I’ve been thinking long and hard about my use of Credit Card links. I stopped putting them into the body of my posts because I thought of the following situation:

Guy reads story about first class travel, thinks he can do the same. Does not check credit, does not apply in a savvy way, gets card by clicking link. Doesn’t really understand what is happening or how, but now has a card.

The person that just clicks a single card on whim like that I think, is more likely to come from a demographic of people that are not in tight control of their finances. There is a chance that a savvy reader just happened to be reading the post at exactly the same time as wanting to get that card, but I think more often than not it is an impulse purchase, by someone lacking willpower. I went on to assume that such a person is more likely to end up in a poor financial situation because of that lack of self control, so I wouldn’t enable that.

But I am not communist, I love the greenbacks, I want to work hard and get paid for it, what to do? Well, today I want to ask you if you think there is room for a Fiduciary, Fee Based consultant in this space.

Fee Only VS Fee and Commission Advisors

As some might know, I am working towards my Certification in Financial Planning from the CFP board, whilst they don’t state it overtly yet, the CFP is very politically inclined towards Fee Only Advisors, I wouldn’t be surprised to see them going exclusively this direction in the future. The difference between a Fee Only Advisor and a Fee and Commission Advisor (they try to use the term Fee ‘Based’ to trick you watch out..) is that the Fee Only Advisor receives 100% of their compensation from the client, rather than a third party. This is supposed to foster a Fiduciary relationship (one where you put the clients needs above your own) I have long argued against the predilection of the CFP board towards Fee Only since you can certainly have ethics and a Fiduciary approach as a commission based Advisor.

Conflict of Interests

It is reasonable to see that when conflicts of interest arise between commissions and advice, people can be more inclined to make poor advisory decisions, indeed, they are compensated to sell product, not help you. The same is true of the Credit Card industry, though it has far less regulation than other areas of finance, which really is disgusting since it is the one area of finance that the least educated will find themselves encountering. Get a 22 year old with low income – what do you think they are applying for, a mutual fund with load fees, or a credit card with stacked interest and a fee schedule buried in the small print.

Revenue and lack of transparency forcing bad decisions

People who host affiliate links for Credit Cards are not allowed to disclose the amount that they earn from them, for fear that the cards will be taken away. I think that is kinda shitty, if I was selling insurance, or a mutual fund or what not and was acting as a Fiduciary for you then I would have to say:

‘hey matey, check out this fund, it is awesome!!! You gonna make $1000 in the first year alone! You gonna get rich like me!’

Swiftly followed by:

‘past performance does not guarantee future results, and you should know that your entire first year of $1000 is eaten up by my load fee, and if you exit the fund prematurely I get to charge you again, smooches’

I don’t know about you, but I think I am a killer sales guy.

However, there is no control over the Credit Card area, yes people will cite FTC guidelines, but everybody who is making money on the card knows that the FTC is a complete waste of space – disagree? OK show me who they have ever sanctioned or taken action against. I think you will find the answer is nobody.

How conflict of interest works in the blogging world

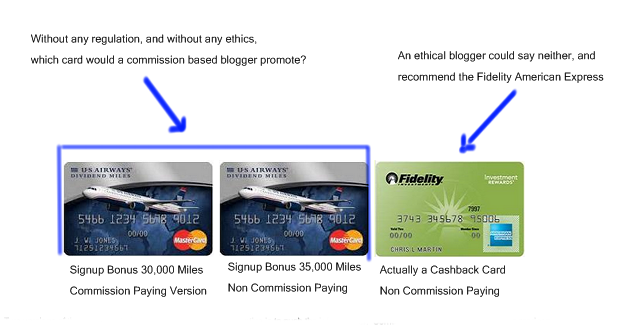

Some innocent victim comes to your site and asks you for advice on a credit card, let’s say that they want a Cash Back card, but hey, you are fresh out of commission paying ones, so how about recommending a US Airways card instead? Sounds like a good way to make a buck, and as I said earlier, I LOVE to make a buck (note I am not suggesting that the commission paid is a buck, because that would be against the terms of my affiliate agreement, and incidentally that isn’t what it pays) ok back to that US Airways card, here are my options to recommend this cash back card to you:

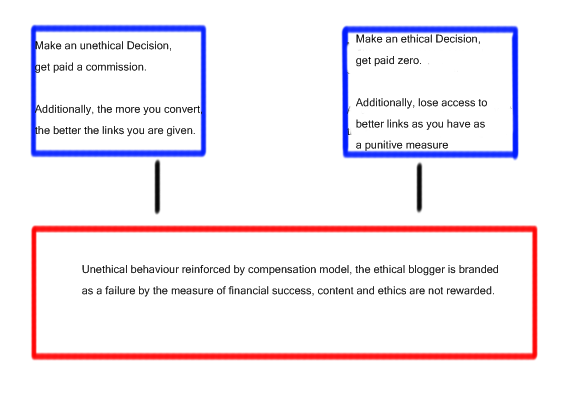

Let’s look at the output of this compensation flow

So the ethical blogger gets shafted, and the unethical one makes money, and since the oversight by the FTC is a joke, and the internet is faceless, you can pretty much get away with recommending the shitty card and get away with it. In fairness, even if the FTC was a powerhouse, it would still be hard to argue that sharing an inferior offer was in violation of a rule, the one thing that it isn’t though, is Fiduciary. It is self interest first, and the blogger gets paid at the expense of the consumers ignorance.

Would you like to change the system?

Many blog readers have been unwittingly duped into acquiring substandard cards by unscrupulous bloggers and websites – it is big business now, and even Google and Facebook are hawking credit cards – they don’t give a crap about you either, so why would the small time blogger (or the blogger who can make a 6 figure income?) perhaps you know better now, and know where the best offers are, but what about those who do not?

Drawing from the concept of a Fiduciary Fee Only approach, what if instead of compensating ‘The Points Guy’ by commissions on products, what if instead you retained a real ‘Points Guy’ to advise you with no sales commission involved. What if you got to the point where you were ready to make a credit card application and someone consulted with you purely in your best interests. Would you pay a fee for that?

I mean a real fee. Something substantial enough for a person like me to give up my time and create a personally curated selection of the best offers available, and present them to you with no hidden agenda.

For example, if you wanted Cash back cards, wouldn’t it be nice for the real Points Guy in your corner to talk about the Fidelity Amex and how it earns 2% cash back with no fee? Just getting that instead of the US Airways card in the example above, especially the commission paying crappy one would save you an annual fee and get you towards your goal.

What about taking it further, what if you used this Fiduciary service and you had poor credit, or had unrealistic expectations of your spend requirements? If the guy you are talking to gets paid to advise you purely for your own betterment, he might say – don’t do it! Here are some tips for getting your spending under control.

Don’t be fooled by Free

So many people think that if they don’t see a fee then something is free, and if something has a fee then it is bad. It is one of the most inane behavioral finance characteristics – that transparency is a negative. It is abused daily by people manipulating your mind and money. Major financial institutions craft complex products and confound the buyer, baking in fees throughout the cycle that reduce profit, but they say ‘its free’ to buy and people love it products like this often have 2-3% of fees baked in. On the other hand, a Fee based advisor who charges you say 1% of your portfolio to recommend buying an Index fund with a 0.05% expense ratio seems like he is ripping you off….

Show me the money!

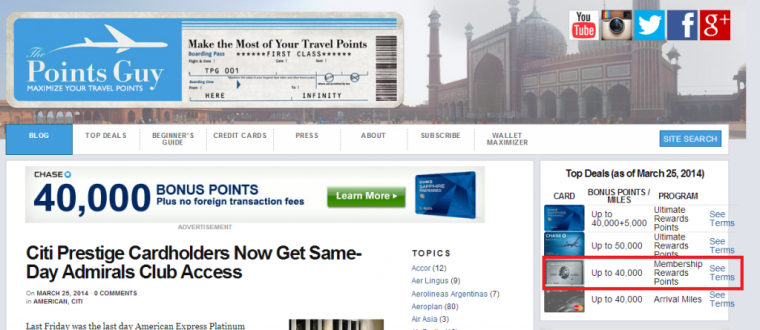

If there wasn’t value in this service, it wouldn’t make sense, so here is an example. You are in the market for an American Express Platinum. You go to Thepointsguy.com and you see this:

Because he is on a Commission based model, he lists the version of this card that pays him a commission. Great for him. Not so great for you. Also, I would add that Brian who runs the Points Guy seems to be one of the better folk out there on commission, he doesn’t (as far as I have seen) hide other offers, but also he doesn’t overtly advertise them on the front page, there are other blogs out there that actually deliberately post inferior offers and delete any comment that alerts the reader to that, those I wouldn’t even link to here in the hope they will fade away….

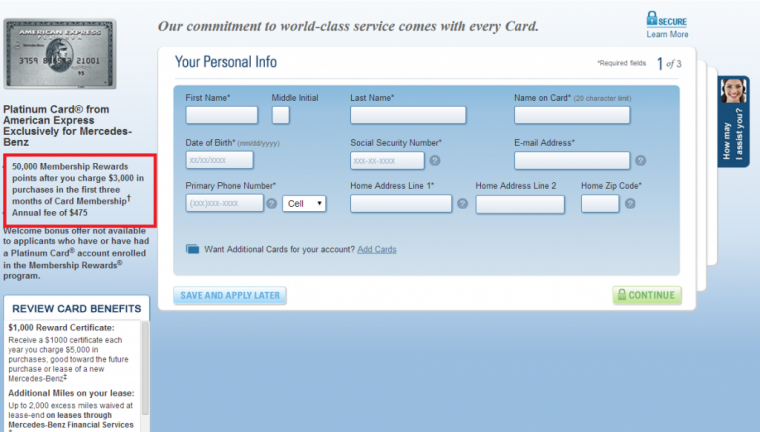

So you can get a 40K bonus with a $450 fee (which pays a nice commission I might add) Or how about if you instead pay a Fee to retain an expert who instead recommends something like this:

This card offers all the same benefits (plus actually a couple more if you want a Benz) it has a slightly higher annual fee at $475, but for that you get 50K bonus to start, which we could value at over $100. By being free of the sales commission your advisor could recommend only the best card for you, and you would have already recaptured profit. He would have ‘earned his fee’.

Can we change it?

Can we create a new paradigm, where bloggers put the readers first, cut out the affiliate companies altogether, add value, and everybody wins? Replace the murky world of commissions with transparency, focus on helping people, not on leeching from their weaknesses I think we can, but it starts with you, the reader. Until you stop clicking on links in a post that catches your eye and start being really strategic about when you apply for a card, and what card to apply for, you are enabling the problem. Can you make change happen?

Can you decide to retain a Fee only Credit Card Advisor?

You, my good sir, Rock!

Thanks Leigh! Glad you like the post. We could change the game here…

Liked what you wrote yesterday and today. You are different from the other bloggers and I mean that in a good way. Yes, there is value in what you suggest but it would take someone already somewhat sophisticated to realize that. And what about the cards that you would recommend such as the Mercedes Benz example: who gets the commission?

Well, there would be some cards that have best offers and are affiliate paying, those I think may have to be suggested to go towards a network of like minded people. It would be murky if I suggested my own arrival card for example.

Glad you took this subject head-on. The main reason is the profit for the blogger/CC company is higher on the low reward card and people follow the money. A fees-only advisor would attract clients that know how this game is played and have confidence that their advisor would look after their needs. Way to go! Not everybody is going to sign up for your service.

I’d love to join if you ever start this service.

Thanks Chandu, I appreciate the vote of confidence!

Great post Matt.

What this game needs is a cash back portal for credit cards..

LOL -that would be a game in a game and probably blow my mind.

I’m not a blogger, but have been following this credit card world since the good ol days in 2010, 2011, first with FTG, then TPG, then others. I actually stopped going to TPG because on numerous occasions, I found that it certainly did not have readers’ best interest in mind. Same with some other blogs. In fact, it seems that the “bigger” these blogs become, the more “corporate-y” they are, casting aside the customer/reader’s best interest only to boost their “bottom line”, contrary to what they try to portray. Though it certainly is none of my business and I am not making “a buck” by ranting. I have thought numerous times about what you are proposing, though the question for those seeking advice would be how can they trust you (the advisor)? It is definitely a different feeling when one has to explicitly fork out a fee as opposed to bloggers getting the fee (commission) that the customer is not explicitly paying for.

Brilliant outside the box post Matt!

I am a CPA and a CFP and this question always comes into play. The problem with the cc realm is a person who is going to signup through a credit card link doesn’t pay anything out of his pocket. Whether he is advised or directed to a lessor version of an offer or an inferior product doesn’t change this fact. If a fee based points guy were to charge his client to show him a better offer or advise him objectively it would “cost” the client money upfront, rather then the cc companies funding the cost.

The idea however fundamentally is great and should be practiced. It will just be a difficult thing to change the masses.

Excellent post though Matt!. Exposing the truth and questioning speaks volumes

Hey Sweetvibes,

Really, that is the same with any fee only planner, the customer pays for a plan, and often AUM too. They see the savings by getting the offers they haven’t thought of, a 10K mile difference is over $100 per card. Find a card without an annual fee, another $100 saved, find them a card with a statement credit, another $150 perhaps… it isn’t hard to show value.

Really all you have to do is not hyperlink to any cards you recommend, and then there is no profit for you to earn from them.

Folks who click on sub-standard offers “pay the price” for not shopping around. It is the same concept when you use marketing to sell things for a higher price because you grab the “lazy” shoppers.

Try telling the timeshare guy that it is unethical to sell the same property that can be bought for half the price somewhere else. It just means that if you are “lazy” or you just don’t know, you will pay the price. Of course when you find out you will not return, but some sites just want to make a quick profit.

MV and FTG comes to my mind…

Yeah, there is the lazy factor for sure. I’ve already lost revenue by making it harder for the lazy folk to convert on this site, it is a price to pay for helping keep the barriers high to potentially dangerous financial tools.

Matt, You are definitely creative on this one. Personally, I don’t think you can earn enough on a fee basis to make it worth your time. As a purely business proposition I think you would need more value added to get a regular (monthly fee paying) customer base. Maybe more on the front end like financial counseling (cash back cards) or aspirational travel and how to put the whole points, airlines, hotels scheme into a package.

For the last couple of weeks, it seems like Bloomberg, the WSJ and almost every business outlet are hyping up the latest study on how baby boomers will be working till their 70’s/80’s and eating cat food. However their are many, perhaps millions, of boomers who have good FICO scores, would love to travel premium class but cannot afford too. A fee base opportunity may be to package a couple of aspirational trips a year (based on the clients desires) funded by a comprehensive points/miles program, then consulting on a fee basis to reach the goal. The difference between this and a good travel agent is that you would bring into play your financial planning skills and credibility and points/miles knowledge. The guy that simply clicks through to CC links, willy nilly, would not be a good client for you. IM,humble O.

Thanks Bob. I see your point, but I think more about building long term trusting relationships. It is not uncommon for me now to spend time on the phone with readers, or answering emails, just to help them out, I think that this is the same idea, it wouldn’t pay a huge amount, but then how much time would it take for me if I was really ‘tuned in’ to the best current deals? It could save the customer time and create a chance to build a relationship.

Hi Matt,

Great out of the box thinking, but a little idealist to me. In my opinion, this could be looked at from a generalist vs. specialist perspective. In the case of the financial advisor, information asymmetry prevents a person from becoming a “specialist” without significant investment of time and energy, whereas in the case of the credit card advisor, one can become a “specialist” with relatively little investment – maybe a couple of hours of reading, or even stumbling on a miles website that has a legit list of the best offers. Unlike asset management, the best credit card “investments” are not hard to discern – this one gives 50,000 points versus the official offer which gives 30,000 – for example. The credit card advisor’s role would almost be limited to just pointing his or her client in the direction of such a list rather than any deep analysis. And if any deep analysis did occur, how much time would it legitimately take the advisor to do said analysis, and how much would he be able to charge for that service? Very little in both cases.

Just my thoughts.

I see it loosely as different levels of service, noobs would need hand holding on many areas, more experienced people could pay a retainer to have the best card options presented to them… and I love the idea of taking the murkiness out.

Clint,

I differ. I’ve to read half a dozen blogs and flyertalk to find out what’s the latest. Consumes a lot of my time that could be spent with my family. If Matt had a monthly service like this, I’d gladly take it up. It’d eliminate the need to constantly track websites.

Interesting thought but concerned that you are running an ad currently for an inferior card yourself? The regular Platinum card instead of the non commissionable Mercedes card.

I’m going to make a suggestion that will not be appreciated by many, but as the one that originally brought travel cards to the travel hacking space. You can not keep up with all the offers available to the consumer and therefore can not offer the “best advice” The market changes so fast you just can’t find all the offers. Phantom links, special promos and email and snail mail offers that people may or may not qualify for. The task is immense. My personal guess would be that you will be questioned about your suggestions, and proven that you suggested less than the best offer, more times than you would like to admit, OR be comfortable being called the fiduciary of the space. Hence my simple example above.

And are you going to make the distinction for others if a deal is better with an anniversary bonus or balance transfer offer without all the facts of the clients (and yes they will be clients at this point)

I agree that all sites do not always offer the best cards available, including, at times, the site I used to own, and I agree that some sites appear to deliberately offer the lower offer that is commissionable.

My guess is as follows: The space will begin to police itself, or on another front, be shut down by the card companies over their concerns about compliance.

I’m not excusing the behavior some in the space, but it is also the responsibility of the card applicant to handle his own due diligence when determining which link, email, snail mail or “at the airport” offer they chose to take. I like to call it Personal Accountability.

And lastly, I know this is a tough one, stop reading the blogs you don’t like. the bad ones will “fail away” based on the quotas some seem to think are in place with the card issuers 😉

Was that a question or are you concerned that I am? I have the Amex available but I do not promote it, it will not appear in links nor will I say ‘go get it’. If you asked me today, without me being officially your advisor I would say the same, go get the MB amex, all I am doing is monetizing that ethical decision.

The card companies do care about losing their links, but they let it slide, money talks.

Oh, and I don’t read other blogs, other than popping into TBB every now and then. Thanks for your input.

All I’m suggesting Matt is if you have an offer on your site that is a recommendation of sorts regardless if you “promote it” or not. Your site offers the Amex Platinum card. Plain and simple. After 6 years of having links on a website, you will be accused of all types of things true and untrue. That is the facts and my suggestion that you offer the link as proof is what you will hear.

” Why don’t you have the Mercedes Benz link? Are you promoting a lessor offer? Sure looks like it.”

If you decide to go through with the idea of helping people pick credit cards as a fiduciary, I’m all for it. But get ready for the mayhem that will soon begin. Best of luck to you

In regards to the card company losing money, and letting things slide, I can tell you, the fines they are facing for misleading consumers or alledgedly doing so, and the bad press that will follow, will have them shut down bloggers in the bat of an eye.

I haven’t launched the Fee only system yet. So all you say is moot. The rest of it doesn’t really interest me Rick. I welcome any real person to complain about me in the way you suggest (by real I mean not another blogger with an agenda to make pimping cards acceptable).

That was a rather insulting response to my comment. I am a real person that has been in this game much longer than you and have tried constructively to give you a heads up on what is coming when you begin this project with examples and facts.

If you are not interested in my concerns and suggestions, why not just delete the comment?

I am sorry if it seemed insulting. All I said is I wanted to see some real comments about it from the people you mentioned as having an issue, not people who have a vested issue in pimping cards. The latter make up silly arguments.

I have A LOT to say on this subject. I said just a few things in my new blog post but, oh man, there are many things in my mind about this subject that is dear to my heart. We ‘ll expand on it in Charlotte I am sure.

In the meantime, I need to bust my butt writing for that other tabloid publication I am involved in before getting out of Dodge to Mauiiiiiiiiiiiiiiiiiiiiiiiiiiiiii!

I think the biggest issue is that only savvy people would see the value in a fee based service, but savvy people are the ones that know how to find the best offers. Although word of mouth can go a long way, maybe more value is the answer.

I think if you offered a bigger picture service, maybe based on a reward goal. Best cards, ways to meet min spending, and award booking all as a package deal. That might be worth a fee and by packaging in a service more people are already willing to pay for (award booking) you might have a wider appeal. Make sure you are very clear about the better value in certain card bonuses, I understand the example in the post, but more because I’d already looked at those cards and because I understand how much an extra 10k of MR’s is worth. If I didn’t I might think you meant 50k in points is worth $100. Which would make the 40k offer for $25 less in fees better by $5.

There is room for both a fee service and the affiliate driven blogs. Thinking of it another way, those affiliate driven blogs teach people about earning and using points, something many of those readers would not have figured out otherwise. People who click the link for the 40k instead of realizing the 50k offer is better are still better of than if they had never stumbled across the blogs in the first place. So long as they don’t run up debt, most blogs seem to warn people not to play this game if they don’t pay off balances in full every month.

Thanks Haley, good points. But also, I think just going down this route is better for the reader, so there is lots to explore.

Just asking the question shows you’re thinking about the Golden Rule.

Good.

But when you watch TV you get the commercials selected for you and pushing finely tailored Superbowl ads out to lots of folk is more effective than allowing the masses to select their preferred commercials.

So your idealistic idea won’t work.

It’s not as drastic as the difference between Capitalism and Communism but it’s close.

The bloggers making more money will travel better and write more interesting pieces and soon will float to the top of the blogosphere.

Just enjoy your blog and display the best curated offers with your best boilerplate and original text and you’ll get recognized and appreciated by your readers. They’ll click through out of appreciation. You can’t save the people in trouble like the guy tries to do in Ground Hog Day but finally he just plays the piano and lives joyfully. Do that, sharing the best you know how to share.

Thanks John. Make no mistake though, there is nothing communist about charging a fee for your services 🙂

If you were truly committed to this vision you would have started out this way. The issue was on the table back when you started. Instead feels like you’re trying to get on the high horse as a way to drum up traffic and corresponding revenue out of self interest.

Moreover you gloat about removing affiliate links from your posts, yet they litter the sidebar for an unsuspecting reader.

I see a banner that says ‘Best of 2013 for Travelers’ from CreditKarma on the right hand side of this post.

If you click, it’s an affiliate link for you ,though there is no indication of such unless you pay attention to the URL structure. And it does not have a comprehensive list of cards by any means.

**All credibility is with regard to this post is lost in my view because of that.**

Not a single blogger gets paid for that 100K AA offer. And it’s promoted like crazy. This niche is more transparent than many in finance thanks to its own self-policing and consumers have benefited greatly the last few years.

REALLY? The 100k card is promoted like crazy? How about ANY of the Chase cards that pay them? The mentioning of the 100k card to the chase ones must be once every hundred times you year the word “Ink” or “Sapphire”…. so please…

YouBlewCredibility Don’t be a silly goose. ‘Could have started that way’ is a ridiculous argument, I hadn’t thought about the harm it could do until I started to see the harm it could do, and I made positive change. This is a positive change and you can spin it whatever way you like but you are still full of crap (and a blogger with an agenda)

Great post Matt! I think bloggers should only recommend credit cards that they personally have and offer the sign up bonus that they used to get the credit card. For example, I’m sure all the bloggers who push the AMEX Platinum card actually have the AMEX Mercedes Benz Platinum card, which everyone knows is superior. What do you think? Keep up the great work on your CFP training.

I think that approach is fine, and well intentioned. Though it is not one I would take.

In providing a consultative service, you should consider the needs of the customer. I live near JFK, so I would gravitate towards BA for domestic travel, but a person that does not wouldn’t benefit from them. Inversely there are cards that are good, but I don’t have because they don’t fit into my plans. In my case, I actually have the Business version of the Amex, everyone is different.

I appreciate your thoughtfulness on this issue. However in order for this to become an economically viable business venture, I think it will be necessary to increase the value of the service offered. Right now, with a bit of time spent searching through the various travel forums and blogs, it is reasonably easy to find the best credit card offer at any one time, including targeted offers.

However, it is much more difficult and time-consuming for most interested individuals to determine the most efficient and cost-effective methods (including MS when appropriate) of utilizing specific sets of credit cards to meet specific travel or financial goals. I think this type of service offered on a fiduciary level could present a successful profitable and ethical business avenue.

Thanks, different people have different needs, service could be tailored towards each.

In the past week or soI have noticed a few blog posts about the Chase Ink. I thought that chase must have upped the commission on it if all the main blogs I follow have been posting about the same card in the same week.

There is a stick and a carrot at work.

I like the idea. My gut tells me that the market will not support it. The people that are most likely to need such advice are too naive to know better and would rather get “free” advice from the likes of MMS, TPG, and FTG, then pay a fee. Plus, most likely those are the sites that they will go to first. As for the others, those of us that are a bit more savvy, don’t need to pay for the advice. All the reasons you mentioned above is why I apply with non-affiliate versions of card offers. It is my own personal boycott against all the issues that you accurately described.

The sidebar of this page is littered with affiliate links. Of all the cards in the world you can choose to highlight you pick the Lufthansa 35000?? And highlight the companion ticket (which is full of heavy taxes)?? Oh and do you want someone to do a balance transfer? Because you advertise 35,000 points which requires doing a balance transfer.

And I agree with the commenter above that the ‘Best Credit Cards for Travel’ link to Credit Karma is misleading, but hey you probably get paid if someone clicks or gets one. Seriously you think those are the ‘best cards’??

You go through a tirade about these incentives and make a big deal about removing links from your posts, yet right next to the posts are a bunch of flagrant links, all of which you get paid for.

Sorry man, but you don’t have much to stand on here. I trust you about as much as MileValue at this point.

Indeed – is there a better offer for the Lufthansa card? If so I would link to it.

Now, as for the rest of your comment, not true – I said that that if you pull them out people don’t read the post, get excited and click it, which is what happens. I think we both know that very well. By pulling them out of the text I lose conversions.

Why would someone click on the 35K Lufthansa advert, because it is bright and shiney? Perhaps, but it is very different from pimping the heck out of it to make people convert. They are clearly identifiable as adverts, links are not, which is one thing, plus the words around the links influence conversions, this is a fact.

I do think that I could adjust things further, and I will, but I think you need to reflect on the differences and the steps forward being made here.

Matt, as I hope you can clearly see from the comments posted after mine, you are walking into a can of worms trying to act as a “fiduciary” in this space. I would think to do it right and regain 100% creditability you would have to remove every single ad on your site, and we all know that ain’t gonna happen to take a risk on an unproven business model.

Rick, just go away and pimp. There is room for us both in the wide world of the internet.

Why Matt, you sound so, so, so “Angry?”

Are you asking me not to share my perspective on your blog? Do you just want faithful believers? Are opposing views not welcome here? I’m just trying to give you another perspective?

Rick,

Quick recap here: You have vested financial interests in creating and encouraging content that converts readers into credit card customers with very little care on the matters of ethics I raise here. You then engineer false arguments in order to build a case for not trying to do better under the guise of ‘it is too hard’.

I wouldn’t say I was angry so much as disappointed in you.

Try and keep up with current events here Matt. My earnings are per post and any remaining buyout is of little financial impact to me personally. The matter of ethics is was and will continue to be of importance to me. Why not go back to the early days of my blog before the sale before continuing with your current line of thinking. In fact I gave the basis for sound credit card analysis that all of you continue to use today. There is nothing new in what you are doing today than what I suggested 6 years ago. Go read the history book Matt.

You certainly are entitled to your opinion of course regardless of the facts. You are certainly entitled to visit the Chicago Seminars where I lay out in great detail how to apply for cards, how to watch bloggers and what is the prudent way to begin. But it seems the mood of this core of readers, many of which I helped teach the game, is much more critical than willing to look at the facts. And I’m not talking post sale.

And while you continue to continue to slant the truth there was no guise in my statement regarding it being just too hard. It was simple fact that you can not keep up. You can’t even with a straight face suggest being a fiduciary when you offer links to the Plat card instead of the Mercedes card.

So please get off your high horse and consider the information I passed on to you in good faith, or join the crowd of pimps as your other commenters have suggested up comments.

And please Matt. I am the one disappointed in you for your responses to advice offered freely without financial interest. Hope we get to meet face to face someday soon

Rick,

I wouldn’t want to misrepresent you, let’s set the record straight, here are some Yes/No questions for you, and feel free to factually elaborate where you see the need:

Do you receive financial compensation directly and indirectly from sites that are promoting inferior links within the text of a post?

Do you believe that removing the links within the post will reduce conversions?

Do you believe that people can be influenced to convert into card ownership by the content of a post, and the decision as to where to include links?

Do you think removing the links from the body of the post could be considered a bad thing from a protection of the consumer perspective?

If you think think that removing links from the body of the posts is a good thing for the consumer, why would you focus on what I am not doing right, rather than fostering this idea that we can make things better for the consumer?

Where have I stated I am a Fiduciary in this post or blog?

Why are you trying to accuse me of not being a Fiduciary, when all I am doing is opening debate?

Why are you trying to squash this concept of movement away from affiliate links?

1. I assume that FTG at times offers inferior links and suggest in the sidebar if you know of a better link please email editor@frugaltravelguy.com. Yes I am paid by IB.

2. I don’t know as I don’t track it. I rarely if ever used text links during my ownership. I couldn’t figure it out and banner ads did just fine.

3. The average American has about a fourth grade comprehension level. I believe in the system that calls for credit scores of 700 or above to be approved for cards as the industry standard. It is not my responsibility to make decision for consumers and believe those with good scores have earned them and the right to make their own decisions.

4. Banner ads like yours or text links in posts matter little to me. If you want to hang your hat on removing text links as a good thing go for it buddy, but your and my banner ads still exist. A good or bad thing is advertising for cards, not the type of advertising be it text or banner.

5. I’m not trying to focus on your good or possibly bad intentions. I’m focusing on your misconception that you can change the landscape. If you can great. Get all the bloggers to remove all ads banner or link. That is changing the landscape not the removal of text links.

6. I don’t believe I ever accused you of being a fiduciary? What I am suggesting is you can not be one or really speak to the subject if you have any ads on your site. Are you ready to pull all your advertising? Neither are other bloggers.

7. I am not trying to squash moving away from affiliate links. Never said that. If I had known what a f’ing disaster inserting links may have caused when I started, I may have thought twice about it. Links came to the space with me promoting my favorite card at the time, SPG, for a whopping $35 per card. And I in clear conscious going back to that time could do it again.

I think we got off on the wrong foot here Matt, and I will gladly discuss you idea in private if you’d like. I am embarrassed for what has happened to travel hacking, personally assume some of that responsibility and will gladly do what I can, if anything (which I highly doubt) to improve the situation. You have my email address

Rick

Good reply Rick.

Now, I would push you on your thoughts about including a link to a card within a post, if not, why in your most recent post did you talk about 5 credit variables to consider, then segue directly into > get these two cards if you are a beginner? Why no omit that last ‘twist’ on the post, as it had no place there, other than to encourage conversions. Why would a post about credit need conversions, unless the content is there to promote an expert opinion, make it easier to ‘trust’ it was ok to apply, and then spoon feed the application within the text.

If the post was pure in purpose, it wouldn’t need that.

Regarding me being a Fiduciary, I am not, but it is something that I want us to discuss moving towards – what you are doing in your comments (even though some, like this one are polite) is trying to discredit my ability to talk about change by pointing a finger at the negatives you see.

So it comes across like you are trying to stop change, by pointing out faults, rather than encouraging change by rewarding and encouraging the positive aspects that I am presenting.

Instead, what we should do is say ‘that is great, let’s try to get more people to do that’ then next say ‘OK we made progress, what can we do next to make it even better?’

Matt, Are you suggesting that you should be editing everybody’s posts for intent? I don’t put any links in my posts. My employer does and my employer edits my content as they see fit and within compliance guidelines. That is not your responsibility now is it?

I have no intention of discrediting you at all Matt. Only you can do that and will continue to do so in the eyes of many as long as you offer the topic of fiduciary duty and have ads in your blog.

Let me try to be crystal clear with these statements:

1. You can not be a fiduciary as long as you have commissionable links anywhere on your site. Just as no one trusts a hotel review if the writer is comped the room night or given any special favors. I had this discussion with Brian six years ago. Nothing has changed. Some take the comp and write the reviews anyway. I’m going to assume you hold a higher standard for yourself. You must do the same with credit card links.

2. You are fighting huge corporations here that could give a crap about what you are trying to do. That doesn’t mean your intent is not good. It doesn’t mean I don’t support your effort. Try to get CreditKarma to change their banner ad you are currently running that offers numerous cards INCLUDING the inferior Platinum card. Tell them to change that ad to include the Mercedes Benz card or you won’t run their ad. They will tell you to go pound sand. Try to get IB to ALWAYS run the best offer. It ain’t gonna happen and neither will it with the other much bigger players in the market. Again, I’m not trying to discredit you but let you know that us little old bloggers got no say in the game that is meaningful anymore. That was taken away back in 2011 before you ever even thought of the subject.

Here Matt is my Congratulations to you on a worthwhile goal and I wish you all the success. I wish I was not involved in the demise of the space, now seeing the disaster it has turned into, but I am a REALIST. Until you take away the financial incentive of affiliate links, in their entirety, and get rid of 90% if the current crop of bloggers, you are suggesting floating in the clouds on angels wings. The only ones that can change the landscape are the credit card issuers, plain and simple.

All readers can do is click with their conscious and stop using links of bloggers they don’t like. That is the REALITY of the subject in its current state. If you want to call that obstructionist thinking so be it, “pitter patter and have at her”

The financial skin I have in this game is paltry at this point. I got out while the getting’ was good and will support you any way I can that has a chance of success. There is so much that has gone on behind the scenes that I’d love to discuss with you IF you are going to continue the crusade. You may find it helpful. You may find it obstructionist. It is your decision to reach out or not. Best of luck to you.

Rick

I read numerous travel and card blogs daily and appreciated your candor and message. I look forward to now reading your blog regularly as well.

Thanks Neal, glad to have you onboard.

Would be interesting if Bloggers would provide an affiliate link and a NON-affiliate link in the same post when talking about a certain Credit card. If both links are provided, readers can make a determination whether or not to reward the blogger for the advice. This way if the blogger is providing a service that is deemed valuable he can be rewarded and if the reader feels that nothing of value was received, he can still get the card without the blogger benefitting.

Good thinking. There are certainly a few solutions to consider

This has been a fascinating blog post and discussion. I posted the following comment in my blog in response to another comment. May be food for some additional thoughts on the subject:

——————————-

There are MANY moving pieces in this hobby and an ever changing landscape that can change before you can say the phrase “Chase Ink Bold” 🙂

To properly consult you need full information about current situation, goals, prior cc history and other special situations (baby, skiing equipment, whatever, etc.). And don’t get me started about burning strategies that could be maddening to pull out (throw a few schedule changes in the mix and no wonder newbies don’t bother…it’s TOO MUCH for them).

But you may be up to something about the “demand schedule”…START there with the goal of a specific trip in mind and the proposal is something like “We can get your family of 3 to Maui and 5 free hotel nights” for $300 if you do X and Y and Z. We can email you specific directions and keep up with your progress and nudge you if you are slacking. After all the points post we will help you book the trip. Now, the key then becomes at what pricepoint do customers buy and you do it in a way that you do not work for less than minimum wage? You see how easy it is to just come up with a post you have posted a gazillion times (i.e., Companion Pass) and catch a few newbies who happened to see you on Nightline or read an article somewhere and with a few clicks you made more than busing your butt trying to help the newbie do this the right way…

You are on the right track. But at the present economics I have a hard time believing this fiduciary relationship is viable right NOW. It will be IF the banks stop over paying for the bloggers marketing work for them. Just some additional food for thought.

—————————————————————

Which I then followed up with this:

I forgot to add of course that the above model becomes MORE viable if in the advice given the BEST links are provided at ALL times. After reading the comment by LHFlyer in Matt’s blog post perhaps give BOTH the affiliate and non affiliate link if they happen to be the same! If not, always must give the better one! And all that is fully disclosed. Of course you won’t be able to disclose the affiliate commission because them bitches contractually forbid it because if the masses knew about it MMS would have interviews scheduled to eternity hehe.

Always appreciate your perspective G, look forward to meeting you in Charlotte to talk more.

Great post, Matt. You rock.

Thanks Kumar!

Seminal post. I am new to your blog due to March Madness. I’m an unrepentant capitalist who wants the very best I can provide for my family and myself. I plan to never sit in coach again and the reason that goal is realistic to me is from fat credit card signups and great manufactured miles strategies. But anyone who has spent any time on these blogs can clearly see there is an ethos to the way you approach this game in a very similar humility to the way Frequent Miler approaches his readers. As an older guy who has always done wherever my heart said go I recommend you do what is in your heart. As a businessman, I recommend you flesh out your plan in a business model as part of a grand smorgasbord strategy. As an advertising guy from the 80’s I would strongly discourage you from making your recommendations “hard to get to”. I am somewhat clueless how you make money from this blog if I never see an ad or never click through to an offer. If your ethical approach to this space is going to be effective you MUST have an income stream to support that approach. Finally, I am looking at all the credit cards I have today and hate to say that I clicked through on sites I don’t like, on bloggers I don’t respect and on credit card companies direct sites and the biggest REGRET I have about all those cards is that I wasn’t more thoughtful in supporting the bloggers I truly love and support their continued existence.

Very glad to have you onboard sir, I hope that we can keep producing interesting content. The money will look after itself.

Good post Matt, without having read all the comments, I suspect this is redundant but I would think there isn’t really market for your idea. Those in the know would be the ones who are aware that the shills and pimps will sell them down the road are aware of the sources to get the best available offers. Those that don’t know, have no idea they are getting snake-oiled by the top hits on Google. If they don’t know they have no reason to pay you.

Hey Boon,

I guess what I have to wonder, and this may sound stupid, is could enough money be made by enough people doing things the right way to pay them to make good, honest content and help out the reader at the same time?

Right now, the model is broken, and the lure of $$$ is making people not only influence their content, but also incentive them to screw someone over. Can doing the right thing, and getting some money make sense?

The problem of monetizing it should be something that we embrace, rather than discard due to its difficulty, and find a way to make it work.

So Ingy is now attacking another one of my fav bloggers. Yawn (to him). Great post (to you). I agree that marketing/monetizing such a service is tricky but I do think many could benefit. There’s a saying that the tree we plant today may not bear fruit for years and may not offer much shade for even more years. Yet we must plant. In that vein, a famous sage who lived in the 1st century AD said: “It is not incumbent upon you to complete the work, but neither are you at liberty to desist from it” (Avot 2:21). Ideas we plant today may indeed bear fruit eventually. Let’s hope this one does.

No attacking here. Why is it that any opinion contrary to that of the blogger is attacking? It seems disingenuous to me to make that statement in an open society and I think I have been very fair in my statements to Matt. It just leads me to believe that the opposing side is angry or defensive? Why is that?

Is your question ‘Why is your belief that?’ Probably because you have an unusual way of looking at what happened here… I can only speculate as to how your brain works.

You see, you haven’t expressed an opinion contrary to what I said here, because I said we should move away from affiliate links being used in posts, and rather than disagree with that ( which would be a contrary opinion) you instead attacked me by saying I was guilty of having links in another capacity. When I suggested approaching things as a fiduciary you said ‘I cannot be a fiduciary because I have commission paying links’ you aren’t offering a contrary opinion, you are attacking my personal position in an attempt to discredit it. You actually built a fallacious argument around that and then told me that I would have to certain things to appease you in order to gain credibility back!

Can you see the distinction?

Rather than argue with me (I welcome argument and debate) you instead attempted ad hominem character attacks, by stating I couldn’t be in a position to suggest change when I had adverts on my site. You consider it ‘high horsed’ of me.

I’m a big boy, so I’m not saying I can’t handle the focus of your discussion being me rather than my argument, but I want to show you the difference in the hope you can have an answer to your question ‘why are people angry and defensive?’ You are capable of higher level debate, but you frequently miss the mark and try to discredit, you have a track record of this.

I hope you can take this as a constructive reply to your bewilderment as to why people react in the way they do.

I’m no angel either, but I at least recognize when I’m being a dick, Rick.

Don’t try to speculate how my brain works. Concern your self with your own and we will get along just fine. Sorry you feel so defensive about the opposing position and felt I attacked you personally. That obviously was not my intent. I am not singling you out in any manner so quit being so defensive. Nobody has the right to criticize others behavior when their own is in violation of the principle they are trying so mightily to uphold. I’m suggesting to you that I can’t, George can’t, you can’t Brian can’t, MMS can’t etc can’t even begin to discuss the term fiduciary duty while engaged in a practice that is not fiduciary to their readers. You heard it above from more people than me. You are just taking it as a personal attack. It is not. Again Matt. you miss the point. Nobody is calling you out for anything other than putting the cart before the horse. You want to discuss being my fiduciary for a fee? How much do you want per hour to help me pick the right credit cards? Oh BTW, if we can agree on an hourly rate in order for me to feel comfortable acting in my best interest only, you’ll have to give up all sources of income related to the credit cards I may apply for. Are you ready to do that Matt? Yes or No?

As far as being a dick, I never considered it being a dick to present the other side, but it certainly know it doesn”t work calling others one either. I’m disappointed in you Matt. I thought you were high level than name calling. And to that, I can say I am no angel either, but certainly won’t stoopp so low to characterize your responses as dicklike.

You missed the point of that comment entirely. Let me try to elaborate.

You asked in your post why you felt like that – you asked us to speculate on this! You said, verbatim, “It just leads me to believe that the opposing side is angry or defensive? Why is that?” So why now turn a reply to your very question into some sort of chastisement?

And I am not defensive, so you don’t need to feel sorry for me, I simply attempted to explain why people were reacting to you in a way that seems so alien to you – I really don’t give a monkey’s chuff about you or your ‘attack’ I purely was using that word to explain the feelings that were confusing you.

As for the rest of your discussion, I cannot really see it being productive since I cannot seem to have any sense or reality when talking with you, there are glimmers of sentience, but you digress far too much into very unusual interpretations of discussion, as such I’d rather you just move along,as it is too much effort for me to get through that perspective on life and find any value from your comments.

Speaking pretty plain English for most Matt. Sorry you can’t follow the clear cut logic without getting defensive. See you in Charlotte

Your English is fine, as much as any of you guys can speak it, it is your logic that I struggle to get to. Don’t be a tart in Charlotte, we have a strict door policy 🙂 Look forward to meeting you too. PS I am much worse in person.

Hey Matt – I’ve been in the game about 6 months now. I follow all the blogs, study flyertalk and have pretty much gone into this full time. I know I can find all the information I need, I even know where to find it all. Even still, I’d feel much more comfortable at this stage with some guidance. I would love to work with you if you’re interested in a Guinea pig to try this with!

That could be interesting. First off, what would you be looking for from this based on your present position, and what would you be willing to pay for that?

This has the making for a fantastic new reality TV show for BRAVO….. ‘ Frequent FLYghters Club’…..brought to you by Chase.

Hey, as long as I get paid I am down.

Should be no problem….just leave a disclaimer in the credits….

Oooh a play on words!

Matt, your intentions are honorable. Preach on. Even if the oldest whore in the whorehouse keeps crying from the back pews. Nobody picks her out of the lineup anymore, so she gets testy.

Matt I definitely think you are on the right track with this idea. It will be interesting to see if you can effectuate change within the “online space” of this hobby.

One thing I want to point out though is that it seems everyone is assuming what Matt has proposed is something new. Perhaps it is within the context of the blogging space. However, I will tell you first hand that acting in a fiduciary or “consulting” role for this hobby is already being done. It is perhaps on a much smaller scale then what Matt is proposing, but I am acting in a very similar role within my immediate and extend network (which expends quite quickly if you offer a valuable service).

I think most of us who have been in this game for a while just assume that newbies will know where to go and be willing to read all the necessary material in order to play this game safely and effectively. Certainly, many in fact do, however the vast majority of people are deterred from pursuing this because the learning curve seems too steep and the time invested in learning (at the beginning) is not worth it compared to what they can be earning in other entrepreneurial endeavors.

TravelBloggerBuzz said it well:

“There are MANY moving pieces in this hobby and an ever changing landscape that can change before you can say the phrase “Chase Ink Bold” 🙂

To properly consult you need full information about current situation, goals, prior cc history and other special situations (baby, skiing equipment, whatever, etc.). And don’t get me started about burning strategies that could be maddening to pull out (throw a few schedule changes in the mix and no wonder newbies don’t bother…it’s TOO MUCH for them).”

If someone wants to play this game successfully over a period of time they need to know how all the pieces of this puzzle (both their personal variables and the system’s) interact. Yes, they can figure them out, but many don’t want to. Many would simply rather pay a fee to be taught how to do this, to have it done for them during specific times of the year, or even pay for an annual service.

The hardest part for me was not getting clients but figuring out an appropriate fee and this took some real trial and effort. That I think will be the biggest hurdle. Finding the price where clients feel they are receiving real value for their fee and where you (the fiduciary) are being compensated appropriately for your time and knowledge.

Found out something new today, at least for me. Was talking with affiliate company re: LH M&M card and he asked if I wanted to apply for Chase links. He said in order to be approved for Chase (at least with this affiliate co.) you need to have on average of 150 approved apps a month. Translating that into $60-100 (or more) per app, you are looking at $9k-15k in revenue per month. Nice work if you can get it……. IF and When these affiliate deals dry up a lot of people I suspect will be looking for ‘real’ work 😉

the ‘new’ learning was the minimum that you have to hit in order to be affiliate eligible with Chase. never knew it was that sky high.

I don’t think it is, my guys focused more on the content – they hated me running milemadness but I think content over revenue every time

Something I’ve learned from dealing with affiliate managers… take everything they say with a pinch of salt 🙂

But yeah, you need a lot of conversions, plus the content must be vanilla (not the reload type)

Good point…..I dealt with a few over the last couple of years and it was tough to get straight, accurate answers.

Matt, you are a stand up guy and have been a real help. To answer your question, I think it would take some convincing for people (myself included) to pay a consulting fee for help. But I, and many others I suspect, would go for it if there was a real show of the benefit. For example, let’s say you did a post about how much you saved or earned for someone, etc. We’ve all been drinking the “free” it will take some educating for us to learn the truth.

I came back to read comments, I’d love to be a fly on the wall in Charlotte.

A reality show based on #milemadness was the first thing I thought of when I read about the contest.

I still like the heart behind the idea of fee for service advice in this realm, but I don’t see the market. However I think a great blog on how to play the travel/point game would be a strong selling point for a financial advisor.

Speaking as someone in the investment business, adding points/miles consulting would immediately be subject to regulatory bodies such as FINRA, MSRB, SEC, SIPC, Alphabet soup galore, etc. etc. etc. etc. etc. and another etc. It would open a Pandora’s box and after the regulators are done with regulations, clients may be worse off than they currently are as far as the miles/points market place. Then of course since the Federal Reserve is responsible for credit policies, Yellen & Co would want to have their say as well. Am I being a bit outrageous? sure, but lets keep overbearing regulators out of our tidy little mess! 🙂 An interesting option maybe to create something akin to the CFP (Certified Financial Planner) program where its basically an SRO that creates its own rules and bylaws and grants membership to those who qualify. In this case you can admit bloggers/affiliate link users et al. who meet a certain certification process and agree to act in the best interest of the client and at the same time are subject to the rules of the SRO as well as to disciplinary action if they violate the rules/regs. This way the SRO and bloggers can advertise that they meet a certain level of qualification to give advice on Credit cards / Frequent Flyer programs. Overkill right? 😉 Those who are not members of the SRO would be at a disadvantage. This exists today where the CFP advisor is usually held in higher regard than a stock-jockey sitting in their office in a strip mall! 🙂 Flame away!

Well, as you might have noticed from the post, I am midway through attaining my CFP qualification, so I don’t find your views too outlandish 🙂