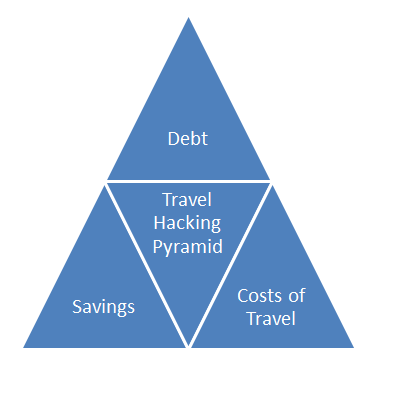

I am hoping not to offend any readers here, but would like everyone to have something of a Travel Hacking Reality Check when it comes to the hobby of collecting Frequent Flyer Points via Credit Card Spend. It might not be a good thing for your finances, and maybe you shouldn’t be doing it… There is an ever increasing network of resources to help people get into the Travel Hacking game, the idea of traveling for free and experiencing First Class travel and 5 Star Hotels by using points and miles is so attractive that the flood gates have opened up and blogs and forums are filled with helpful people trying to guide you on the right path; indeed I have done so in some of my posts here too.

I am hoping not to offend any readers here, but would like everyone to have something of a Travel Hacking Reality Check when it comes to the hobby of collecting Frequent Flyer Points via Credit Card Spend. It might not be a good thing for your finances, and maybe you shouldn’t be doing it… There is an ever increasing network of resources to help people get into the Travel Hacking game, the idea of traveling for free and experiencing First Class travel and 5 Star Hotels by using points and miles is so attractive that the flood gates have opened up and blogs and forums are filled with helpful people trying to guide you on the right path; indeed I have done so in some of my posts here too.

However, from the number of reader questions I receive I am starting to worry that people are Traveling for Free who cannot afford to do so, and this can spell real problems for them. Also, the people that I am meeting with in real life don’t seem to have enough idea of money, or actual money, do be playing this expensive hobby.

The crux of this comes down to the value of points and miles, people hear that a certain mile is valued at X, subjectively, and therefore lock on their goal to accumulate and then spend these points on a trip or trips of a lifetime. Earn’em and Burn’em. Indeed, that is the only way to use miles, you shouldn’t hold onto them as their programs are just waiting for a devaluation.

Manufactured Spend isn’t Cheap

Recently people have approached me with questions regarding fueling Manufactured Spend – in order to manage many of the Manufactured Spending opportunities out there you require a certain amount of ‘float money’ for example, if you want to buy gift cards and cash them out via Kiva you get Cash back and points, so typically end in profit (though there is a <1% Default risk with Kiva it does exist and should be factored in). With Kiva you can loan for a minimum of 6 months before your repayments are made in full, meaning if you put $1,000 on your Credit Card you have to be able to float $1,000 for 6 months until the money is returned to you in full.

The concerning area I see now is the number of people who are suggesting not contributing to an IRA this year and using the money for ‘float’ purposes instead, making a conscious choice to ‘invest’ in points instead of their retirement. Now, whilst many people wouldn’t make such a conscious choice, how about an unconscious one?

How many people are purposefully, or not, avoiding targeting money into key areas of their financial ecosystem in order to play the Manufactured Spending Game with the wealthy people who can and have taken care of their financial responsibilities?

Prior to engaging upon Manufactured Spending for Points and Miles

Debt Analysis

When deciding to commit money to a pure points and miles earning strategy you should consider what is your current debt situation, and would the money be better used to pay down debt. Firstly. you should never carry a Credit Card balance (unless it is interest free) whilst this seems obvious, even transferring to an Interest Free Offer in order to free up cash will likely kill your Profit/Loss from Manufactured Spending, since these typically come with a one time charge of 3% for the Balance Transfer.

When looking at other debt the numbers that matter are the after tax cost: certain debt, such as Mortgage Interest, Home Equity Lines/Loans (HELOC/HEL) and Student Loans are tax deductible. As such, many people recommend that you don’t pay them down and keep the equity for ‘investments’ but it is worth noting that some of these HELOC/HEL and Student Loans have high starting interest, and if you haven’t refinanced your Mortgage recently then you might still have a high rate on that too.

Think of a 6% HELOC, for $10,000, that you are using for Manufactured Spend or any other sort of ‘Investment’ in one year you will pay $600 in Interest on that $10,000 which is Tax Deductible, however, that doesn’t make it free money, it means you get something between 20%-30% of the interest paid returned to you in the form of the deduction – and if you are using a HELOC to fund Manufactured spending the chances are your salary is low enough to be in a lower tax bracket, making your gains even smaller. So you are paying, on top of other things, $400 per year or more to fund your 2 cents value per point.

Savings Analysis

Once you have passed the Debt Analysis test and have decided that you have a certain amount of additional money for investments, make sure you have your savings sorted out too. Each year you need to contribute to certain things:

Emergency Funds

How much do you need and why? The amount of an Emergency Fund alters inline with phase in life, if you are younger, with no kids then you want at least 6 months of monthly expenses in an Emergency Fund, if you are later in life and have a family then the number should be 12 months. I always think about what ‘Emergency’ there could possibly be for me to need the funds, and mostly the scenario is a medical problem – so think about your insurance too, if you aren’t properly covered will the amount in the fund cover you for 6-12 months if you became sick?

Retirement Accounts

Company Plans like the 401(k) and 403(b) aren’t enough, you should also fill up an IRA, either a Traditional or Roth IRA (I just set up a ROTH, it is very easy to do). They come with phase out limits on income, Traditional 59K Single and 95K for Joint Filers; ROTH IRAs are higher at $112,000 single and $178,000 Joint. If you are under the phase out limits you should be striving to put the full $5,500 into one of these IRAs every year.

College Savings Accounts

Coverdell and 529 Plans are good for today, when you don’t have kids, and in the future if you do. Of course we all want our children to get a full scholarship to college, but if that doesn’t happen, or they need funds to suppliment it then having a college savings account is going to make a huge impact. Also, you can use them to pay for your own qualified education expenses if you decide later in life that you want to go back to college yourself. In New York, the amount you contribute is State Tax Deductible, and Federal Tax Deferred.

Taxable Accounts

Brokerage – these savings are critical when you hope to play any strategies to increase Tax Free income or increase Social Security income. The Taxable Brokerage money will be the funds that you rely upon to pad your annual income to delay accessing other forms of retirement money so that it can appreciate further. Ignoring this will be to your detriment.

The Costs of Free Luxury Travel

So you have your Debt under control, and have met your Savings commitments, now you have the opportunity to Travel for Free with the Rich and Famous, however, you should realize that Traveling for Free isn’t a cheap thing at all. Now it is time to figure out how much you can afford to travel.

Dining and Tipping

Typically when traveling you will be staying in a nice hotel (paid for in Points) which will not come with a kitchen, you will be dining out 2-3 times per day. Hotel dining is notoriously expensive (when I meet clients in Tokyo I am often paying $15-20 per cup of coffee), and nearby restaurants can also add up quickly. Dining out that many times a day isn’t sustainable and not something that you would typically do at home, so you can expect a burden from this.

This is exacerbated when you shoot for the stars – many of the most amazing hotels available are removed from the general city location and create a captive audience, an example of this would be the Conrad Maldives Rangali Island where I stayed for free earlier this year. The 4 night stay should have cost us several thousand dollars in the beach villa, but we got it for Free on points! Total Cost: Several Thousand Dollars!…. Yep, once you add up the extra costs of getting to the resort (sea plane required) and Scuba diving at inflated prices we were out about $4,000 for four nights. A bargain some might say… I see an ever increasing list of high end properties that are actually more of a Resort to them, meaning that they can artificially control prices and your folio will be very expensive on that free trip.

Other Costs to Consider

- Travel to and From the Airport

- Dogboarding (check out Dogvacay for this!)

- Award Ticket Fees

- Cash when you Pay Cash and Points for Awesome value (can be up to $100 per day of value right there)

- Paid Upgrades – The Beach Villa At Rangali Island not good enough for you? Has to be Overwater bungalow or nothing? A snip at $150 -$350 per night extra depending on if it is guaranteed or available at check in .

- Visa’s for Entry and Exit Sorry to my US Readers, but you guys pay the most for Visas (I’m a Brit and typically I pay half what Mrs Saverocity pays for a Visa when I travel on my British Passport).

- Specialized activities – Scuba Diving anyone? Traveling without your own equipment can make a dive very expensive if the operator forces you to rent everything from them, some places (like the Conrad) won’t let you dive without a Dive Computer, which you can rent from them…. I guess that is for safety reasons which is why I found it funny they didn’t teach us how to operate their model!

- Oh and don’t forget that apparently everyone wants a souvenir!

So, if you are on the tight end of things and using Points to travel to far away lands you might want to take a long look at your finances and decide, even if it is free, can I afford it?

Don’t burn your passport yet…

So, whilst I am suggesting that people stop focusing on earning points for free travel, I do think that a certain amount of it is still a great idea. My proposal is that people use Credit Card signup offers exclusively to fund their travel needs. Any other manufactured or regular monthly spending should be done on Cash Back cards, so that you can cover the gaps in your Debt and Savings Plan and use the tricks of the trade to get out of Debt and plan your retirement better. The additional income from this should help with some of the costs that come with even Free Travel and overall you will be in much better financial shape. If, on the other hand, things are good for you financially then absolutely points start having real value, but until you get your house in order, you should focus on something with much more tangible value – real cash.

Personally, I am about to embark on my next challenge, I hope you will join me, as I seek to build, for free, a Brokerage account using Cash Back that will help me grow my Net Worth. In tandem with this, I will continue to apply for the right credit cards to keep traveling for free, but that will be a much smaller part of my overall approach to Credit Card Rewards.

I have created an anonymous Survey on this site: http://saverocity.com/survey where if you could spend a few minutes to answer the 10 questions there related to Finances and Points I think we might be able to get some interesting results to talk about this subject more.

Leave a Reply