Tax returns require accurate data. The purpose of the accounting system underlying that data is to substantiate it, and have clear record of your transactions to back up what you put on the tax return in the event of audit.

I used Xero this year for my Reselling business, and when I’d finally reconciled my year, I was out by (at least $17,000) of profit. I used the Income Statement Report and the Balance Sheet report to find the problems and mistakes that I made, and have highlighted them in this post ‘mid parse’ to help share common mistakes. First, a quick primer on Reconciling accounts.

Reconciling means matching up transactions in the ledger to their purpose for your business, and coding it accordingly. You generally need to look at two types of event when reconciling:

- Matching/Creating a transaction (Spending Money)

- Transfer Transaction (eg paying the credit card bill

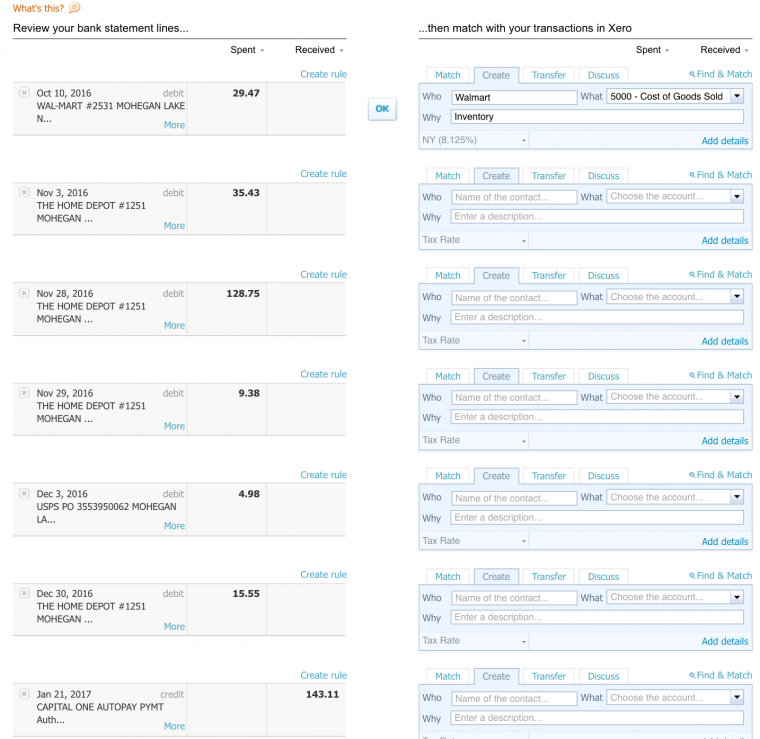

Here’s a list of the reconciliation page for my Capital One card:

The first item is ‘Walmart Inventory, Cost of Goods sold account’ This is generated automatically. I can do this by telling Xero that any transaction at Walmart is COGS, and then come in to check the ‘OK’ box to reconcile. This rule creation makes book keeping a LOT easier!

Note that I can’t run the same rule on Home Depot because I buy boxes there for shipping, and also sometimes buy Inventory – so I need to manually tell Xero the account.

The last transaction, at the bottom is called Capital One Autopay, this is a ‘Transfer’ transaction.

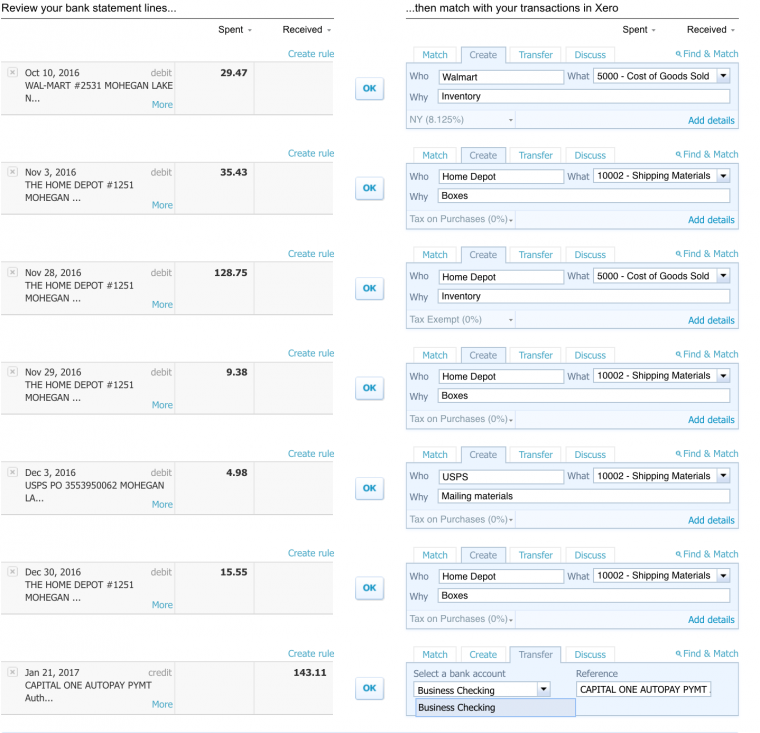

Creating the matches, note that the account (5000 COGS or 10002 Shipping) is what matters here, much more important than the ‘Who or the ‘Why’.

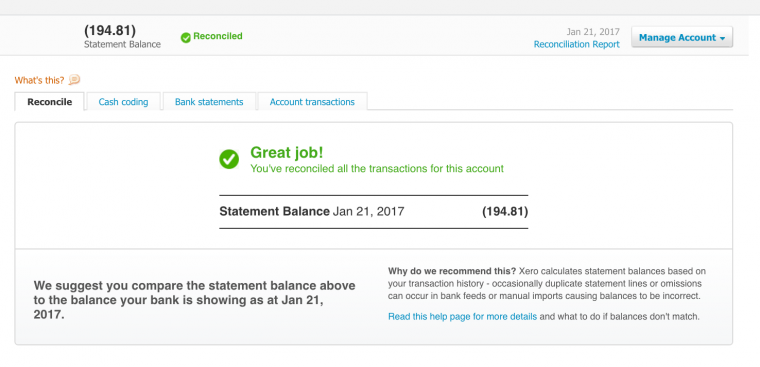

Hitting OK – creates a reconciled account

This process is the key to your final year book keeping, and ultimately is the source of all my errors. I found them by looking at two key reports, the Income Statement and the Balance Sheet. The income statement shows profit/loss (Income/Outflows) and the Balance Sheet shows how much is retained or owed by the company in terms of assets/inventory/profit not distributed.

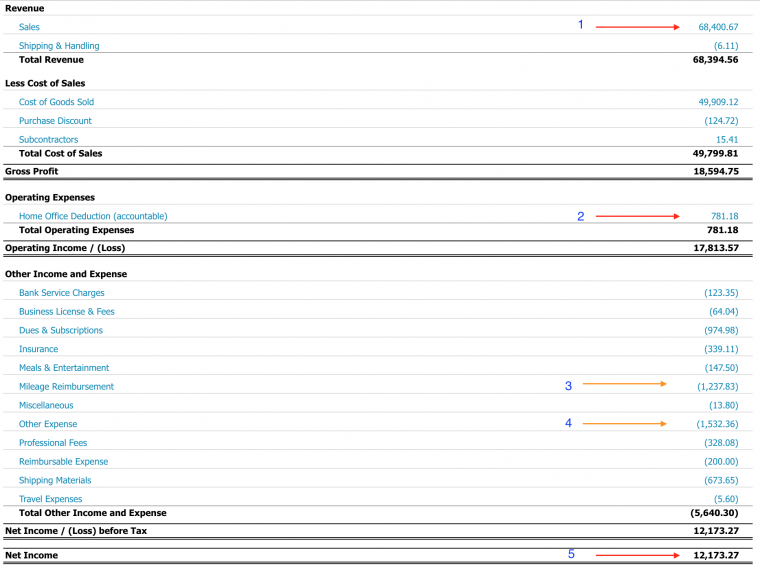

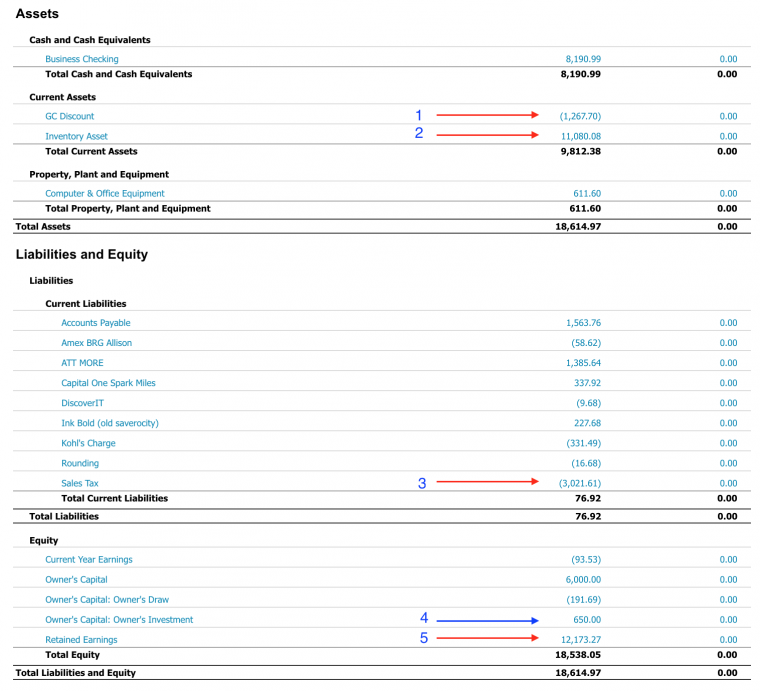

Below are my reports, I’ve highlighted the areas that I ‘know’ are incorrect, these will be the first parse, and then when fixed, I will take a finer look at the details on these reports.

The Income Statement

Errors:

1 Sales. This figure is generated from the transaction within Xero. If my business checking states I received $100 in sales from Amazon, what actually happened is that I sold perhaps $128.55 on Amazon, but after their fees my ‘net’ is $100. I need to change the inbound transactions from Amazon to reflect the actual total sales, and then deduct fees from that to balance to $100.

2. Home Office Deductible (Accountable) This was an error. I thought I could take $1500 per year from the home office using the Simplified Home Office Deduction. However, if I wanted to use the Accountable plan for this I’d have to use the averaged actual costs. To resolve this I’m going to recode all the money I took out here as ‘Owners Draw’. I’ll then take the deduction for $1,500 on my return instead. Also, the amount of $781.18 implies that something else got bundled into the coding, since I was reimbursing this at $125 per month.

3. Mileage Reimbursement – I just know that I didn’t book December miles, so I need to come back to add that.

4. Other Expense – I was lazy creating accounts within Xero so many things fell into this generic ‘Other Expense’ category. I need to look at this and perhaps clean it out, assigning to a new account code.

5. Net Income – this is the big one… $12K in net income. That’s not what I had planned at all..! Originally, the figure was $17K, but I found the root of the problem and started the tidying up process.

The reason that the Income Statement shows a net income of $12K is hard to spot. As the business owner it is hard to fathom, since I knew I started with $6,000, I had $8,190.99 in checking at end of year, and about $3,000 in unsold Inventory. I looked over to the Balance Sheet for some help.

The Balance Sheet tells us more:

GC Discount Account

GC (Gift Card) Discount Account – considered as a current asset. This is incorrect. The way I set up my books I created two accounts for discounted gift cards (from Raise etc). If I bought a $500 gift card for $450 I would add $500 to GC Account, and add –$50 to the discount account. If I had unspent gift cards, I could carry this amount forward. I plan to change the balance to zero by creating a transaction of –$1,267.70 in my COGS account, and pay for it with this account… weird, but it will work. This will increase my profit.

Inventory Asset Account

The amount here is far different from my $3,000. The reason for this is that when I started coding purchases I tried to use Xero’s Inventory Tool. I added Inventory, but then I found the process too cumbersome to continue, so I never ‘removed’ the inventory on the sales invoices. I’ll clean that up to reduce the Inventory number to the accurate amount. This adjust the retained earnings shown in figure 6.

Sales Tax

I captured Sales Tax on my purchases and tracked it. This was a mistake. Sales Tax for purchases should be part of COGS, and there should be a zero balance here. I’ll need to edit this.

A final note to figure 4 Owner’s Capital. This was a difficult one for me with regards to credit card bonuses. I used the Citi AT&T card and received a statement credit of $650. I consider this bonus to be a personal bonus, and non taxable. Therefore by contributing the amount to the business in the form of not having to pay $650 of the bill, it was Owner’s Capital. I haven’t filed yet, so I may re-evaluate that.

Conclusion

The hardest part of book keeping is deciding what account to code to, and remaining consistent. My flip/flop on the Inventory Tracking mid year caused the reports to be wrong, so I need to go back and fix that. Luckily, knowing how much should be there, and what is actually reflected helped me want to track down the errors.

As an aside on personal taxes, I also ran a partial Roth conversion of $9,000 at year end. And when I saw that the result from Xero needs some cleaning up, I decided to push a $1,500 Estimated Tax Payment for Q4 to bide time until I calculate the pass through income (if any) from the Reselling business. My plan is to run through the tax reporting on this, along with four other W2’s for the year and use Traditional IRA’s to lower MAGI below a certain point for optimal tax credits. The $1,500 1040-ES will likely be unnecessary after doing this, but it also allowed me to meet min spend on a new card…

Interesting, I manually calculate the GC discount on the front end rather than the back end. It takes a little time and messes me up a bit with inventory numbers (e.g. qty 9 @ $21.10 and 6 @$21.11). The way you are doing it seems smarter and easier.

May re-evaluate going forward. Did you realize this was the better way from the start?

Yes, I think this is the best way to deal with it. The way it works:

Buy $200 GC for $185.

Add $200 to GC account, add -$15 to discount account

Buy Inventory for $235.

Pay for inventory with $200 GC, $35 CC

CC account (bill/statement) shows a line item for $35. This $35 then matches the bill for $235, and the GC account is drained.

This also allows you to track balances. You could do it for all accounts, eg Staples GC account, Sears, etc, but I just use a generic account for all.

Finally, at year end, you need to eliminate/reset the GC discount account for all GC spent. If you are still holding the cards, then the liability account could represent that moving forward. Until you ‘realize the liability’ (like a taxable sale) you haven’t truly brought the discount into the COGS figure for P/L

Thanks – I love reading about stuff like this – especially with real numbers. How many hours would you guess you spent creating the $60k in revenue?

Hard question. Firstly, it’s more like $100K in revenue (remember I have to build that number up then deduct fees). Secondly, this included the period of learning the ropes. This was inefficient.

Now, since effectively stopping I would say I do about 1hr a week, and I might see a similar amount of revenue this year if I maintain that.

Thanks Matt, this is a very helpful for beginner. I also wondering how does the points valued when it comes to reporting tax for business? For example if I got a Amex Business Platinum card and earned 100k point for signup bonus and 200k for spending in the business. How would I report this part since there is no “standard” value for it? Thanks again

That is not a taxable event. No reporting.

Hey Matt – Thanks so much for posting. As someone who started venturing down the reselling path earlier this year, I really love this stuff.

The GC discount bit is especially helpful. What would you recommend for someone wanting to learn more about accounting/bookkeeping for reselling? (I already know taxes this year are going to be a pain in the @rse, but I’d really like to make things easier moving forward.) I read in an earlier post that you became a Xero Certified Partner – in hindsight, do you find this necessary? What was the process for doing that?

I don’t know that I’d go that far. It’s a qualification aimed at making you a professional book keeper rather than just adept at books.