Since I posted about the experience of Pat with Chase account closures, and the recent update that Wells Fargo and US Bank were doing the same, more and more people are writing in either via email or on the comments section to say the same thing has happened to them. A commonly felt reaction from many has been that they feel victimized, and that they are treated like criminals. This is natural, and it is ok to go through these feelings as you come to terms with the results of this action.

There are two things that you need to do in order to best protect yourself from loss at this point, you need to get all your points out of Ultimate Rewards, and you need to get all of your automatic payments, incoming and outgoing over to another bank. Read the original interview with Pat for more suggestions.

To protect yourself from fallout from this happening to you, get out of the mindless earn approach. A number of people are talking to me about points balances of 400,000 and 500,000 Ultimate rewards being confiscated. Which even conservatively is a penny a point ($4,000 to $5,000 value) and to me is more like 1.6 cents per point. Ask yourself, what are you doing with that many points in the account, remember, these points can be confiscated when sitting there, and get a plan together to spend them sooner.

Top ways to spend Ultimate Rewards

The best way to spend these points will depend on your goal, lets look at scenarios:

Goal – International Travel

Even in coach, by far the best value for your points if your goal is an international trip is using Transfer Partners. The best of these was clearly United, and whilst they have recently devalued their chart it still offers some of the best value for your Ultimate Rewards points. Remember when you are booking a United Award to add on free one ways for even more value.

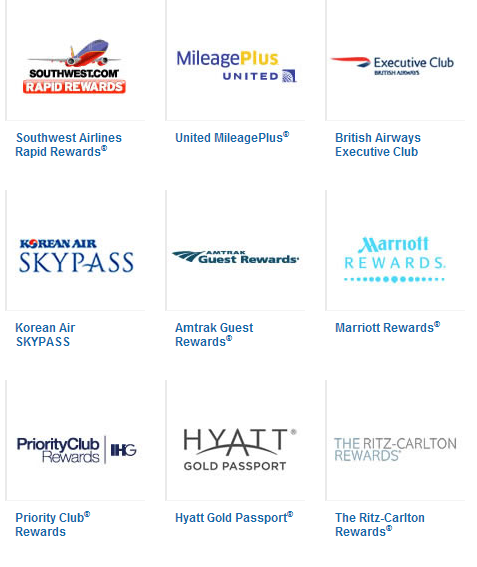

Here’s a list of the transfer Partners of Chase

Goal – Domestic Travel

Here you have a couple of paths, you can either transfer into BA Avios for travel on American Airlines, this is great for distance based travel, so if your goal is lots of shorter hops and you live near an American Airlines hub this is a great option. If however you do not live near a hub for AA or just want more flexibility you are able to book flights through the Ultimate Rewards Travel portal often at a great price, if you use the portal your points are multiplied by 1.25. Southwest might also be an option, personally I have never flown with them and don’t think they would offer me great value from NYC, but depending on your hub they ‘might’ make sense.

Goal – Luxury Hotels

I would recommend transferring to Hyatt, even with the devaluation that they also just unveiled they offer some great properties, and some of the best service from a chain hotel.

Goal – Boutique Hotels (high or low budget)

You can book through the Ultimate Rewards Travel portal, but when I compared that with booking and paying with your card (then using the points as a statement credit at 1:1) I found it better value to not do that. The post Exploring Hotel Strategies – Fracking Ultimate Rewards explains how.

Goal – A Cruise

I found the cheapest cruise option to not be using any of the Credit Card travel portals and instead use a combination of cards, and a service called Cruise Compete. Check out a detailed post on how to book a cruise for the least amount of money For that I would take the same approach – pay with the card then use the points to statement credit the balance.

Firm up your goal now

Above are some ideas on how to spend your points on travel. The concern could be that you aren’t ready to book right now, but from my experience that is usually down to some sort of mental block and procrastination. Most of these options will allow you to book travel for 330 days (award travel tickets) or more in advance, so you can get those tickets locked in now.

If you really cannot decide when to travel, or simply cannot find award space, you might want to consider the risks of transferring into your program of choice now. If you transfer into United there is a chance that they could devalue again in that account, and you lose the value of flexible points, but at the same time, they are more protected there since once they are out of your Chase Ultimate Rewards account Chase isn’t able to confiscate them.

You really shouldn’t need any more than something between 50,000-100,000 sitting in Ultimate Rewards because you should turn to this account only to top off your other balances. If United is your partner of choice start feeding that account, and if you are short of miles at redemption time do a small top up, rather than a massive transfer.

How complex is your spending pattern really?

Personally, I find myself using a very narrow strategy when it comes to Ultimate Rewards – I use them for United (90%) and Hyatt (10%). I would not transfer to Avios as I have Avios from the Chase card, and I have Membership Rewards from Amex that transfer in, often with a bonus. United and Hyatt are the only two that I cannot gain from Membership Rewards, so I use them there.

Thinking about your spending pattern like I did here makes it easier to narrow down what to do with your points, if you see a list of 9 Partners you may have too many options and face a buyers remorse type of inaction from the fear of being wrong.

Stop, think, plan, act

Take this time to look at your balances, if they are over 50,000 points per person in your household you are already way too far into a holding game, and over exposed in the event of an account shut down. Think about your earning goal – if it really is very likely to involve United, transfer the points now, keep the balances low and keep taking your chips off the table. Don’t just earn for the sake of it, if you really cannot think of how you want to spend, but are earning aggressively, cash some out at 1:1.

Remember, they can take away your points, but they can never take away your experiences.

Wasnt her bank acct shut but not her CC acct? Seems to me the best reason to have these programs like UR is to have the flexibility to move them when needed. If you panic and move them all then you are decreasing the potential of UR pts.

I’ll have to check in with her specifically, but I have heard from a number of other sources now that the bank goes first, then the Credit Cards.

To me, the best reason for UR is the multiplier, though there is genuine value in flexibility of points I don’t think there is real value to many people since I don’t think that everyone really uses all the outlets for spending. It is my suggestion to examine your spending habits and therefore narrow down which of the approaches you will be taking to burning your points, so you can take action earlier.

I have been hitting the Chase credit cards pretty hard for the last 8 months (3 Inks and a UA Club). I am running $30-$45k/Mo through the Club card plus another $20-$30k through the INKs in bonus category spend with out trouble yet (I do try to mix in normal transactions as much as possible and buy GC’s/etc. from multiple enterprises). I do keep two different bank accounts not affiliated with any credit card I use to earn points (I also hit the USBank Carlson, LifeMiles pretty aggressively and AMEXs) and am running about $100k/mo through them. Though I am thinking about expanding to 4 to spread out the deposits a little more. I never deposit cash, only MO’s and occasionally do deposits over $10k to make it clear that I am not attempting to hide anything I am doing. In addition I have personally had discussions with each branch manager about what I am doing and how I am doing it and have a great relationship with the tellers (I am hopeful that this will significantly reduce the risk of a SARS being filed locally) I have kept every GC/VR/PP card/receipt ever purchased in case anyone ever wanted to know how the funds flowed. I tend to Move most of UR points to UA and Hyatt and almost always have about 1.5M points locked up in future pending travel. I would be interested in your thoughts on this Matt or anyone else’s.

Sounds like a great strategy, earning hard and shifting out ASAP. I like it!

Wow… $100k per month in manufactured spend. That’s awesome. Are your credit lines big enough to support that, are do you pay down the balances mid-cycle as you go along?

You really should be paying them down very quickly as you say. The lines aren’t that hard to get. I have found that when closing cards and pushing the lines over I have several cards with rather high limits now.

I make regular payments to the various cards I use on a weekly basis (on average). Usually my cycle goes like this: Day 1 Mfg Spend, cash out with MO’s, Day 2 Deposit MO’s, Day 3 MO’s clear, payoff credits used on Day 1. Then repeat with second set of credit cards for Day 4-6. This usually means I am making about 4 payments per month per card I am using. The above cycle gives me about 7 days between each wave of spend on each card, I feel this is pretty aggressive, but to date this hasn’t caused any calls from the card issuers.

I had a quite similar situation with VA BofAm Amex credit card a few months ago. As an authorized user to my wife’s account I started buying VRs in addition to some minor daily expenses. At the same time, I processed a couple of payments, i..e $2K or 3$ from three different BBs plus other higher amounts from our regular account to clear out the balance as soon as possible. I must admit I was highly motivated to reach an extra spending limit in order to obtain an additional 15K bonus. One day, however, I was not able to use a card as it was blocked. As it turned out, an investigation was in progress due to ‘unusual transactions’ we just had. A lot of questions were asked over the phone, I was even placed on hold when a customer representative tried to contact the institution where my payment had come from before. To make a long story short, we ignored them and ….. this Amex card was converted into MasterCard which we can still use without any hiccups.

I encourage anyone cut off by Chase to file a complaint with CPFB via this link:

http://www.consumerfinance.gov/complaint/

In my case, i came out a small loser when they shut all my accounts including a checking account that had $60k at 0% and no activity, no money orders, lots of real spending, and not even 1/2 of one month of what is mentioned above. My opinion is someone is taking their job too seriously and gets brownie points for closing accounts that cost the company money in the short term. The only thing it has cost me is the hyatt transfer and 2x MR on foreign hotel stays.

And then AMEX comes along with gift cards earning 4x points and appreciates my business.

Chase lost over $200,000 in actual spend from me just in the past 12 months.

I reapplied after a year but Loss prevention told me it’s a permanent ban. I was just testing, and have not filed a complaint, just exercised my feeble yet fulfilling opporunity to return their credit card offers in prepaid return envelopes with nothing inside. I think that’s up to about $7.50 this year in postage, and it’s silly, but i am not about to really retaliate or even file a complaint with CPFB.

However, i do think that’s the only way you will get to the bottom of your shutdown. Mine only makes partial sense because overall they were making money from me.