This is a guest post from @RobertDwyer

One thing to be on the lookout for in this game are programs which allow you to earn a rewards currency one way then redeem them another way, but with upside.

A familiar example of this is Chase Ultimate Rewards. With the Chase Freedom card you earn 5x in rotating categories. This is worth 5% cashback if you only carry the Freedom card. But if you carry a fee-based Ultimate Rewards card you can get more than 1 cent per point of value when redeeming towards travel.

The Chase Sapphire Reserve offers 1.5x uplift if redeemed towards travel through their portal, which means the 5x you earned with the Freedom becomes 7.5x thanks to the Reserve – a very nice return.

Similarly if you have a Citi AT&T Access More card that earns 3x online you can redeem for 1.6 cents per points towards AA flights if you have a Citi Prestige card, a benefit that’s unfortunately going away soon.

If we carry an AmEx Business Platinum card we can redeem Membership Rewards for 2 cents a piece towards airfare, regardless of which AmEx card earned the Membership Rewards.

What about Wells Fargo?

A program you may not be as familiar with is Wells Fargo GoFar Rewards. With GoFar Rewards you can earn points with one of their cards then “pool” them together with another of their GoFar Rewards cards with redemption upside.

For example you could sign up for the Wells Fargo Propel World AmEx (over the phone) for a 40,000 point signup bonus. If you, your spouse, or a friend carry a Wells Fargo Visa Signature then you can redeem points towards air travel with 1.5 cent per point uplift. This would make the 40,000 point Propel World signup bonus worth $600 instead of the $400 it’s worth on its own. Not too shabby.

How pooling works

You’ll want to create a pool associated with the rewards account with redemption upside, so log in to the account associated with the Visa Signature card for example.

In your GoFar Rewards account click on “Share -> Pool Rewards”.

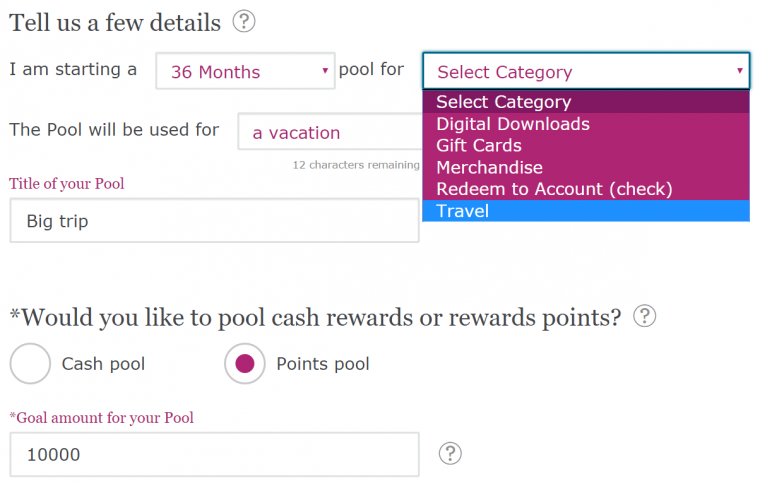

Then “Start a Pool”. You can create a pool for 12, 24, or 36 months. Why someone would create one with a short duration is beyond me because you can use the points straight away.

Say the pool is for “Travel” because you want to be able to redeem with upside.

Choose any amount for the goal. You can over- or under-fund the pool as needed for redemptions.

Once the pool has been established you can transfer points from another GoFar Rewards account to the pool. You can then redeem points towards air travel with uplift that otherwise wouldn’t exist.

Wells Fargo is quite liberal with who can pool points together saying that points can be pooled between “family, friends, and others who are Wells Fargo customers”. This is quite nice compared to, say, AmEx where even spouses can’t share points.

But wait, there’s more

The Visa Signature card comes with 5x earning at gas/grocery/drugstores the first 6 months. Shutdowns have been reported for abuse of these categories, but still – for legitimate/moderate use it’s not a bad deal.

If you choose to spend $50,000+ on the Visa Signature you get bumped up to 1.75x uplift towards airfare and $24 per ticket booking fee is waived. For more information on this, hit the comments section on Frequent Miler’s post on the card here.

You may already have a dormant Wells Fargo Visa Signature from prior use. But if you don’t there might still be merit in you or your spouse applying for the card.

Keep in mind

To get a credit card with Wells Fargo you need to have an existing relationship. If you don’t already have some sort of account with them consider opening a checking account online, even if they don’t serve your area.

Most Wells Fargo credit card applications I’ve seen lately say you can’t get the signup bonus if you’re opened a new Wells Fargo credit card in the past 16 months.

Other uses?

I’m uncertain whether you can pool points from, say, a cashback Wells Fargo credit card like the 1.5% cashback everywhere Cash Wise card. If you could that would make it a 2.625% back towards airfare card if paired with a Visa Signature with 1.75x uplift. Anyone know?

Any other card combinations besides the World Propel and the Visa Signature that look interesting?

Any other lesser known bank points programs like this?

Bottom line

Many banks offer the ability to take points earned from one credit card and redeem it according to the scheme of another of their credit cards. Wells Fargo is just, perhaps, a bit more obscure than others.

Wells Fargo GoFar Rewards can be pooled which is a terrific, documented, user-friendly attribute of their program.

If you’re in two player mode you can combine a card with a good signup bonus (like the Propel World card) with a card with good redemption characteristics (like the Visa Signature card) to provide some nice upside towards travel.

What other ways are there to maximize the value of GoFar Rewards co-mingling and pooling? Ping me on Twitter (@RobertDwyer) or leave a comment below.

It seems like much less hassle and risk to get BOA TR with Platinum Honors.

Well, there’s the small matter of the $100,000.

But that aside, why not both?