Repeat after me: My name is <insert name> and I have a travel hacking problem. I want to acquire points for travel and I keep on finding all these new ways to do it, but I don’t really know what the hell I am doing. I get it, we all need to earn points so we can post pictures of our first class seats and tweet how we got to drink a few glasses of Krug and attempted to eat some caviar without puking in our mouths. But we have to keep a grasp on reality folks. All that glitters is not gold….

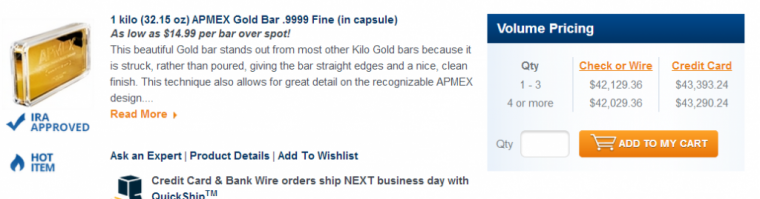

For those of you who haven’t headed over to the finance side of my site recently, I just wrote what I consider to be a fabulous article on Investing in Gold. Please take some time out of your busy day to read it and share it with friends and family via twitter. They will appreciate the diversification of your tweets as it is nice to see something other than your Foursquare checkin at Walmart, making up #amexhashtags and pics of planes you really want to ride in. Once you understand the risks that come with investing in Gold you might get all excited about this little number:

Here is what happens:

Level 1 Travel Hacker

Description: can barely write their own name, drools frequently in public, never stepped on a plane and hasn’t traveled further than Detroit on a bus, starting out in Windsor, CA.

OMG – I can put $43,393.24 on a credit card, this will mean that using my Barclay Arrival Card, with points I value at 2.80 I could earn enough cash back to get a bus all the way to Vegas and spend 4 nights at Excalibur!

Matt’s response: OK, clearly if you are hoping to ride a bus to Vegas and stay in a crappy hotel you have no good reason to have a line of credit that will allow for that size of purchase. I recommend getting a vasectomy instead, and saving the future of the human race.

Level 2 Travel Hacker

Description: Until they found Flyertalk and Dans Deals they were a Level 1 Travel Hacker with a bit of promise. These folks know a deal when they see one, especially if it has arrows attached!

Oh Lordy this looks sweet! I can put $43,789.04 on my Business credit card that has a super high limit and is in my own name as sole proprietor. I wonder if I can get a category bonus for GOLD!!!

Matt’s response: Good to see you got that $50,000 credit line and will be using it wisely, perhaps you should look at the regular earn rate on those cards, multiply it by the value per point you think is appropriate for your First Class travel needs and see how close you are to an award. Oh, and how are you going to pay down that card again?

Level 3 Travel Hacker

Description: Within 3 months of finding Flyertalk they realized that copying and pasting the content into wordpress would result in enough income to support a family of 8. They employed a high level developer via freelancer.com to do the technical stuff, bought a Macbook Air and are now camped out in Starbucks saving the world, one drooling hacker at a time.

Hmm if I divide the cash cost by the credit card cost I can see that they are charging a spread of 3% for using the credit card. However, if I can find a credit card offering 5% I can net a 2% gain from this transaction, which is what I plan to do.

https://www.youtube.com/watch?v=SUS4TpBry6c

It just doesn’t work like that! There are two key factors that you are missing. The first one is the door slapping your arse on the way out- remember the spread when you bought the gold, it was Spot Price + Premium + 3% = $43,393.24 well when you try to sell it back to them the price they will offer you will be Spot Price – Premium = $41,000.89

What that means is that if nothing at all happens to the price of gold you would be looking at a net loss of $2392.35 on the asset sale. If you could find a 5% card that would have earned $2169.66 so your proposed spread of 2% net profit is actually a loss.

It Gets worse!

The real problem is just that they are using the spread to control the entry and exit prices, it is that you are at the mercy of the market. Look at what happened to gold last week, in just one day it dropped 2%:

What happens then? You are on the hook for a $43,393.24 credit card bill and all you have is a lump of gold that they would have bought back from you at a loss previously – now knock another 2% ($876) off the price and all told you just lost over $1,000. And there is nothing you can do about it. This is gold we are talking about here, which is a very sluggish beast – I have seen numpties thinking like this with fricking Bitcoin – that can swing 50% in price in a single day!

The point is simple. If you are manufacturing spend to gain points the underlying vehicle must be stable. That is why the dollar coins from the mint worked – they cost a buck, and they were worth a buck. As soon as there is the potential for change in value you have to be able to throttle that completely in order to eliminate risk. The way it is done in reselling products is to know the market, and apply coupons that reduce the basis price fare below fair market value. When it comes to gold, or other volatile investments you don’t have that luxury, in fact with gold you are actually marking up rather than marking down your basis.

So please, for those of you that enjoy the finer things in life, don’t lose sight of the big picture when collecting your next credit card point.

Always good stuff here.

I’m here to serve, Bart.

Whoa Whoa? The Excalibur a crappy hotel? Say it aint so

I spent some time there back when I needed to attend tradeshows in Vegas and had no money, it’s actually rather fun!

Good one, Matt. Really good. Summed it up beautifully in the end. People should think what they are up to. Just reading blogs, forums and collecting whatever comes by doesnt make sense – as you rightly said, underlying vehicle should be stable.