I recently posted about my upcoming travel booking needs, I’ve had a bit of luck since then, as I’ll have 4 Marriott Nights rather than two (they reset in June) and I snagged roundtrip airfare for the three of us from NY to Miami for 14.5K Delta miles a pop, non stop. I was already preparing myself for $1,000 in airfare expense there, so it really lightens the load.

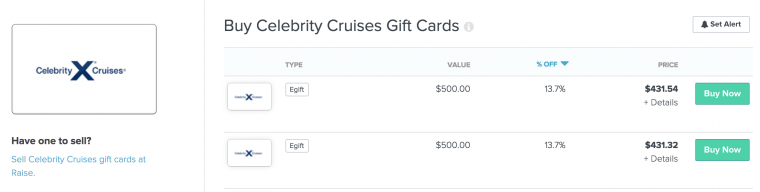

Next, bored one evening I decided to run a search through Raise.com to check out what gift cards were vastly discounted. The concept here was that if I found one that was really cheap, I may try out a little reselling using that vendor. Low and behold, they have Celebrity Gift Certs for 13.7% off.

As you might know, I’ve just paid Celebrity $986 for our upcoming cruise for three people, and I’d already paid for it on the credit card. Some fast talking allowed me to get them to allow the swap to gift cards after the fact.

The rules for these Gift Certs are that Celebrity allows you to use only $1,000 per cruise, and they must be used in $100 blocks. I prepaid gratuities to bump me over the $1,000 level and applied the gift certificates. Essentially, that one transaction gave me $137 of ‘free money’ (the best kind) but now what? I’m facing the problem that was raised in this post, Where does your marginal dollar go?

Spending and Anchoring

This latest round of booking has really got me questioning valuations and ability to spend. Another example of this is the strong inclination to cash in 25K plus $350 per person for American Airlines upgrade to Business. When anchored to the notion that I can travel for ‘free’ using AA Saver awards, this has been a challenge, but if we start to question our thinking, the deal isn’t such a bad one.

With regard to Anchoring, it is interesting to note that I still consider 50K AA miles to be a one way in Business to Asia or Europe, because I’ve not really taken that second look and internalized any devaluations. Also interesting (to me at least) is that I always forget that the 50K AA miles come with taxes and fees when valuing them in my head.

So what to do with the $137?

We’re in an good spot financially. We’re not ‘all set’ but our cost of living is very low, much more so than average. No debt, few restaurants nearby and most of our consumption spend coming from groceries. We could ‘afford’ to splurge. There’s always talk of lifestyle inflation and the such, but I think a lot of that misses the point of living a life you can enjoy.

What’s more, the focus is on the clear win of $137, but I also ‘saved’ at least $500 by snagging those Delta flights. Saved is a complicated choice of words here, because it is easy to start tricking yourself with such thinking, but the end result is that this component of my travel ‘budget’ (if I had one) is significantly lower than expectation.

Booking Miami

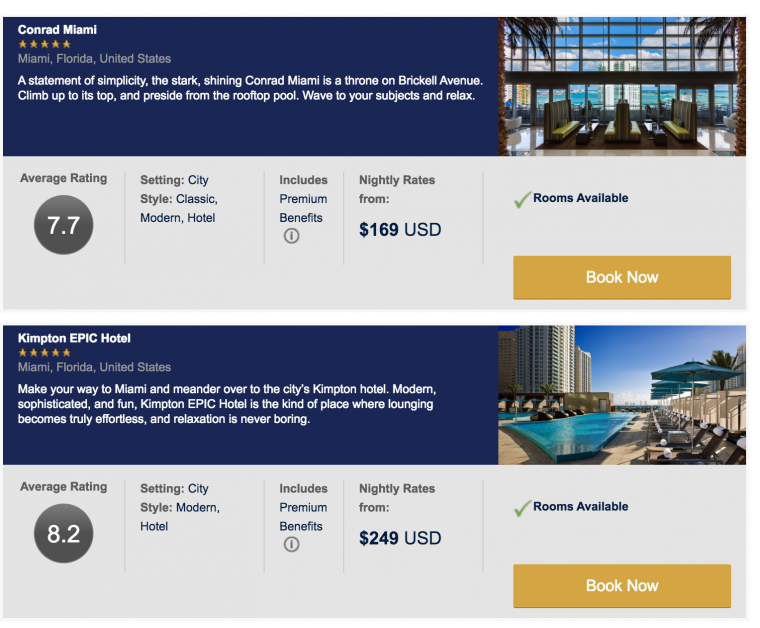

Our flights to Miami get us in at 7pm the day before the cruise, so we need a hotel. This is one area where we can spend some of the $137 (or $637) but again, I had somewhat planned for the need here, so the money may go to an upgrade (lifestyle inflation) or perhaps somewhere else.

In terms of Miami, it is also strongly challenging Hotel point usage. I’ve always struggled with hotels because their points tend to cannibalize. For example, it was hard to spend 20K SPG per night when that was 25K AA miles. Hyatt draws from my United stash (via Ultimate Rewards) and so forth. This does lend itself to ‘cash’ taking over.

Cash itself though (ideally statement credits) creates a conflict between using it for hotels or using it for flight fees and taxes. Going forward, I may find myself using the Altitude card for this type of booking, assuming their rates are good, and protect my transferrable points for future flights. An added perk of this card is access to the Visa Infinite Hotel program (similar to the Amex Fine Hotels).

Conrad Miami

Paid with ‘cash’. The rate isn’t that bad if we consider the alternatives, and comes with $25 dining credit. Incidentally, the Kimpton is about $70 over the market rate, so make sure to shop around!

If I do decide on the Conrad, the last two things I would try to ‘hack’ with it would be to swap out the card on file to a Capital One card that has about $300 of statement credits on it, and to see if I can haggle something in exchange for the free breakfast, since I think I get that as a Gold anyways….

Travel is very personal, and while we often follow the thought leaders when it comes to things like valuing Delta miles, or booking a certain type of hotel, eventually we all develop our own taste and standards. For me, I remain ‘cheap’ in that I wouldn’t pay $249 for a Kimpton room over $169 for a Conrad room, I may pay that $169 instead of staying at MIA airport for $80.

Leave a Reply