This is a guest post from Robert Dwyer, a Saverocity reader and points & miles enthusiast.

In 2016 Chase and American Express introduced new benefits to their premium cards that, for many situations, tip the scales in favor of earning bank points over airline miles. The Chase Sapphire Reserve and the American Express Business Platinum cards, both with $450 annual fees that can be whittled down significantly with annual travel credits, provide leveraged ways to redeem points for airfare.

Chase Sapphire Reserve cardholders can redeem Ultimate Rewards for 1.5 cents a piece towards travel booked through Chase’s portal (or over the phone). With the AmEx Business Platinum things are more complicated, but potentially more lucrative: You get a 50% rebate on points redeemed towards air travel with your “airline of choice” or any business/first class ticket on any airline which equates to 2 cents per point of value.

Combined with signup bonuses, and cards that reward spend at more than 1x, this creates a very strong earning floor for these bank points programs. And this isn’t just Chase and AmEx. US Bank FlexPerks, Wells Fargo GoFar Rewards, and others are also worth looking into.

The real kick in the pants, when it comes to airline miles, is the lack of domestic saver level award availability. A situation which seems to me to only be getting worse.

My point: With the exception of international premium cabin flights, I’m better off earning bank points than airline miles.

Why does this matter?

It matters because a lot of people think the best way to earn “free” flights is by signing up for co-branded airline credit cards affiliated with the airline they want to fly. I don’t think this is the case anymore.

Don’t get me wrong: When people ask which airline credit card they should sign up for I say “all of them”. That’s because it’s possible to get value out of all the programs and I’d certainly not refuse any of their generous offers. I’m just saying I’d prioritize bank points over airline miles if my interests were primarily deep discounts on the exact domestic flights I want to take.

When I first heard about the 1.5 cpp benefit of the Sapphire Reserve a ~2 cpp with the AmEx Biz Plat I thought, “Well, that’s nice. But it’s still a better redemption to transfer miles 1:1 to travel partners.” And it is.

But there are only so many international flights with award availability when I want it that I can enjoyably take in a year. And a lot more situations where I’d like to jump on a plane and fly somewhere in the US in any given year. And when I look for award availability I come up with no good results. So when I redeem bank points for exactly the flights I want I think:

“Man, that was nice. That’s how this is supposed to work.”

Examples

The idea that miles are dead is nothing new. It’s ironic that banks are so intertwined with airlines and at the same time killing frequent flyer miles. But this didn’t really sink in – I really didn’t have a feel for what this would look like – until I started booking flights this year.

Examples are useful in illustrating this point. It’s one thing to say “2 cents per point” but it’s more impactful when you look at award availability and fare prices for things you and your family/friends actually want to do.

Boston – Dublin for a U2 concert

I thought it would be really cool to fly from Boston to Dublin for the U2 concert this July. I wasn’t able to get tickets (since I didn’t pay to join their fan club this go round) but I had a look at airfare options.

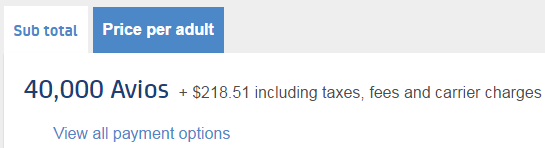

Boston to Dublin used to be a favored way for travel hackers to get to Europe using Avios because the distance is just under 3,000 miles. This made it a tremendous redemption, but British Airways fixed that for us by bumping it up to the 3,000+ bracket. It now costs 40,000 Avios + $218.51 for roundtrip economy flights when there’s award availability. And in this case there is (shout out to the excellent MileCards for the latest info on booking Aer Lingus flights with Avios):

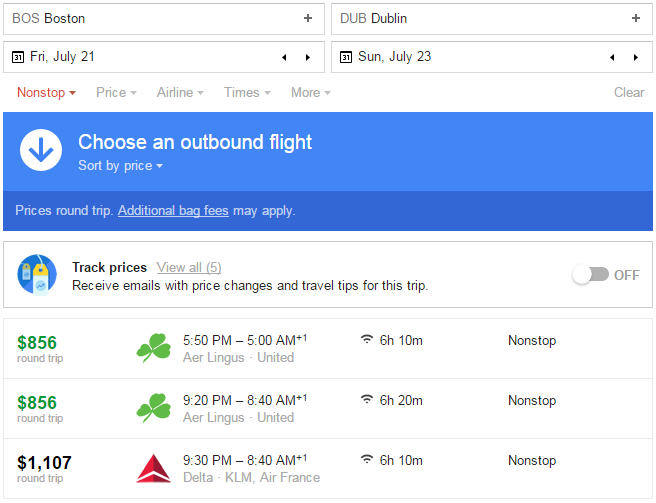

But the flight only costs $856 roundtrip, including taxes and fees. If we were to pay for this with AmEx Membership Rewards while carrying the AmEx Biz Plat (and designating United as our chosen airline) the flights would cost ~42,800 Membership Rewards after rebate:

That’s better than 40,000 + $218.51. Especially considering we’d earn miles for the flights.

See also: Stacking AmEx Insider Fares with the Biz Plat 50% rebate

Munich to Johanessburg

A friend wanted to fly from Germany to South Africa with his family. If there was saver level availability (there wasn’t) on Star Alliance partner South African Airways it would cost 60,000 United miles + $100 per person roundtrip.

But the flights only cost $800 per person roundtrip. My friend has a Chase Sapphire Reserve so he could pay ~53,000 Ultimate Rewards for the flights thanks to the 1.5 cents per point uplift the card provides. Plus he doesn’t have to contend with award availability so he can travel on the days that work best for him.

Boston to Chicago

My wife and I want to see Gnash in concert (check out ‘Lil Tokyo for an example of why). He’s coming to Boston but the dates don’t work for us. He’ll be in Chicago on my birthday so this is a nice opportunity to center a quick trip around.

Although round-trip flights to Chicago on United and AA were affordable ($250 for Economy and $500 in First) there was not a single seat of saver level availability on either carrier on the dates we were looking for. But using Wells Fargo points with 1.75 cents per point of uplift we were able to select exactly the flights we were looking for.

Boston to San Diego/LA

I saw this unique opportunity for a Father’s Day sleepover at Sea World in San Diego. I thought it might be a fun getaway for me and one of my boys.

Since there was no saver level availability non-stop to San Diego on Alaska, flights cost 20,000 pp one-way in Economy or 60,000 pp one-way in First. If I wanted to take the flights in First they cost $1,368 pp roundtrip. If I paid with AmEx MRs that would be ~68,000 pp roundtrip. Far better than 120,000 Alaska pp roundtrip.

If I was willing to fly into LAX (about 2 hours north of San Diego) I’ve got my pick of options. I could fly jetBlue’s fantastic Mint product for just $549 pp one-way. If I wanted to slum it in Delta First it’s even cheaper: $436 pp one-way. If I paid for these flights with MRs they could be as little as 21,800 pp one-way.

Alaska does have saver level award availability on the way out in First on Virgin America for just 25,000. But that seems to be more of a fluke circumstance due to Virgin America flights being newly bookable with Alaska miles. I’m sure they’ll fix this shortly to keep pace with United and AA’s terrible domestic saver level availability.

Boston to Orlando

Delta’s SkyMiles program gets beat up a lot. But they’ve been useful for me to Europe in Business Class, for 10,000 pp one-way flights to Orlando, and relatively affordable First fares domestically.

10,000 miles to Orlando sounds like a great deal, and relative to United/AA’s abysmal saver level award availability patterns it is. But as Joe points out it’s better to pay with Membership Rewards than Delta miles unless the 10,000 award offers more than 2 cpp of value.

Bottom Line

Having the option to book with bank points can relieve the frustration caused by scarce saver level availability. You also have more flexibility to book dates and flight times that work best for you, making the travel experience more pleasant.

If you see a program that combines:

- Good signup bonuses

- Bonused spending

- Upside when redeeming towards travel

…you’ve found a good program.

Are airline miles dead? Hardly. Although they can be difficult to get value out of especially domestically they can be terrific for international premium cabins. I find it very hard to get more than 2 cents per point of value out of them otherwise.

My advice? Take time to make sure you’re focusing on the right currency for the travel you really want to take in the next couple years. If you travel more domestically than internationally bank points are likely a better play. For me that means focusing on earning Membership Rewards (check out this card) and Ultimate Rewards over airline miles.

I’m not the only one thinking this way. Oren’s Money Saver shares his thought process on this and comes to similar conclusions. I swear I didn’t read his post before writing this!

You can follow Robert on Twitter: @RobertDwyer

Pretty much in agreement, though if I understand the MR angle correctly (granted I’m not invested in that program), you could not have used it, in the same year, in the manner you mentioned. In one case your chosen airline was Delta and in another it would’ve needed to be United. Since you seem perfectly fine with domestic Econ (me too), you’re really locked into one airline per year with the MR angle…right? Just something to keep in mind.

Also, can you point me towards any posts that explain the WF 1.75cpp angle? I’ve never heard of that.

I’m invested into UR and USBank, personally, for pretty much the same reasons you’ve outlined here.

You’re right about only getting 2 cpp with AmEx MRs for your chosen airline in Economy. In practice, I’ll probably select my favorite Economy carrier (jetBlue) then use other currencies for other airlines. Or just fly First (it’s often not that much more than Economy) if the numbers work out well.

That said, there could be a way to change your chosen airline so long as you haven’t used your annual $200 air travel credit in a given year.

If you spend $40,000 (or is it $50,000? not certain) on a WF Visa Signature you get bumped from 1.5cpp to 1.75cpp and they drop the $24 booking fee. You can pool points with their program so you could theoretically get Visa Signature for one person then have another get something like the Propel World then combine points for uplift.

People have lost interest in the Visa Signature due to shutdowns for excessive spend in 5x categories, but a bit more on that card here:

http://frequentmiler.boardingarea.com/2014/11/13/a-card-i-wrongly-ignored/

Hmmm, I have the Propel World which is maybe why I didn’t know about the Visa Sig benefits. I didn’t realize you could even get 1.5cpp. In reality though, I doubt I’ll ever utilize it b/c I never spend $40k on a card. I don’t have that much regular spend/year and would rather MS on other cards. But thanks for the info.