Edit – per the comments, you can’t discount via the Coupon then use Kohl’s cash, so ignore that part of the post.

Kohl’s cash is a wonderful thing. For the uninitiated, it’s a bit like real cash, but you can only spend it at Kohl’s. Generally, you earn $10 for every $50 that you spend, though I believe once or twice a year they up it to $15 per $50.

Earning it is pretty easy, spending it is pretty damn hard. Not because of any inherent program rules, but because of my incessant desire for value, and my struggle to spend in general. I thought to do a quick case study to explore further. Let’s assume that I earned say, $280 of Kohl’s Cash last night, and it will soon be sitting in my account ready to spend.

The Case of the Fancy KitchenAid Mixer

After many years of discussion, we’re almost at the point where we can agree to buy a KitchenAid Mixer, one of these things:

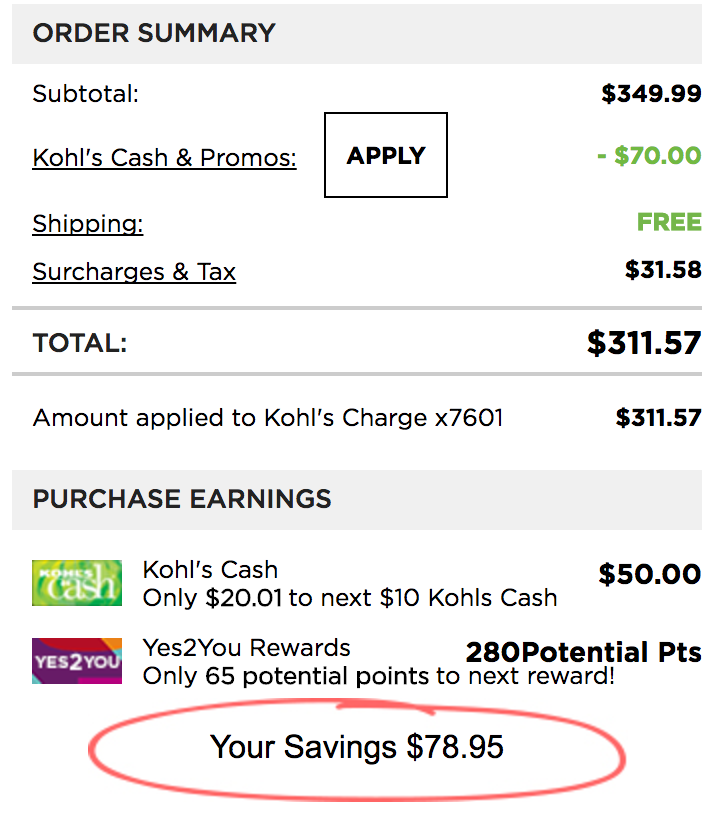

So how to pay for it? Kohl’s has it listed at $349, but the good news is that it qualifies for their coupons, which could be 15-40% off. I personally have a 20% off coupon (though you can often buy 40% coupons for a few bucks online).

Note: If I could get 40% off, the price would come down to about $209 plus tax, which would be a good deal. But at this moment, we’re limited to 20% off, which is somewhat the point of this post.

With more than enough money to buy this using Kohl’s cash. Is this the best solution? The answer (for me) is no. The reason why it doesn’t work is that we’re getting caught up with the notion of free money, and ignoring the true market value of the underlying item. This is the essence of the ‘Truck’ system which I first wrote about in 2013.

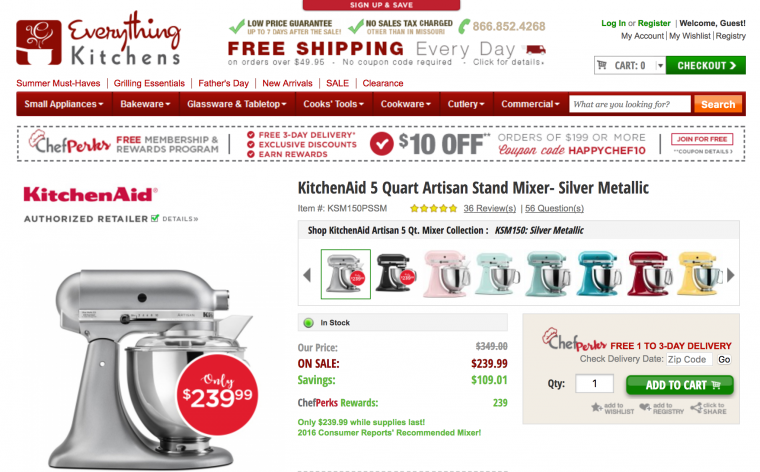

Instead, we need to examine both the ‘earn side’ and the ‘burn side’ of the equation, and look into how we optimize for both production and consumption. A quick search leads me to the following:

Before we get into any advance stacks/giftcards, we’ve got a base price of $239.99 (plus it looks like $10 on the top of the ad here) which is substantially cheaper than the $280 base price from Kohl’s ($349-20%) and therefore a more attractive purchase.

But what about Fungibility?

Funny money, like Kohl’s Cash we should always value less than real money, but when we’re converting for a like item (the Fancy Mixer) then focusing just on the method of payment can be deceptive. The true way to look at this decision should always be:

What is my net worth (including a line item for Kohl’s cash) before, and after the purchase? This is a much more sophisticated approach than ‘I’m spending my free money and keeping my real money’.

Let’s compare Bob and Bill, both have a net worth of $1000 and $280 of Kohl’s cash, both want a mixer.

- Bob pays cash for the mixer, and gets it for $230. No state tax as he lives in

Florida, New Hampshire. His new net worth is $770 and $280 of Kohl’s cash. - Bill pays $280 of Kohl’s cash for his mixer, and keeps his $1000 in cash.

This is where many might think that Bill is smarter, with his free mixer. But if we decide to value the mixer as an asset, at perhaps $200 due to some depreciation, it looks different:

Bob

- Mixer $200

- Kohl’s Cash $280

- Cash $770

- Net Worth = $1250

Bill

- Mixer $200

- Kohl’s Cash $0

- Cash $1000

- Net Worth $1200

Note you can take the mixer asset out of this equation for both, and Bill is still behind Bob.

This is where people might state that due to fungibility, $280 of Kohl’s cash isn’t worth $230 of real cash, and there are some strong arguments for this. However, if you can find a way to spend Kohl’s cash at Kohl’s in a better market rate than the Mixer, you’ve found the true answer to the dilemma.

For example. If a pair of shoes are on clearance at $40, you could buy 7 pairs of them with Kohl’s cash. If you could sell them for breakeven, or more, then you’ve converted Kohl’s cash into real cash at a rate of 1:1 or higher, and then used the real cash to get the mixer. I did this recently with a pair of Nike’s at around $40 that are selling for $65.

There’s a lot of mental gymnastics here, you’ll probably come up with a bunch of reasons for why you want to spend the free money instead, the big one might be that dreaded topic of Taxes.

Let’s look at the 25% bracket and the $280

Buy cost 7*40. Sell cost $65. Net after Amazon fees (illustratively) $53. Your gross profit here is $53, as your Cost of Goods Sold (COGS) is $0. So by selling 7*$53 you’ve generated taxable income of $371. Which at the gross taxable income level would be a tax liability of $92.75

Let’s look at net worth again

Bob

- Mixer $200

- Kohl’s Cash $280

- Cash $770

- (Subtotal) Net Worth = $1250

- Kohl’s Cash spent $280

- Business income $371

- Taxes from Business $92.75

- Net Worth $1248.75

Bill

- Mixer $200

- Kohl’s Cash $0

- Cash $1000

- Net Worth $1200

As you can see Bob’s liability went up, as did his income. Overall, with taxes, he lost a small amount to attrition on liquidating the Kohl’s cash. Though we should note that if the profit margin was smaller, the gain would reduce, possibly to something less than what Bill has.

However, we’re also over simplifying a lot here, by generating income without really introducing new ‘deductions’ that can null out the tax implications of the income. For example, new equipment, retirement plans, travel, and other items all reduce income. Some keep the money in the ‘family’, such as a 401(k) whereas others generate expenses from nothing, such as the Standard Mileage Rate.

This is the area where things get more subjective. If you’ve truly maxed everything (and if so please tell me how much is in your Cash Balance Pension) then you might struggle to find a better/ easier solution than spending your rebates on yourself, but if you haven’t, then throwing rebates back into Inventory can be a smarter move.

While the focus here is reselling, the notion of always looking for optimization on what you’re buying should apply everywhere. This is the point where we start examining using cash for travel rather than ‘too many’ points, and where we monitor and grow net worth by viewing everything as an asset or liability.

You wouldn’t get 20%off the mixer if you paid with Kohl’s cash. Discounts are taken after Kohl’s cash is applied. If you used $280 of Kohl’s cash you would get a discount of 20% off of$69, the amount of the purchase price remaining after applying Kohl’s cash.

Ah, cool, thanks. I think my underlying point stands, but that’s a major error with the post.

Id rather do nothing than to buy stuff to resell from Kohls.

Also are you saying there isnt state tax in Florida? Its 6% state sales tax here. Wouldnt BillyBob pay 230 +6% tax? This whole scenario is messed up from start to finish

LOL good point! But it doesn’t matter… it’s all COGS. I’ll update it so that people don’t get as confused as you were.

A valid point, StartSpreadingTheLove. But if you close your eyes and think real hard, you can apply the concept to other points or miles 🙂

This is an interesting post, especially since I used to work at Kohl’s (their world HQ, not a store or distribution center) in IS-Marketing, and was on the team that designed Kohl’s loyalty program. I have always followed the “spend funny money first” philosophy, but I can see the alternative now. Back when I worked for Kohl’s, I was a little bit naive about a lot of this, TBH. Thanks.