I’m undecided as to whether loyalty programs are stupid or genius at this time. I see them as stupid as I can gain huge value from them, but in the same breath, I see otherwise smart people falling over themselves to gain ‘status’. Status is a bad long term bet. You buy something with real investment today in exchange for a pattern of rules and offers that may change overnight. Once your money is in the system, it is a race to get a return on the investment before they move the goal posts on you, in any manner of ways:

- Dilute the tier via status matching (Hyatt.. Hilton)

- Devalue the per point redemption value (pretty much everyone, some tell you, some don’t)

- Throttle inventory, flying empty seats to avoid giving them away to their loyal members…

- Cannibalize inventory, blocking off seats from one group of elites so another can have them..

Where the gravy train began

It all started with a disconnect between price to redeem and price to acquire points. Especially true in the early days of points and miles, someone priced out ‘rewards’ but then another someone came along and made the awards super cheap as an indirect effect of selling miles to credit card firms. It seems to me that the loyalty programs are slowly catching onto this, and making changes.

Can you change with the times?

The glory days of points and miles were before my time. When I spent a week or two to learn them and achieve ‘expert status’ I basically read what was out there, and copied along. Sometimes finding my own little things along the way. More often than not though, I was doing this:

- Read award rules

- Read acquisition concepts

Optimize the two based on my available time.

The Vegas gig changed that

A key motivation behind the Vegas gig was that playing the loyalty game in this current age is fraught with risk. A risk that by reading their rules you trap your mind into the limits they propose. A risk that you present yourself as an unattractive customer to the program in an attempt to jump through its hoops. Never mind that the jumping is a negative aspect of your life.

For example, if you were chasing an award status tier with American, maybe an ‘EXP’ you might be 1000 miles short of the goal for the year, and then take a red eye flight to mileage run to EXP. This is brass tacks when it comes to ‘travel hacking’.

I called poppycock

My belief is that there is a hidden level of rewards that you don’t see advertized, but when you chase EXP or other such status offers that appear ‘quid pro quo’, you are actually helping the company screen you out of something better. You can see touches of this appear in things such as the American Airlines Helix system.

We live in an age of big data, but companies don’t always share. I learned this in Vegas where they told me that they don’t share ‘good customer info’. This is a closed ecosystem, but within it there are ways to target the highest value customers.

CACs, ARPUs and LTVs

These terms are familiar in the world of subscription based services, many coming from SAAS.

- Customer Acquisition Cost

- Average Revenue Per User (monthly)

- LifeTime Value per customer

These are the areas I’m playing with now. How can we present ourselves as the best possible tier of LTV in a brief encounter? And what will that mean to the business development team of a loyalty program (or just a business development team in general) with regards to how much they would invest in Customer Acquisition Cost.

In terms of loyalty, that outlay from the company is supposed to be a part of what they get returned from valuable customers over time.

Here’s a couple more examples that I’ve personally experienced:

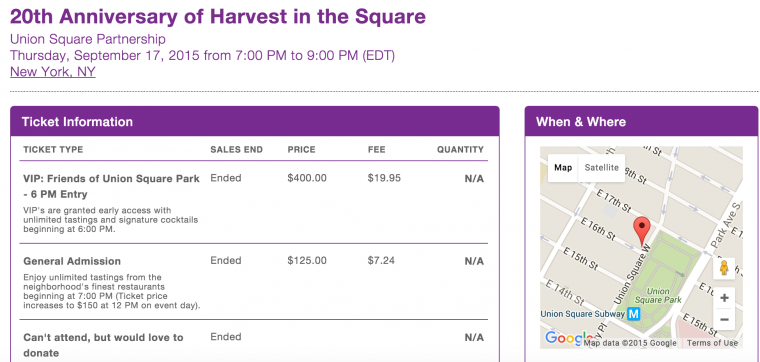

Citi gave me 2 VIP tickets to Harvest in the square when we were in Manhattan, they retail for $400 per person:

Now, when you think of Citi, are you thinking about Citigold and getting some fees waived and a fancy Gold debit card, or are you thinking about getting comped tickets to gigs like this?

How do you get them? I’ve found two approaches: be filthy rich, or have a bit of cash, show them potential and use social engineering. Just think about it.. beyond the stuff you read everyday in the points and miles world about earning points from Citi, they have comped tickets in supply for every event they sponsor. How can you get them?

Another eye opening experience for me was once earning an amazing stay at a hotel for simply using an ATM. The hotel bought ATM data from a competitor and used it to target me…

As I mentioned in Vegas, the other real draw of trying these types of gigs is that they are less transactional – you aren’t always earning and burning (and needing to earn again). Instead, you find things offered to you over a period of time, paying back like a perpetuity.

Everywhere there is upside (like Citi sponsoring events or owning stadiums) there is potential. Every encounter with that closed ecosystem is an opportunity.

It’s time to think beyond the rules.

Matt, This is a bit deeper than I expected for my Tuesday morning reading, but, wow… Its interesting because, I’ve looked at things, like PatMikeL’s experience with getting shut down with Chase, as a reason to keep much of my business separate, e.g. I don’t have a CitiGold or Chase Banking account, specifically because I value the points and credit card relationships.

To that same point though, I’ve found more and more with reselling, that while I still MS, I’m not getting as much of a boost from that and CC sign-ups as I used to. It could be the changing T&C’s, or the limited bandwidth. Still traveling just as much, if not more though.

Great food for thought here.