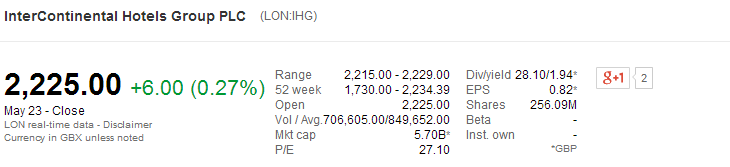

Yesterday, the Telegraph of London announced that Intercontinental Hotels (IHG) had spurned a 6B GBP bid to acquire the chain. The source of the offer is unconfirmed, though speculation has it that Starwood may be the suitor. In the financial world here is what would have just happened to the IHG stock price:

- Market Cap prior to offer 5.7B GBP

- Offer – premium of 0.3B GBP

If the market considers the offer viable people will opportunistically jump into the stock, hoping that they will capture that 5% premium, in fact even if the offer is rejected (as it was initially by IHG) the price of the company will like rise to 6.0B or above as money flows in waiting for a higher, or competing bid. However, if the market doesn’t think this to be the case the price might hover where it is today at 5.7B, with the price held below the offer and the spread being the risk premium.

EDIT – noticed that it was a national holiday in the UK today also, hence the lack of movement – watch for a pop tomorrow on LON and the ADR over here. Will in the comments states the offer has increased.

Markets are tricky things to predict, and profiting from the news of an acquisition is very hard indeed due to the banks holding all the cards – if you do spot a sweet deal in the news, the price will have been bid up above the profit line before you could come close to it. It is notable to see that the market has just closed in London and the price of IHG has not surged at this time.

Points on the other hand… might be an option

While buying stocks on speculation of acquisition is a game stacked against the individual investor, perhaps acquiring points could be valuable. Such speculative purchases have pros and cons. Personally I still see risk involved because when moving into a points position for the purpose of program alignment, but the downside is very small compared to a stock purchase play. An example of a speculative points purchase would be to acquire US Airways points in the hope that they will become American Airlines points when the two programs fully combine.

Of course, my fear is that when these two programs do combine it will be a perfect opportunity to enhance (devalue) the new program. Having said that, there are sometimes small windows of opportunity where the US Airways points might be combined with American Airlines points prior to a devaluation.

Ultimately its a gamble – but if you are acquiring points via a credit card then the only real risk is that you pull your credit, get a card that you don’t really need, and hope that the points become more powerful. I am not recommending this strategy for the average reader, but the power churner might want to consider it.

Could a lot of IHG points survive a devaluation and still be profitable?

SPG Points are massively valuable – they transfer to airlines at 1:1.25 when sent in blocks of 20K. Sadly they are really hard to acquire as the card is a 1x earner and the sign-up bonus is typically 25K (seasonally raising to 30K) however the IHG card offers 60,000-80,000 signup bonuses – so theoretically, if they were acquired and if they devalued the IHG by 50% that card could still offer 30-40K SPG points, which might make it a good speculative play.

Personally, I do dislike bloggers writing about such speculative plays as a reason to pimp credit cards, but I think from the lack of coverage the IHG card gets it doesn’t offer a commission, so we should be safe! Remember, there is a great chance with ideas like this that they simply won’t work out.

Status counts too

When combining programs the acquiring partner doesn’t want to offend loyal customers (too much..) so they will often status match their Elites – in this case the IHG card offers Platinum Elite status which is one of their highest levels – it wouldn’t be unrealistic to assume that you could acquire SPG Gold Elite through a merger, again, just some food for thought.

Best IHG Credit Card Offer 80,000

There is a grey offer [Are grey market deals right for you?] out there for 80,000 – this means a rogue link that when you click it you get to an application page that doesn’t show the amount of the bonus. Here it is 80,000 IHG Grey Offer. Also there is a 60,000 standard offer. Reports from The Forum are that you can start a secure message with Chase and they will match that up to 80,000 retroactively. This is another way to try to get the best offer out there.

Credit card applications should be taken very seriously, and you shouldn’t even consider a speculative acquisition like this unless you are fully in control of your finances, and are willing to also take the loss if the acquisition never happens, or if it does happen and your points become worth less than they are today.

H/T for the news story Barb Delollis

I guess I should add my own strategy to this – I wouldn’t get the IHG card as speculation, because while I do love SPG points if they stay as IHG then I don’t really want them, so it isn’t worth it for me. How about you?

That Barbara Delollis is now reporting the take over bid is at 10 billion. Market cap is now at 9.7billion, you were previously looking on the LON exchange not NYSE.

Thanks for the update- yep, that’s not a surprise.

I looked at the LON because it was Memorial Day here, and they are a uk company, so I wasn’t as interested in the ADR.

I was trying to remember if the UK was also on a bank holiday (it was) hence the lack of movement. I’m sure both will ‘pop’ now accordingly.

Interesting post. BTW, today is a non-trading day for the London exchange: http://www.lseg.com/areas-expertise/our-markets/london-stock-exchange/equities-markets/trading-services/business-days

It will be interesting to see how the market responds tomorrow.

Yep- I thought it might be, but wasn’t sure. When I wrote this I checked and it said market closed, opens in 23hrs 45mins – so I thought I might have just missed it today, but it was indeed closed.

Expect a solid pop tomorrow.