rent a car via UR found prices more than $100 higher there. Another anecdote, I know, but a surprising one for me because several bloggers claimed that UR is almost always better for car rentals. Maybe the exception makes the rule….?

Even if it does, I think the arrivals card is a better bet. And with a churn coming up, and my needing to choose between a Chase app for the CSP (I just downgraded my husband’s to plain vanilla Sapphire to save the annual fee when it hit) and the Avios offer which I believe is up to 100,000 again, I think I may just opt for the Avios. And get our household another Arrivals card while I am at it!

Yeah I’ve had little luck with the portal, but I will take into account what Rich says here and take a look to see how the flights price out – for me though, the Arrival is great for these types of trips, as are Avios, both work best for short hops.

To make my stance clear…I don’t endorse using UR points for cash-back type awards. Even with the devaluation, you can still get a much better deal by transferring to BA or United directly. Even on coach awards, you can almost always get 2+ cents of value out of them. Hyatt also comes handy sometimes in expensive cities.

The Arrival now is my goto card. Ink Plus comes next 🙂

I’m a fan, my goto remains the Fidelity Amex, but I do like the Arrival a lot since I do have enough travel incidentals to make it worthwhile.

I’m not going to write a huge rebuttal or anything, but it’s really not that uncommon to find the exact same price on the UR portal. I wrote the below post a while back on a super-cheap mileage run fare that had the exact same price on the portal as on United’s website. Your argument is as anecdotal as mine.

http://travel-summary.com/sometimes-its-better-to-not-transfer-your-ultimate-rewards-points/

In your example you compare United.com with Ultimate Rewards- meaning you left off the chance to get extra value on a revenue ticket by buying through a OTA and shopping portal.

The differences on hotels and cars seem massive, I will have to look at flights more closely.